The cost of living in Singapore has been rising.

In fact, in 2023, the headline (or overall) inflation was 4.8%. Furthermore, GST is set to increase from 7.0% to 9.0% between 2022 and 2025.

While Singaporeans do enjoy higher-than-average incomes and generally have higher net worths compared to others, income (and wealth) inequality is still prevalent.

Therefore, no matter your financial standing, knowing how to manage your personal finances has never been more crucial. But, do you even know how to?

We set out to understand the financial literacy of Singaporeans and whether it has a positive impact on their financial standing.

We surveyed 1,183 adults aged 18 and above. Here’s what we found, along with other noteworthy statistics.

Summary of Key Findings

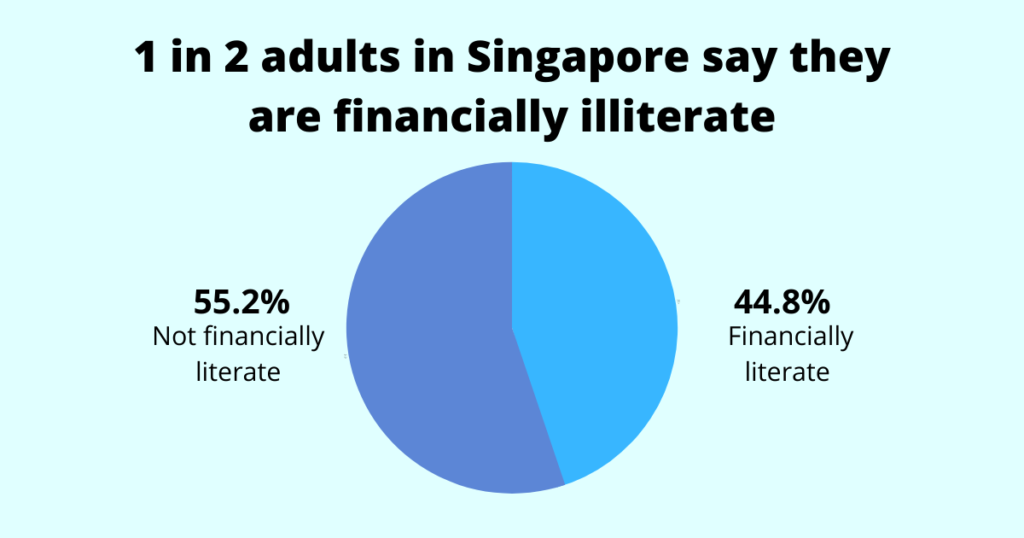

- 55.2% of adults in Singapore say they are financially illiterate

- Females are more financially literate than males

- The rate of financial literacy is lowest within the age group of 18 to 24

- Two in every three adults who are financially literate make good financial decisions

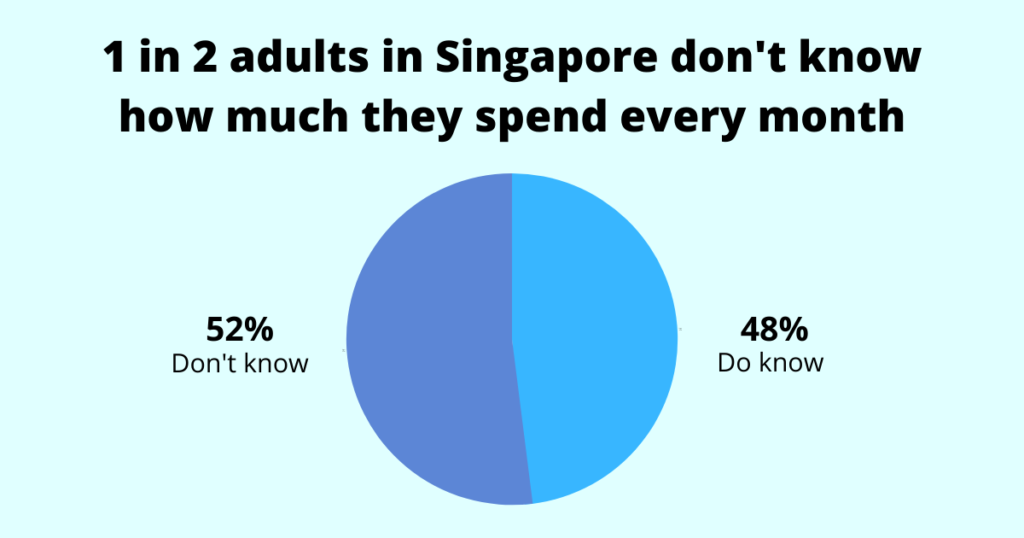

- 52% of adults do not know how much they spend every month

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is Financial Literacy (& Why Is It Important)?

Financial literacy is a term that gets thrown around a lot but never really gets defined.

So what exactly is the meaning of being financially literate? It is simply having different financial skills and knowing how to use them to serve your objectives and goals.

The knowledge and skills are not so technical that you’ll need a degree to learn them. They are simply understanding various financial concepts that can help you make smart money decisions in areas such as budgeting and investing.

This allows you to be more intentional and deliberate with your finances rather than just trying to save and hoping for the best.

Now more than ever, it is important to be financially literate.

The high cost of living in Singapore is recognised worldwide and it is bound to increase over time. But it’s not just the prices of everyday necessities that are getting higher; prices of big-ticket items such as properties and cars are edging up at a fast pace. In fact, in 2023, a record-breaking 470 HDB flats were transacted at a million dollars or higher.

With a lack of financial literacy, you might not know how to prepare for retirement or even just be able to downpay (and continue to pay) for a home of your own, which can leave you struggling later in life. Simply relying on just your income and savings could cause you to get left behind instead.

Considering all that plus our longer life expectancy, knowing how to deal with our finances becomes imperative.

But, are Singaporeans financially literate?

55.2% of Adults in Singapore Say They’re Financially Illiterate

Less than half of the respondents (44.8%) say they’re financially literate, while the majority (55.2%) say they’re not.

This is a concern because personal finances are so integral to one’s quality of life.

And if a large number of people aren’t equipped with at least the basic financial knowledge, one can wonder what the future would look like if nothing is being done.

Note: the financial literacy rate of our female respondents is higher than male respondents (48.9% vs 41.2%).

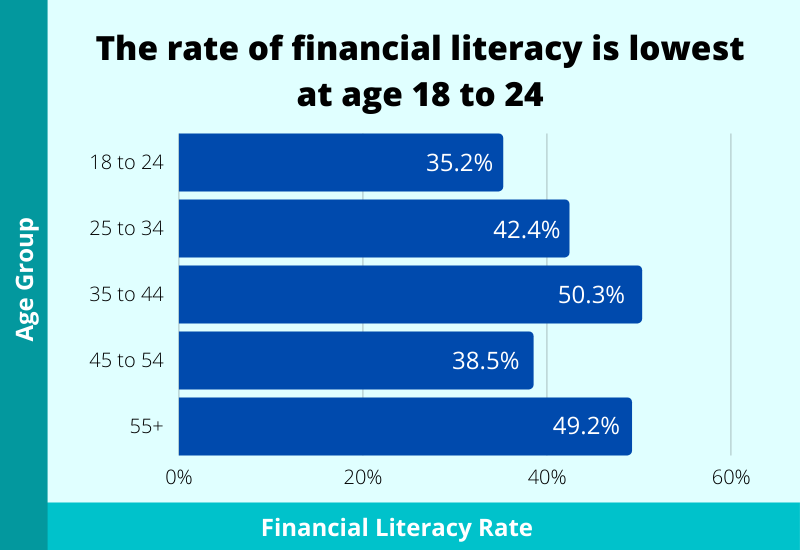

The Rate of Financial Literacy Is the Lowest at Ages 18 to 24

Do people of different ages, especially the young adults and millennials, know how to manage their money?

We found that among the respondents aged 18 to 24 years, only 35.2% say they’re financially literate. This is the lowest percentage among all the age groups.

Like in parenting, it is always best to be taught young. This is when bad habits can be caught and good ones can be taught.

If not, undesirable situations can happen in the future. Children or young adults can grow up unaware of the bad financial habits they’re practicing and it can compound throughout their adult years, causing unwanted issues, such as being in heavy debt, constantly gambling, and living from paycheck to paycheck.

It is thus heartening that the Ministry of Education (MOE) recognises this and has already implemented ways to teach students from primary school up to university.

2 in 3 Adults Who Are Financially Literate Make Good Financial Decisions

Having touched on the importance of financial literacy, does being financially educated have a positive impact?

The answer is a resounding yes.

Of those who are financially literate, 2 in 3 (67.9%) respondents say they make good financial decisions.

This shouldn’t come as a surprise because only with the proper knowledge will one be able to apply it.

However, that statistic also shows the reverse: those who are equipped with knowledge might still make bad decisions.

Why? One of the main reasons is human emotion, which has to be kept under control.

Here are two scenarios to illustrate how emotions can affect our decisions:

- Even if you’ve set a budgeting rule and already allocated a fixed percentage of your income towards “needs”, “wants”, and “savings”, in your daily life, you could succumb to additional emotional spending when you’re feeling celebratory or feeling down.

- You know that the stock markets are volatile (they go up and down), and in the long run, well-selected investments tend to trend upwards. However, when your investments are down, and you fear they might sink lower, you could sell them off and incur a loss.

So, although you may be equipped with the knowledge, you still have to keep your emotions in check.

This is also why rigid systems such as our Central Provident Fund (CPF) work. They take the emotion out of the picture. People can’t recklessly use their CPF monies on the unnecessary, but only on things that are important, such as paying for a house, education, healthcare matters, and saving for retirement.

Additional Statistics on the Financial Literacy of Singaporeans

Let’s take a look at other statistics on the financial literacy of Singaporeans.

It turns out that more than half (52%) of Singaporeans don’t know how much they spend every month. And those most likely to not know their monthly expenses are also between the ages of 18 to 24.

This is a concerning point because the first step of financial planning is knowing how much you spend so you can control it. This is bolstered by the fact that of those who track their monthly spending, 71.9% don’t overspend.

The disinterest in financial planning and related matters seems to be a common theme among the younger tranche of the earning population.

For example, according to the MAS, half of the working adults between 17 and 29 years haven’t even started thinking about financial planning because they think it is “still too early.” It turns out that one in every five Singaporeans feel that any sort of financial planning should only be done closer to retirement. Knowing this, it makes more sense how so many of us lack the understanding of some very basic yet critical financial concepts and skills. In fact, only 20% of us feel knowledgeable about investing.

Also, in a different survey, it was found that Singaporeans were lacking knowledge in financial matters. 4 in 10 respondents (aged 18 to 79) failed to understand basic financial concepts, such as simple and compound interest and risk diversification. The survey also noted that slightly more than half of the respondents did not have a plan in place for their retirement savings.

Needless to say, we as a population have room for improvement when it comes to becoming fully financially literate. But do not despair; these surveys also show that we are improving. The task before us now is to accelerate and perpetuate financial education.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Tips on How to Improve Financial Literacy

The truth is, financial literacy is no longer a concept just for those who want to get rich.

In today’s climate, it has really become a life skill – a skill you need to make the most out of life and, in some cases, to survive. As with other life skills, the best time to start acquiring it is as early as possible.

The best way to do this is to ingrain financial skills and concepts in individuals from a young age, at home whenever possible. This way, the child sees them as an everyday skill rather than something confined in a classroom. This means that parents should be financially literate to be able to impart this knowledge to their children at the prime learning stages.

And because it really is a life skill, it should also be taught in school. Doing so will reinforce the parents’ teachings from the home with the substantive and theoretical aspects. In a way, the parents provide the general and basic ideas while the schools provide the framework to solidify the knowledge.

However, not everyone has been fortunate enough to have been taught these financial skills and concepts at home or at school. Many people will go through the first years of employment without giving any thought on their financial goals and how to get there.

Well, it’s not too late. As with most life skills, you can easily start now. Of course, this goes without saying that the later you start, the greater the gap you’ll have to catch up on in reaching your financial goals.

Fortunately, reliable resources for becoming financially literate abound.

One Google search will get you an unlimited stream of relevant and accurate information. It’s just a matter of picking out the ones that will work for you.

You can also check out MoneySense, a government initiative, to learn about basic financial topics.

And of course, our blog as well.

4 Core Components to Being Financially Healthy

As a parting note, and without delving into too much detail, let’s have a quick look at the four components of being financially healthy:

1) Increase Income

The first component is increasing income. Your income should not plateau or remain stagnant.

Inflation, however slow, will catch up and the value of your income will decrease over time.

As such, you must always strive to increase your income. Some ways to increase income include self-improvement and upgrading of skills in order to get a promotion or a better job, having an extra or part-time job, or investing in a business or funds.

Do not feel pressure if there is no clear way to do this at this very moment. The important thing is that it is on your radar and you are actively looking for ways to improve on it.

2) Increase Protection

Because income is so important, you should protect it and the wealth you’ve accumulated by getting the right type of insurance.

For instance, having adequate coverage for health insurance and life insurance ensures that you will not be financially burdened if death, disabilities, accidents, or illnesses happen.

Just remember to make sure that the premiums work within your income. Getting insurance with premiums you can’t afford will obviously do more harm than good.

3) Decrease Spending (to Save More)

Third is looking at your spending and figuring out how to lower it, if possible.

Sometimes, even just the act of sitting down and making a list of your expenses provides unexpected insights.

Having a good hard look at what you are spending your money on will help you save more. Remember, the first step in building wealth is having enough saved.

4) Increase Investing

Last is growing your wealth by investing, depending on your risk appetite.

Saving your money does indeed build wealth, but investing grows it. It opens up new revenue streams which in turn increases your income. With increased income, you’ll then be able to save more and invest more.

It can actually become a self-perpetuating cycle if you get it right.

However, finding the right investments is just as important. Some investments can take years to see a return, while some might result in losses.

If you want to learn more about how to improve your personal finances, you can read this guide.

And if you are feeling overwhelmed by all of this information, don’t worry. You don’t have to learn or do all of these at once. Take a step back and digest. The worst that can happen is that you give up halfway.

If you wish to take a hands-off approach or have no clue where to start, consider going through a comprehensive financial planning session.

Methodology

This survey was conducted online using Google Surveys. The survey received 1,503 completed responses – 1,183 with known demographics (age and gender). Only those aged 18 and above in Singapore were surveyed. Post-stratification weighting was applied to ensure an accurate and reliable representation of the total population. Responses were collected on 7 Feb 2022. There are small rounding errors.