Estimate how much life insurance and critical illness coverage you need in Singapore with our simple calculator.

Read on further to learn how these figures are derived.

How Much Life Insurance Coverage Do You Need in Singapore?

This question sounds simple but it’s difficult to answer.

If you’re here, you already know the importance of insurance, but you’re just thinking how much is enough.

Unfortunately, there is no definite answer. No right or wrong answer.

This is something you have to accept.

Many people stress over finding that one ultimate number but there’s no end to it because some may say this, an article may say that, a financial advisor may say something else.

And because you can’t come to a conclusion, you put off making a decision – one that can have a huge impact.

So the trick is to know that whatever decision you make, you must be comfortable with it. As long as you’re covered sufficiently and know the implications of under-insuring (or over-insuring), you’re good to go.

There are a few methods to calculate insurance coverage such as compiling expenses and summing up liabilities, etc…

But let’s stick to just one and that’s…

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What is Income Protection All About

Income protection is not a new term.

It’s basically to replace the potential loss of income when an adverse event happens.

We’re not talking about temporary loss of income like getting retrenched or quitting to find another job, because you can still find another job within a few months in Singapore.

We’re talking about the permanent loss of income.

- Death

- Total and Permanent Disability (TPD)

- Critical Illness (CI)

- Early Critical Illness (ECI)

Any of these happen and the ability to earn an income will be greatly diminished or eliminated.

Therefore, the goal is to have sufficient insurance coverage so that when such events happen, the insurance payouts can cover your future income (that would’ve been lost forever).

How Do We Protect Our Income

In my opinion, whether it’s calculating your expenses or your liabilities, they’re all just subsets.

The main thing should be your income because when you cater for your income, you cater for everything.

Some may say that it’s over-insuring.

Let me share with you my thoughts in this section and in the later parts.

When you cater for your income, you’re not only catering for your current expenses and liabilities, but your future financial commitments as well.

What about your kid’s education? Retirement?

These do matter too.

If not, you’d be merely surviving.

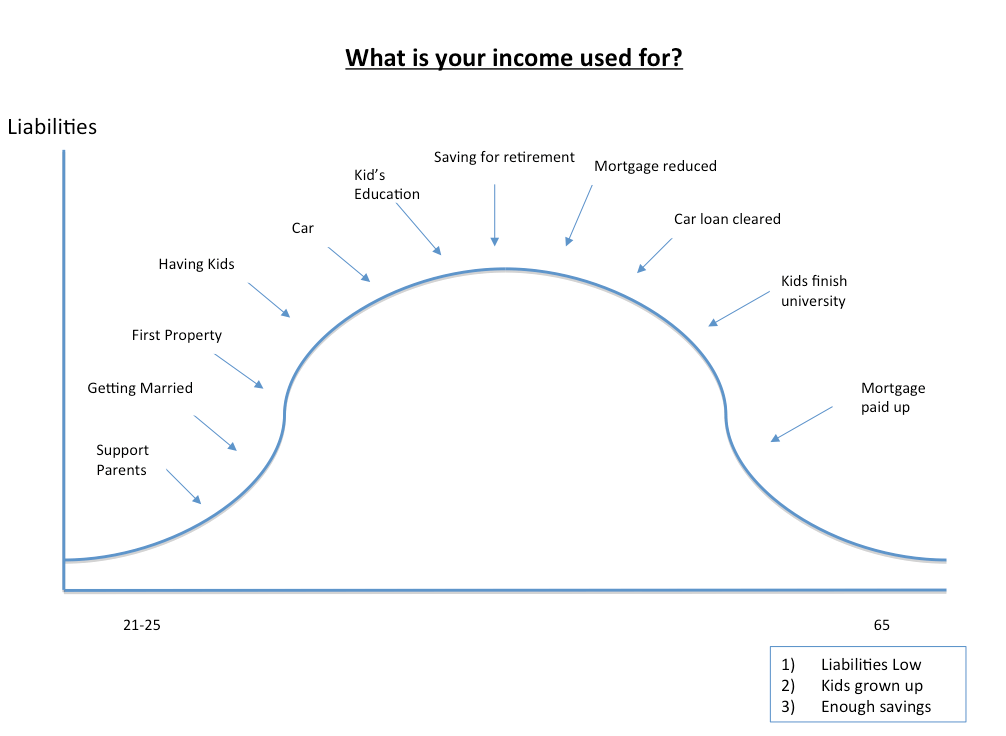

Here are some of the financial commitments that one would typically have:

To have sufficient coverage is to cater for them.

A simple way is to take your current income and multiply it by how many years you would want your income to “continue”. If you think that you don’t need to cover your full income (and expect a reduction in your expenses), simply take a percentage of it – say 70% or 80%.

(Use our calculator above)

For how long?

Some may just want to see that their children turn independent (21 years old), some may want to cover till their retirement age (income-generating years).

It’s all up to you.

How to Calculate Your Life Insurance Needs

From the calculator, you’re able to see an estimation of how much coverage you need.

Different types of coverages – death, TPD, CI, ECI – have different ways of calculation.

This section is meant to show the meaning behind these figures.

Step 1: Calculating How Much Cover You Need

How Much Death Coverage Do You Need?

If you’re single, death may not mean much especially when you don’t have any dependents unless you include your parents.

But your parents have brought you up throughout these years so the least you could do is to provide something for them when you’re not around.

Other than that, if you’re thinking of getting married and have kids in the future, then it becomes more important.

Because when you’re young, insurance is cheaper and you have a higher insurability.

For those who are married and/or have kids, your income is important to provide for your family.

If you’re taken out of the picture, can your spouse handle all the financial needs and future goals? It can be burden when they need to take care of the family and still work hard to earn a decent income.

Apart from expenses and liabilities, future financial commitments such as kid’s education and retirement should still be factored in.

And that’s why we use income for calculation.

You can choose to cover till when your kids are independent or till your retirement age.

How Much TPD Coverage Do You Need?

Your TPD coverage amount usually goes hand in hand with death. And you can’t get an amount higher than the death coverage.

Whether you’re single or not, TPD will always be applicable.

When you’re wheel-chair bound and unable to earn an income, someone still has to take care of you.

Life still goes on, whether you like it or not.

As the probability of TPD happening is lower, TPD coverage is the cheapest compared to death and critical illness.

How Much Critical Illness Coverage Do You Need?

The standard CI usually refers to the advanced stages of illnesses – there are only 37 of them.

You might not need the same amount of coverage as death or TPD.

The reason for this is because when a CI happens, the general rule of thumb is that within 5 years, you either recover or the worse happens.

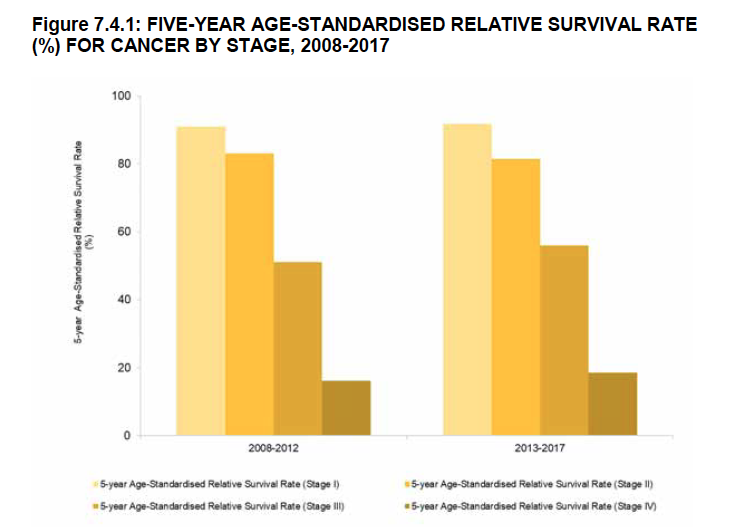

Here are the survival rates for cancer:

| Stage | 5-Year Age-Standardised Relative Survival Rate |

| Stage 1 | 91.7 |

| Stage 2 | 81.4 |

| Stage 3 | 56 |

| Stage 4 | 18.6 |

As you can see, if a stage 4 cancer happens, the chance of surviving is 18.6% within a 5-year window.

So, what does this mean?

Most of the time, death would happen, and that’s when the death coverage kicks in.

But if you manage to survive, then at least that CI insurance payout (5 years of income) can help with expenses during that period.

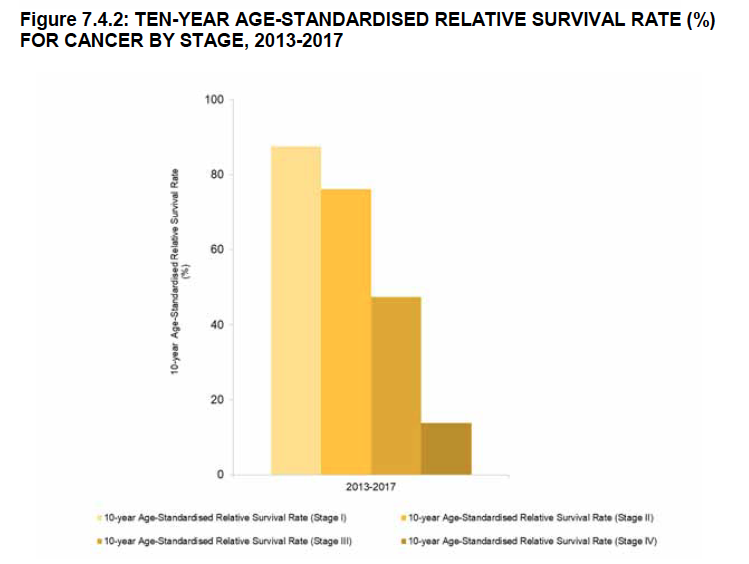

Just to give you another perspective, here are the survival rates within a 10-year window:

| Stage | 10-Year Age-Standardised Relative Survival Rate |

| Stage 1 | 87.6 |

| Stage 2 | 76.1 |

| Stage 3 | 47.4 |

| Stage 4 | 13.7 |

Another reason why people don’t get more CI coverage is because the premiums are high (due to a higher probability of it happening)

All in all, CI coverage is important.

How Much Early Critical Illness Coverage Do You Need?

The most expensive cover amongst all life insurance.

ECI covers early, intermediate and advanced stages. And it can pay out multiple claims.

In my opinion, I view ECI as a bonus and only if you want to have the most comprehensive cover.

The reason for this is because if one were to contract early cancer, he might still be able to work (until it progresses to later stages).

But if you have ECI cover, it allows you to take a break from work and focus fully on recovery.

A period of 1-2 years can be good.

Step 2: Subtract Existing Insurance

If you have any existing policies that cover these areas, just subtract them.

This is when policies summaries come in handy to give you a snapshot of what policies you have and the total amount.

If you’re thinking of replacing/switching, then you don’t need to subtract.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Step 3: Subtract Existing Assets

Lastly, subtract any assets such as investments or cash at bank that you want to utilise if the adverse happens.

Most would not want to use their hard-earned money for such.

So you can just put 0 if you wish.

Step 4: Find Your Shortfall

Formula: Calculated Coverage – Existing Insurance – Existing Assets = Shortfall

If your shortfall is in the negative, it means that you have a surplus.

But if like most people, you have a shortfall or a protection gap, you might want to find a solution to address this shortfall.

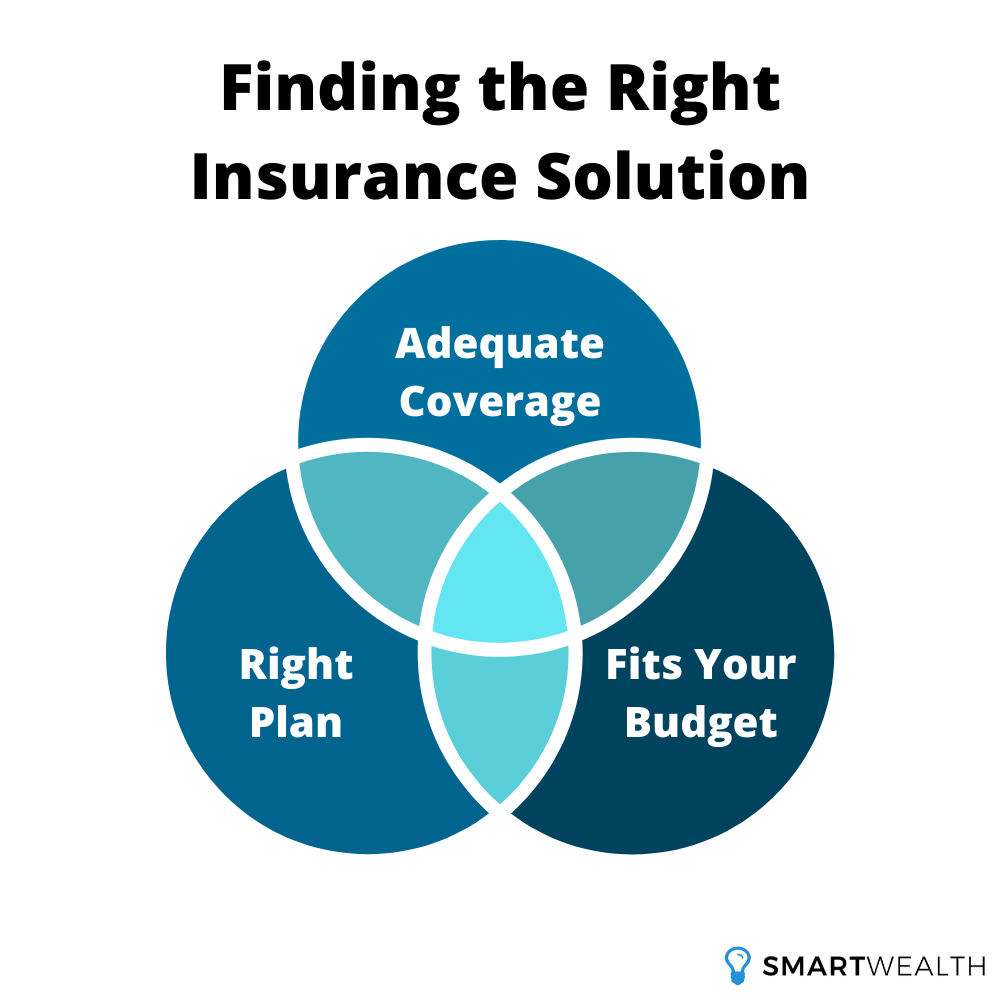

Finding the Right Solution

There are times when your shortfall is very high.

While that poses a bigger issue, does this mean that you should do all you can to cover this shortfall?

There are several factors to consider and not just from a coverage point of view.

Finding the middle ground will allow you to find the best solution.

The 3 factors are:

- Adequate Coverage

- Fits Your Budget

- Right Plan

1) Adequate Coverage

While it’s best to cover all your shortfall to eliminate any potential gaps, there are times when you can over-insure.

The question to ask: is the selected coverage amount enough?

This is when you need to imagine yourself in the future.

Would you be satisfied with the payout amount? Can you rely on it fully?

Once you got that down, we look at the other 2 factors.

2) Fits Your Budget

It goes to say that with a higher coverage amount, the more expensive insurance will be.

So if you want to cover everything, do you have enough budget to cater for it?

Having a fixed budget in mind will narrow what sort of coverage and insurance plans you can take up.

3) Right Plan

When you have a rough idea of what coverage and budget you should set aside, then comes choosing the right plan.

The right plan would allow you to fit both these aspects.

There are 3 main plans that you can consider (I’ll touch on it soon).

So it’s not all just about the coverage amount. These 3 factors allow you to narrow down your options and provide you with a suitable solution.

3 Types of Insurance Plans to Cover Your Insurance Shortfall

Depending on your preference and situation, these 3 policies are what most people turn to.

1) Term Insurance

Term plans can cover a much higher amount at a lower cost compared to any other form of insurance.

In most cases, covering your shortfall will be the most important.

The downside is that term plans do not have cash value. In return, you can replace/switch/terminate at any time.

This is suitable if you combine it with your own investments and/or other asset building solutions – buy term, invest the rest.

In recent years, this has been the most popular insurance policy.

Term plans can cover a multitude of riders including death, TPD, CI, and for some, even ECI.

2) Whole Life Insurance

Whole life plans have a combination of protection and saving/investment elements.

This means that you have some coverage as well as some cash value further down the road so it doesn’t feel like you’re throwing money down the drain.

It also means that your coverage amount might not be as high as the term plan because it will be very expensive for the same sum assured (unless you have the budget for it).

More recently, whole life policies include a multiplier effect that includes term-like characteristics.

For example, from now till the age of 70, the payout will be a multiple of your selected basic sum assured.

The reason for this is that this period will be your critical income-generating years, and so it provides a higher cover.

Whole life insurance can also cover death, TPD, CI, and ECI.

3) Early Critical Illness Insurance

Look for early CI plans only when you have the basic coverage (death, TPD, CI) settled.

This is because ECI plans usually come as a standalone. They cover early, intermediate and advanced stages of illnesses.

Additionally, they cover recurring and multiple claims too.

Death and/or TPD cover on such plans are negligible.

Conclusion

Calculating and finding how much insurance coverage is not enough as other factors come into play.

But by covering your insurance shortfall, it will give you greater peace of mind.

This allows you to fully concentrate on your work and life.

If you want to learn more about the types of insurance, do read up on term insurance, whole life insurance, and early critical illness insurance.