Have you heard of trusts?

(No, not the one between two people. The financial kind..)

Most would think that a trust is only for the ultra-rich. But it can also be relevant to retail individuals.

How is that possible? Because of the different types of trusts available.

Today, I’ll touch on:

- what is a trust

- important features of a trust

- specific situations where it can be useful

- most common types of trusts in Singapore

- .. and more.

The content is created to be as simple as possible.

So, read on!

Too Long; Didn’t Read

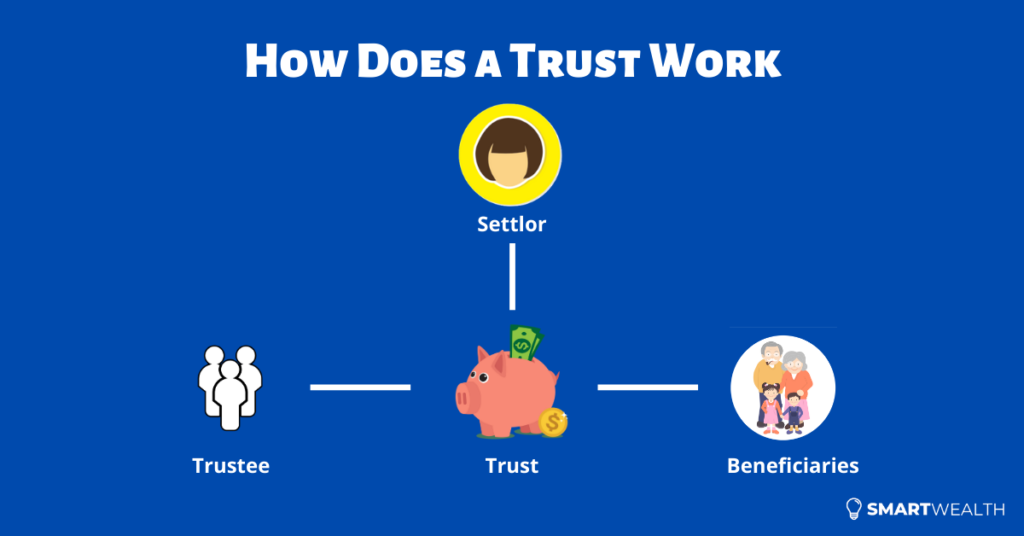

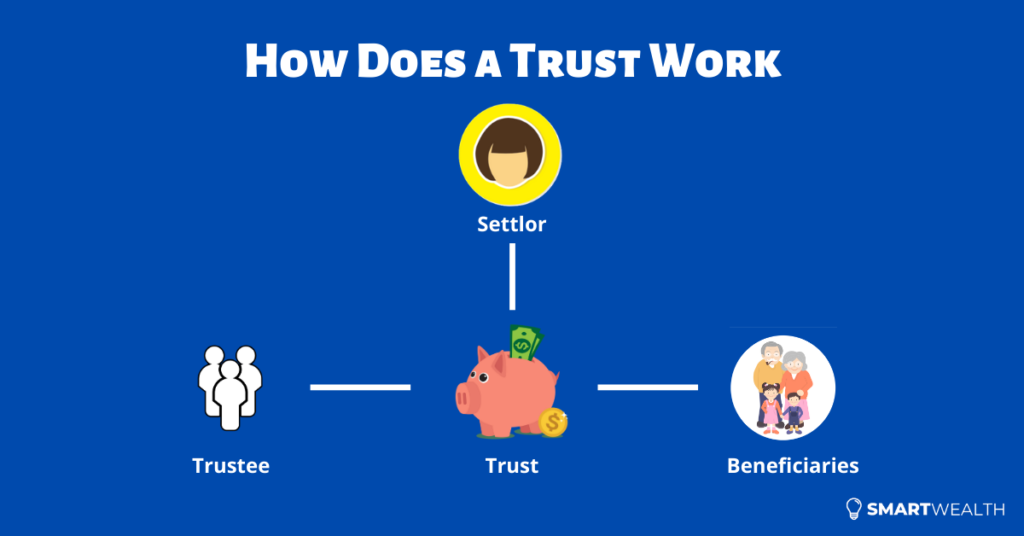

In a typical trust, the settlor (the person or entity who creates the trust) sets aside assets into the trust. These assets will then be managed by the trustee (person or entity) who ultimately makes distribution to the beneficiaries named by the settlor.

But this is just a simple flow.

There are many details that need to be touched on, so read on further.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is a Trust

What is the meaning of a trust, trust fund, or a trust account?

They’re similar.

The definition of a trust is a legal arrangement between a settlor (the person or entity who sets up the trust) and a trustee (the person or entity who holds the legal ownership) to provide proper distribution of assets to the beneficiaries (the person or entity who holds the beneficial ownership).

The trust can be “funded” by a variety of assets.

What’s the Purpose of a Trust

While a trust can serve a variety of needs, there are 3 core reasons why people turn to trusts.

Firstly, the trustee has a fiduciary duty to manage and distribute the assets for the sole benefit of the beneficiaries, and not for anyone else. Not doing so may result in breaking the law. Professional trust companies can be trustees too.

Secondly, with a trust, you can have greater control over how the distribution of your assets are to be made to your beneficiaries, whether you’re living or not.

And lastly, trusts can be extremely useful in special circumstances where no other instrument can cater for.

More on these specific situations later on, but let’s take a look at what a trust is made of..

The Different Components in a Trust

While a trust may seem complicated at first, it’s only made up of a few important parts.

Settlor

The settlor is the person who creates the trust and starts the ball rolling.

A trust can be created when the settlor is living (living trusts) or when he’s dead (testamentary trust/will trust).

He does this by setting aside a variety of assets into the trust to be handled and distributed by the trustee, for the ultimate benefit of his beneficiaries.

Trust

When the trust is created, it has to be “funded” with something.

It need not be just cash, and can include a variety of assets.

Examples of assets a trust can hold:

- Cash

- Shares

- Residential/commercial properties

- Insurance policies

- etc

One of the main reasons why you would create a trust is to make delayed gifts to your beneficiaries.

Trustee

What is a trustee?

The trustee is a very important person or entity that is the legal owner of the trust assets, and has to manage these assets and make proper distributions to the beneficiaries.

Here are some duties of the trustee:

- invest in only authorised investment vehicles

- optimise returns for assets

- distribute assets to beneficiaries

- etc

The trustee has a fiduciary duty to act according to the beneficiaries’ best interests. Failure to do so may result in a breach of trust and can be liable for lawsuits.

Having a professional trust company as a trustee works best for everyone as the duties can be performed at the highest level. They act as a “middleman” to the settlor and the beneficiaries. And dutifully act according to the wishes of the settlor.

An example of a trust company is the Special Needs Trust Company (SNTC).

Beneficiaries

The settlor names beneficiaries who can be individuals or entities.

Ultimately, the trust is created for the benefit of these beneficiaries as they ultimately receive the assets

Examples of beneficiaries:

- Spouse

- Children

- Parents

- Any close friends or relatives

- Charitable organisations

- etc

Trust Deed

The trust deed is a legally binding document which spells out the terms and conditions to how the trust should be administered.

It contains information such as:

- whether the trust is revocable or irrevocable

- whether it’s discretionary or fixed

- who the beneficiaries are

- the types of investments the trustee can make

- .. and a lot more

Letter of Wishes

The letter of wishes is a separate document where the settlor (person who created the trust) expresses additional wishes as to how the trust should be administered by the trustee.

It’s used as a reference and it provides guidance to the trustee, and it’s expected to be followed.

Although the document is not legally binding, it can have an influence in court (when challenged).

Protector

The protector is someone appointed to “oversee” the trustee, and it’s optional to have.

He/she is given power which includes:

- appointing and removing trustees

- adding/removing beneficiaries

- trustee has to seek approval from the protector when making distributions

- etc

A protector is particularly useful when the trust lasts beyond the next gen (i.e great-grandchildren).

Other Important Features of a Trust

There are other estate planning tools that you can use to create your desired roadmap.

Most of the time, these tools are used together such as CPF nominations, insurance policy nominations, writing a Will, etc.

But what makes the trust entirely unique?

Flexibility, which no other tool can replicate.

Here are some of the various features of a trust:

Revocable or Irrevocable

Most living trusts are revocable.

So you’re able to change any details of the trust whenever circumstances change at any time during the lifetime.

Only a small percentage of trusts are irrevocable. But they do come in handy in certain situations such as protecting your assets from creditors.

Discretionary or Fixed

If a trust is fixed, the trustee has to execute according to what’s spelt out.

And there can be no deviation.

This may not be ideal as one will never be able to predict the future, which is why most trusts are discretionary.

This would mean that the trustee has some wiggle room.

It does not mean that the trustee can do whatever they want, but they’re still expected to follow the trust deed and the letter of wishes. They still have a fiduciary duty to act in the best interests of the beneficiaries, just that they have more freedom to do so.

6 Situations Where a Trust Can Be Useful

Here are some scenarios where you can consider creating a trust:

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

1) Providing for a special needs child

If you have a beneficiary who is a special needs child, who’s going to provide for the child financially when you’re not around?

That’s why you may want to consider setting up a trust.

The trust will then be able to distribute funds so that the child will have continuous financial support when you’re not around.

And at the same time, you’re able to avoid placing legal and financial responsibilities on people around you.

The Special Needs Trust Company (SNTC) in Singapore is one that specialises in this area.

2) Delaying gifts for vulnerable family members

Some of our loved ones may not be great at handling money.

This can be seen in a number of news where the spouse receives insurance proceeds but is left with almost nothing at the end of a year.

This happens because not many of us are able to deal with a sudden increase in wealth and money.

So a solution to this is to structure how your gifts are to be made.

You can decide whether you want your loved ones – parents, spouse, young children – to receive a monthly amount or staggered payouts at different stages, etc

3) Buying real estate for children

When parents are more than self-sufficient, they’d usually think about the next generation, and how to provide more for them.

An asset class they think would be ideal is real estate.

Creating a trust to transfer beneficial ownership to the child may also allow the parents to avoid paying Additional Buyer Stamp Duty (ABSD).

But there may be downsides to this (more on that later).

4) Protecting your assets

Money is hard to earn, and so your assets are hard-earned.

You don’t wish them to go to unintended people.

Placing these assets in a trust can be a good way to protect against undeserving people, especially when the trust is irrevocable.

It can then have some protection against creditors, divorce and lawsuits.

However, there may be situations where it can still be challenged. For example, if there are creditor troubles within 5 years upon the creation of the trust, it may not be protected.

5) Avoiding probate

As assets placed in a trust do not form part of the deceased’s estate, it can skip the lengthy probate process.

It’ll be business as usual.

6) Having confidentiality

This is an area where the trust can be a good addition to a Will.

If you have just a Will, you’re likely to state whatever you have, who are your beneficiaries, and all the sensitive information.

But you may not want others to know about these information, for whatever reasons.

If you create a trust, all details are private and confidential, and will never be made to known to anyone.

Such details include who the beneficiaries are, what types of assets are in the trust, how the distribution plan will be like, etc.

Here are some situations where this could apply:

- if you don’t want anybody else to know what you have

- you may have another family or mistress that you don’t want anybody else to know

- a partner who is same sex that you don’t want others to know

- wanting the distribution plan to be private

- etc

The list is not exhaustive.

6 Most Common Types of Trusts in Singapore

Trusts come in all shapes and sizes.

And because of this flexibility, it caters to the different needs of those who want more than what the regular estate planning tools can provide.

Here are 6 common types of trusts:

- Trust (Irrevocable) Nomination

- Will Trust (Testamentary Trust)

- Living Trust

- Standalone Insurance Trust

- Property Trust

- Standby Living Trust

More details of each are below..

Trust (Irrevocable) Nomination

If you own a life insurance policy, you should know that you can make a nomination.

An insurance policy nomination is where you can specify who your beneficiaries are and how much each beneficiary can receive if you were to pass away.

By nominating, you’re able to bypass the legal process of obtaining probate; the insurance company will just pay out directly to the beneficiaries.

There are 2 types of nominations, revocable and trust (irrevocable) nomination.

Revocable is one that you can change the nomination details at any time, but the irrevocable one has much more restrictions.

Trust nominations can be great for those who wish to protect their assets from creditors.

But it comes with downsides such as any proceeds (even if you surrender; critical illness claims) will go to your beneficiaries instead and nominated monies are paid out in one lump sum.

Making a trust nomination is free of charge.

Testamentary Trust (Will Trust)

A testamentary trust or a will trust is created only when the testator (the person who makes the Will) passes away.

In making the Will, he/she would’ve specified who the trustee is (can be an individual or entity) and how the assets are to be managed and distributed to the beneficiaries.

So when the testator passes away, the executor of the Will would’ve to transfer these assets to the trustee (if different from the executor).

A will trust is useful when your estate is large and don’t wish your beneficiaries to receive everything in one-shot.

So you can specify to stagger or pay out a regular sum of money.

This will be useful in cases where you have young children or vulnerable family members who might not handle a sudden increase in wealth.

However, if you were to appoint a family member (i.e spouse) to be the trustee, you’re placing a lot of control and responsibilities on him/her. These responsibilities include legal and financial.

Which is why it can be advisable to appoint a professional trust company to be the trustee instead.

This will allow your family members to carry on with their life as per normal, and the trust company will then take on this responsibility of managing and distribution of the assets. They still have a fiduciary duty to do so.

To include provisions for a testamentary trust in the Will, it’s affordable and can cost less than $2,000.

If you wish to appoint a trust company as the trustee to manage the assets after death, it also comes at a cost, usually a small annual percentage (can be as low as 0.5%) of the asset value.

Living Trusts

While testamentary trusts are created only upon death, living trusts are created during the lifetime of a settlor (person who creates the trust).

Living trusts which can also be known as inter-vivo trusts, give an even greater control and flexibility compared to the will trust or trust nomination.

Because of this, they tend to cost more. There may be setup costs, annual cost of running it, and an annual percentage of the asset value, etc.

Depending on which type of living trust is created, it can cost less than $10,000 at the lower end.

The different types of trust are usually defined by how they’re funded:

- Standalone Insurance Trust

- Property Trust

- Standby Living Trust

Standalone Insurance Trust

In an insurance trust, a trust is set up during when the settlor is living, and then funded by having insurance policies nominated or assigned to the trust.

That way, the trustee (trust company) can manage these assets.

Such insurance policies can include life insurance policies with death benefit or surrender value/payouts.

This can be useful when everything else in estate planning is already properly done up, and you just want to separate this particular trust from everything else.

You’re still able to indicate how your want these proceeds to be distributed.

Property Trust

A property trust is funded by placing properties in the trust.

One of the main reasons for doing so is to buy properties meant for your children.

There are several benefits to this:

- Delaying this gift till when your child reaches a mature age

- Being able to avoid paying Additional Buyer Stamp Duty (ABSD)

- etc

However, there are downsides such as the child becomes the beneficial owner to the property and the property usually needs to be fully paid up.

Standby Living Trust

The standby living trust is just on standby.

It just means that you create a very small living trust, subject to a minimum amount.

The creation of it will include specific instructions and who the beneficiaries are, distribution plan, etc.

So what are we standing by for?

Death or mental incapacity.

If death were to happen, there’s likely to be specific instructions in the Will to “pour over” all assets into this “standby trust”.

Once that happens, the trust is then “funded”.

And all the instructions that have been created prior will kick in.

This is more for the affluent individual who wishes more confidentiality and control.

The Disadvantages of a Trust

One of the main disadvantages to set up a trust is the obvious – fees.

Depending on what type of trust you want to create, the fees will vary.

The cheapest but most beneficial one would be to do a will trust.

Living trusts may come with “front end” and “back end” fees.

In more specific situations, there are also other disadvantages.

For example in irrevocable trusts, it’s much harder to change any details once it’s set up. Another disadvantage is that you’d be giving up control to the trustees. So generally, they should be competent.

How to Set up a Trust in Singapore

Depending on what type you want, there are several options.

The easiest would be the make a trust nomination for insurance policies. Approach your financial advisor to assist you with it.

For the rest including the will trust, having a professional trust company to be the trustee, and living trusts, you might want to approach an estate planner to deals with these areas.

They’ll be best equipped to advise you on the whole estate planning process too.

What’s Next?

Trusts are a part of the estate planning process.

But to start this journey, make sure the basics are done.

These include making CPF nominations, insurance policy nominations, and writing a Will.

And then consider whether Will trusts or living trusts would be beneficial for you.