Singapore has no natural resources.

But even with its limitations, it has grown to be more than just a little red dot.

Many of Singapore’s successes, such as its economic growth, come from the people living in it, and these successes will likely continue for the foreseeable future.

Education is a core component of human capital, which has played a pivotal role in the growth of Singapore.

As such, the importance of education has always been highlighted, not just from a national level, but from a parental level too. And that’s how we get the saying, “Study hard and you’ll get a good job.”

However, with a stronger demand in education, costs will inevitably rise, and that also contributes to the overall increase in the cost of living in Singapore.

How much has the cost of education already risen? And what is the average education inflation rate in Singapore?

Read on to find out!

Summary of Key Findings

- From 2003 to 2023, the cost of education has increased by 74.7%.

- The inflation rate for education in 2023 was 2.7%.

- Over the past 20 years (2003 to 2023), the average annual education inflation rate in Singapore was 2.83%.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is an Inflation Rate?

To put it simply, an inflation rate is the measure of how the cost of a bucket of goods and services increases (or decreases) over time, usually calculated annually.

A positive inflation rate means that the cost of goods is rising, and a negative inflation rate (or deflation) means that the cost of goods is falling.

In a growing economy, a moderate amount of inflation is usually seen, and that’s perfectly normal. This is because when an economy grows, businesses and consumers spend more. Therefore, when demand increases and supply stays constant, prices will increase, thus leading to inflation.

How does a country measure inflation?

As it’s impossible to track the price of every single item and get an average, the Consumer Price Index (CPI) remains to be the most reliable source of data.

Most developed countries (including Singapore) use the CPI, which is designed to track the average price changes of a fixed bucket of goods and services over time. The data are compiled by the Singapore Department of Statistics.

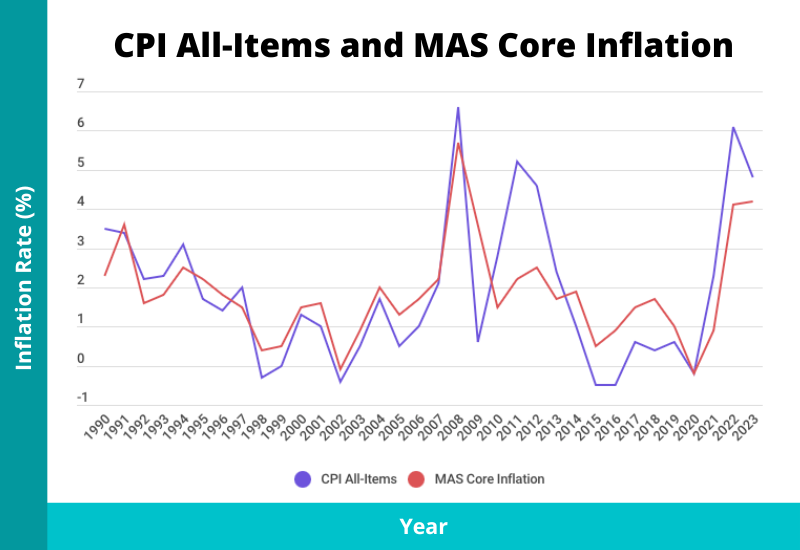

The two main inflation rates that reflect the cost of living in Singapore are the CPI All-Items (factors in all categories of goods and services that a resident household usually consumes; also known as headline inflation) and the MAS Core Inflation Rate (CPI All-Items minus accommodation and private transport).

If you want to know more about the general inflation in Singapore, you can read this article.

What Is the Education Inflation Rate?

Education is one of the main categories in the Consumer Price Index (CPI).

The CPI-Education attempts to track the average prices of tuition fees (e.g., university tuition fees), other fees, textbooks, and guides.

Therefore, when one wishes to investigate the cost of education over time, they just need to zoom into this category.

We’ll then be able to extract insights such as:

- How much have tuition fees increased over the years?

- What are the annual inflation rates?

- What is the average annual inflation rate over a fixed period of time?

How Much Did the Cost of Education Increase?

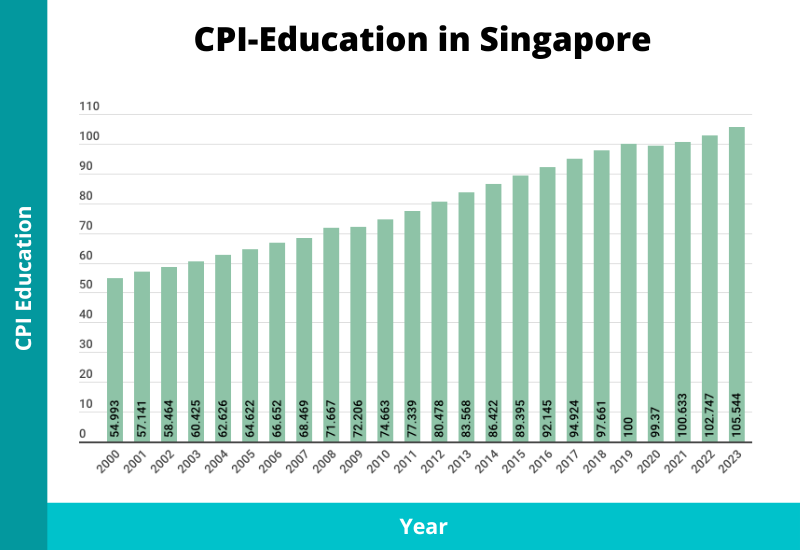

Here are the CPIs for Education from 2000 to 2023:

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| CPI-Education | 54.993 | 57.141 | 58.464 | 60.425 | 62.626 | 64.622 | 66.652 | 68.469 | 71.667 | 72.206 | 74.663 | 77.339 | 80.478 | 83.568 | 86.422 | 89.395 | 92.145 | 94.924 | 97.661 | 100 | 99.37 | 100.633 | 102.747 | 105.544 |

As you can see, since 2003, the CPI-Education has increased every single year except in 2020. Within that time frame of 20 years, it has increased 74.7% (from 60.425 in 2003 to 105.544 in 2023).

Hypothetically, that means that a university degree that cost $50,000 in 2003 would have cost $87,350 in 2023.

And if we were to calculate the increase from 10 years back, it would be 26.3% (83.568 in 2013 to 105.544 in 2023).

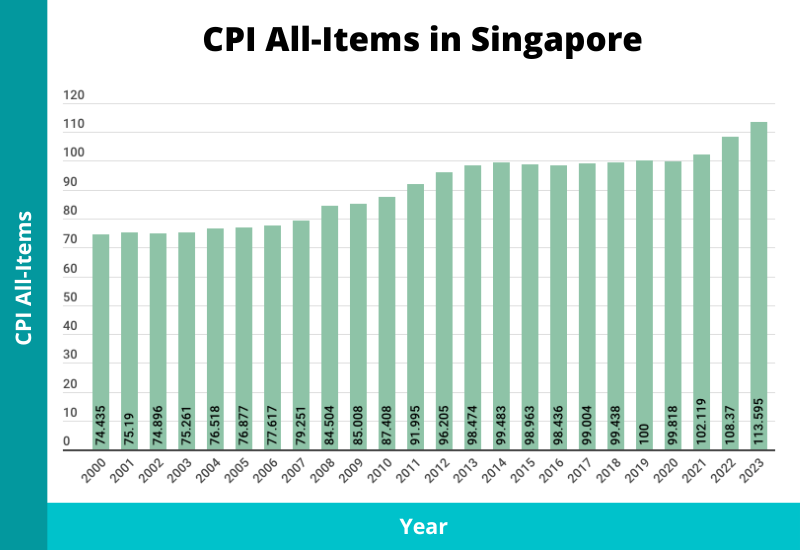

How does the education inflation compare with the headline inflation (CPI All-Items)?

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| CPI-All Items | 74.435 | 75.19 | 74.896 | 75.261 | 76.518 | 76.877 | 77.617 | 79.251 | 84.504 | 85.008 | 87.408 | 91.995 | 96.205 | 98.474 | 99.483 | 98.963 | 98.436 | 99.004 | 99.438 | 100 | 99.818 | 102.119 | 108.37 | 113.595 |

In the period from 2003 to 2023, the CPI-Education increased 74.7%, while the CPI All-Items only increased 50.9% (from 75.261 in 2003 to 113.595 in 2023).

If we were to look from 2013 to 2023, the CPI-Education increased 26.3%, as opposed to the increase of 15.4% for the CPI All-Items (98.474 in 2013 to 113.595 in 2023).

These data signify that the cost of education outpaces the cost of living in Singapore.

However, one should know that the CPI is just an average of a fixed basket of goods and services that are tracked. As such, it doesn’t represent the actual prices.

Case Study: Cost of University Fees in Singapore Over the Years

For a more holistic view, we should take a look at the actual costs.

Let’s look at the course fees of two different courses from 2011 to 2020:

1) NTU Accountancy (Undergraduate)

For a course in Accountancy, Singapore citizens had to pay $7,940/year in 2011 and $9,400/year in 2020, an increase of 18.4%. The CPI-Education increased 28.5% during this period.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

2) NTU Accountancy (Graduate)

For a Master of Accountancy, Singapore citizens had to pay $5,050/year in 2011 and $9,000/year in 2020, an increase of 78.2%. The CPI-Education increased 28.5% during this period.

From these two case studies, we can see that although the course fees have become more expensive, they have not risen in line with the CPI-Education.

We also researched on the cost of getting a local university degree in 2023, which is $38,250, on average.

If you factor in living expenses, estimated at $41,200 for four years, the total cost amounts to $79,450. Studying overseas will be much more expensive.

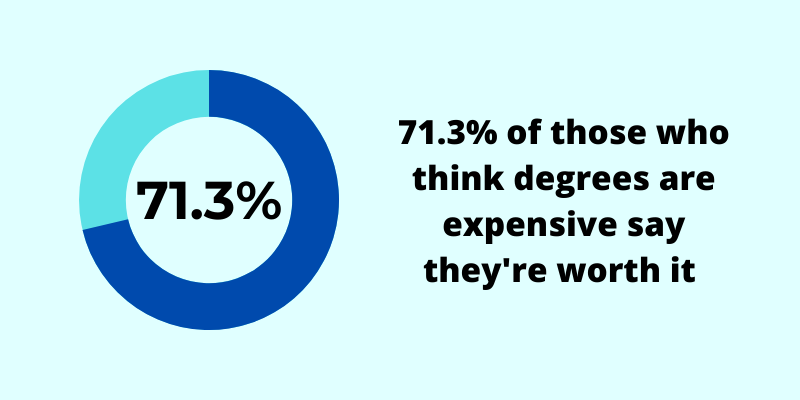

Thus, it’s not surprising that a majority (2 in 3) think that getting a degree is expensive, from a survey we conducted. However, most still believe it’s worth it.

The Education Inflation Rates Over the Years

To calculate the inflation rate, we can use this formula:

Inflation Rate = (CPI of current year – CPI of previous year) / CPI of previous year * 100

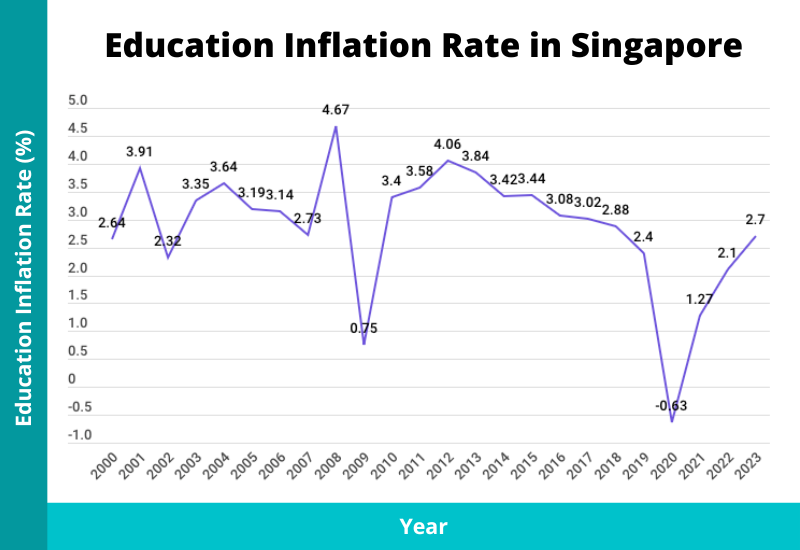

Using that formula, here are the inflation rates for education over the past 20 years (2003 to 2023):

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| CPI-Education | 54.993 | 57.141 | 58.464 | 60.425 | 62.626 | 64.622 | 66.652 | 68.469 | 71.667 | 72.206 | 74.663 | 77.339 | 80.478 | 83.568 | 86.422 | 89.395 | 92.145 | 94.924 | 97.661 | 100 | 99.37 | 100.633 | 102.747 | 105.544 |

| Education Inflation Rate (%) | 2.64 | 3.91 | 2.32 | 3.35 | 3.64 | 3.19 | 3.14 | 2.73 | 4.67 | 0.75 | 3.4 | 3.58 | 4.06 | 3.84 | 3.42 | 3.44 | 3.08 | 3.02 | 2.88 | 2.4 | -0.63 | 1.27 | 2.1 | 2.7 |

As you can see, the inflation rates fluctuate. In every year since 2003, there has been a positive inflation, with the highest being 4.67% in 2008. The exception to this is in 2020, where the inflation rate is negative at -0.63%.

Part of the reason for this deflation is that the local universities didn’t increase their tuition fee rates in 2020.

The Average Education Inflation Rate in Singapore

As actual inflation rates fluctuate, you can’t predict what the future inflation rates will be. As such, an average is needed to forecast the future cost of university tuition fees decades later.

This by no means is the actual cost you’ll be expected to pay. It’s, at most, an estimate.

In short, the average annual education inflation rate in Singapore over the past 20 years (2003 to 2023) was 2.83%.

How did we get this rate?

Here’s the long answer:

To calculate the average annual inflation rate, we can’t just use the sum of annual inflation rates over the years and divide it by the number of years. For example, we can’t take the rates from 2003 to 2023 (2.64% + 3.91% + 2.32% + … ) and divide it by 20 years, and take that as an average.

The correct way is to use this formula:

PV (1+r)^n = FV

Where

r = the compound average annual rate of inflation

n = the number of years

PV = the CPI-Education in 2003, which was 60.425

FV = the CPI-Education in 2023, which was 105.544

Using a financial calculator to find r, we’ll get this answer: 2.83%.

When we want to project future university fees, we should be prudent and include a buffer on top of the average inflation rate. That offers a more conservative estimate; better to have more than to have less.

However, perhaps you’ve realised by now that if you use different time periods, the average rate will differ.

As an added perspective, here are the average inflation rates (over 20 years) for different periods:

| Time Period | Average Education Inflation Rate |

|---|---|

| 2003 to 2023 | 2.83% |

| 2002 to 2022 | 2.86% |

| 2001 to 2021 | 2.87% |

| 2000 to 2020 | 3.00% |

| 1999 to 2019 | 3.17% |

| 1998 to 2018 | 3.26% |

| 1997 to 2017 | 3.37% |

| 1996 to 2016 | 3.36% |

| 1995 to 2015 | 3.43% |

| 1994 to 2014 | 3.46% |

| 1993 to 2013 | 3.45% |

| 1992 to 2012 | 3.47% |

| 1991 to 2011 | 3.59% |

And with that, we can see a pattern: the rates don’t exceed 4.00%.

Will this stay true? Maybe, maybe not. Historical data aren’t representative of how the future will look.

But at least we can use these data to make better decisions.

In short, the average annual education rate over the past 20 years is 2.83%. But, if we want to include a buffer to estimate our children’s future tuition fees, we can use a figure of 4.00-5.00%.

3 Tips to Fund Your Children’s University Education Fees

Education is an integral part of our lives, and will likely continue to be so for generations to come.

Is it possible that university fees will stop increasing in the future? Probably not. And there’s nothing we can do about that.

Because of this, we’ll have to save even more for our children’s universities.

I’ve written another article on how to save for your child’s education fund, but here are three things you can do now:

1) Know how much you need to save

The first step is always setting a financial goal. Without having a goal in mind, you won’t know whether you’re on track or not.

A shortfall could mean that your child might not be able to attend university when it’s time.

To find out how much you’ll need to save, you can use an education fund calculator.

2) Start saving earlier

The time between the current age of your child and the age that they will be when they enter university will only get shorter.

The best time to start saving for their university education is now.

If there are delays, the slope will only get steeper, and you will need to save a bigger amount in a shorter amount of time.

It’s always better to start saving earlier, even if you start with a smaller amount.

3) Explore various alternatives

There are many ways to save for a university education.

While savings accounts are safe, secure, and very liquid, they offer smaller returns. Most of the returns that you’ll get will be “eaten up” by the inflation.

On the flip side, if you were to place your money in volatile investments, when it’s time for your child to enter university, there’s a possibility of losing part of your principal.

That’s why it’s good to have a balance – something that’s safe yet offers potentially higher interest, which could offset the education inflation rate. One such alternative could be endowment savings plans meant for education.

Having said that, it’ll all depend on your preferences and risk appetite.

Also, before you start saving, do ensure that you have the proper insurance protection plans in place.