Do you think we can afford to send our children to universities in the future?

The cost of education has risen significantly over the years, leading to some Singaporeans questioning whether it’s worth it to pursue further studies.

We were curious to see what Singaporeans’ thoughts are on the cost of a university education and whether it’s worth its high price.

We surveyed 1,088 adults aged 18 and above and here’s what we found.

Summary of Key Findings

- Education costs have increased by 74.7% from 2003 to 2023

- 2 in 3 adults think that a university education is expensive

- The total estimated cost of a 4-year general degree at a local university (including living expenses) is $79,450

- 71.3% of those who say getting a degree is expensive believe it’s worth it

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

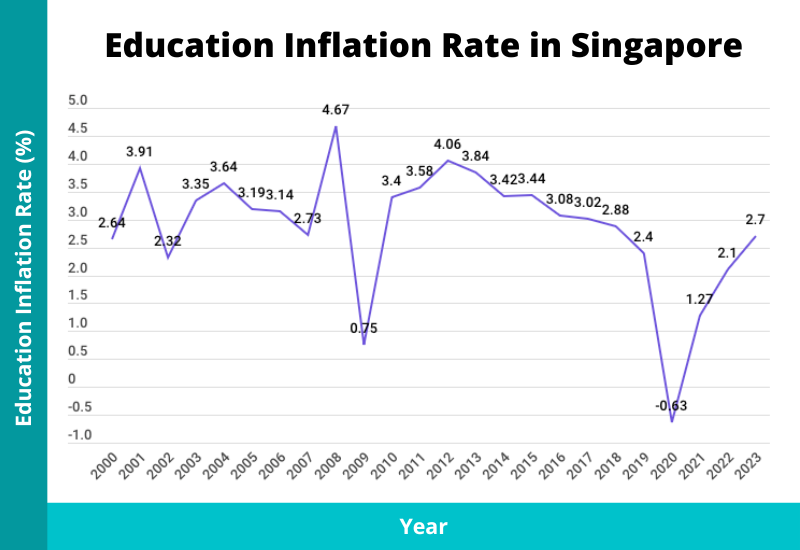

Education costs have increased by 74.7% from 2003 to 2023

Due to the dominance of a knowledge-driven economy in Singapore, the demand for employees holding a university degree has gone up. As such, the demand for a university education has also risen.

When we look at the Consumer Price Index (CPI), the cost of education has increased by 74.7% from 2003 to 2023, and the annual education inflation rate has always been positive, except in 2020, when local universities decided not to raise tuition fees.

Over the past 20 years, the average education inflation rate was 2.83% per year. In contrast, the average headline inflation was only 2.08% per year, which meant that the rising cost of education has outpaced the rising cost of living.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

2 in 3 adults think that a university education is expensive

For most students, obtaining a university degree is the last hurdle of their education journey and is the most costly one.

From the survey we’ve conducted, 63.1% of our respondents think that getting a degree in Singapore is expensive. Only a minority (36.9%) of respondents say that it’s not.

This doesn’t come as a surprise as university tuition fees have risen over time. From a separate study we’ve done recently, the total estimated tuition fees of a 4-year general course at a local university is $38,250. For medicine courses, one can expect to pay four times that amount ($151,000 at NUS).

Those fees are what a Singapore Citizen has to fork out, and the fees above are calculated after considering subsidies from the Ministry of Education (MOE) Tuition Grant.

The living expenses of a student, estimated at $10,300 per year, has to be factored in as well. This will be $41,200 (four years) on top of the tuition fees, amounting to a grand total of $79,450 for a university education in Singapore.

It is likely that prices will be higher in the future with rising inflation. Also, expect to pay much more for an overseas university education.

71.3% of those who say getting a degree is expensive believe it’s worth it

Of those who think that getting a degree is expensive, a huge majority (71.3%) of respondents say it’s worth it.

These findings suggest that the benefits of having a degree outweigh the costs of obtaining it. Perceived benefits include increased job opportunities, higher starting salaries, higher long-term earning potential, etc.

However, is having a degree really enough?

While degree holders do have an edge over non-degree holders, this is not always the case.

To succeed in today’s world, one needs to possess vital skills such as complex problem-solving, leadership, being adaptable, and having the right attitude.

COVID-19 has shown us that such skills come in handy when massive disruption and unpredictability happen. When an industry goes into a decline, it takes much more than what we’ve learned from school to overcome obstacles.

It doesn’t mean that the pursuit of academic qualifications is pointless; it just means that it should be complemented with skills learnt outside of the classroom, especially in an increasingly competitive space like Singapore.

The success of an individual doesn’t depend on how much they know, but how well they can apply their knowledge and the value they add to the company.

Want to Send Your Child to University?

Here are 3 tips for you:

- Decide where to send your child for higher education

Tuition fees and living costs are vastly different between a local and an overseas university. You’re likely to need a much bigger education fund to send your child overseas. - Know how much it will cost in the future

With some research, you can easily find the total estimated cost of a particular university in today’s value. But, you’ll still need to factor in inflation. Over a longer period (e.g., 20 years), this amount will be substantial. To estimate future costs, you can use our free education fund calculator. - Start saving now

Start building their education fund now. This can reduce the monthly financial commitment, especially if it’s over the span of 20 years. There are various ways to do so. One way is to make use of a child education savings plan.

Saving for your children’s future opens up the option for them to enter university, if they wish to. If they qualify for bursaries or scholarships in the future, that money you’ve saved up can instead go into covering their wedding expenses, partially funding their first home, or supplementing your own retirement. Learn more about how to save for your child’s university education fund.

Survey Methodology

This survey was conducted online using Google Surveys. The survey received 1,501 completed responses – 1088 with known demographics (age and gender). Only those aged 18 and above in Singapore were surveyed. Post-stratification weighting is applied to ensure an accurate and reliable representation of the total population. Responses were collected from 17 May 2021 to 3 June 2021. For journalists/publishers who are interested in looking at the raw data, feel free to drop me an email here.