Do you know what your net worth is?

Knowing your net worth is important. It indicates the true health of your finances.

If you do know your net worth, how does yours compare with others’ in Singapore?

We set out to take a deeper look into Singaporeans’ net worths and found interesting facts and statistics such as the average (mean and median) net worth, average debt, wealth distribution, number of high- (and ultra-high-) net-worth individuals in Singapore, and how our wealth compares with other countries. If you want to check out statistics on average (mean and median) income instead, click here.

So, read on!

(Conversion rate used: US$1 to S$1.35)

Key Findings

- The average debt per adult is S$72,831

- The average mean and median net worth per adult in Singapore is S$516,991 and S$134,308, respectively

- There are 332,491 millionaires in Singapore, of which 78 have more than half US$1 billion

- 330,752 adults are considered high-net-worth individuals (having between US$1 million to US$50 million) and 1,739 adults are considered ultra-high-net-worth individuals (having more than US$50 million)

- 16.0% of the adult population (or 796,320 adults) in Singapore have less than S$13,500 of wealth

There are more interesting details. Read on to find out more.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

The Current Financial Landscape in Singapore

Singapore, a safe place with low taxes, attracts wealthy individuals (and businesses) from all parts of the world.

Some have come to this little red dot and now call it their home, making them some of the country’s richest people.

What about the general population?

In recent times, million-dollar HDB (public housing) homes are becoming more common. In fact, 470 of such homes were sold in 2023, contrasting to only two such transactions completed in 2012.

With the rising cost of living, are Singaporeans really getting richer?

One way to find out is to look at the net worth (or wealth) of the adult population.

Note: To calculate net worth, simply take your total assets and subtract your total liabilities. You can use an online calculator or an Excel template for this. It’s also good financial practice to track your net worth on a regular basis.

The Data We Looked At

The primary data we looked at comes from the Credit Suisse Research Institute’s Global Wealth Report (2023), which was published in Aug 2023. As of 5 Mar 2024, this is the latest report available.

The report is extremely comprehensive and analyses the household wealth of 5.3 billion people across the world, covering those who have less than US$10,000 to the pinnacle of the wealth pyramid. It also includes data from 2000 to the end of 2022.

The Singapore Department of Statistics, our national statistical office, is indicated as a source for Singapore’s household balance sheet and financial balance sheet.

Unfortunately, the breakdown of net worth by age isn’t available in this report. There is currently no published and reliable data elsewhere either. Do also note that the data looks at the resident population.

Finding the Average Net Worth: Difference Between Mean and Median

Included in the report are data on the average mean and median net worth or wealth.

It’s important to know their differences before showing you the research findings, so let’s take a quick trip down memory lane.

There are three types of averages: mean, median, and mode. Mean is the most commonly used average, and as such, the terms “mean” and “average” are often used interchangeably. Mode is the least commonly used, so we can ignore that for now.

Let’s look at this example.

| Person | Net worth |

| Person 1 | $10,000 |

| Person 2 | $12,000 |

| Person 3 | $30,000 |

| Person 4 | $35,000 |

| Person 5 | $50,000 |

| Person 6 | $60,000 |

| Person 7 | $70,000 |

| Person 8 | $500,000 |

| Person 9 | $800,000 |

| Person 10 | $1,000,000 |

To calculate the mean, we’ll sum up the net worth of the 10 people and divide it by 10, and we’ll have $256,700. If we were to say that the average net worth is $256,700, it paints an incomplete picture as seven people (the majority) have less than $100,000. That number is pushed up by only a minority of three people who have $500,000 or more.

In reality, income/wealth inequality is indeed prevalent (the richest people hold a greater proportion of wealth). Thus, the mean average is usually skewed.

What is the median average then? If we rank the values from smallest to largest, the number in the middle is the median.

But in this example, the middle number can be either from Person 5 or 6, so the median will be $55,000 ((50,000+60,000)/2).

The median gives a better indication of the overall net worth of a population.

7 Statistics on the Net Worth (Wealth) of Singapore Adults in 2024

Here are some noteworthy facts and statistics from the report.

1) The average debt per adult is S$72,831

Debt is money that is owed to another party. It could be in the form of mortgage loans, car loans, credit card debts, or others (e.g., personal loans and education loans).

Mortgages typically account for the bulk of household debt because of their larger quanta and the fact that everyone needs a roof over their head.

Debt per adult has increased from US$26,598 (S$35,907) in 2000 to US$53,949 (S$72,831) in 2022, a significant increase of 103%.

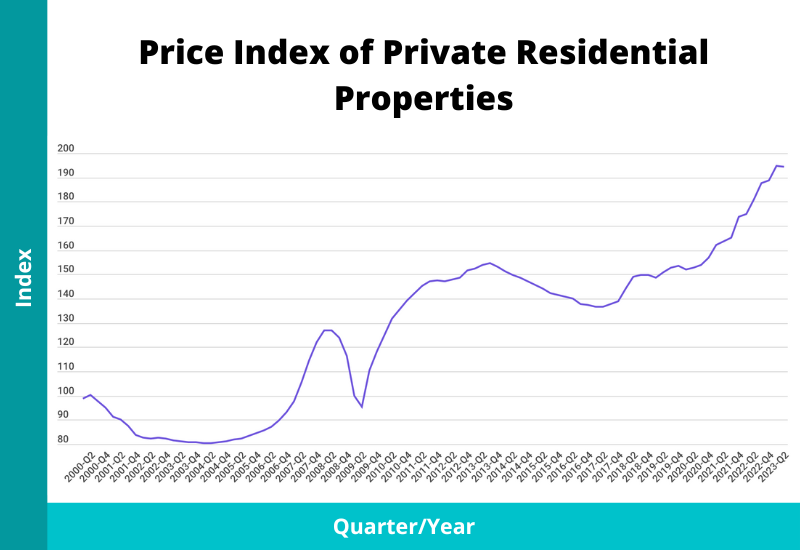

While there are many factors at play in this increase in debt, one possible reason could be rising property prices, especially in the private sector, which have been on an upward trend throughout the decades.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

2) The mean net worth per adult is S$516,991

Net worth or wealth is defined by adding financial assets plus non-financial assets (mostly housing and land) less debts.

In 2022, financial and non-financial wealth per adult in Singapore was US$245,992 (S$332,089) and US$190,914 (S$257,733), respectively, a ratio of 56.3% and 43.7% of gross wealth.

Factoring in debts, the average mean net worth per adult in 2022 was US$382,957 (S$516,991), which is more than triple the US$107,007 (S$144,459) figure in 2000.

Given what we have learnt from our quick maths lesson earlier, is the general population that rich? We should also look at the median.

3) The median net worth per adult is S$134,308

The median will be a better indication of the wealth of the average man in the street, as half of the population is below the median and the other half is above it.

Since 2000, the median net worth per adult has risen by 178.1%, from US$35,769 (S$48,288) to US$99,488 (S$134,308) in 2022.

This would be a more realistic figure to use if you want to compare how well you’re doing with your “neighbours”.

4) There are 332,491 millionaires (inclusive of billionaires) in Singapore

With an adult population of 4,977,000, how many can be called millionaires (and billionaires)?

Here are some wealth distribution statistics of the richest in Singapore:

| Net Worth | Number of People |

| US$1 million to US$5 million | 294,217 |

| US$5 million to US$10 million | 23,269 |

| US$10 million to US$50 million | 13,266 |

| US$50 million to US$100 million | 1,045 |

| US$100 million to US$500 million | 616 |

| More than US$500 million | 78 |

| Total (US$1 million or more) | 332,491 |

Singapore is home to 332,491 millionaires. Although there is no further breakdown of those who have US$1 billion or more, we have 78 individuals who are worth more than half US$1 billion.

In the report, it is also stated that people who have wealth between US$1 million and US$50 million are considered high-net-worth (HNW) individuals, and those who have more than US$50 million are considered ultra-high-net-worth (UHNW) individuals.

Following this categorisation, Singapore has a total of 330,752 high-net-worth (HNW) individuals and 1,739 ultra-high-net-worth (UHNW) individuals.

5) 796,320 adults in Singapore have less than S$13,500

Apart from the “riches” we see in the news and media, there’s also the other side of the coin.

Here’s the wealth distribution of the population:

| Net Worth | Percentage of Population |

| Less than US$10,000 | 16.0% (or 796,320) |

| US$10,000 to US$100,000 | 34.2% (or 1,702,134) |

| US$100,000 to US$1,000,000 | 43.1% (or 2,145,087) |

| More than US$1 million | 6.7% (or 333,459) |

From the data, 16.0% of the total adult population, or 796,320 adults, have less than US$10,000 (S$13,500) to their name. 1,702,134 (34.2%) adults have wealth between US$10,000 and US$100,000 and 2,145,087 adults (43.1%) are worth between US$100,000 to US$1 million. 6.7% of the adult population has over US$1 million.

This shows the wealth gap or inequality between the rich and the poor.

When we zoom out and look at these numbers on a global scale, the number of people in Singapore who are in the lowest wealth range doesn’t look so bad.

52.5% of adults in the world have less than US$10,000. This group of people, although forming the majority, holds only 1.2% of the world’s total wealth. In contrast, a small minority of 1.1% of the world’s adult population has over US$1 million, but collectively, they have a 45.8% share of total wealth.

6) Singapore is ranked 10th in the world for mean wealth per adult

How wealthy are Singaporeans compared to the rest of the world?

| Rank | Country | Mean Wealth per Adult (USD) |

| 1 | Switzerland | $685,226 |

| 2 | Luxembourg | $585,950 |

| 3 | United States | $551,347 |

| 4 | Hong Kong | $551,194 |

| 5 | Iceland | $498,290 |

| 6 | Australia | $496,819 |

| 7 | Denmark | $409,954 |

| 8 | New Zealand | $388,761 |

| 9 | Norway | $385,338 |

| 10 | Singapore | $382,957 |

With a mean net worth of US$382,957 (S$516,991) per adult, Singapore is placed 10th in the world rankings. The top three countries in this category are Switzerland, Luxemborg, and the United States.

| Rank | Country | Median Wealth per Adult (USD) |

| 1 | Iceland | $413,193 |

| 2 | Luxembourg | $360,715 |

| 3 | Belgium | $249,937 |

| 4 | Australia | $247,453 |

| 5 | Hong Kong | $202,406 |

| 6 | New Zealand | $193,065 |

| 7 | Denmark | $186,041 |

| 8 | Switzerland | $167,353 |

| 9 | United Kingdom | $151,825 |

| 10 | Norway | $143,887 |

| 11 | Canada | $137,633 |

| 12 | France | $133,137 |

| 13 | Netherlands | $112,450 |

| 14 | Taiwan | $108,247 |

| 15 | United States | $107,739 |

| 16 | Spain | $107,507 |

| 17 | Italy | $107,315 |

| 18 | Japan | $103,681 |

| 19 | Singapore | $99,488 |

With a median net worth of US$99,488 (S$134,308) per adult, Singapore is ranked 19th in the world. The top three countries for median net worth per adult are Iceland, Luxembourg, and Belgium.

7) One-third of the adult population are members in the top 10% of global wealth

According to the report, 39.2% (1,951,000) of adults in Singapore are members of the top 10% of global wealth. And 6.0% (299,000) of adults are in the top 1% category.

These are some of your crazy rich Singaporeans.

How Do You Grow Your Net Worth?

There you have it. Hopefully these statistics on wealth in Singapore have shown you the financial health of the average person living here.

While money isn’t the solution to all problems, without (enough) money, financial goals such as having a comfortable retirement and funding children’s education can’t happen.

The financial blueprint to increase net worth is to increase income (as well as to protect it with the different types of insurance policies), spend less to save more, and lastly, invest the excess.

Don’t know where to start? Consider going through a comprehensive financial planning session with us. Learn more about FullCircle™ Planning today.