Raising a child in Singapore can be a costly affair.

Amongst the many costs involved – child delivery, childcare, living expenses, etc – the biggest ticket item of all is to provide for their university education.

Providing financial support for a child’s last hurdle in their education journey before they become a (real) adult is one of the last things we can do as parents.

Singapore is a competitive space; every edge that can be given to a child increases the likelihood of them succeeding in the future.

Setting up an education fund for your children ensures that when it’s time for them to enter university, the money is always there if they need it.

One popular way to fund an education is a child education endowment plan.

Today, we’ll take a look at what it is and some reasons why it’s effective.

So, read on!

How Much Will Your Child’s University Education Cost?

The very first step of saving for an education fund is to know where you want to send your kids for further studies.

Do you intend to send your child to a local or an overseas university?

Knowing that will tell you roughly how much you need to save.

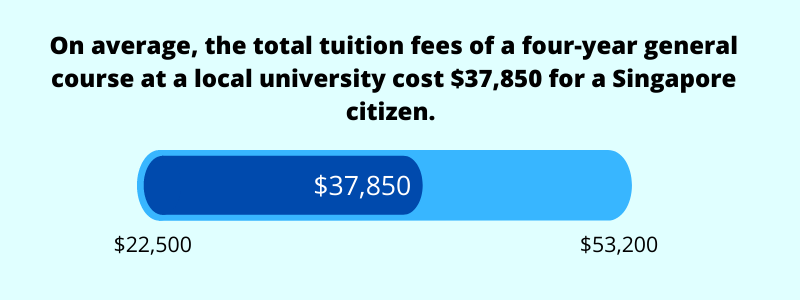

To give you an idea, you can expect to fork out around $37,850 for a degree in a local (public) university in Singapore such as NUS or NTU.

Although it seems expensive, a good proportion of people still view it as worth it.

For an overseas university, it’ll cost more. You can learn more about the costs of overseas studies here.

But tuition fees are not the only costs to save for. There are still living expenses.

Annual living costs for a student in Singapore can amount to $10,300, a total of $41,200 for four years.

Therefore, the estimated cost of obtaining a local degree is $79,050.

However, that estimate uses today’s value. When we factor in the average inflation for tuition fees and the average general inflation, future costs will be much higher. If you’re still not sure how much it’ll all cost, simply use our university education fund calculator.

There are a variety of ways to fund a university education; saving and investing is one of the best ways.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

It’s Almost Always Better to Start Saving Early

Unless you’re living from paycheck to paycheck or you have bad spending habits, you’re likely to have a healthy surplus of savings every month. If not, do check out how to budget efficiently and control your expenses.

By using our education fund calculator, you can know what your shortfall amounts to and how much you’ll need to have at a certain age. The time horizon is fixed – the goal post doesn’t shift.

So, the more you delay in saving/investing, the more difficult hitting your goals will be.

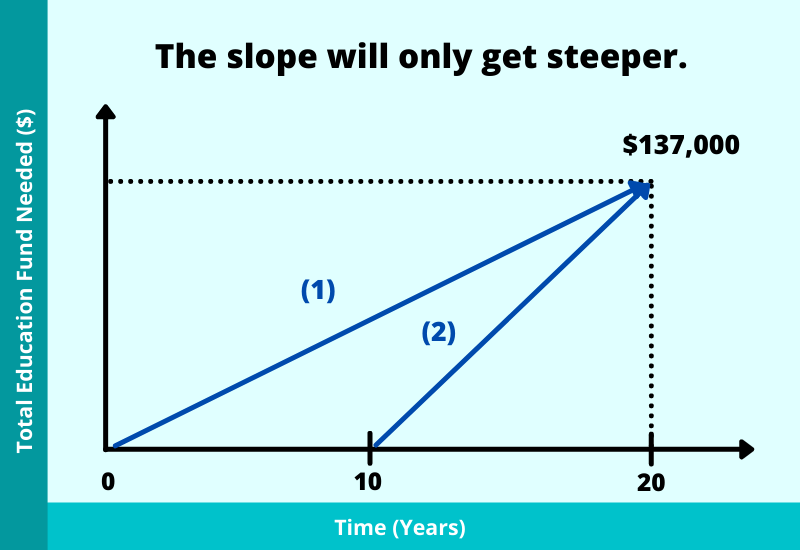

Here’s an illustration, assuming you need to save a total of $137,000 in 20 years’ time:

When you start earlier, the monthly commitment is smaller and more digestible. However, when you start later, there will be much less time to accumulate. Hence, your monthly commitment must then be increased in order to hit the target. The slope will only get steeper.

If your child is eligible to receive bursaries and/or scholarships in the future, these funds can still be used for other purposes such as paying for their wedding, partially funding their first home, or supplementing your retirement.

Investing to get more out of your dollar allows you to set aside an even smaller monthly commitment while still being able to hit your end goals.

One such option is the child education endowment plan.

What Is a Child Education Savings Plan (& How Does It Work)?

To put it simply, a child education plan is an insurance product that aims to provide funds for your child’s university education by a specified time.

There are many variations of savings plans. Some plans are education-specific and pay out a stream of money over a few years, while others are simple and pay out a lump sum after a fixed period of time.

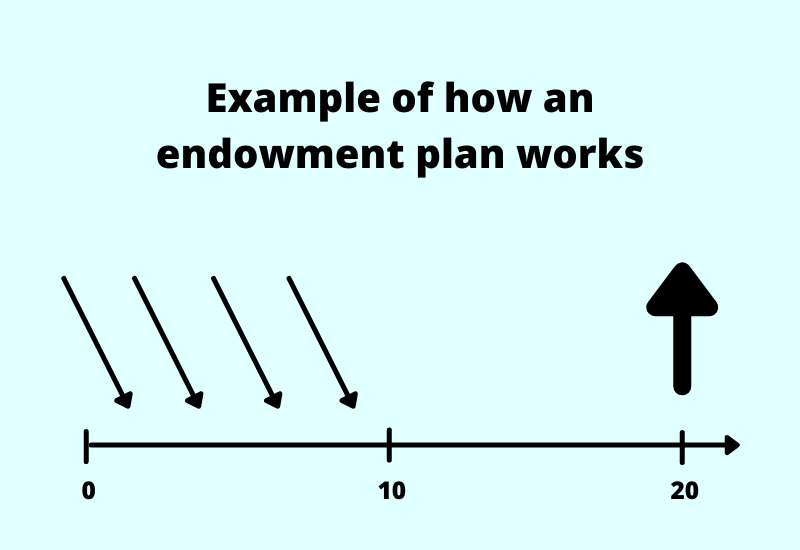

In order to fund the plan, you’ll have to commit to a regular premium (the amount you’re “saving”) for a specific number of years.

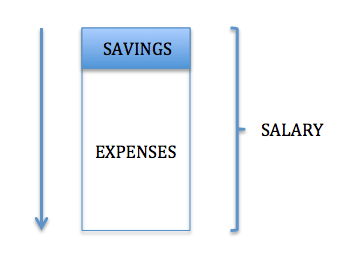

In summary, here’s a simple illustration of how an endowment works:

Such savings plans are often capital guaranteed upon maturity, and provide guaranteed and non-guaranteed returns.

Below, we’ll look at the education savings plan in greater detail.

5 Reasons to Build an Education Fund With an Endowment Plan

There’s no lack of financial instruments to help you save and invest. All of them have their pros and cons.

So, here are five reasons why an endowment plan is great for building an education fund.

1) It enforces discipline

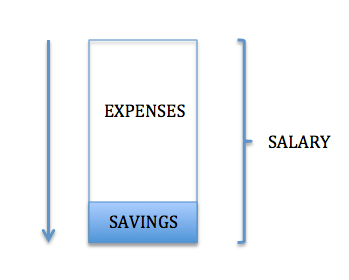

Without the correct spending/saving habits, we tend to spend first, then save whatever is left.

Because of emotional spending, we may buy things that we don’t need, leading to overspending.

The proper way to save, in my opinion, is to save first and then spend later.

We can do this by transferring out the amount we intend to save into another bank account when our monthly income comes in. This account should be made inaccessible so we don’t unnecessarily withdraw money from it whenever we feel like it.

Endowment plans embody this concept. Money is transferred via giro out from your savings account on a regular basis, ensuring that you’re always contributing to your goals.

2) It provides guarantees

Most education savings plans are capital guaranteed upon maturity.

This is important because you don’t want to be caught in a situation where you get back less than what you’ve put in (which can happen from investments).

You’ll know for sure that there will be money when it’s time for your child to enter university.

3) It also provides potentially higher returns

Investing into equities (stocks and shares) can give you the highest potential gains.

If you know what you’re doing, you can DIY. If not, you can always transfer that function to a financial adviser.

Having said that, investments come with a higher degree of risk in the form of volatility (where the value can fluctuate) and a potential loss of principal (you get back less than what you’ve invested).

Furthermore, as your time horizon is fixed (the child’s university entry age doesn’t typically change), timing will be extremely crucial. If it’s time for your child to enter university and your investments aren’t performing well, what will you do? Will you be willing to cash out at a loss? If you want to wait for your investments to recover, can you wait for an extended period? What if they never recover?

Depending on various factors, you can expect the total illustrated yield from a savings plan to be about 2-3% per year. The expected return (which is made up of guarantees and non-guarantees) isn’t fantastic, but it doesn’t need to be.

You’re likely to have higher returns than if you were saving in a bank account, fixed deposit, or even the Singapore Savings Bond (the 1 Jun, 2021 issue provides only an average of 1.61% per year over a 10-year period).

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

4) It is flexible and can suit your specific needs

Individuals are always unique.

That means your specific needs such as time horizon, amount of monthly savings needed, premium term, etc, will certainly be different from another’s.

Fortunately, there’s always something for everyone. Plans can be tweaked.

5) Your child’s education fund can still be provided for, rain or shine

The main objective of an endowment plan is simply to save (and enhance your savings), so that it can be used to pay for school fees in the future.

But, it doesn’t end there. Unfortunate events such as death could happen, and when they do, there might not be funds coming in anymore to support the premiums.

This is why such plans come with riders: to pay out the sum assured (or the cost of education) if death, disability, or critical illness happen.

Collectively, they provide greater assurances and peace of mind.

The Main Downside of Endowment Plans

The picture isn’t entirely rosy.

After making various decisions on the premium amount, premium term, and the policy term, the endowment plan becomes rigid. Also, it might not provide you with any liquidity if you need money along the way.

In the event that you decide to stop paying the premiums and/or cash out (surrender), what you get back may be lower than what you’ve put in.

But in exchange for this long-term commitment from you, insurance companies can take away the risk of “capital loss” for you while still providing upsides.

Furthermore, this rigidity ensures that you’re constantly saving. Any setbacks are akin to not providing the complete package for your child.

3 Things Parents Should Also Take Note Of

I know, saving and investing are important. But there are equally (or more) important aspects you should be aware of.

Here are some of them:

1) Having emergency funds

First and foremost, having some money set aside and rarely touched is always a good financial habit.

From the COVID pandemic, we can see how important this is. If a retrenchment or a drop in income happens, such funds can help you sustain living expenses until the situation gets better.

You can set aside 12 months of expenses.

This safety net shouldn’t be drawn upon as and when you like. It should only be used in dire situations.

2) Having adequate healthcare coverage

The cost of healthcare has been rising over the years, and the estimated healthcare inflation rate was 10% in 2019 and 2020. This is likely to continue.

One way to protect yourself from increasing healthcare costs is to have adequate hospitalisation coverage, which is the foundation of a proper financial plan. Coverage for both parents and children is essential. Without it, medical bills will always eat into your hard-earned savings. Huge bills will drive you into debt.

3) Protecting the income of both parents

As the monthly cost of living has increased over the decades, a dual-income family has become the new norm.

Expenses (and savings) come from the income you earn. Without it, daily living can’t function.

Therefore, it’s vital to protect your income.

While retrenchments can happen (which is why you should have an emergency fund), unfortunate events such as death, disability, or critical illness will cripple your income-generating ability.

Who’s going to pay for the daily expenses as well as provide for long-term goals then?

With sufficient life insurance, your family will not be burdened by financial woes.

Other than these three things, there are other factors to take into account too.

Finding the Best Child Education Savings Plan in Singapore (2021)

A child education plan provides guarantees as well as higher potential returns.

It’s better than leaving your money stagnant in the bank.

As there are many plans out there, how do you decide which is the best?

Apart from being able to compare multiple insurance companies and finding the best for you, we advocate holistic financial planning. That way, other important aspects can be factored in too.

Find out more about our FullCircle™ Planning today.