Use our free monthly budget and expense calculator to save more and spend less.

(If you prefer this in an excel spreadsheet format, check out our free template, FinSnap.)

We’ve Got It All Backwards

Have we been saving the wrong way?

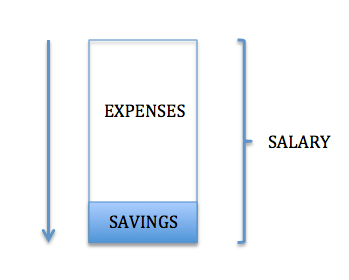

You see, here’s how most people save:

When we receive our income, we’ll spend on whatever we want – essential and/or non-essential – and at the end of the day, we’ll save the rest (if any).

If you’ve been doing that, it’s probably not the best way to save.

This method often leads to overspending, and results in low amounts of savings or living from paycheck to paycheck.

The primary reason for that happening is because we don’t exert any control over our expenditure or have any forced savings mechanism in place.

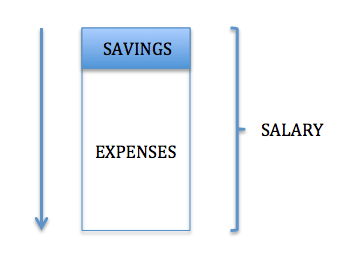

But here’s what would happen if we flip it:

When our incomes come in, we’ll set aside a defined amount to save or invest, and then we can spend the remainder.

This’ll ensure that we have something at the end of the day.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

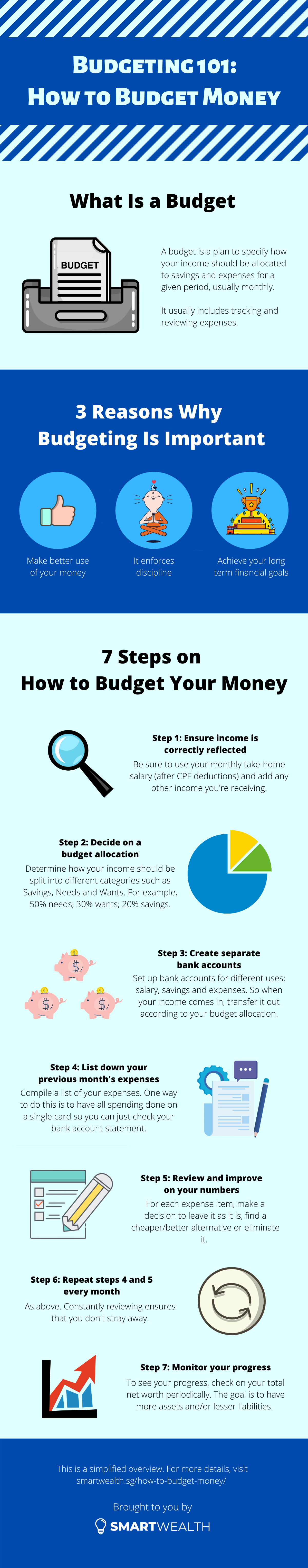

How Do We Force Ourselves to Save First

The trick is to make it structured and easy.

Here’s an example:

You can have 3 savings accounts – A, B and C.

A: account where income is “GIROed” in

B: account purely for savings and waiting to be invested

C: account purely for daily, monthly and annual expenses

So when income goes into A, transfer the amount you want to save/invest into B. To make it easier, set up a standing instruction to transfer automatically.

And the rest can go into C. You can also set up a standing instruction for this.

You may also do this with just 2 accounts.

The Point of Tracking Your Expenses

For some of you, it may be difficult to track all your expenses.

(I do find it quite a hassle too, especially if it’s daily.)

But the point is to be aware of what you’re spending your money on.

This could be done by looking at your past month’s bank account statements and going through each item.

This way, by tracking and control how we spend our money, we’re able to trim the fat (reduce unnecessary expenses).

Combined with forced savings, doing this regularly will ensure that we have the savings to hit our financial goals such as having sufficient funds for retirement or providing for our kid’s education.

Also, sticking to a budgeting rule, such as the 50/30/20 rule, helps you to budget money effectively.

4 Key Factors to Improve Your Finances

If you took the step to fill in your numbers, it means that you’re serious in managing your money for a better future.

Although the calculator gives you some insights on your saving and spending habits, it doesn’t give you everything.

How can you improve on your overall finances?

Here are 4 ways:

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

1) Earn More

One of the best ways to have more money is investing your time and effort into your career or businesses that you run.

We need to be excellent at what we do so that we’ll be rewarded with promotions, higher salaries and bonuses.

Some examples of how we invest in our careers:

- take more responsibilities and show that we’re competent

- going for courses

- seriously think about our career paths

- improve our interview skills

- etc

2) Protect More

Protection here means making use of insurance.

Although it may be deemed an expense, it’s can be an asset when the time comes.

Having adequate insurance allows you to protect future income and preserve the wealth you’ve accumulated.

As your income enables you to spend, save and invest, it’s the most important resource you have.

Once you lose it due to death, total & permanent disability or critical illness, future income is lost, and your current savings are unlikely to last.

Having enough life insurance enables you to replace future income if the worse happens.

How can insurance preserve wealth?

If smaller incidents happen and you need to be hospitalised, medical insurance can cover the bills. It’ll be an essential item if your hospital bills are large.

If you don’t have it, paying for these bills will come from your hard-earned savings and investments.

3) Save More (Spend Less)

When you make it a priority to save first before spending, it’s like locking away money in the vault, and the money you’re left with can only be spent on things that you’re allowed to.

This discipline will go a long way.

You’ll be more conscious of what you’re spending on if you have a limited amount of money you can spend each month.

For example, if you find yourself in a situation where you’re questioning to buy an item which is not budgeted for, chances are that you shouldn’t.

Because you know that by doing so, you’ll overspend at the end of the month.

This mental resistance combined with the desire to achieve future financial goals will enable you to say “no”.

From the calculator, you can also see what necessities and wants are you spending on, and improve on them.

For each item, make a decision:

- Continue it

- Look for better/cheaper alternatives

- Eliminate it

4) Invest More

Hopefully, by doing the above, you’re left with more cash in the bank.

But aside from emergency funds and upcoming financial commitments where you need liquid cash, you should put them into alternatives that can give potentially higher returns, based on your risk tolerance.

That’s because, with inflation, the value of our money decreases over time. And we can make use of the compounding effects of higher interest rates.