If something unfortunate were to happen to you today, would you and your family have sufficient resources to tide through it and get back on your feet?

It may seem as if insurance agents are always telling you “you’re under-insured,” but have you ever stopped to ponder if this may be true?

In this article, I would like to present an informational overview of 15 different types of insurance plans in Singapore and their benefits.

Life Insurance

In general, life insurance policies exist to provide income protection in the event that your ability to earn your usual income is impaired.

This may be due to a variety of reasons, such as critical illness, disability, or death.

Accordingly, there are different types of life insurance policies catered towards each of these categories.

The four key life insurance policies that I shall cover here are term insurance, whole life insurance, standalone critical illness plans, and disability income insurance.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

1) Term Life Insurance

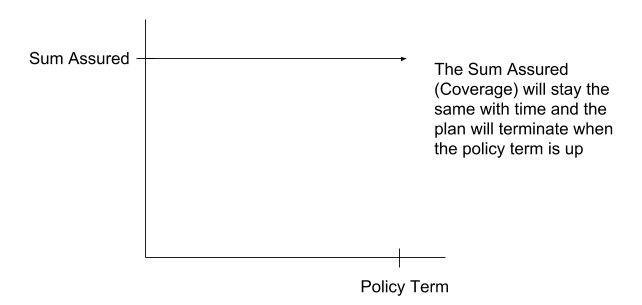

Term life insurance provides coverage for a fixed duration at a fixed premium, for death and terminal illness.

In most cases, you’re able to add on riders to cover for total and permanent disability (TPD), critical illness (CI), and early critical illness (ECI).

If any of these undesirable events occur, a lump sum payout is provided to the insured or his or her family.

One main benefit of term plans is its affordability as it is able to provide a high amount of coverage at a low premium.

Also, the premium typically does not increase over time and the policy can cover the most important years of your life – usually up to 65 to 70 years of age.

However, there is no cash value. This means that once the policy term is up, the policy expires and you do not get a payout.

(Get a comparison of the best term life insurance in Singapore.)

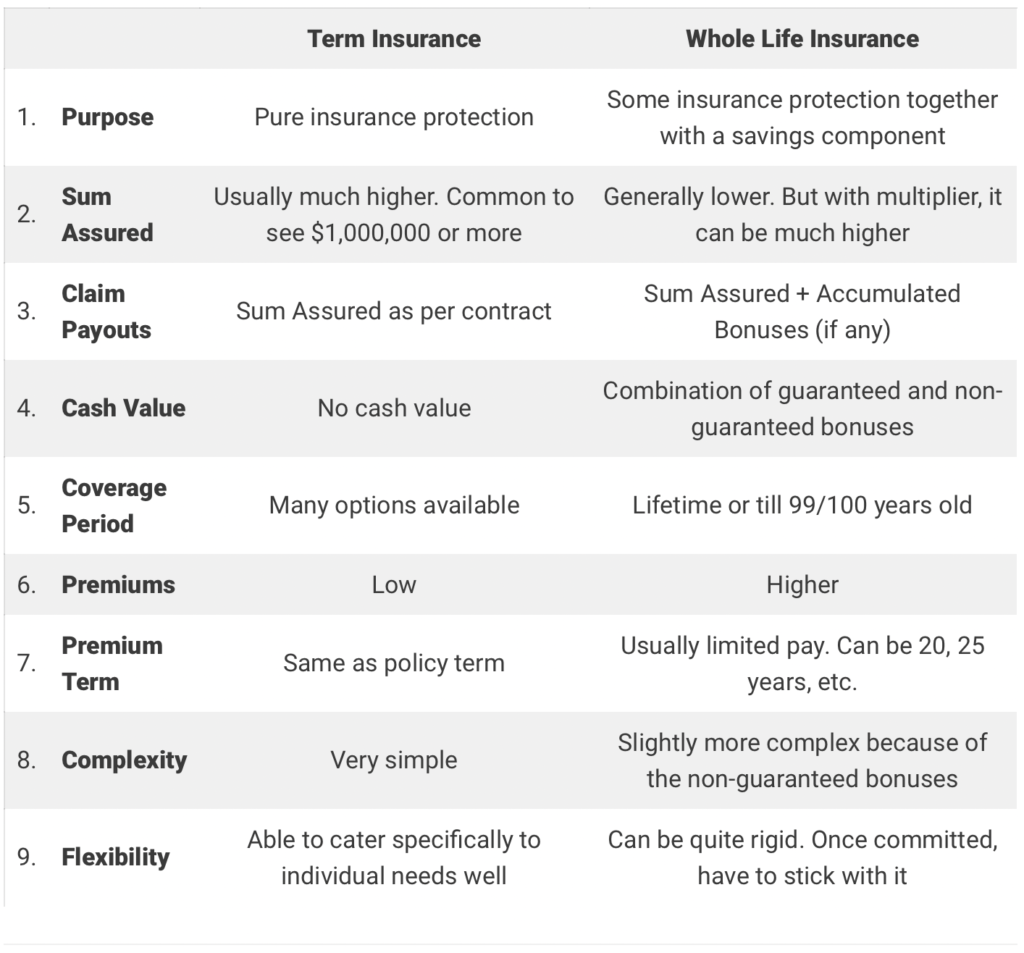

2) Whole Life Insurance

True to its name, whole life insurance policies cover the entire lifetime of the insured party.

This is different from term life insurance policies, which only cover a specified duration. This may be especially relevant in the face of rising life expectancies.

Another benefit that makes whole life insurance popular is the fact that there is “cash value” whereby the policy can be surrendered for a lump sum payout. The longer the policy was held, the higher the payout.

The only caveat is that it must be held for the long haul as an early surrender would likely result in you receiving a lower payout than the premiums you have paid.

Here are some of the main differences between term life and whole life insurance policies.

(Get a comparison of the best whole life insurance in Singapore.)

3) Standalone Critical Illness Plans

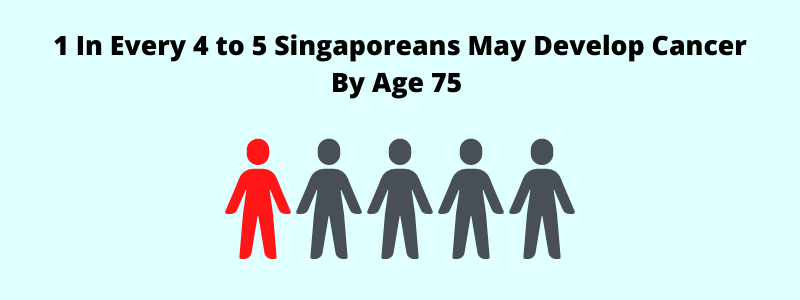

Some insurance providers offer separate, standalone critical illness plans.

These plans have greater emphasis on critical illness coverage, including in the early stages. The insured is also able to make multiple claims, subject to terms and conditions.

With the relatively high probability of getting a critical illness, such as cancer, and the cost of treating it, such plans can come in handy.

(Get a comparison of the best early critical illness insurance in Singapore.)

4) Disability Income Insurance

There are also insurance policies that focus on covering disabilities.

Disability income (DI) insurance is typically designed to replace a percentage of the insured’s gross income, although this can differ from provider to provider.

Health Insurance

Health insurance is meant to provide you with the resources to tide through unexpected medical expenses that can be very costly.

5) MediShield Life

All Singaporeans are covered under MediShield Life.

It is administered by the Central Provident Fund (CPF) Board and aims to provide basic insurance for hospital bills and selected outpatient treatments.

MediShield Life provides lifetime coverage, including for pre-existing healthcare conditions.

Premiums are also generally affordable and fully payable by MediSave.

However, it is only meant to be a basic safety net and there are limitations to its coverage. For example, it is geared to cover B2/C wards. It also does not cover pre and post-hospitalisation fees.

6) Integrated Shield Plan (IP)

Integrated Shield Plans provide an “upgrade” to the basic coverage from MediShield Life.

It is meant to be more comprehensive, offering coverage for private hospital expenses, pre- and post-hospital treatments, and higher claim limits.

Depending on your needs, you can either get the “basic” upgrade and/or further add on a “rider” with additional benefits. The following diagram illustrates how MediShield Life, a basic Integrated Shield Plan upgrade and a Rider can come together to give you holistic healthcare coverage.

(Get a comparison of the best integrated shield plans in Singapore.)

Long-Term Care Insurance

An extension of healthcare insurance is long-term care insurance. It is designed to provide a monthly payout when a severe disability happens, which happens more often in old age.

7) ElderShield

Apart from MediShield Life, Singaporeans used to be automatically enrolled into the ElderShield insurance scheme at the age of 40.

This is a long-term care insurance scheme initiated by the Ministry of Health (MOH).

Those under this scheme who are unable to perform at least 3 of the 6 Activities of Living (ADLs) are eligible for a monthly payout.

However, the ElderShield has since been replaced by a newer healthcare scheme, CareShield Life, in October 2020.

8) CareShield Life

CareShield Life is a severe disability insurance scheme to provide protection against the costs of long-term care.

It is a replacement for the ElderShield. Now, instead of being enrolled into the ElderShield scheme at the age of 40, Singaporeans are automatically enrolled into CareShield Life once they reach 30 years of age.

Similarly to ElderShield, Singaporeans are eligible for payouts if they are assessed to be unable to perform at least 3 out of the 6 ADLs.

However, it is also meant to provide only basic coverage and may not be fully adequate for your needs.

As such, there is the option of upgrading with supplements, which can be paid from your CPF MediSave.

Plans for Wealth Accumulation

Apart from income protection, insurance policies can also help you to grow your wealth passively. There are several types of wealth accumulation insurance plans, which can be considered once you have minimally been insured for income protection and medical expenses as described above.

9) Endowment Insurance (“Savings”) Plans

We all know that living in Singapore is expensive, and inflationary rates are high.

To grow your money, placing your money in the bank is often not the best option as the low interest rates are not enough to beat inflation. This means that over time, your savings will actually be decreasing in value and you will be able to do less with the same amount of money.

Endowment plans can be a better way of saving up for your goals, such as your children’s education fees or retirement.

The downside to it is that there is low liquidity – endowment plans may not allow the withdrawal of funds before the stipulated duration is up. This can be both a pro in terms of forcing you to save up for the future, and a con in terms of lack of flexibility.

10) Retirement Plans/Annuities

Retirement is an inevitable stage of life. Planning for your retirement will ensure that you are able to do so comfortably.

While CPF LIFE does offer monthly payouts from the age of 65, this may not be sufficient, especially if you want to maintain a comfortable lifestyle.

As a complement, you can consider private retirement plans and annuities.

In a retirement plan, you allocate a fixed monthly/yearly amount to be placed into the plan for a specified duration. Upon the selected retirement age, you can receive a regular stream of income for 10, 15, or 20 years, depending on the policy.

The total potential returns you can expect from such a plan are likely to be higher than saving accounts, fixed deposits, and their equivalent.

There are also retirement plans which you can fund using your SRS monies.

(Get a comparison of the best SRS endowment annuity plans and the best retirement annuity plans in Singapore.)

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

11) Investment-linked Policies

Another option is to invest. Apart from investing directly in stocks, ETFs and other securities on your own, you can choose investment-linked insurance policies which have both life insurance coverage and investment components.

One benefit of investment-linked insurance (ILP) is the flexibility of switching your funds depending on your investment needs and risk profile.

Plans for Leaving a Larger Legacy Behind

There is a Chinese adage that “you cannot take your money with you when you pass on.” Most of us would also want to leave something good behind for our family. Legacy planning allows you to leave an estate for your family to enjoy and tide through any difficult times when you are no longer present to help them.

12) Term Insurance Till Age 99

A term till 99 insurance plan is similar to the regular term life insurance.

However, it goes one step further to cover you till the age of 99, which is well above the average life expectancy. This means that a claim is much more likely to happen.

If you’re relatively young, have a high cash surplus, and have dependants, you may consider such plans.

The downside is that these plans come with a higher premium compared with the typical term insurance that covers to say, age 65.

13) Single Premium Whole Life Insurance

At a certain point in your life, you may find that you have earned more money than you will ever need, and wish to leave it for your next generation.

You can choose to put it in a single premium whole life insurance, which achieves the dual goals of insuring you for your entire lifetime (usually up to 100 years of age), and leaving an even larger payout for your family once you pass on.

This type of insurance is similar to an ordinary whole life insurance, except that you pay for the premium using a lump sum at the very beginning. By doing so, you gain the benefits of having a higher sum assured and a greater multiplier for your death benefit. This creates an even larger estate for your legacy.

14) 3-Generation Lifetime Income Plans

Legacy planning can go beyond just one generation. If you would like to leave assets for your grandchildren as well, you may consider 3-generation lifetime income plans.

How it works is that it provides you with monthly income to supplement your retirement needs. Once you have passed on, the monthly income can be provided to your child. The policy also can provide a payout to your grandchild when your child has passed away.

In this way, you are able to provide for all three generations.

15) Universal Life Insurance

A Universal Life (UL) insurance plan covers both life insurance and savings/investments. Unlike a whole life insurance plan, it is highly flexible. However, the life insurance component typically covers only death.

There are 3 main types of universal life plans, namely traditional, variable, and indexed.

A traditional UL provides returns based on a declared crediting rate. A variable UL offers returns entirely based on the returns of the investments or funds that were selected. Last but not least, an indexed UL is a mixture of the above.

Others (Including General Insurance)

As a bonus, here are some other insurance policies that exist in the market. You may want to consider getting the extra coverage to protect your assets, such as your home and car. Or, you may find some of these insurance policies relevant as you hit significant milestones in your life, such as having a newborn child.

Mortgage Insurance

You’ve got all your finances planned out to ensure enough savings for mortgage payments. However, unexpected circumstances cause you to use up the savings for another emergency. Unfortunately, the penalty for not paying your mortgage is extremely severe – your home could even be taken away from you.

Getting mortgage insurance provides a blanket of security for one of you and your family’s most precious assets. A mortgage insurance can cover the the mortgage loan in the case of death, total and permanent disability, and critical illnesses.

(Get a comparison of the best mortgage insurance in Singapore.)

Maternity Insurance

Pregnancy is a joyous occasion, one that should be full of celebration and wonder.

However, just like in all other situations, complications can sometimes arise. Since regular healthcare insurance does not cover your newborn baby, you would actually need to foot the bill by yourself if your baby requires special medical treatment after birth, or if there are any issues during birth.

Thus, mothers can obtain additional maternity insurance to cover medical expenses in the event that something happens to the newborn baby or if there were pregnancy complications. It also provides an easier pathway for your child to get insurance in future even if they have pre-existing conditions at birth.

(Get a comparison of the best maternity insurance in Singapore.)

Home Insurance and Fire Insurance

Home insurance may sound similar to mortgage insurance, but it is actually quite different. While mortgage insurance covers the person paying for housing loans, home insurance covers the house itself. If anything awry were to happen, you’ll be able to claim damages for home fixtures, furniture, personal belongings, and other items.

Meanwhile, a subset of this is fire insurance. Fire insurance covers the cost needed to rebuild your home and return it to its original state. HDB provides a basic fire insurance plan, however this does not cover fires which were caused by you. It also covers only the internal building structure, fittings and fixtures built by HDB, and omits coverage for the furnishings and belongings that were lost.

Maid Insurance

Many Singaporeans require domestic help. If you belong in that category, you will find maid insurance to be necessary and relevant. You are required by law to procure medical insurance and personal accident insurance for your domestic helper before she arrives in Singapore. This may cover hospitalisation fees, bills for outpatient treatment, and personal accidents that lead to death or total and permanent disability.

Some maid insurance policies also offer additional benefits, such as wage compensation if your helper is unable to work, critical illness coverage, and even the fees for hiring a replacement maid if something unfortunate were to happen to your helper.

Personal Accident Plans

Personal accident plans are useful if you regularly engage in sports and outdoor activities, work in high-risk jobs, or simply want higher coverage and payouts in the event that something untoward happens all of a sudden.

Personal accident plans can cover ambulance fees, hospitalisation, treatment and recovery bills, and pay out a death benefit to your family members. However, most of what you can claim from have to be due to an accident.

Whether you should get a personal accident plan also depends on the coverage from your other life insurance and health insurance policies. Getting a personal accident plan can be beneficial even if you have coverage from these other policies as it can provide more comprehensive coverage.

Car Insurance

Third party only (TPO) car insurance is the minimum requirement in Singapore.

It covers damage you caused to other people’s cars.

However, it does not cover damage done to your own car. This is why people may get comprehensive car insurance, which has a higher premium but offers better protection.

Your premium typically depends on factors such as age, occupation, driving experience, claims history, and the make and model of your car.

Travel Insurance

We all love to travel and can’t wait for COVID-19 restrictions to be lifted.

Travel insurance protects you from risks so that you can have fun with a peace of mind. It typically includes coverage for personal accidents, medical fees, theft and loss of baggage, as well as travel inconvenience.

There are different types of policies, namely single trip or annual travel insurance. You may also choose between individual plans and family travel insurance plans as well.

It is recommended that you research this while planning for your travel itinerary, and include it while making your bookings and purchases.

What’s Next?

I hope that the above overview of the different types of insurance plans in Singapore has been useful to you.

Whether you choose to implement these insurance policies for yourself or not, it is always good to understand the various options out in the market so that you can ensure you are maximising the use of your funds to ensure the best future for you and your family.