Check your financial health (net worth) by taking what you own (assets) minus what you owe (liabilities). Here’s a free online net worth calculator to make that easy for you.

If you prefer to calculate your personal balance sheet (a.k.a net worth) in an excel spreadsheet format, check out our free template, FinSnap.

How to Calculate Your Net Worth (Formula)

What’s the meaning of net worth? Simply put, it represents the wealth you’ve accumulated.

By doing up a personal balance sheet, you’re able to identify the total assets and liabilities you have.

And then, you use this formula to calculate your net worth:

Net Worth = Total Assets – Total Liabilities

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Are Assets and Liabilities?

Broadly put, assets are things that you own which hold value, while liabilities are things that you owe that need to be paid off.

For most individuals, just knowing that will suffice. There are other types of assets such as tangible, intangible, fixed and variable, but you don’t need to go there.

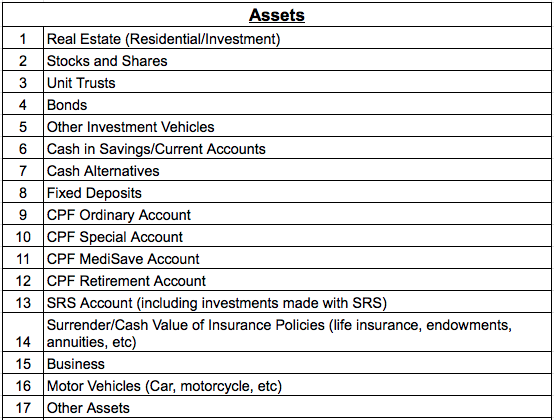

Here’s a list of the common assets you’ll own:

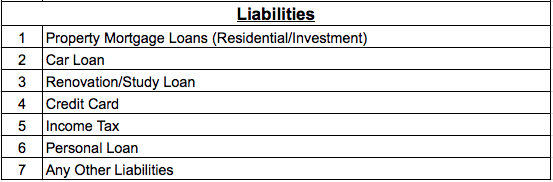

Here’s a list of the common liabilities you’ll owe:

Your Net Worth & Cashflow Are Important Numbers to Know

When you’re serious about your own personal finance matters, uncovering your net worth and cash flows are the first tasks to be done.

Not only at the beginning but you’ll have to track these numbers regularly.

Why are they important?

Not only do they show the health of your finances, they also give further insights such as gaps, potential pitfalls and areas of improvement.

Net worth

Your net worth is broken into the assets you own and the liabilities you owe. As these figures change over time, you’ll need to check in periodically.

Having a positive net worth that’s increasing at a decent pace shows that you’re on the right track.

If the progress is slow or you find yourself falling behind the national average, more should be done.

Cash flow

Your cash flow consists of your cash inflow (income) and your cash outflow (expenses).

Although there are other ways to increase your income, controlling how you spend through proper budgeting is one of the best ways to increase your cash flow.

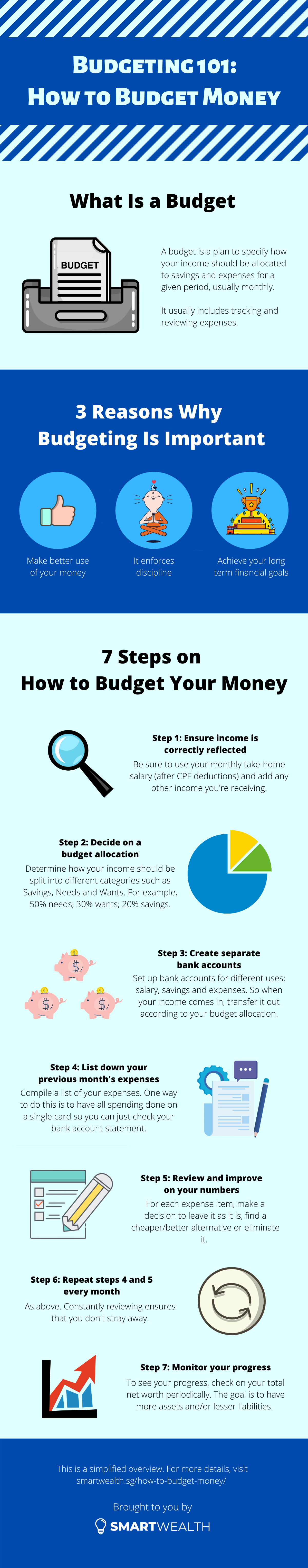

Here’s a simple infographic on how to budget your money:

(Note: to help you budget better, you can use a budgeting calculator or a budgeting excel template)

A growing positive net cash flow is a sign that you’re progressing well.

The higher your net cash flow, the more you can save and have more to invest.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

How to Increase Your Net Worth

The end goal is to increase the size of your assets and reduce the number of your liabilities.

So to increase your total net worth, here are 4 ways:

1) Earn More

When your income increases, everything else gets better too.

But because there are so many distractions on how to make more money out there, we tend to jump from one thing to another. So in my opinion, we shouldn’t sweat the small details that don’t move the needle.

One of your main focuses should be to invest in your career and/or business.

As build yourself to be the expert at what you’re doing, monetary rewards will come at a faster pace.

2) Protect More

Since your income is the most important resource you have that provides the ability to spend and save, thereby increasing your wealth, it makes sense to ensure this income continues to come in.

While the temporary loss of income (e.g getting fired or you quitting) can cause some disruption, it’s usually short term and one can find another job within 6 months.

However, permanent loss of income – death, total and permanent disability or critical illness – will be a nightmare.

When future income is lost and there’s no way to recover it, whatever you’ve accumulated in terms of savings and investments will deplete fast.

So always ensure that you have adequate life insurance coverage to be able to replace your income when the worse happens.

3) Save More (Spend Less)

Spending less to some degree is within your control.

When you’re able to spend less, you save more leading to an increase in assets and net worth.

Another way to look at increasing your net worth is to reduce your liabilities.

For example, if you buy a big house, you may end up with a big loan that stretches you too thin.

Other ways to reduce liabilities are to clear your debts such as credit card spending and the likes of it.

Having said that, debt can be a good thing if you know what you’re doing. You’re able to leverage on higher potential returns because of money you don’t own. Of course, it comes with its risks.

4) Invest More

With more money sitting in the bank, that money doesn’t grow.

You can’t accelerate the growth of your assets when you do that.

So one thing you can do is to invest that pool of money with potentially higher returns earlier on in life for the purpose of saving for retirement. Eventually, you’ll have a greater nest egg to depend on because of the compounding effect and the longer time horizon.

But of course, everything depends on your risk appetite.