With a higher income, you’re able to create wealth at a faster pace (if you practice proper financial planning).

Despite its small size, Singapore already boasts 298,650 millionaires. The average mean and median net worth per adult in Singapore is $483,575 and $125,729, respectively.

Does this mean that Singaporeans are earning a high income? What about the average man on the street? Is there income (and wealth) inequality here?

We aimed to determine the average median income or salary in Singapore. And we further break it down by age, sex, education, occupation, and industry. If you want to check out statistics on household income instead, click here.

So, if you wish to compare your income with others and see whether it’s good enough, then you should read on!

All figures are in Singapore dollars unless specified otherwise; an exchange rate of US$1 to S$1.35 was applied for conversions.

Summary of Key Findings

- The average median income (inclusive of employer CPF contributions) in Singapore is $5,197/month ($62,364/year). This equates to US$3,850/month or US$46,200/year

- Without employer CPF contributions, the average median income is $4,550/month or $54,600/year

- Singapore’s median income has grown 40.3% over the past 10 years, an annualised increase of 3.4%

- At age 40 to 44 is when salaries should peak

- In general, males earn more than females. In 2023, the median salary for men was 7.7% (or $390) higher than women

- Degree holders earn a median income of $8,190, which is $3,436 (or 72.3%) more than diploma holders

- Over the past 10 years, the industry that held the highest median salary was financial and insurance services. In 2023, this industry had a median salary of $8,190

Read on for more details.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

The Source of Our Data

We only looked at the most reliable data available, which come from the Ministry of Manpower.

The Manpower Research & Statistics Department publishes comprehensive employment reports and data on a yearly basis. As of 16 Feb 2024, the latest published data was on 31 Jan 2024.

For the purpose of this article, we’re just going to narrow the scope down to gross monthly income from work. Gross monthly income, in this case, covers full-time employees and self-employed persons who are Singapore citizens or permanent residents (PRs).

For employees, gross monthly income refers to the monthly salaries or wages (including basic wages, overtime pay, commissions, other allowances, and one-twelfth of annual bonuses) before deduction of employee CPF contribution and income tax. It also includes employer CPF contributions, unless otherwise stated.

For self-employed persons, it refers to the average monthly profits from their business, trade, or profession before income tax.

Although there are some distinctions between “income” and “salary”, for clarity purposes, we’ll be using them interchangeably.

The Difference Between Averages: Mean vs Median

The most popular measurements of average are mean and median.

For example, we have this set of data:

| Person 1 | $3,000 |

| Person 2 | $4,000 |

| Person 3 | $5,000 |

| Person 4 | $6,000 |

| Person 5 | $17,000 |

To get the mean, you’ll need to sum up all the figures (3,000+4,000+5,000+6,000+17,000) and divide the sum by five, and the answer will be $7,000.

To get the median, you’ll just have to arrange the figures from smallest to largest. The one at the very middle (or 50th percentile) is the median, and that’s $5,000. If there are two numbers in the middle, then you’ll sum up both the numbers and divide it by two.

For determining average income/salary, median is preferable. It would mean that 50% of the population is below that median figure, and the other 50% is above it.

Average Income/Salary in Singapore (in General)

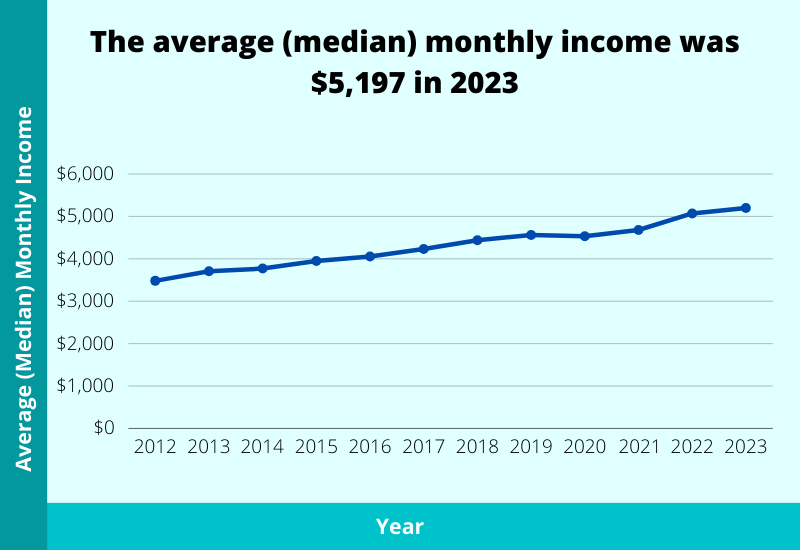

What is the median salary in Singapore? The median monthly salary in 2023 was $5,197 ($62,364/year). This equates to US$3,850/month or US$46,200/year.

Here are the income data for the past 10 years:

| Year | Median Monthly Income (Including Employer CPF Contributions) |

| 2012 | $3,480 |

| 2013 | $3,705 |

| 2014 | $3,770 |

| 2015 | $3,949 |

| 2016 | $4,056 |

| 2017 | $4,232 |

| 2018 | $4,437 |

| 2019 | $4,563 |

| 2020 | $4,534 |

| 2021 | $4,680 |

| 2022 | $5,070 |

| 2023 | $5,197 |

From 2022 to 2023, the average monthly income increased from $5,070 to $5,197, reflecting an increase of 2.5%.

Over the past 10 years (2013 to 2023), Singapore’s median income increased by 40.3%. This is an annualised increase of 3.4%. After factoring in inflation, the annual increase was 2.0%.

If we exclude employer CPF contributions, the average median income in 2023 was $4,550 per month (or $54,600 per year).

Average Income/Salary in Singapore (by Age)

It is typical that as we age (up to a certain point), our wages rise too. This is because of many factors, such as experience, pay increments, and promotions.

Here are the median salaries by age group:

| Age Group | 2023 Median Monthly Salary (Including Employer CPF Contributions) | 2022 Median Monthly Salary (Including Employer CPF Contributions) | 2021 Median Monthly Salary (Including Employer CPF Contributions) | 2020 Median Monthly Salary (Including Employer CPF Contributions) | 2019 Median Monthly Salary (Including Employer CPF Contributions) |

| 15 – 19 | $1,580 | $1,638 | $1,170 | $1,170 | $1,053 |

| 20 – 24 | $3,042 | $2,925 | $2,691 | $2,793 | $2,730 |

| 25 – 29 | $4,680 | $4,446 | $4,095 | $4,056 | $4,081 |

| 30 – 34 | $5,850 | $5,792 | $5,222 | $5,265 | $5,197 |

| 35 – 39 | $6,718 | $6,825 | $6,102 | $6,143 | $6,148 |

| 40 – 44 | $7,098 | $6,825 | $6,825 | $6,435 | $6,338 |

| 45 – 49 | $6,825 | $6,581 | $5,958 | $5,850 | $5,850 |

| 50 – 54 | $5,850 | $5,850 | $5,070 | $4,719 | $4,680 |

| 55 – 59 | $4,351 | $4,323 | $3,729 | $3,500 | $3,563 |

| 60 & Over | $2,905 | $2,621 | $2,543 | $2,330 | $2,562 |

From the table (for the year 2023), we can see that the median salary is at the lowest ($1,580) in the age group of 15 to 19. It then starts to grow to its peak ($7,098) at the age of 40 to 44, and then it starts to decline from that point onwards until it hits the typical retirement age of 60 and over where the median salary is at $2,905.

What kind of insights can we get from this?

It is expected that during your retirement years (or close to them), you won’t be earning as much as compared to your prime working years. So, if you’re young, you must make sure to allocate some of your money towards saving for the future (especially for retirement). If you delay this, you might find it a struggle to hit your retirement goals in the future.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Average Income/Salary in Singapore (By Sex)

The gender pay gap has always been a hot topic in Singapore (and in any developed country).

Are males earning more than females?

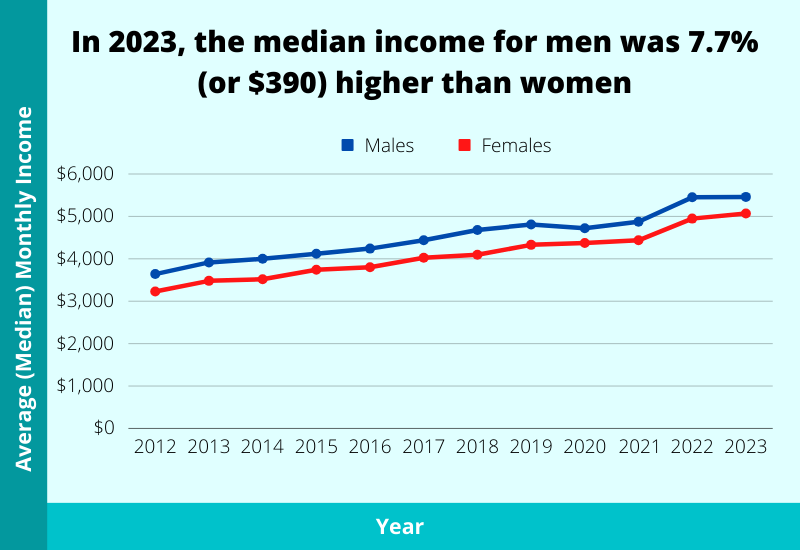

Here are the median incomes for both males and females for the past 10 years:

| Year | Males’ Median Monthly Income (Including Employer CPF Contributions) | Females’ Median Monthly Income (Including Employer CPF Contributions) | Is the median income higher for males than females? | What’s the difference in absolute dollars? | What’s the difference in percentage? |

| 2012 | $3,640 | $3,230 | Yes | $410 | 12.7% |

| 2013 | $3,915 | $3,480 | Yes | $435 | 12.5% |

| 2014 | $4,000 | $3,518 | Yes | $482 | 13.7% |

| 2015 | $4,118 | $3,744 | Yes | $374 | 10.0% |

| 2016 | $4,241 | $3,803 | Yes | $438 | 11.5% |

| 2017 | $4,437 | $4,027 | Yes | $410 | 10.2% |

| 2018 | $4,680 | $4,095 | Yes | $585 | 14.3% |

| 2019 | $4,810 | $4,329 | Yes | $481 | 11.1% |

| 2020 | $4,719 | $4,374 | Yes | $345 | 7.9% |

| 2021 | $4,875 | $4,437 | Yes | $438 | 9.9% |

| 2022 | $5,450 | $4,948 | Yes | $502 | 10.1% |

| 2023 | $5,460 | $5,070 | Yes | $390 | 7.7% |

In 2023, men’s median salary was 7.7% (or $390) higher than women’s. This gap was smaller when compared to the previous year of 2022, when men earned 10.1% more (or $502) than women.

When we zoom out to the bigger picture, it does seem like the gender pay gap is narrowing over the years. In the earlier years, since 2012, the percentage difference in salaries has always been in the double digits. It was only in 2020 and 2021 when the gap went into the single digits. 2023’s figure of 7.7% was the lowest we have ever seen.

To give further insight, here are the median salaries broken down by age:

| Age Group | 2023 Males’ Median Monthly Salary (Including Employer CPF Contributions) | 2023 Females’ Median Monthly Salary (Including Employer CPF Contributions) |

| 15 – 19 | $960 | $1,901 |

| 20 – 24 | $2,691 | $3,291 |

| 25 – 29 | $4,563 | $4,706 |

| 30 – 34 | $5,850 | $5,796 |

| 35 – 39 | $7,387 | $6,143 |

| 40 – 44 | $7,776 | $6,435 |

| 45 – 49 | $7,664 | $6,084 |

| 50 – 54 | $6,338 | $5,324 |

| 55 – 59 | $4,843 | $3,990 |

| 60 & Over | $3,000 | $2,664 |

Females outearn males in the younger age brackets of 15 to 24. At ages 25 to 29, the median salaries of both genders start to converge. It’s only in the age group of 30 and above where men then start to earn more than women.

There are a few possible explanations for this. Firstly, males have to go through full-time National Service for two years. Even after that, they still need to complete their 10-year reservist cycle. Secondly, by age 30, women have reached the typical age of child-bearing in Singapore. Therefore, some mothers may choose to provide extra care and attention to their child and may take lower-intensity jobs.

Average Income/Salary in Singapore (by Education)

In Singapore, there has always been a greater emphasis on the education system to gain a better financial standing (income and wealth), especially in the earlier years of its independence.

Today, this is still prevalent. Parents still want their children to get good grades, get into a good school, and eventually get at least a degree.

But does having a degree matter in today’s context?

Here are the median salaries according to the highest qualifications achieved:

| Highest Qualification | 2023 Median Monthly Income (Including Employer CPF Contributions) |

| Below Secondary | $2,312 |

| Secondary | $3,346 |

| Post-Secondary (Non-Tertiary) | $3,276 |

| Diploma & Professional Qualification | $4,754 |

| Degree | $8,190 |

When we look at those numbers and nothing else, we can conclude that education still has a big part to play in terms of how much one can typically earn. The more educated you are, the higher your wages will be.

Degree holders still command the highest pay at $8,190. They earn $3,436 (or 72.3%) more than the second-highest group, which consists of diploma and professional qualification holders.

However, whether education will remain a determinant of income remains to be seen.

Average Income/Salary in Singapore (by Occupation)

Below are the average salaries by occupation:

| Occupation | 2023 Median Monthly Salary (Including Employer CPF Contributions) |

| Managers & Administrators | $10,889 |

| Professionals | $8,020 |

| Associate Professionals & Technicians | $4,680 |

| Clerical Support Workers | $3,361 |

| Service & Sales Workers | $2,788 |

| Craftsmen & Related Trades Workers | $2,863 |

| Plant & Machine Operators & Assemblers | $2,481 |

| Cleaners, Labourers, & Related Workers | $1,861 |

In 2023, professionals, managers, executives, and technicians (PMETs) earned a median monthly salary substantially higher than non-PMETs.

The managers and administrators are the highest-earning group, with a median salary of $10,889. The lowest are the cleaners, labourers, and related workers, with a median salary of $1,861.

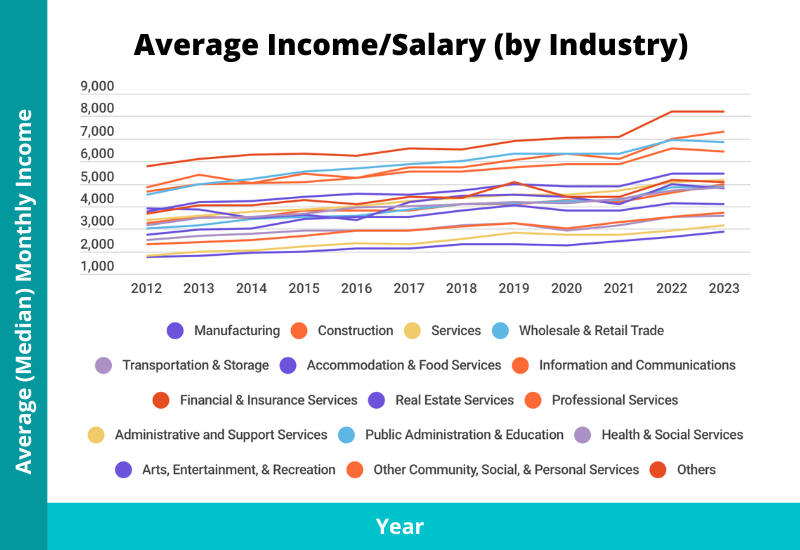

Average Income/Salary in Singapore (by Industry)

The COVID-19 pandemic has caused dramatic industry changes over a short period.

Some industries have recovered, while some will never, and then there are those who have performed exceedingly well.

Here are the average incomes by industry:

| Industry | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Manufacturing | $5,460 | $5,460 | $4,896 | $4,885 | $5,000 | $4,680 | $4,500 | $4,571 | $4,437 | $4,210 | $4,162 | $3,770 |

| Construction | $5,000 | $4,583 | $4,200 | $4,294 | $4,095 | $4,095 | $3,803 | $3,803 | $3,790 | $3,480 | $3,518 | $3,263 |

| Services | $5,187 | $5,070 | $4,680 | $4,505 | $4,516 | $4,388 | $4,212 | $4,000 | $3,844 | $3,750 | $3,582 | $3,384 |

| – Wholesale & Retail Trade | $4,875 | $4,817 | $4,285 | $4,212 | $4,118 | $4,070 | $3,861 | $3,591 | $3,549 | $3,420 | $3,141 | $3,000 |

| – Transportation & Storage | $3,554 | $3,510 | $3,168 | $2,925 | $3,225 | $3,161 | $2,925 | $2,925 | $2,916 | $2,797 | $2,675 | $2,500 |

| – Accommodation & Food Services | $2,853 | $2,640 | $2,457 | $2,282 | $2,300 | $2,308 | $2,123 | $2,106 | $2,000 | $1,915 | $1,800 | $1,740 |

| – Information and Communications | $7,320 | $7,000 | $6,092 | $6,330 | $6,047 | $5,719 | $5,704 | $5,265 | $5,460 | $5,026 | $5,414 | $4,838 |

| – Financial & Insurance Services | $8,190 | $8,190 | $7,069 | $7,020 | $6,913 | $6,540 | $6,581 | $6,240 | $6,338 | $6,300 | $6,090 | $5,751 |

| – Real Estate Services | $4,777 | $5,000 | $4,095 | $4,437 | $4,520 | $4,475 | $4,183 | $3,390 | $3,611 | $3,500 | $3,857 | $3,915 |

| – Professional Services | $6,435 | $6,581 | $5,850 | $5,850 | $5,704 | $5,558 | $5,558 | $5,265 | $5,075 | $5,026 | $5,000 | $4,640 |

| – Administrative and Support Services | $3,168 | $2,925 | $2,725 | $2,748 | $2,808 | $2,535 | $2,311 | $2,362 | $2,238 | $2,036 | $1,972 | $1,799 |

| – Public Administration & Education | $6,833 | $6,962 | $6,338 | $6,338 | $6,338 | $6,012 | $5,850 | $5,655 | $5,538 | $5,220 | $5,000 | $4,495 |

| – Health & Social Services | $4,817 | $4,680 | $4,309 | $4,129 | $4,199 | $4,095 | $4,000 | $3,949 | $3,649 | $3,518 | $3,480 | $3,141 |

| – Arts, Entertainment, & Recreation | $4,095 | $4,150 | $3,803 | $3,803 | $4,056 | $3,803 | $3,549 | $3,510 | $3,422 | $2,997 | $2,978 | $2,736 |

| – Other Community, Social, & Personal Services | $3,721 | $3,510 | $3,296 | $2,996 | $3,250 | $3,089 | $2,925 | $2,925 | $2,662 | $2,514 | $2,395 | $2,289 |

| Others | $5,079 | $5,176 | $4,437 | $4,437 | $5,070 | $4,368 | $4,407 | $4,081 | $4,292 | $4,060 | $4,022 | $3,654 |

In 2023, the industry with the highest median income of $8,190 was financial and insurance services. The industry with the lowest of $2,853 was accommodation and food services.

Looking at the trend over the past 10 years, the industry of financial and insurance services has always provided the highest median income, which is still growing. It is likely to perform well in the future, too, because of Singapore’s positioning to be a strong financial hub.

In Closing

Your income is one of the most, if not the most, important resources you have.

It allows you to pay your bills and financial commitments and to save for the future.

To increase your income, investing in your career is one of the surest things you can do. And when you have excess money, always make sure to make it work harder with investments. This is to ensure your hard-earned money doesn’t get eroded by inflation.

It’s essential to safeguard your future income and accumulated wealth with appropriate insurance policies, such as term or whole life insurance.