Estate planning is often an afterthought.

Most of us tend to focus on how to make more money, but we don’t think about what happens to that money when we die.

Sure, we earn money to make our lives better, but it’s also for our loved ones.

If you don’t get the basics of estate planning done right, your money may not go to the intended parties when you’re not around anymore.

So, read on to find out more about estate planning in Singapore!

The Importance of F-E-A

At any stage in life, there are 3 areas that interplay with each other.

I call it the F-E-A.

Financial Planning, Estate Planning, and Advance Care Planning.

Financial Planning comes into play when you’re alive.

Estate Planning comes into play when you’re dead.

Advance Care Planning comes into play when you’re “neither alive nor dead” (i.e mentally incapacitated).

When one part of the equation is missing, there are bound to be gaps.

For example, you’ll need proper financial planning to have something to leave for your loved ones. If you don’t have anything, then there’s no point in doing estate planning because there’s simply nothing to give.

Another example: if you’ve done proper financial planning and estate planning, but not advance care planning, and mental incapacity happens, it doesn’t mean that your family is automatically granted access to your assets to pay for the bills and all. The assets still belong to you, but if you’re already “not here nor there”, what happens then?

That’s why all 3 areas have a role to play.

But for now, let’s zoom into estate planning.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is Estate Planning

The purpose of estate planning is to allow the individual to decide who his/her beneficiaries are and how much they will receive upon death.

There’s also another debate: estate planning vs legacy planning.

What’s the difference? In my opinion, both generally mean the same thing in the grand scheme of things, so I’ll stick with estate planning.

Here are some benefits when we utilise estate planning tools:

- decide who receive what

- faster distribution of assets upon death

- overall lower costs to unlock assets

- avoid ugly arguments and fights between family members

- etc

But estate planning is such a broad topic, and there’s many moving parts..

What Happens If You Don’t Do Proper Estate Planning

One of the main reasons why you would want to do estate planning is to make sure your assets go to your intended beneficiaries, and to not let the law decide for you.

But how many people do it?

Let’s look at some statistics on unclaimed and un-nominated assets:

- $132 million in CPF savings are left unclaimed

- Only 120,000 CPF nominations are made in a year

- More than 8,000 insurance policy payouts are unclaimed

- Only 2% of life insurance policyholders make nominations

- Your assets may go unaccounted for if a Will isn’t made

- Not more than 10-15% of Singaporeans have made Wills

And what are the consequences? More on that later..

Tracking Your Personal Finances Is Always the First Step

“What can be measured can be improved”.

If you don’t measure or track your finances, it’s very hard to improve on it, because you’re not able to identify any shortfalls or gaps.

But there’s also another benefit of tracking your finances, and that’s to note down what you have.

Why is this important?

It’s because if such a list is not made, how would your family know what you have when death or mental incapacity happens? The assets will just go “unclaimed”.

So it’s always good to have an all-in-one collection of these data:

- Assets & Liabilities

- Income & Expenses

- Insurance Policy Summary

- Other Essential Information

For a free downloadable google sheets/excel template (without subscribing to anything), check out our FinSnap.

How to Leave a Larger Estate for Your Loved Ones

When you’ve done the proper tracking, there may be shortfalls.

And even if there aren’t any, you might think of maximising and enlarging your estate (the total assets upon death) for your family members.

How do we do this?

Firstly, the core basics of insurance protection should’ve already been done. That should be achieved by having adequate insurance coverage, usually from a term insurance or a whole life insurance, if something adverse happens prematurely.

Secondly, you need to have a plan to save for retirement and your kid’s education has been catered for already.

Thirdly, you can consider 3-generation lifetime income plans, which can provide income for your own retirement as well as for your next-gen.

And lastly, legacy insurance plans.

These legacy plans are specifically meant to leave a bigger estate for the next-gen:

Regarding Inheritance Tax in Singapore

Once you’ve got everything in place, and death happens, will the government tax your estate?

The short answer is no.

The long answer: Singapore used to have an estate duty tax but that has since stopped. For all deaths that happen on or after 15 Feb 2008, there’ll not be an estate tax.

An Overview of What Happens If You Die Without a Will

Once death happens, all your assets will be frozen. Nobody is supposed to have access to them anymore.

For the majority of those who die without a Will, an Administrator has to be appointed, and apply for a court order called the Grant of Letters of Administration.

This Administrator is usually the next-of-kin (e.g spouse or eldest child) and has responsibilities to fulfil such as:

- gather information on the deceased’s assets and liabilities

- creating an estate bank account

- transfer funds from the various banks into the estate account

- paying off all debts and liabilities

- and if there are any remaining assets, to be distributed to beneficiaries

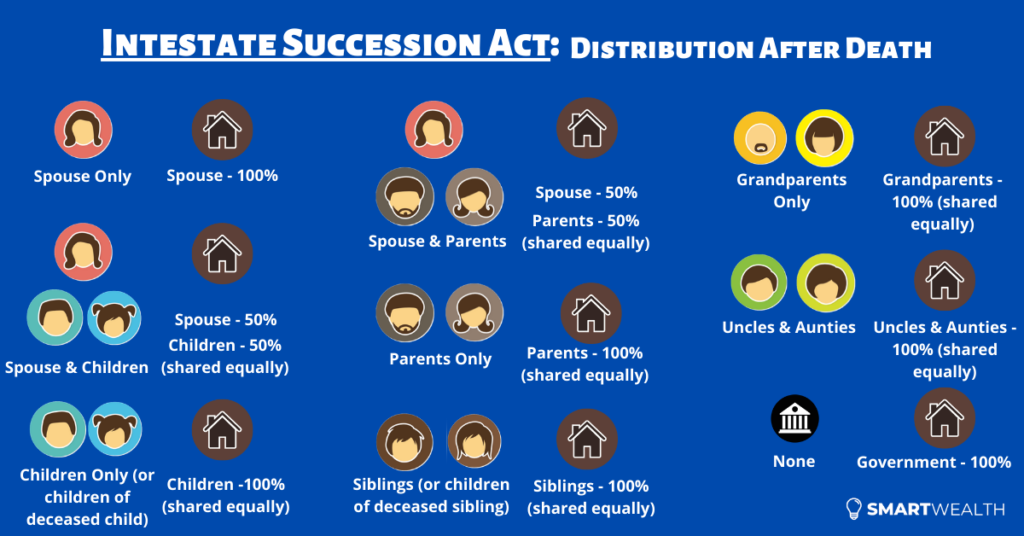

How are these assets distributed?

According to the intestate succession act or the muslim law.

However, not all assets are treated the same.

Depending on several factors, the following assets may be treated differently:

- Joint properties

- Joint bank accounts

- CPF monies

- Insurance proceeds

- etc

They may not be distributed according the intestate law or muslim law depending on what has been done prior.

Generally, making a Will makes it easier for everyone.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

The 3 Basic Estate Planning Tools

There may be a lot to take in.

But to start you off, there are a few core tools that you should take advantage of.

- CPF nominations

- Insurance policy nominations

- Wills (and testamentary trusts)

More details below..

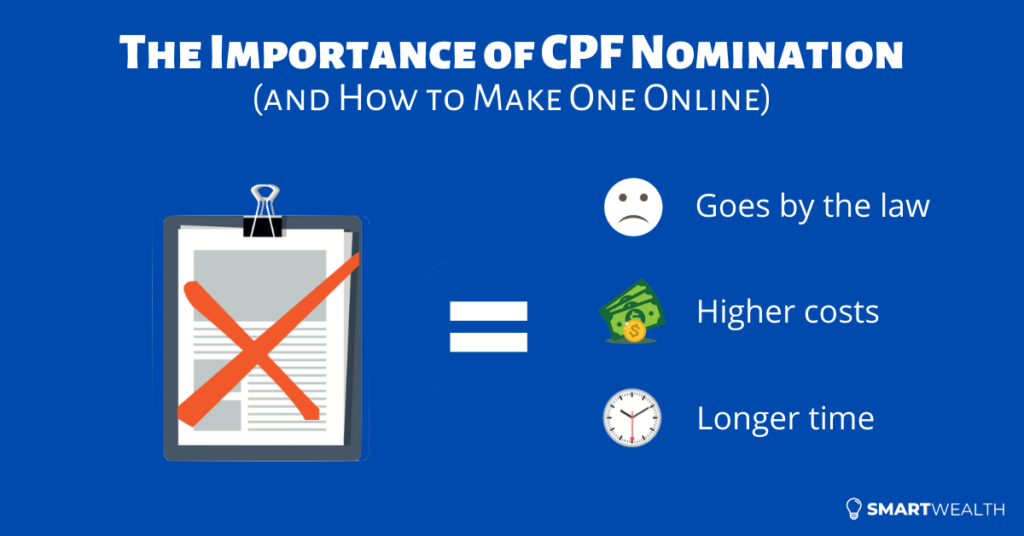

1) Making a CPF Nomination Is Easy Now

Whether you’ve made a Will or not, it doesn’t matter.

What matters is whether you’ve made a CPF nomination or not.

If you didn’t make a nomination, the CPF monies will go according to the intestate law or the muslim law.

Only if you’ve made a nomination, then it’ll go according to your wishes

Not only that, it can be cheaper and faster.

It used to be that CPF nominations can only be done via the CPF service centres or the submission of hardcopy forms (with 2 witnesses).

This limitation resulted in fewer nominations made, which negatively impacted the family of the deceased.

However, you’re able to make a CPF nomination online now. This is by far one of the easiest methods.

2) Some Insurance Policies Should Be Nominated

For insurance policies with a death benefit, you’re able to make a nomination.

By making an insurance policy nomination, you can decide who and how much your nominees would receive.

There are 2 types of nominations – revocable and irrevocable (trust).

Most nominations are revocable as you’re able to change details at any time.

And whenever you’ve made a nomination, the insurance company can pay out straightaway to your nominees when there’s a successful claim.

This is great because it gives your family liquidity.

However, it can be a double-edged sword because it will pay out one-shot, which may not be advisable for the nominees who aren’t great at handling money.

So you could consider nominating only a portion of your policies, and the rest can be dealt with more properly with a Will (particularly, with a testamentary trust).

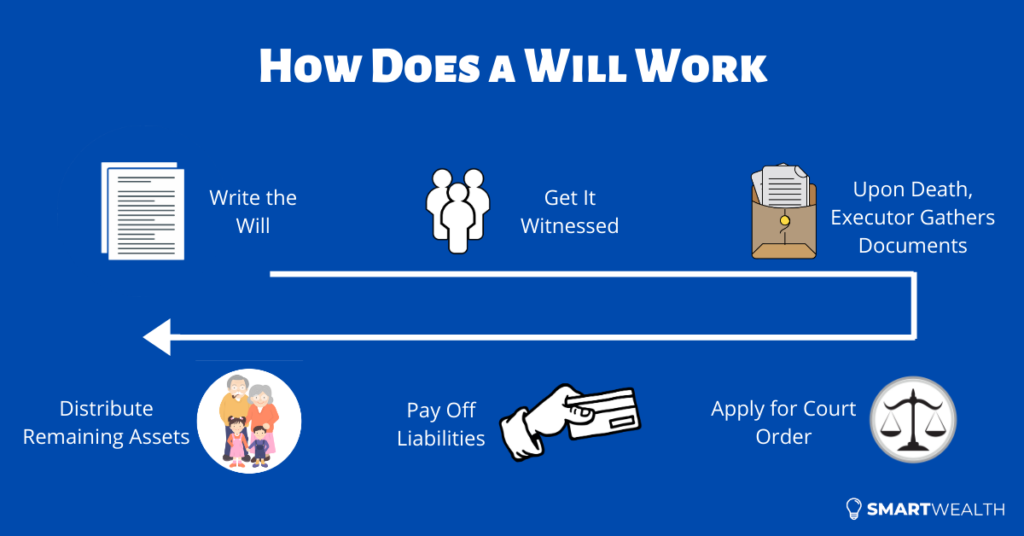

3) Making a Will is Important at Any Stage in Life

Making a Will will allow your to specify who receives what for all other assets.

The signing of the Will must be witnessed by 2 people, and then it should be kept at a safe and accessible place.

Upon death, the executor of the Will needs to gather all documents and apply for the Grant of Probate.

This enables him/her to gain control, pay off liabilities and distribute the assets according to the Will, etc.

The Will does have other features that will be useful.

One is that you can appoint a guardian for your children.

And the other is you can include a testamentary trust (Will trust) which can allow the staggering of payments or a monthly amount to be paid out instead.

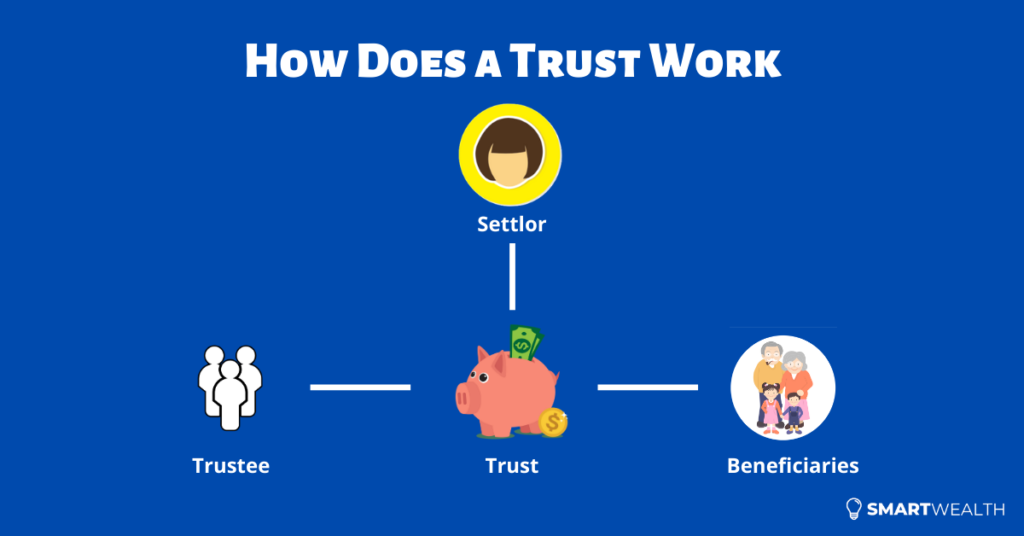

You Can Also Consider Setting up a Trust

Setting up a trust is not just for the rich, it can be for the retail individual too.

There are 3 main parties in a trust: the settlor (person who sets up the trust), beneficiaries, and the trustee.

A trustee is a person or entity that manages and distributes the assets for a period of time (e.g 20 years, till when the beneficiary turns 21, etc).

A trust provides greater control and flexibility which the basic estate planning tools can’t provide.

As such, it can be handy in certain situations.

There are different types of trusts available such as:

- Trust (Irrevocable) Nomination

- Will Trust (Testamentary Trust)

- Living Trusts

- Standalone Insurance Trust

- Property Trust

- Standby Living Trust

Don’t Forget About Advance Care Planning Too

What happens if you’re just mentally incapacitated?

Estate planning doesn’t kick in because it mainly deals with death.

So in the event when you’re “not dead or alive”, advance care planning comes in.

It consists of 3 main tools which can only be made when you’re mentally capable (and comes in when you’re not):

- Advance Care Planning Workbook – indicate your healthcare preferences

- Lasting Power of Attorney (LPA) – appointing a donee(s) to act on your behalf

- Advance Medical Directive (AMD) – forgoing life sustaining treatments when you’re terminally ill

All these tools help to make life easier for yourself and your loved ones when an unfortunate event happens.

What’s Next?

As mentioned, estate planning is nothing when proper financial planning is not done.

If you don’t have anything to give, then it’s rather pointless.

So emphasis has to be on improving your finances.

This can include getting adequate insurance coverage, catering to wealth accumulation needs with retirement planning and setting aside a fund for kid’s education, and then implementing legacy insurance plans.

Then start to utilise estate planning tools such as CPF nominations, insurance policy nominations, writing a Will, and setting up a trust.

At the same time, advance care planning comes in when you’re “neither dead nor alive”. So, take some time to read about that too.