…Compare and Save Precious Time & Money

1179+ Singaporeans have benefitted from our comparisons

- Avoid multiple agents yet be able to compare across 18 insurance companies

- Our DeepDive™ provides an in-depth comparison of the best term life insurance plans in Singapore

- Tailored to your specific needs with personalised quotes and premiums

- Replace your income when the undesirable happens so you and your family will not face any financial burdens

We’re Mentioned On

The Purpose of a Term Insurance

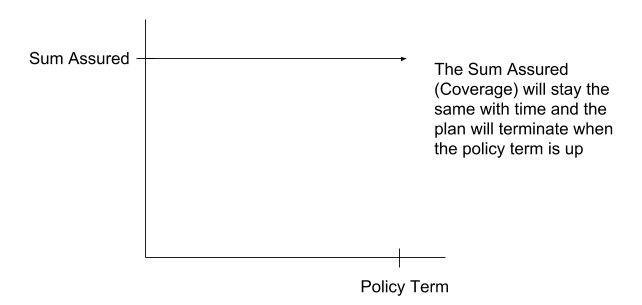

A term life insurance is a policy without any cash value but is able to replace your income if something adverse happens to you.

It can pay out a lump sum upon death, total and permanent disability, or critical illness, during the tenure of the plan.

Although the policy will be terminated when the tenure ends, a term insurance would be able to provide high coverage for your needs at an affordable rate.

With a term insurance cover, you are able to eliminate the financial risk when a mishap happens.

It will relieve any financial burdens you and your family may have to face. This will give you a greater peace of mind that no matter what happens, life will still continue on smoothly.

(If you’re new to term insurance and want to know more about it instead, read this guide first.)

Best Term Insurance in Singapore (Comparison for 2024)

If you like the idea of a term insurance, what’s next?

Finding the best one of course!

You’re using your hard-earned money and you’ll definitely want to make the best decision (with no regrets in the future).

But term plans come in all shapes and sizes… and one size doesn’t fit all.

The only way to find the best one for you is to do an in-depth comparison across the different plans offered by the different insurance companies.

And that’s what we’re good at.

Here’s a non-exhaustive list of term insurance plans that we can compare:

| Insurance Company | Plan Name |

| AIA | Secure Flexi Term |

| Singlife with Aviva | Singlife Elite Term (previously MyProtector – Term Plan II) |

| AXA | Term Protector / Term Protector Prime |

| FWD | Future First |

| HSBC Life | Term Protect Advantage |

| Manulife | ManuProtect Term (II) |

| NTUC Income | iTerm TermLife Solitaire |

| Tokio Marine | TM Term Assure (II) |

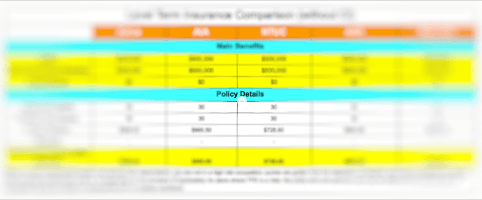

What’s in our Term Insurance Comparison DeepDive™

Unlike others, our DeepDive™ gives you the Good and the Bad…

So you will be equipped to make better decisions.

What we’ll cover in the comparison:

- Amount of cover for Death, TPD and/or Critical Illness

- Policy term

- Premium term

- Premiums payable

- Any secondary benefits

- Any available discounts or promotions

- Potential disadvantages

- Anything else you wish to know…

We spent hours scrutinising policy documents so that you don’t have to.

But, We Do Things Differently

Unlike others, we don’t publish these comparisons online (comparisons from other sites are usually generic in nature, may contain outdated information, and their quotes aren’t specific to your profile and your needs). Also, we don’t send these these personalised comparisons directly to your email.

We do this on an appointment basis (via zoom video call or a meet-up) to first understand your situation before going through the comparison with you. This ensures that we can provide appropriate advice there and then.

It may sound troublesome to you, but hear us out.

3 Reasons Why We Need to Meet

(Either through a zoom video call or a meet-up)

You just want to look at the numbers… you got no time… you don’t want to meet strangers.

Perhaps you’re here because you were doing research online or came looking for more information when someone – friend or agent – told you about this.

So you may thinking, “just email the comparison and quotes to me!“

As consumers ourselves, we understand the convenience of that.

But a mere comparison table will not help you make a concrete decision (one that you can set in stone).

Here are 3 reasons why there’s a need to meet:

1) Give Accurate Recommendations

Can you be absolutely sure of what you want? Could there be something that you may have missed?

A wrong decision might lead to a lifetime of regrets.

If you go to a doctor and without asking you anything, the doctor gives you medicine for this, this and this.

Would you have full confidence in the solution? No.

And that’s why there’s a need to understand your situation first before we give a recommendation – we’re not in the business of pushing products.

2) Requirement of MAS

In the Financial Advisers Act, it is stated that in order for a recommendation to be made, information on the client has to be gathered first.

Any inaccurate or incomplete information may affect the suitability of the recommendation.

Over the years, MAS has imposed stricter regulations to ultimately protect Singaporeans (and that includes you).

It is there for a reason and that is to ensure that you don’t end up with an unsuitable plan.

3) Touch on Fine Prints

What’s the purpose of a comparison table?

It’s to present information in an organised and simple way, so that you can make a decision based on it.

But can you really make an informed decision from it?

If you can easily do that, there wouldn’t be a need for two-digit pages of policy documents (for just one plan).

There are fine prints and clauses that might make or break your decision.

And that’s why we meet to not only show you the comparisons but to go through any critical pointers that you must be aware of.

We don’t want to overpromise and underdeliver.

We Compare 18 Insurance Companies to Find the Best Term Insurance Plan for Your Needs

This Is Great if You:

- Don’t know which plan is the best

- Don’t wish to waste precious time and money going to individual companies for quotes

- Don’t wish to tear your hair out looking through product documents

Our Trusted Providers

- AIA

- Singlife with Aviva

- Friends Provident

- China Life

- Generali Worldwide

- China Taiping

- NTUC Income

- Manulife

- LIC

- Old Mutual

- Swiss Life

- HSBC Life

- AXA

- Tokio Marine

- Singlife

- Transamerica

- Etiqa

- FWD

Frequently Asked Questions

A term insurance is a policy that pays out a lump sum of money in the event when the insured passes away, is met with a total and permanent disability, or is diagnosed with a critical illness.

Life insurance, be it term or whole life, helps to lessen the financial burden of you and your family if you’re unable to work and earn an income. A term insurance is affordable and the premium is typically just a small fraction of your income.

Yes, there’s no fee involved.

It typically takes around 45 minutes. However, it can be longer for more complex situations or if you have further questions.

Depending on your situation, we may or may not recommend solutions. If we do, it’s entirely up to you to go ahead with it. As consumers ourselves, we dislike high-pressure tactics.

Yes! If you do have them, do bring them along (or a policy summary) as we can provide more accurate feedback.

This can be done over a zoom video call or a meet-up.