Term or whole life insurance? Which is the best?

This debate has been going on forever.

Both camps always say they’re better.

But which one should you go for?

In this article, we’ll touch on the differences between the 2 popular insurance plans.

At the end, you’ll gain a better understanding to help in your decision.

Read on!

What is Life Insurance?

Amongst the different types of insurance available, life insurance remains as one of the core elements in a healthy financial portfolio.

It pays out a lump sum of money if the unfortunate happens – death, total and permanent disability, critical illness, etc.

In my view, its sole purpose is to protect your income.

The insurance payout should replace the future income that you would’ve earned if you were healthy.

This payout will then enable you to continue to pay for the daily expenses, cater for your kid’s education, your retirement, etc, so that all is not lost.

Life insurance is the generic term. And under the umbrella of it lies 2 important plans: term life insurance and whole life insurance.

But before getting to that, allow me to take a short detour.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

3 Reasons to Get Life Insurance

People usually don’t get life insurance solely for themselves – it’s mainly for others.

Here are the 3 reasons why:

1) Earning an income for the family

When you’re contributing your income to the family, you’re supporting vital expenses so that your family can live comfortably.

Without your income, can your spouse cope with the increased financial burden?

And if you’re the sole breadwinner, then it’s all on you.

The well-being of your family depends greatly on you and your income so you need to ensure this income is kept coming in, even in the worst case scenarios.

2) Have dependants

This point is largely similar to the first.

But dependants do not necessarily mean your spouse or your children.

It can also be your parents (who have raised you up for so many years) and so you’ll want to give something back to them.

Even if you’re single right now, life insurance matters too.

Are you thinking of getting married and having kids in the future?

If not, have you thought about what happens if a permanent disability or a critical illness happens?

3) Have Liabilities

At every stage in life, there will be liabilities.

Liabilities can come in different forms:

- Mortgage loan

- Car loan

- Monthly expenses

- Future commitments such as kid’s education and retirement

- Giving allowance to your parents

Life insurance can ease the “paying off” of these liabilities if the worse happens.

How Much Life Insurance Coverage Do You Need

Before jumping into the type of plan to get, have you thought about how much cover you need?

The amount of insurance you want can determine what type of plan to get.

While there are a lot of opinions on how to determine insurance coverage, it largely depends on you and your needs.

You can try out our life insurance calculator to estimate how much life insurance cover you need before coming back here.

Let’s zoom out and take a quick look at what are term and whole life insurance. Then, we’ll zoom in on the differences.

Quick Overview: Term Insurance & Whole Life Insurance

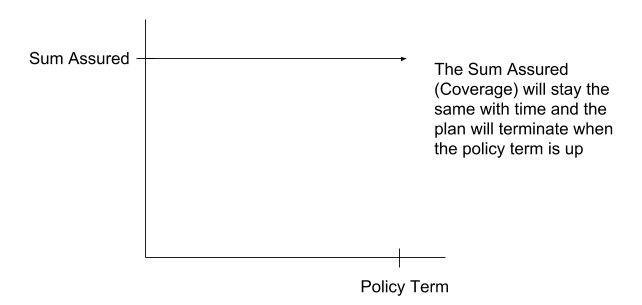

In a term life insurance, the coverage period is fixed:

When the coverage period ends, the policy terminates.

The premiums you pay solely goes into insurance protection costs and so the cost per dollar of sum insured is lower.

You’ll get nothing back after the policy ends.

In a whole life insurance, the coverage period is till the whole of life (usually till age 99).

The premiums you pay goes into insurance protection as well as a savings component and that’s why the cost per dollar of sum insured is higher.

You can still get a surrender value during the policy term.

There are different types of whole life insurance plans:

- Participating policies

- Non-participating policies

- Investment-linked policies

But I’m only touching on the participating polices in this article.

The Great Debate: Which Is Better?

Both plans serve the same purpose: providing life insurance coverage.

But their mechanisms are different.

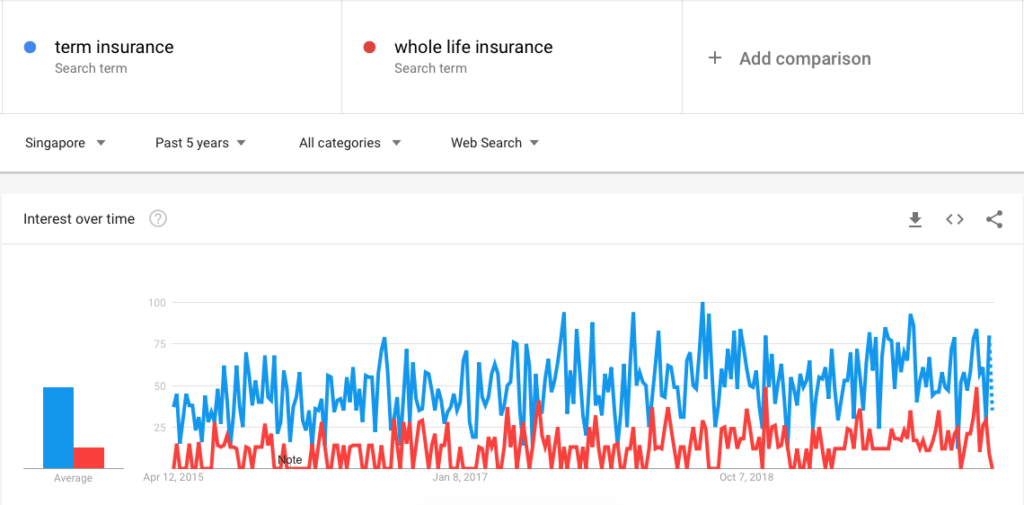

The popularity of term insurance does have an edge over whole life insurance.

Here’s a trend comparison over the past 5 years in Singapore:

And here’s the comparison between term and whole life…

1) Purpose

Although both term and whole life plans provide life insurance coverage, the whole life provides more than that.

For term insurance, it’s only pure coverage.

On the other hand, the whole life provides some coverage and the ability to accumulate some form of savings.

This allows the policyholder to “surrender” sometime in the future so that he can get some money back to cater for his retirement and such.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

2) Sum Assured

Given the same amount of budget, the cost per dollar of sum assured is lower in the term than in the whole life plan.

10 years ago, a $1,000,000 cover is uncommon. Nowadays, it has become the new norm, especially with term insurance.

In comparison, to get a $1,000,000 cover in a whole life insurance, it will be very expensive and that’s why you’ll see lesser of million dollar whole life policies.

You’d see lower insured amounts instead which may be inadequate.

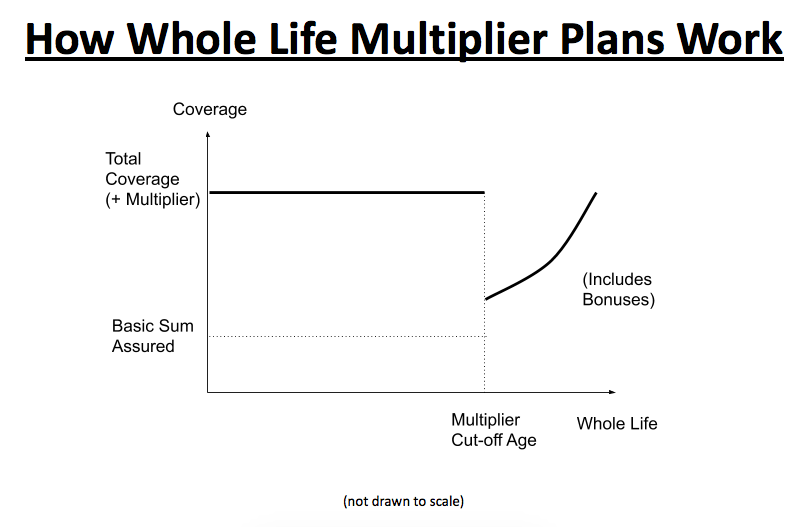

However, modern-day whole life plans now include a multiplier effect.

Meaning?

For example, you can enjoy 3x of your basic sum assured during the multiplier period (e.g till 70 years old). After that, the coverage returns back to the basic sum assured.

This is like a combination of term and whole life insurance, so that you can get a higher payout during your most important years – the income-generating years.

3) Claim Payouts

Upon claims, the term insurance will only pay out the sum assured you’ve applied for.

In the whole life, the plan will pay out the basic sum assured + any accumulated bonuses or the enhanced cover, whichever is higher.

So usually the death benefit in a whole life will continue to increase as the non-guaranteed accumulated bonuses will be added on each year.

4) Cash Value

Term plans have no cash value.

So if nothing happens to you and the policy term ends, there’s no refund or anything that you can get back.

You’re just paying for protection.

The whole life plan does accumulate cash value and has a surrender value.

These come in the form of non-guaranteed reversionary bonuses and terminal bonuses.

But let’s put that aside for now because it can get more complicated than it should be.

Basically, the premiums you set aside for your whole life plan goes into a pool of monies (called the participating fund).

Then the insurance company takes this fund and reinvest it, providing you with guaranteed and non-guaranteed returns.

This gives you the potential to grow your money too.

So the longer you hold, the more it accumulates.

That being said, it would be harder to access the cash value. You’d either need to take a policy loan at a high interest rate or surrender the plan and lose the cover.

5) Coverage Period

There’s a wide variety of options you can get with term policies.

It can be on a 5-10 years renewal term where premiums increase with each renewal, for a period of years such as 20 or 30 years, till retirement age (65, 70, etc) or even till 99 years old.

Most would choose to cover till their retirement age (critical income-earning period).

One thing to note is that the coverage ends when the policy term is up.

Rarely do term plans allow you to continue coverage but if they do, it comes at a high premium.

The whole life plan covers for life or usually till 99/100 years old.

If you’re especially concerned with having a critical illness cover beyond your retirement, then a whole life plan could be useful.

6) Premiums

As every dollar goes into protection, the premiums are much affordable in a term life insurance.

With a fixed budget of say $6,000/year, you’re able to get a few millions of coverage (depending on age and other factors).

And since every dollar goes into protection and savings, the premiums in a whole life policy are generally higher.

With the same budget, you may only get a few hundred thousands of coverage amount.

7) Premium Paying Term

Basically, it means how long you need to pay the premiums for.

In a term plan, the premium paying term is usually the same as the policy term.

If you want a coverage for 30 years, that’s 30 years of paying premiums.

If in the event that you don’t want the coverage anymore, you can terminate the plan (there’s no cash value anyway) but you’ll lose the coverage. And if you were to reapply, it may be more expensive and/or subjected to underwriting again.

There are more options for the whole life insurance.

It used to be that whole life plans are “pay as you go”. Meaning, the premium term is for life. So even if you were to retire, you’ll still need to pay the premiums to enjoy the coverage.

In modern times, such plans are obsolete.

Now, most whole life plans come with limited pay options such as 20 or 25 years.

After that, the policy is “paid up” and you’ll enjoy the coverage for life or till when you surrender it.

8) Complexity

Term plans are simple.

You pay money -> You get coverage.

Everything is already spelt out. You know what to expect.

Whole life plans are slightly more complex.

Mainly because of the non-guaranteed bonuses that come along with it.

It brings about a greater degree of consideration.

How would these bonuses affect your payouts in the future? Can the insurance company pay these bonuses out consistently?

9) Flexibility

In a term plan, you’re able to separate protection needs and accumulation needs.

You have a defined idea of how much and how long you should be insured? Go ahead with the term plan. For the rest of your excess money, do something about it. That’s why the phrase: “buy term, invest the rest” comes up. You’ll then be able to tailor your wealth accumulation needs better.

If you need to utilise either the protection or accumulation aspect, it wouldn’t affect the other.

And because the term plan has no cash value, you’re free to stop it in the future or even replace it for a cheaper one (if health allows it; consideration to pre-existing conditions and waiting periods).

In a whole life plan, it comes with a greater commitment.

Once you decide on the plan, you should stick with it throughout.

If you surrender early, the surrender value you receive might be lower than the total premiums you’ve paid.

It’s still a good proposition for those who want things simple.

Summary of the Pros and Cons

| Term Insurance | Whole Life Insurance | ||

| 1. | Purpose | Pure insurance protection | Some insurance protection together with a savings component |

| 2. | Sum Assured | Usually much higher. Common to see $1,000,000 or more | Generally lower. But with multiplier, it can be much higher |

| 3. | Claim Payouts | Sum Assured as per contract | Sum Assured + Accumulated Bonuses (if any) |

| 4. | Cash Value | No cash value | Combination of guaranteed and non-guaranteed bonuses |

| 5. | Coverage Period | Many options available | Lifetime or till 99/100 years old |

| 6. | Premiums | Low | Higher |

| 7. | Premium Term | Same as policy term | Usually limited pay. Can be 20, 25 years, etc. |

| 8. | Complexity | Very simple | Slightly more complex because of the non-guaranteed bonuses |

| 9. | Flexibility | Able to cater specifically to individual needs well | Can be quite rigid. Once committed, have to stick with it |

How Should You Decide?

The differences between term and whole life insurance are spelt out pretty comprehensively in this article.

Which should you go for?

Firstly, it need not be an A or B thing, it can be a combination of both.

Most importantly, your decision depends heavily on your personal financial needs and goals.

Understanding them thoroughly will allow you to make the right decision.

If you know what you want, you can learn even more about term insurance or whole life insurance.

If you’re unsure of which is the better option or don’t know where to start, you can go through our FullCircle™ planning.