Many Singaporeans are too busy with the daily hustle to intentionally set aside time for long-term orientated matters such as financial planning.

According to St James’s Place Wealth Management Asia, 41% of Singaporeans do not have a financial plan.

Such a statistic is worrying as financial planning can greatly influence one’s quality of life in the long term.

In this article, we will explain more about the benefits of financial planning and why it is important to start early.

The Purpose of Financial Planning

“If you fail to plan, you are planning to fail.”

This quote from Benjamin Franklin is definitely relevant when it comes to your finances.

Some people attempt to get through their finances by simply trying to save up as much as possible, or by finding the best deals.

While these are good for your finances, such efforts will not allow you to achieve your desired lifestyle and financial state if they are not guided by clear goals and plans.

Here are some key reasons why financial planning is important.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

1) Keep up with the rising cost of living in Singapore

Singapore is known for its high cost of living.

The Economist runs a biannual Worldwide Cost-Of-Living analysis every year and Singapore was ranked the world’s most expensive city to live in (mainly for expats) from 2014 to 2019.

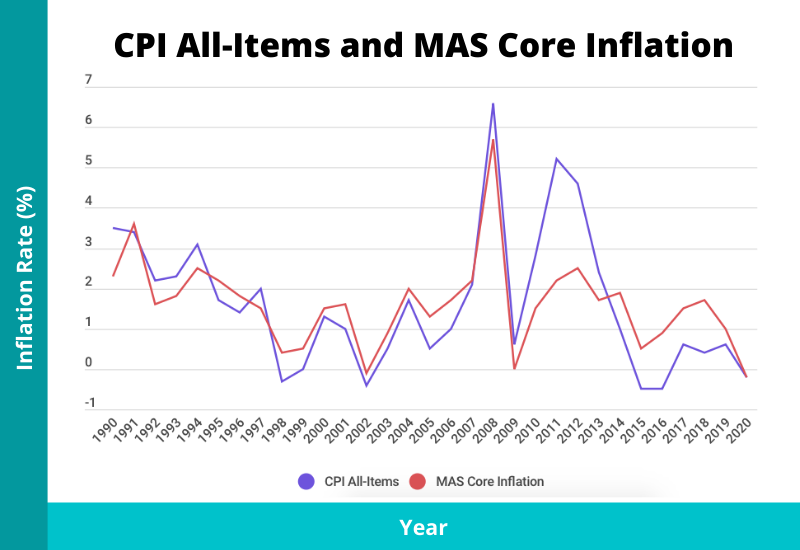

Furthermore, the cost of living is set to increase due to inflation. The average core inflation rate over the past 20 years was 1.52%.

This simply means that the value of your money will decrease over time if you leave it in your savings account or other very low-interest alternatives.

It is thus more prudent to invest your excess money (and depending on your risk appetite) in order to beat the inflation rate. There are a range of lower-risk instruments you can participate in, such as fixed deposits, Singapore Savings Bonds (SSBs), and endowment insurance plans.

While the returns may not be as attractive as that of stocks, these safer options may be a good start for you if you prefer a more conservative approach. The rates could also be sufficient to combat inflation, which is the minimum you should aim for.

2) Ensure your personal finances stay healthy

Financial health refers to the state and stability of your finances.

Understanding your financial health requires a holistic evaluation of your financial inflows and outflows.

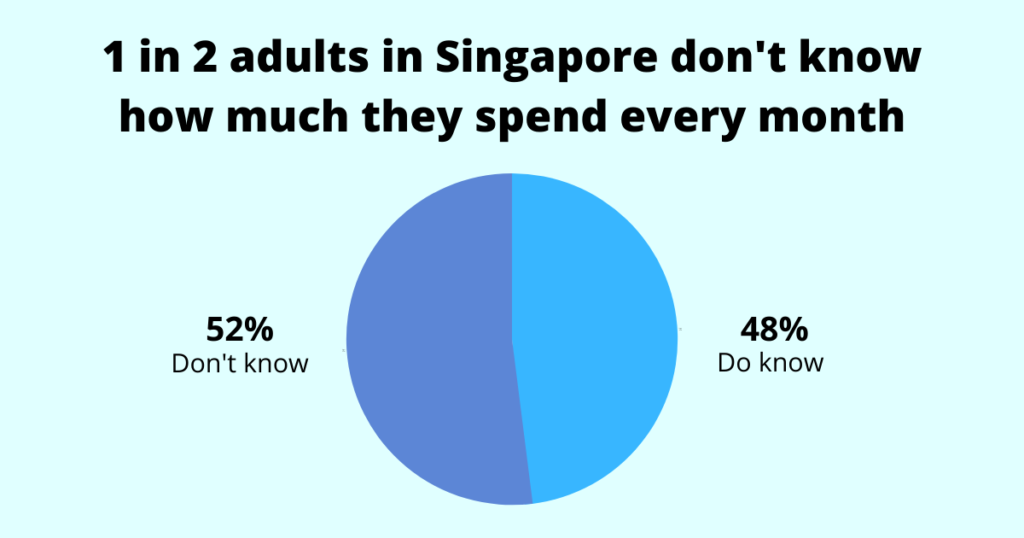

Unfortunately, from a survey that we have conducted, 52% of adults in Singapore are clueless about their monthly spending.

If you don’t measure how much you spend, how are you going to improve on it and save more?

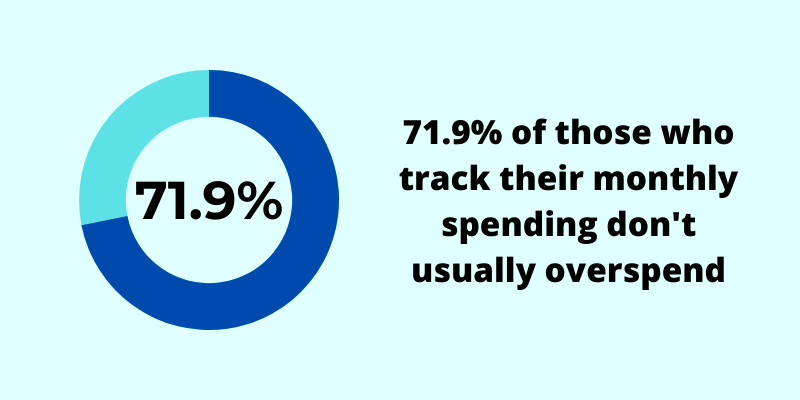

This is why a significant majority of people who do track their spending in some way, don’t usually overspend.

Some key indicators of financial health include an increasing flow of income, well-spent expenses, an increasing cash balance to be deployed, and strong returns on investments.

A general rule of thumb that you can follow is the 50/30/20 budget rule. This basic rule suggests that you allocate 50% of your after-tax take-home income to your needs, 30% to your wants, and 20% on savings or investments.

However, it is recommended that you adjust this budgeting rule based on an assessment of your personal financial needs and goals.

3) Prepare (financially) for any emergencies

Another reason why you should do financial planning is to ensure you are sufficiently prepared to deal with any emergencies.

Unexpected circumstances such as accidents, medical emergencies, and layoffs can result in a sudden increase in expenses or reduction in your usual income.

This is why it is crucial that you are adequately insured.

While MediShield Life can provide some basic coverage, it may be limited. For instance, it doesn’t cover pre- and post-hospitalisation expenses, and primarily covers government B2 wards and below. This is why two-thirds of Singaporeans and permanent residents have already upgraded to an Integrated Shield Plan (IP).

You could also take advantage of using your CPF MediSave balance to pay premiums of up to $600/year to upgrade your CareShield Life with an insurer’s supplement. This allows you to get higher monthly payouts if a moderate or severe disability happens.

In the case of a critical illness, you are likely to face a loss of income if you’re unable to work, which could take a number of years. And illnesses such as cancer may be more common than you think.

Furthermore, if death or a permanent disability happens, how is your family going to find the money to make up for the total loss of income?

This is why it is recommended that you insure yourself with life insurance (typically term insurance or whole life insurance). Doing so will enable you to replace the potential loss of income if unfortunate events happen.

Another safeguard you can set up for yourself is to prepare an emergency fund.

It is typically advised that you save up at least 6-12 months’ worth of your basic expenses. This emergency fund can tide you through shorter-term expenses or sudden income changes, such as a retrenchment, while you search for a new job.

4) Achieve your future financial goals

There are several important milestones in our lives that require large sums of money. These include your wedding, buying a house, your children’s education fees, and your retirement.

For example, the cost of wedding is typically between $30,000 to $50,000.

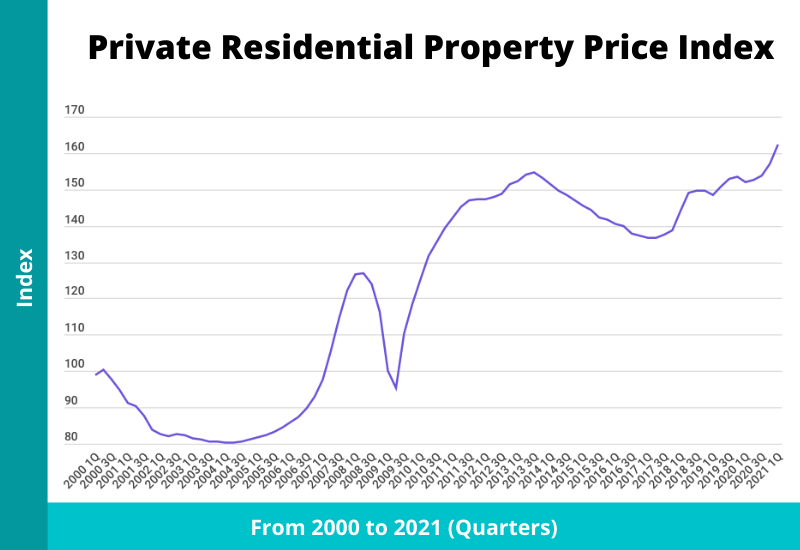

Housing is also becoming increasingly expensive. The prices of private properties has risen 64% since 2000.

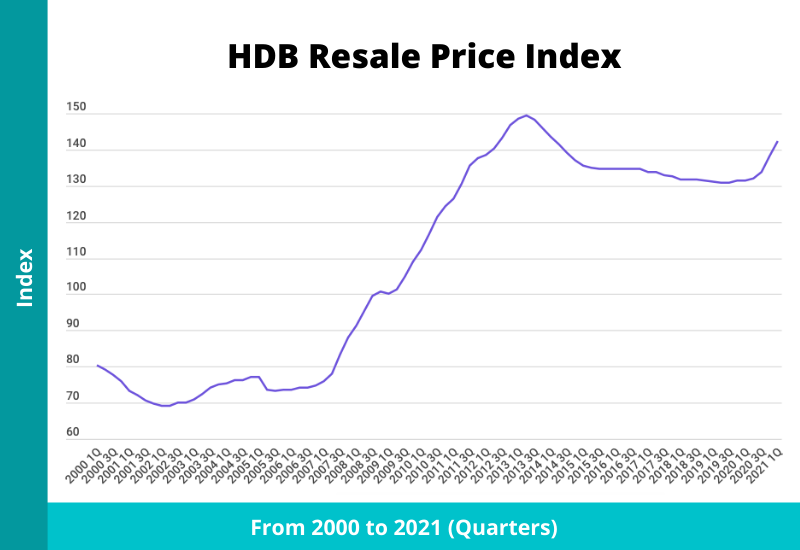

At the same time, those of HDB resale flats have increased by 77%. In fact, in just the first half of 2021, 106 HDB resale flats were sold for over $1 million.

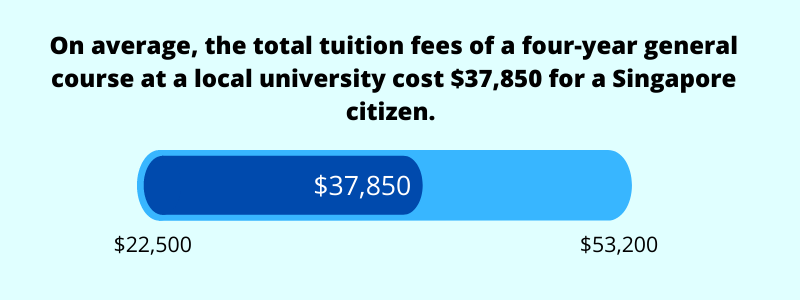

Meanwhile, university fees average around $37,850 for four years of education.

This is notwithstanding the costs of your children’s pre-school to junior college or polytechnic education.

Needless to say, having a sufficient retirement fund requires the most financial resources. Therefore, you should set aside some money to save for your retirement as soon as possible. Failure to do could mean a less desirable retirement lifestyle.

Of course, these statistics are not meant to scare you. Rather, they are meant to be a reality check affirming the importance of strong financial planning in order to achieve these future goals.

To shorten the time spent achieving your goals, it is recommended that you invest at least a portion of your income and make your money work for you. Such compound interest adds up to significant returns over time, which can fight inflation and add towards your savings for big ticket items.

5) Improve the quality of life for you and your family

Many people aspire to achieve financial independence and retire as early as possible.

These aspirations are not as difficult to achieve as you may think. However, it requires forward planning and financial discipline to get there.

Apart from having freedom, you may also wish to have disposable income to travel with your family, spend on other activities that you enjoy, and leave a legacy for your children.

Financial planning allows you to balance your long-term financial goals with short-term wants. Setting aside a feasible budget for spending can enhance the quality of life for you and your family.

Wrapping up

Financial planning takes deliberate effort and discipline.

It also involves an objective evaluation of your financial situation and long-term goals.

Your financial plans need to be recalibrated every year to ensure they are still aligned with your current income and spending habits, as your financial responsibilities and priorities will change over time.

While it is definitely possible to do your own financial planning, this can take a large amount of time and research that could have been otherwise spent on your career or family.

Having a competent financial planner helps to ease this burden. And with the large number of changing policies available in the market, he or she can recommend the best options for your savings, insurance, and investment needs based on up-to-date information.

If it has been a while since you’ve done a review, take the next step and go through a holistic financial planning now!