Do you know how much you spend every month?

If you are looking to grow your net worth and achieve your financial goals, it is crucial for you to know your income, expenses and savings.

We were curious to see how well Singaporeans know their personal spending each month. We surveyed 984 adults aged 18 and above about their spending habits.

Here’s what we found.

Key Findings

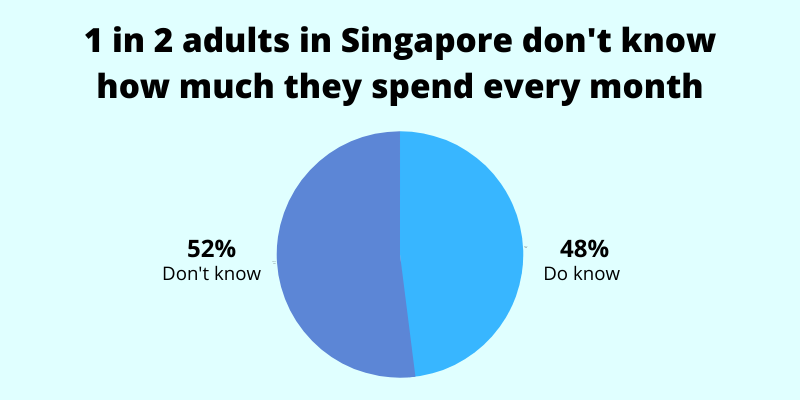

- 1 in 2 adults in Singapore have no idea how much they spend every month

- Those aged 18 to 24 are the least likely to know how much they spend

- 71.9% of those who track their monthly spending don’t usually overspend

These are some of the interesting statistics on spending habits in Singapore we’ve found. From the study, we’re also able to extract some insights that can help you make better financial decisions.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

1 in 2 Adults in Singapore Have No Idea How Much They Spend Every Month

Less than half of the respondents (48%) say they know how much they spend every month, leaving a slight majority (52%) not knowing.

Note: Men and women are equally likely to not know how much they spend (51.6% vs 52.4%).

Why are people not paying attention to their spending?

Here are some possible reasons:

- It can be a hassle to track expenses

- They don’t see a need for it

- Fear of what they would find

- Creates additional stress

If you’re part of the half that’s not tracking your monthly spending, you may be exposing yourself to even bigger problems such as living from paycheck to paycheck, or having a low savings rate.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

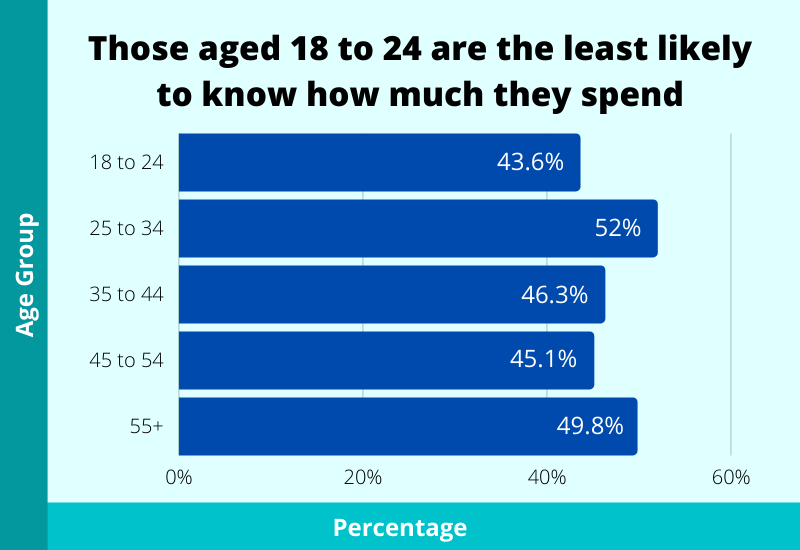

Those Aged 18 to 24 Are the Least Likely to Know How Much They Spend

How are the spending habits of youths and millennials in Singapore?

We found that among the respondents aged 18-24 years, only 43.6% know how much they spend every month. This is the lowest percentage among all our respondents.

The younger generation might not be taking full advantage of having the longest runway. By being more attentive to how much they spend, the odds of having more savings increase, thus leading to greater returns over the long run (if they make better use of their money).

On the flip side, those aged 25 to 34 have the highest percentage (52%) of respondents who knew their monthly spending. This could be likely due to having multiple financial commitments during that period such as a wedding, getting their first property and having kids.

The next highest (49.8%) are those aged 55 and above. This is possibly due to retirement looming around the corner.

These findings suggest that when one is closer to major financial goals and commitments, they’re more likely to take note of their finances.

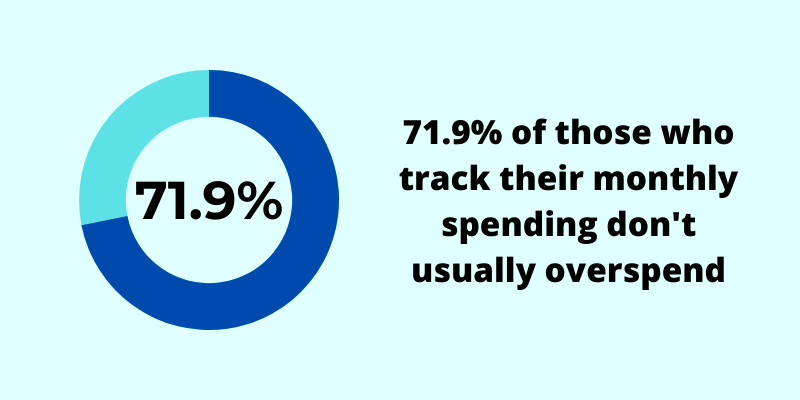

71.9% of Those Who Track Their Monthly Spending Don’t Usually Overspend

We take the view that if you know how much you spend every month, you’ve done some form of tracking (whether it’s knowing every single expense item or just your monthly numbers).

Of those who do know their monthly spending, around one-quarter (28.1%) of respondents say they usually overspend.

One likely reason for consumers who track their expenses yet still overspend is emotional spending (e.g., spending more because you’re feeling happy or sad). In those moments, emotions can overrule logic.

However, nearly three-quarters (71.9%) of those who track their monthly spending don’t usually overspend. And that also means that if you do track, you are 2.6 times more likely to stick within a spending limit.

By monitoring your spending, you would know whether you’re going to overspend (or have already overspent). With that knowledge, you can adjust accordingly. Keeping your financial goals and budget in mind will motivate you to stay within your budget so that you can achieve your goals.

When the “pain” of overspending or not saving enough is greater than the immediate “pleasure” you can get from frivolous spending (e.g., delayed gratification vs immediate gratification), you’re more likely to stick to your budget.

Wrapping Up

From the survey findings, we’ve come up with 4 tips to help you achieve your financial goals:

- Create a budgeting plan.

(Hey, even the government does it!). Decide how much of your income should be allocated to needs, wants and savings. If you have no idea where to start, take a look at the 50/30/20 budgeting rule. - Save first, spend later.

Once you receive your monthly income, transfer the amount you intend to save to a separate account (and make it difficult to withdraw or spend it). - Track your expenses.

The remaining amount is what you can use for expenses, such as insurance, food, and allowances. You can track your expenses for free using a mobile app (e.g., Seedly), an online expense calculator or an excel template. - Optimise your expenses.

For each expense item, decide whether to leave it as it is, find a cheaper/better alternative, or eliminate it. For example, checking multiple delivery apps before ordering helps you reduce costs, according to ValueChampion’s study.

Taking charge of your finances can be a tough one, but it goes a long way.

By taking small steps, you’re able to build habits that once seemed impossible, and save more money in the process.

To learn more about how to budget effectively, check out this guide. It includes a useful infographic too.

Methodology

This survey was conducted online using Google Surveys. The survey received 1,299 completed responses – 984 with known demographics (age and gender). Only those aged 18 and above in Singapore were surveyed. Post-stratification weighting is applied to ensure an accurate and reliable representation of the total population. Responses were collected from 17 Feb 2021 to 19 Mar 2021. For journalists/publishers who are interested in looking at the raw data, feel free to drop me an email here.