Singapore has constantly been ranked as one of the cities with a high cost of living.

While some people may wonder if such statistics on Singapore’s high cost of living is valid, especially since $4 meals still exist in the hawker centres, it is an undeniable fact that other necessities of living are much higher than in other developed countries.

One of the main factors for the rising cost of living in Singapore can be attributed to Singapore’s lack of land and natural resources. This has led to Singapore’s dependency on other countries for supplying natural resources (food, oil, water, etc.) and on foreign labour workers to build our skyscrapers to accommodate a growing population on our tiny island.

Here are 9 statistics on Singapore’s rising cost of living that would affect Singapore residents’ financial decisions in the present day and future.

All prices quoted are in Singapore dollars (SGD).

- 1) Singapore was named the world’s most expensive city for 8 out of the past 10 years

- 2) An estimated monthly cost of living in Singapore is $2,560

- 3) The average headline and core inflation rate over the past 20 years was 2.08% and 1.86% respectively

- 4) Prices of HDB resale flats have increased by 116% since 2000

- 5) Singapore is the most expensive place in the world to buy and own a private car

- 6) The cost of education has increased by 74.7% from 2003 to 2023

- 7) The healthcare inflation rate in 2023 was 4.50%

- 8) Food prices are heavily influenced by external factors

- 9) The median gross monthly income has grown by 40.3% over the past 10 years (2013 to 2023)

- What Can You Do About the High Cost of Living?

1) Singapore was named the world’s most expensive city for 8 out of the past 10 years

The Economist runs a biannual Worldwide Cost-Of-Living analysis every year.

The results are derived from a comparison between cities or countries in terms of the price of 138 products and services worldwide. In the survey, the Economist Intelligence Unit (EIU) examined common consumer goods such as clothing and electronics across 130 countries.

From 2014-2019, Singapore was ranked the world’s most expensive city to live in. Even in the midst of the COVID pandemic in 2020, Singapore was still listed in the top five most expensive cities. In 2021, Singapore climbed up to second place. In 2022 and 2023, Singapore regained its spot as the world’s most expensive city.

Here are some of the reasons for the seemingly high cost of living in Singapore.

However, it is important to note that the survey is geared to reflect the cost of living of expatriates/foreigners and not of Singaporean households. It doesn’t take into account subsidies and grants given by the government to Singapore Citizens and Permanent Residents, especially those from lower-income families.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

2) An estimated monthly cost of living in Singapore is $2,560

An individual’s monthly cost of living is determined by one’s lifestyle and commitments, and whether you’re a Singaporean or not.

In the table below, we considered areas that are necessities and wants and have tabulated rough estimates of the monthly cost of living in Singapore.

| Low-Range | Mid-Range | High-Range | |

| Single Adult (with rent) | $1,245 | $2,560 | $7,780 |

| Single Adult (without rent/mortgage loans) | $545 | $1,360 | $4,380 |

| Couple | $2,740 | $5,770 | $16,560 |

| Family of 4 | $3,200 | $7,920 | $22,060 |

If you are married and have children, the numbers are likely to be much higher. This is due to the inclusion of other essentials such as insurance payments, setting money aside for childcare, or hiring a domestic helper.

(We have not accounted for the full range of expenses, such as a monthly allowance to parents. And tabulated costs may include overlaps, so do not take them seriously.)

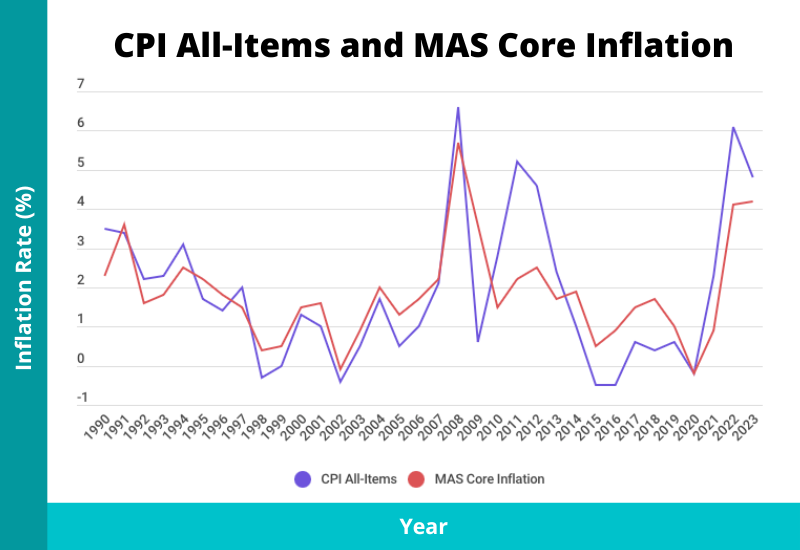

3) The average headline and core inflation rate over the past 20 years was 2.08% and 1.86% respectively

The inflation rate is measured by the change in the Consumer Price Index (CPI), which includes the essential prices of things like housing, clothing, food, healthcare, etc.

To put it simply, headline inflation measures the average change in prices of all goods and services, while the core inflation factors in all goods and services excluding the components of “Accommodation” and “Private Transport”. Thus, core inflation is a better indicator of the change in prices of everyday items.

We’ve done an analysis of inflation in Singapore and here is what we’ve found.

| Average Headline Inflation Rate (CPI All-Items) | Average Core Inflation Rate (MAS Core Inflation) | |

| Over the last 10 years (2013 to 2023) | 1.44% | 1.65% |

| Over the last 20 years (2003 to 2023) | 2.08% | 1.86% |

| Over the last 30 years (1993 to 2023) | 1.73% | 1.67% |

The average inflation rate is much higher than the interest rate that an average bank savings account gives to Singaporeans; money left in the bank will devalue over time.

The annual inflation rate (both the average headline and core inflation rate) has almost always been positive, and only a few years have seen very low inflation rates.

The highest core inflation rate was 5.7% in 2008. Although there was a financial recession in 2008, higher oil prices pushed inflation upwards. The lowest annual core inflation rate was -0.2% in 2020 due to the COVID pandemic.

Inflation is affected by both internal and external forces. As Singapore has to largely depend on other countries for natural resources, prices of certain goods and services were acutely affected.

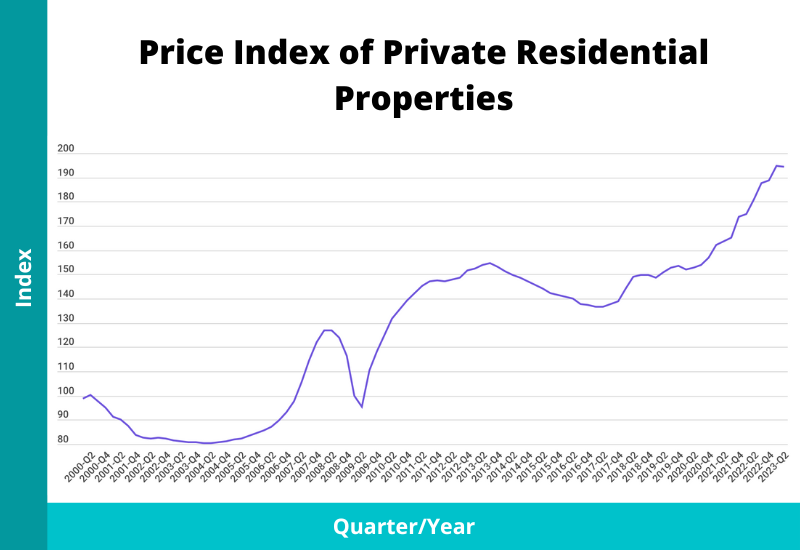

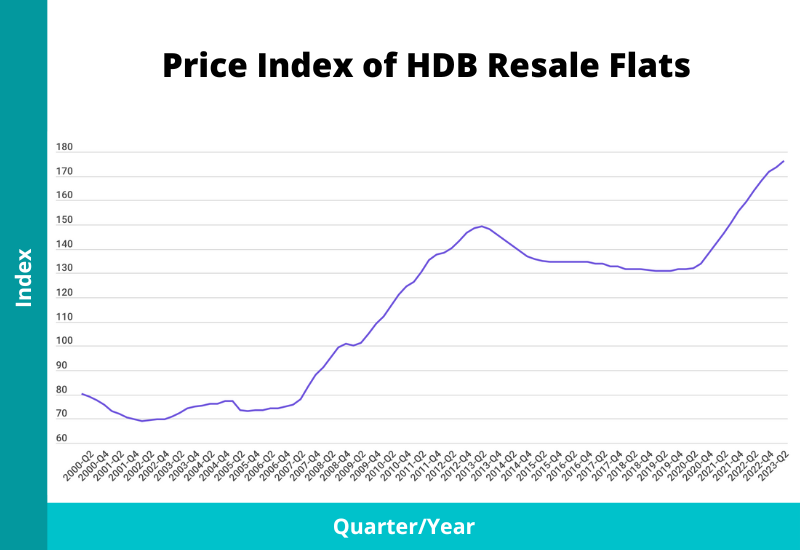

4) Prices of HDB resale flats have increased by 116% since 2000

It is a well-known fact that property prices are extremely high in Singapore compared to other developed countries (with the exception of Hong Kong).

Property prices are almost always on an upward trend. Here are the private residential property and HDB resale price indexes from 2000 Q1 to 2023 Q2:

From 2000 to 2023, private residential property prices have increased by 97%, while prices of HDB resale flats have increased by 116%

Due to more work-from-home (WFH) arrangements and investments from foreigners, property prices have surged since 2020. There were also 470 million-dollar HDB flats transacted in 2023, the highest in any given year.

The table below tabulates the average and median prices for HDB resale flats, private condominiums, and landed properties.

| Housing Type | Average Price | Median Price | Average Price/Sq. Foot | Average Size (Sq. Foot) | Average Price/Sq. Metre | Average Size (Sq. Metre) |

| HDB Flats | $571,796 | $550,000 | $558.52 | 1,023.77 | $6,012 | 95.11 |

| Condo | $1,954,778 | $1,671,000 | $1,936.08 | 1,009.66 | $20,839 | 93.80 |

| Landed | $5,367,170 | $4,070,000 | $1,645.77 | 3,261.18 | $17,715 | 302.97 |

5) Singapore is the most expensive place in the world to buy and own a private car

Did you know that a Jaguar XE costs only $57,000 in the UK? That price is not sufficient to purchase a new Toyota in Singapore.

The Business Insider reported that Singapore is the most expensive place in the world to buy and own a car.

Car ownership is purposefully designed to be unaffordable for the majority, as the government tries to reduce to use of cars as these will cause congestion and the need for more land space to park them. The government primarily controls the prices of automobiles through the Certificate Of Entitlement (COE). In Mar 2024, the COE was at $83,000 for Category A cars.

A new Toyota Corolla Altis now costs $145,888. This has not accounted for other costs of running a car such as petrol, parking, insurance, payment of road tax, and car maintenance.

| Cost of Running A Car | Monthly Average |

| Petrol | $320 ($80 for 38 litres of petrol) |

| Parking (seasonal HDB pass + public car parks) | $130 |

| Car Insurance | $85-$125 |

| Road Tax | $85-$90 |

| Car Maintenance (oil change every 8000-10,000km (approximately once every 3 months)) | $50-$100 |

| Total | >$675 |

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

6) The cost of education has increased by 74.7% from 2003 to 2023

The cost of education has risen by 74.7% over the past 20 years. Benchmarked against the CPI-All Items inflation (50.9% over 20 years), the number is considerable.

The dramatic increase can be attributed to the rising demand from the younger generations to get a degree. This is fuelled by the knowledge-driven economy which rewards those with a paper degree in both opportunities and monetary terms.

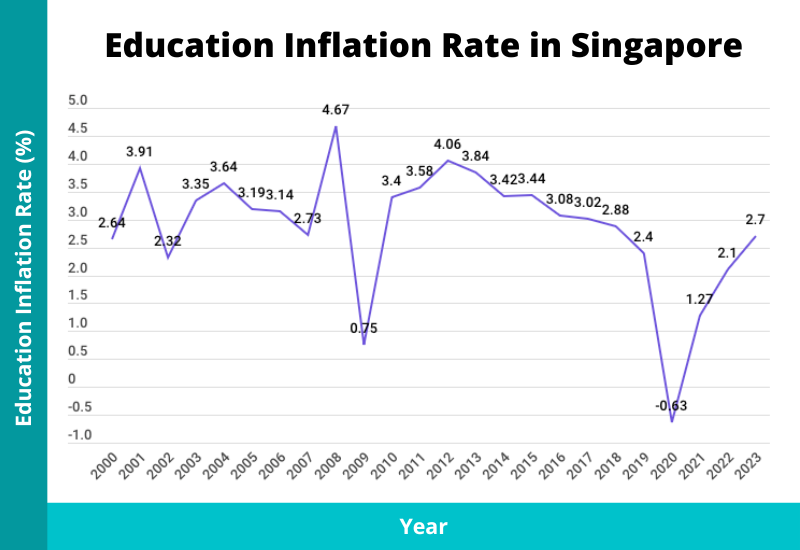

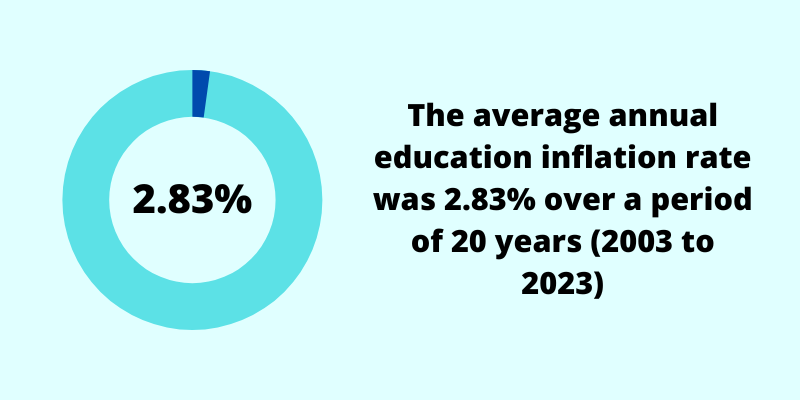

The graph above charts the inflation rate for education in Singapore. Every year there was an increase, except for 2020, because local universities decided not to raise tuition fees. The average education inflation rate over the past 20 years was 2.83%.

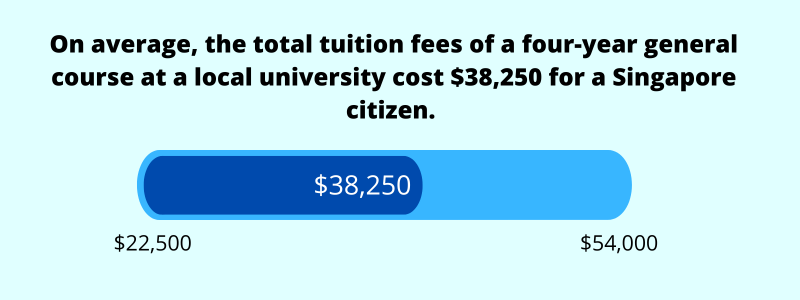

In 2023, the estimated tuition fees for a four-year general course at a local (public) university in Singapore are $38,250.

This does not include the living expenses of a student, which can amount to $41,200 for four years. In total, the cost of obtaining a degree is close to $80,000, in today’s value.

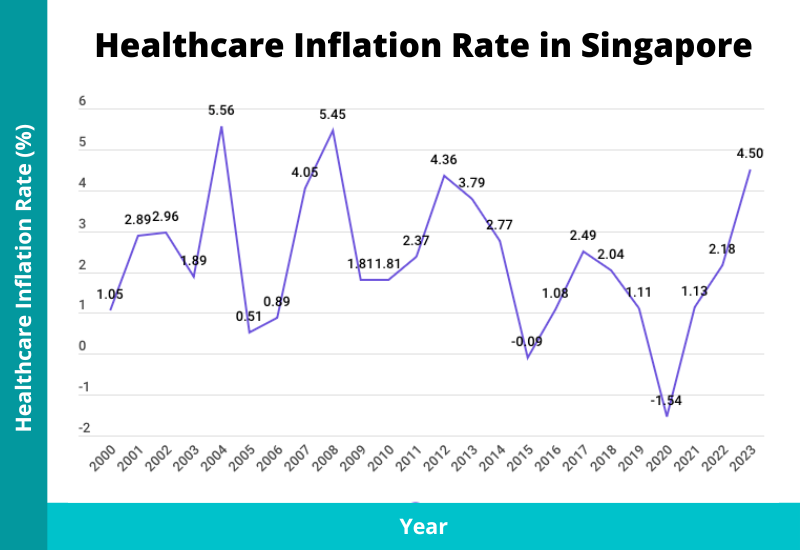

7) The healthcare inflation rate in 2023 was 4.50%

Another contributing factor to the high cost of living in Singapore is the cost of healthcare, which has been of interest lately.

The cost of healthcare has increased by 57.5% from 2003 to 2023, and the average was 2.30% per year.

The reasons for rising healthcare costs are as follows:

- Life expectancy has increased

With a longer life expectancy comes greater healthcare expenditure. It is undeniable that in old age, more healthcare costs are to be expected as the body slows down. - More people are using healthcare facilities

Singapore boasts one of the best healthcare systems in the world. A large part of this is not only because of our well-trained healthcare workforce but the investment in medical technology. This has allowed people to go for more health checkups, and often the early detection of any critical illness would be treated immediately. This also means that more money would be spent on healthcare services. - Increase in manpower and operating costs

As there is strict gatekeeping in Singapore for our doctors, manpower costs have also increased. Students are not only required to have straight A’s but must be ready to set aside at least $60,000-$100,000 for school fees. As such, salaries also need to be matched. Operating costs also went up – there was a 9% year-on-year increase in private healthcare costs from 2007-2017. - Premiums for health insurance are increasing

Premiums for MediShield Life have gone up by up to 35.4% since 1 March 2021. This is due to more comprehensive coverage being provided and to address the rising healthcare costs. Being unable to cope with larger and more frequent claims, insurance companies are also phasing out their “full” riders and replacing them with co-payment ones.

8) Food prices are heavily influenced by external factors

Do you know that 90% of the food consumed in Singapore is imported?

Even water, an essential part of life, is imported from Malaysia.

Due to the lack of natural resources and land scarcity, it is almost impossible to grow our food. As such, Singapore is often at the mercy of other countries’ pricing of their goods.

Thankfully, our government has worked hard to control these prices by building good relationships with our neighbours. However, food supply disruptions and tensions can affect the cost of food (and its supply) anytime.

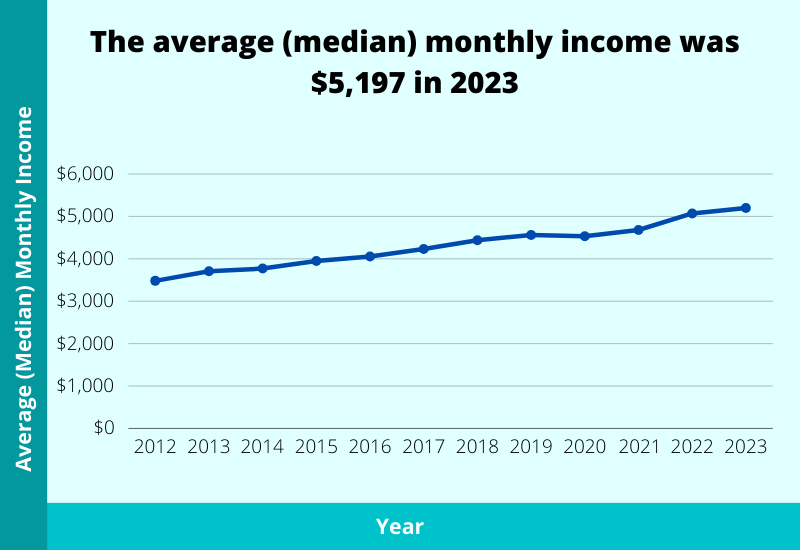

9) The median gross monthly income has grown by 40.3% over the past 10 years (2013 to 2023)

Fortunately, the median gross monthly income has also grown:

| Mid-Year | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Levels ($) | 3,000 | 3,249 | 3,480 | 3,705 | 3,770 | 3,949 | 4,056 | 4,232 | 4,437 | 4,563 | 4,534 | 4,680 | 5,070 | 5,197 |

In 2013, the median monthly income was $3,705, and it has risen by 40.3% to $5,197 in 2023.

The increase in gross monthly income is thankfully faster than the cost of living, thus outpacing inflation. The real annualised change of median gross monthly income from 2013 to 2023 is 2.0% (after factoring in inflation).

What Can You Do About the High Cost of Living?

While the facts and statistics listed above are things the average Singaporean cannot control, we can try our best to manage our finances and lifestyle choices.

Making use of various government schemes helps reduce our expenses, but we must still be conscientious in managing our overall expenses. For example, you may want to reconsider owning a new car, and weigh your options (either purchase a second-hand car or stick to public transportation and private hire cars).

Foreigners tend to experience a higher cost of living compared to locals as they do not get the same grants and subsidies. Expats who plan to relocate to Singapore should do a thorough analysis of whether they can afford to make the move and preserve their current lifestyle choices.

Whether you’re a local or a foreigner, one way to keep expenses low is to know how to budget effectively.