Reminder: There comes a time when all lives will end. And when that time comes, it might be too late.

Tracking your personal finances may seem boring, but it has a greater meaning behind it.

What happens when you die or become mentally incapacitated?

Critical information might be forever gone.

That’s why taking a snapshot of your personal finances (FinSnap) is one way to keep track AND sakekeep it.

Here’s a free google sheets/excel template you can download.

Not convinced why it’s important?

Read the short story below..

Take a snapshot of your personal finances with FinSnap

Why?

- Keep track and improve your finances

- Ensure your family know what you have when the inevitable time comes

It also includes these sections:

- Assets & Liabilities

- Income & Expenses

- Insurance Policy Summary

- Other Essential Information

You don’t need to subscribe to anything, the download link goes to a public google sheet. Get your free template now.

(You don’t need to request for access. Just make a copy or download as an Excel file.)

A Short Personal Story

10th Jul 2020.

I remember that date because it was polling day, and it was also my first visit to the A&E.

In short, it was because of a combination of double vision, a moment when I couldn’t understand simple words, extremely bad headache, and full-on vomiting (at least 5 times) for no apparent reason.

Note: I’m generally healthy and have never been to a hospital other than for a dislocated thumb (thanks, Mabel).

And now, I’ve to see a neurologist and an ophthalmologist (eye doctor).

During this process, I’d be lying if I say I didn’t think of the what ifs.

It’s not about whether I have insurance or not – I do have the essentials (fortunately) – but what happens beyond that.

SIDE NOTE

Even if I were to apply for more insurance now, it’ll likely be postponed or excluded. So if you’re not sure whether you’re adequately covered, do check out our life insurance cover calculator. And also learn more about hospitalisation coverage.

More important to me are the areas in estate planning:

- CPF nominations

- Insurance policy nominations

- Wills and Trusts

- Advance Care Planning (ACP)

- Lasting Power of Attorney (LPA)

- Advance Medical Directive (AMD)

But even with all that, it’s still not complete.

Here’s why..

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

The Purpose of a FinSnap

There will still be important information being left out, including the not-so-obvious ones.

And when death or mental incapacity happens, it can be swift.

You might not have the luxury of time or the ability to communicate all these to your next-of-kin.

And then, everything just becomes non-existent.

That’s why all these need to be done beforehand (preferably, now).

With a FinSnap, it enables you to have an all-in-one collection of these financial information that will come in handy whether you’re living or dead.

There are 2 objectives with it:

- Track your finances so that you’re able to measure and improve on it

- Safekeep key financial information so that it can be accessed by your family members when it’s time

The 4 Areas in a FinSnap

FinSnap is really just a template that includes prompts so that you don’t have to wreck your brain coming up with everything.

It is designed to be organised and presented in simple way.

There are 4 parts to it:

- Assets & Liabilities

- Income & Expenses

- Insurance Policy Summary

- Other Essential Information

Let’s take a deeper look at the significance of each section.

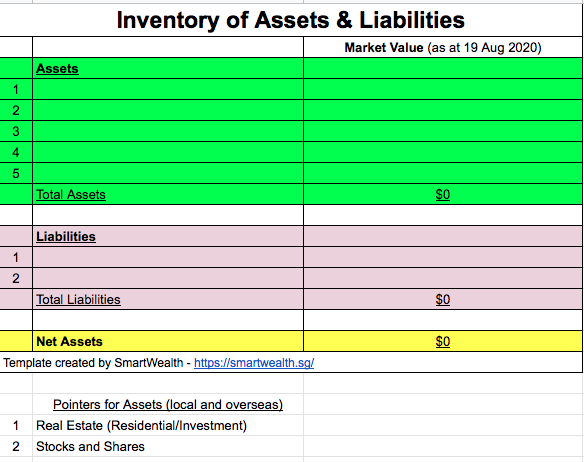

Assets & Liabilities

Whether you’ve made a Will or not, a Schedule of Assets has to be submitted upon death.

This should include a list of all your assets and liabilities.

If you’ve never made this list before, how would your Administrator/Executor be able to find this information?

They will have to write in to all financial institutions to check whether you have holdings with them.

I’m sure you’d be able to see how this plays out.

Not only is it extremely troublesome, but certain assets (e.g cryptocurrency) may not be accounted for, and just be lost in space.

Listing it down will serve as a reference.

It also shows you the overall health of your finances.

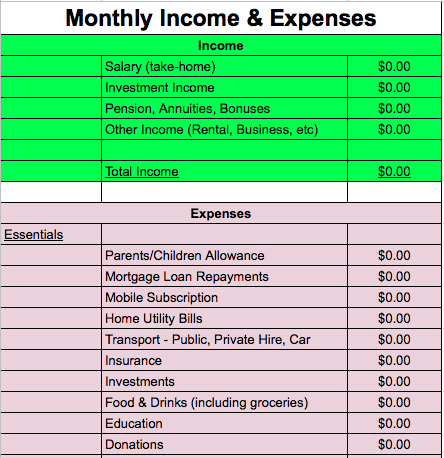

Income & Expenses

While the asset section would’ve listed down the income-generating assets, it’s also good to keep track of all earned income here.

Most importantly are your expenses.

Life around you still goes on, even when death or mental incapacity happens.

Having all your expenses listed down here will allow continuity for the essential ones, especially those meant for your dependants.

When your family doesn’t know of such expenses, and it’s not catered for, it will have a negative consequence.

For example, insurance policies will lapse and there’ll be no more coverage. Even if it’s reinstated, waiting periods will be refreshed.

This section will also allow you to track your spending.

Overspending? Spending on unnecessary items? You’ll know.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

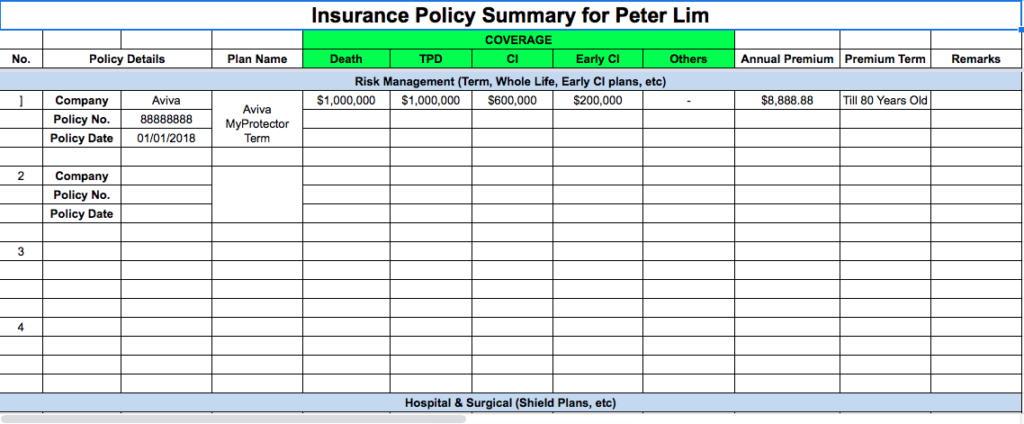

Insurance Policy Summary

Having the basic insurance plans is an important element in a good financial portfolio.

But many a times, consumers do not know what they’ve bought.

This also hampers proper advice to be given by a financial advisor, or anyone for that matter.

An insurance policy summary lists down all the policies you’ve bought.

Not only does it help in times of claims, it gives an overview of each policy.

It also shows any shortfalls or gaps.

Note: If you’re paying for your dependants’ policies, do duplicate and have separate tabs for them. This way, it shows an overview financial health of each individual.

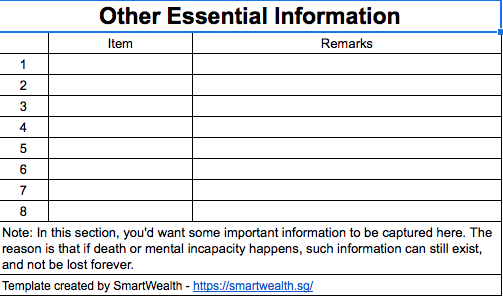

Other Essential Information

In this section, you’d want to list down other information that may not be categorised in the previous parts.

In this digital age, there’s one particular area which is often overlooked, and that’s online accounts.

Online accounts and their passwords can hold tremendous value to the person who’s recently deceased or mentally incapacitated.

If such access is denied or not known, it might not be to the benefit of loved ones and people around them.

Of course, you have to be comfortable to list out such sensitive information. If not, another way is to have a password manager which allow access to emergency contacts.

How Do You Download and Use the Template

The FinSnap download link is to a public google sheets created by me.

You’re able to view it, and there are 2 options you can take.

First, you can duplicate and make a copy, and it’ll then be useable on your own Google Sheets account.

Second, you can just download it as an .xsl and use it as an excel file.

I’d prefer the first option because I can make changes easily and it’s more accessible.

How Should FinSnap Be Accessed by Your Loved Ones

FinSnap is not a sure-fire way of keeping track and safekeeping financial information, it’s just to get you thinking.

You can even use a note-taking app.

But the core idea is that it should be usable and accessible.

You see, it’s how comfortable with you sharing such information with your loved ones.

If you’re comfortable, accessibility to them is not a problem. You can just share all information and passwords with them.

However, if you’re not comfortable, then you’d have to decide how you want them to know of everything when the time comes.

Do take note that all information (sensitive or not) kept digitally carries some sort of risk that it can be accessed by unintended people, so make sure proper digital hygiene is in place.

Here are some examples to get you thinking:

- sharing the file with your Executor (Will) or family members

- printing it out and letting your loved ones know of its location

- placing printed copies in a safe box at home

- etc

What’s Next?

In the bigger picture of things, there are 3 areas that one should look at.

Firstly, financial planning ensures that you have proper protection and wealth (e.g retirement planning) so that you have something to lean on and pass to the next generation.

Secondly, advance care planning ensures that everything is smooth when you’re not “living or dead”.

Lastly, estate planning ensures all that you have can be properly passed to your intended beneficiaries.

To tie this all up together is a simple tool like FinSnap.

Don’t belittle this simple tool as it can make a difference. Remember, it serves 2 purposes: tracking & safekeeping.

If you think this is great idea, make use of it and share this article with your family and friends.

Take a snapshot of your personal finances with FinSnap

Why?

- Keep track and improve your finances

- Ensure your family know what you have when the inevitable time comes

It also includes these sections:

- Assets & Liabilities

- Income & Expenses

- Insurance Policy Summary

- Other Essential Information

You don’t need to subscribe to anything, the download link goes to a public google sheet. Get your free template now.