While term insurance plans have gained in popularity, whole life insurance could still play a part in your insurance portfolio.

If you’re looking to find out more about whole life insurance in Singapore, you’re in the right place.

In this article, we’ll cover what is whole life insurance all about, how it works, the differences between whole life and term life, the pros and cons, and more.

By the end of this article, you’d know whether it’s suitable for you or not.

So, read on!

This page is part of the Whole Life Insurance 2-Part Series:

- Part 1: Guide to Whole Life Insurance

- Part 2: Finding the Best Whole Life Insurance

- The Purpose of Life Insurance: Protecting Your Income (And Wealth)

- How Much Life Insurance Do You Need?

- 2 Plans That Provide Life Insurance: Term and Whole Life Insurance

- What Is Whole Life Insurance?

- How Does the Whole Life Insurance Multiplier Plan Work

- One Disadvantage of Whole Life Insurance Plans

- Whole Life Plans May Be Suitable for These 5 Groups of People

- What's Next?

The Purpose of Life Insurance: Protecting Your Income (And Wealth)

Many of us will vaguely know the importance of life insurance and dive straight into finding product information.

However, the reasons to why life insurance is important should be emphasised.

Depending on the individual’s situation and needs, there could be many reasons, but the most common one would be income protection.

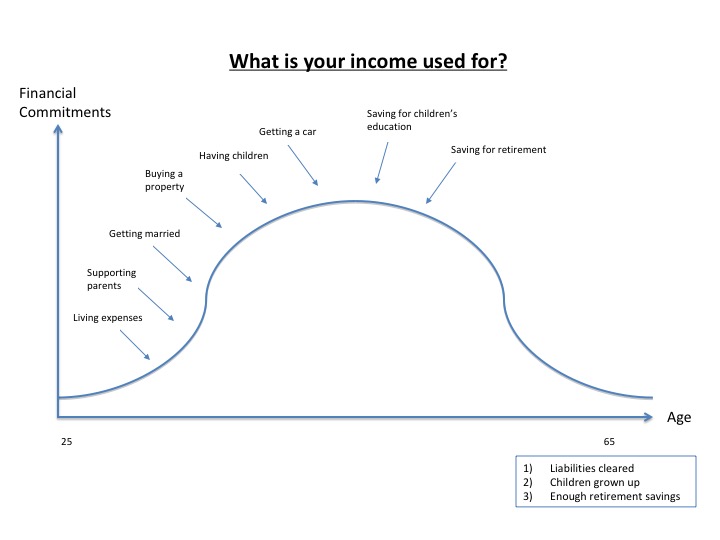

If you’re a sole breadwinner, contributing to the family’s household income, or have people depending on you financially, you’d know that your income plays a huge role.

It allows you to pay for so many things:

Without your income, nothing can function well.

There are two scenarios that could stop your income from coming in:

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

1) Getting fired or quitting voluntarily

In Singapore, it is relatively easy to find another job within a few months. So, this loss of income during this period is usually temporary.

This is also why having liquid emergency funds is vital and not all of your assets should be invested.

Furthermore, if you’re already planning to quit, you would’ve already found another job before pulling the plug.

2) Unexpected and permanent reasons

Here are three events that will heavily reduce your ability to earn an income:

- Death

- Total and Permanent Disability (TPD)

- Critical Illness (CI)

If any of that happens, you might be unable to perform any sort of work and income will stop flowing in.

How would you be able to pay for the ongoing expenses, commitments, and future goals that you have?

That’s why protecting your income should come first before wealth accumulation. It should have a higher priority over savings or investment needs because if you lose your income, whatever you’ve accumulated is unlikely to make up for the lifetime loss of income.

If you think this is true, the next question is, how much is enough?

How Much Life Insurance Do You Need?

Knowing life insurance is important is just the first step. The second is to know how much is needed.

The answer to that can be subjective, but let’s use an illustration.

If your monthly income is $10,000 ($120,000 annually), and anything happens to you now, you would’ve lost the potential income from now to your retirement age.

So, if you’re 30 years old now and plan to retire at age 65, that potential loss of income amounts to $4,200,000 ($120,000*35).

If you wish to fully protect that income, it means getting a coverage of $4,200,000.

Now, some may say that the amount is a lot (which it is), and you should only cover for just your expenses. But if you’re only covering your expenses, other needs such as retirement and providing for your kid’s education aren’t catered for.

At the end of the day, the amount of coverage you should have is entirely dependent on you, as long as it fits your budget. You must be comfortable with the potential payout and the price you’re paying for it, after knowing the implications of over-insuring and under-insuring.

(You can play around with our life insurance coverage calculator.)

2 Plans That Provide Life Insurance: Term and Whole Life Insurance

While there may be other plans that provide life insurance coverage to fill up the income protection gap, the two most common ones will be term insurance and whole life insurance.

Each camp will always say they’re right because of this and that.

But really, neither parties are wrong, as it all depends on your needs and preferences.

There are a lot of factors to consider which could steer you to one camp or the other, or even both.

I’ve written a detailed article of the differences between term and whole life insurance, but here’s a summary of the pros and cons:

| Term Insurance | Whole Life Insurance | ||

| 1. | Purpose | Pure insurance protection | Some insurance protection and a savings component |

| 2. | Sum Assured | Usually much higher. Common to see $1,000,000 or more | Generally lower. But with a multiplier, it can be higher |

| 3. | Claim Payouts | Sum assured as per contract | Sum assured + accumulated bonuses (if any) |

| 4. | Cash Value | No cash value | Combination of guaranteed and non-guaranteed bonuses |

| 5. | Coverage Period | Many options available | Lifetime or till 99/100 years old |

| 6. | Premiums | Low | Higher |

| 7. | Premium Term | Typically same as policy term | Usually limited pay. Can be 20, 25 years, etc. |

| 8. | Complexity | Very simple | Slightly more complex because of the non-guaranteed bonuses |

| 9. | Flexibility | Able to cater specifically to individual needs well | Can be quite rigid. Once committed, have to stick with it |

You can learn more about term insurance plans here, but as this article is on whole life plans, I’ll only talk about the latter from now on.

What Is Whole Life Insurance?

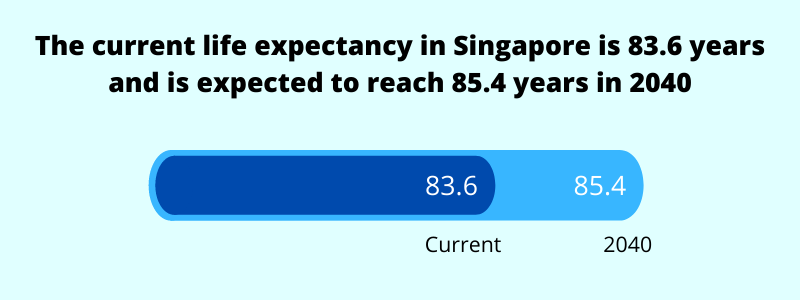

A whole life insurance is a policy that offers coverage that lasts for the whole of life or usually up to 100 years old.

This could be important in today’s context as the average life expectancy in Singapore is getting higher every year. It currently stands at 83.6 years and is expected to hit 85.4 years in 2040.

The policy also comes with a cash/surrender value. This means that part of the premiums you pay goes into a “savings” component, which can potentially generate higher returns. This allows you to surrender the plan in the future and receive the surrender value.

There are two main types of whole life insurance policies: participating and investment-linked.

1) Investment-Linked Whole Life Insurance

In this category, part of the premiums you pay is meant for insurance coverage, and the rest goes into investments.

While you can still retain the plan for life (or till age 100), the insurance charges could go up with age, becoming extremely costly and eating into the value of your investments.

Also, as these investments are volatile, the cash value of the policy would rise and fall depending on performance of the selected funds. There are no guarantees.

For these reasons, the next type, the participating plan, may be a better option.

2) Participating Whole Life Insurance

In a participating policy, all the premiums from policyholders are pooled together into a participating fund.

The insurance company then reinvests the monies from the fund into areas such as equities and bonds. In return, you are provided with a cash value, which comprises of guarantees and non-guaranteed bonuses. The longer the policy is held, the more cash value it builds. This same concept applies to endowment savings plans too.

A participating whole life is the most common type of whole life policy out there.

There are also variations to it:

Firstly, in a “traditional” whole life plan, you would be paying the premiums for life, even after your retirement age. This may not be feasible, and as such, these plans are being phased out now.

Second on the list is the “jumbo” whole life plan. This is a single premium whole life plan that is catered for those who have a lump sum and intend to leave that for their beneficiaries. Such plans are meant to increase the size of the insured’s estate when he or she passes on. It’s for legacy planning.

Last on the list is the whole life multiplier plan. It is an all-in-one plan that’s able to provide a higher coverage amount (without costing a bomb) and can be funded with regular premiums spread over a limited period of years (and not for life).

In today’s context, the multiplier plan is the most modern and common type of whole life insurance plan. This is what we’ll be talking about for the rest of this article.

Get a comparison of the best whole life insurance in Singapore.

How Does the Whole Life Insurance Multiplier Plan Work

In a whole life multiplier plan, there are three things to take note of: the coverage (including the multiplier effect), the premiums you’re paying, and the future surrender value.

Below, we’ll go into more details on the features and benefits:

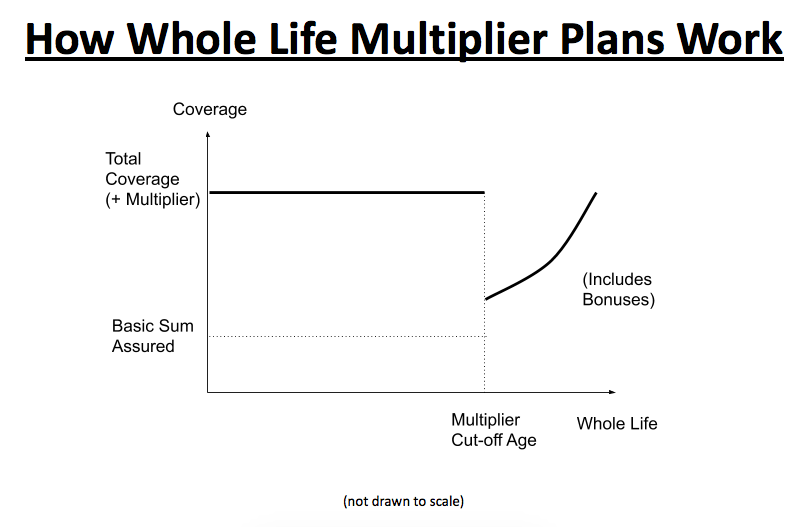

1) The multiplier effect

What makes the plan unique is obviously the multiplier.

There is still a basic sum assured, but you’re able to select a desired multiplier (usually one to five times of the basic sum assured). This is so that you can enjoy an enhanced cover during your most important income-generating years.

This enhanced cover lasts for the entire “multiplier period”, which is typically till 70 years old.

For example, in a $200,000 basic sum assured policy with a 5 times multiplier, if death occurs before age 70, the total payout will be $1,000,000. After age 70, the death benefit becomes the basic sum assured plus any bonuses.

This is like a combination of term and whole life insurance, in one plan.

With it, you can get a higher coverage for your most critical years, and yet still able to accumulate cash value.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

2) Option to include various types of coverage

Coverage for death and terminal illness is standard for such plans.

Total and permanent disability (TPD) coverage may either be embedded into the basic plan or be added on as a rider.

You’re also able to add on coverage for critical illness (CI) or early critical illness (ECI).

CI coverage is crucial as the probability of contracting a CI is higher these days. For example, cancer is more prevalent now than ever before. The lifetime risk of contracting it is 1 in 4-5 Singaporeans.

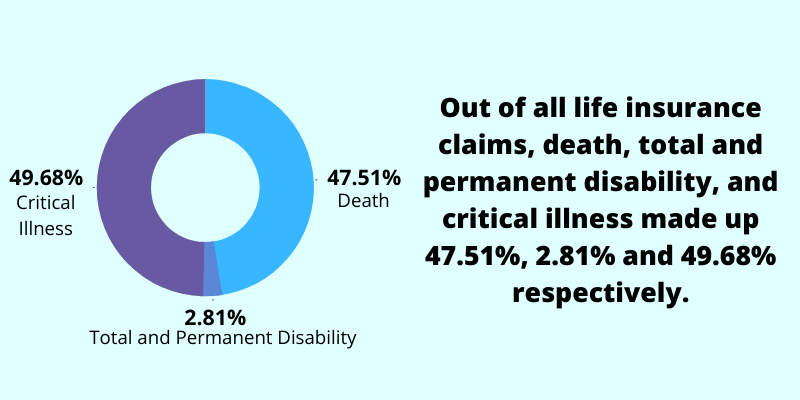

Furthermore, from an analysis of life insurance claims statistics we did, the number of CI claims exceeded death claims.

To sum up, CI coverage is usually more of a neccessity while ECI coverage is a bonus (because it is more pricey).

3) Limited premium paying term

Back then, there was only the option of “pay as you go” for traditional whole life plans.

The premium payment period of those whole life plans are for life. The obvious disadvantage is that after you retire, you’ll still need to pay the premiums. If you’re unable to do so, they can still be paid with the cash value you’ve accumulated. If not, you might need to surrender the plan.

These days, there are limited pay options. Meaning, you can choose shorter premium terms, such as 20 years, 25 years, up to 65 years old, etc.

After the premium payment term is up, the plan is already “paid for”. You can essentially hold it till the rest of your life or when you decide to surrender.

One Disadvantage of Whole Life Insurance Plans

There’s just one thing that you must know if you want to take up such a policy.

And that is: early termination/surrender.

Purchasing a whole life policy is a long term commitment. You should only consider to take it up if you can satisfy the premium payment and the premium term.

Depending on when you terminate/surrender, the amount you receive could be lesser than the premiums you’ve paid. And usually in the 20th-30th year is when the policy should breakeven (still depending on several factors).

However, having the plan ensures that you have some coverage plus some form of savings meant for the future.

Whole Life Plans May Be Suitable for These 5 Groups of People

Without understanding your current financial situation and objectives, it is difficult to give a proper recommendation, so speak to a financial consultant first.

However, here are some scenarios where whole life insurance could make sense:

1) You’re Generally Conservative

There are three types of people that make up this group:

Firstly, those who are against the idea of term plans because of the expiry. Because of that, they’d rather have a lower sum assured but lifetime coverage with a whole life plan.

Secondly, some may feel that the premiums would’ve been “wasted” in a term plan if no claims are made. So, they want something back, at least.

Lastly, it’s advisable to pair a term plan with some sort of investment, depending on your risk appetite. But some people may not wish to take on any form of risk or park their money elsewhere. To some, whole life insurance can provide the convenience they want.

2) You Wish to Leave a Legacy Behind

There are several ways to create legacies for your next generation.

One way is to have a term insurance till 99 years old. The premiums you pay for that are much higher since the probability of claiming is almost guaranteed (especially with special clauses that guarantee payouts). However, in such policies, there is no cash value.

The other option is a single premium whole life plan. It is also meant to leave behind bigger estates, especially when you have a lump sum set aside already. The main advantages is that you can still surrender the policy if needed, as it accumulates cash value.

In a way, the regular premium whole life plan does the same job; you’re just spreading the premiums you pay over a period of time.

3) You’re Buying for a Child

Buying a multiplier whole life plan for a child can be a great gift.

If you’ve chosen the limited pay option of say 25 years, and when your child reaches independent age, you can pass the plan to him or her when it’s already fully paid.

There are several advantages to this:

Firstly, your child can keep it for income protection needs. By purchasing it when your child is young and most likely have a clean bill of health, the cost of insurance will be at its lowest.

Secondly, it can be a gift because the cash value continues to grow, and your child needs the money or reaches retirement age, he or she can “cash out” the policy.

That’s why parents love to apply for a whole life plan as soon as their child is born.

4) You Have a Bigger Budget

If you have a bigger budget or have excess money in the bank and have no idea what to do with it, you can allocate it into a whole life plan.

Because, if you’re going to leave your money in the bank, the inflation will devalue your money. At least in a whole life plan, the cash value grows.

5) You Want Lifetime Coverage for Critical Illness or Early Critical Illness

The occurences of critical illness (CI) and early critical illness (ECI) increase exponentially with age. So, some people may want to get lifetime cover for them.

If you include CI coverage into term plans or get standalone early CI plans that stretch till old age, the price of it will be exhorbitant. Another issue: you would still need to pay those premiums beyond your retirement age.

A limited-pay whole life plan, which includes CI or ECI cover, solves that problem.

What’s Next?

Is whole life insurance worth it? Should you get one?

Hopefully by now, you would’ve have a rough idea. The next step is to look at numbers.

Take the first step by getting a comparison of the best whole life insurance plans in Singapore.