Before the global pandemic struck, Singapore was a popular city of choice for many expatriates seeking to move abroad.

Some famous people who have chosen to move to Singapore include Eduardo Saverin (co-founder of Facebook), James Dyson, and even Jackie Chan.

If you are planning to make Singapore your home, or if you are a Singaporean wondering how to plan your finances well to ensure you can keep up your lifestyle, read on to find out more about the average monthly cost of living in Singapore.

Note: All prices are quoted in Singapore dollars (SGD). As at 28 May 2021, 1 United States dollar (USD) = 1.32 SGD.

In a Nutshell

The average monthly cost of living in Singapore (2021) in a low, mid, and high-tier range is as follows:

(These are very rough estimates, so don’t take them seriously.)

| Low-Range | Mid-Range | High-Range | |

| Single Adult (with rent) | $1,245 | $2,560 | $7,780 |

| Single Adult (without rent/mortgage loans) | $545 | $1,360 | $4,380 |

| Couple | $2,740 | $5,770 | $16,560 |

| Family of 4 | $3,200 | $7,920 | $22,060 |

Read on further to learn more about the living expenses in Singapore.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

An Overview of the Cost of Living in Singapore

Before we dive into the nitty-gritty details, it is important to understand what “cost of living” refers to. According to Investopedia, the cost of living refers to “the amount of money needed to cover basic expenses such as housing, food, taxes, and healthcare in a certain place and time”. These numbers are also put into perspective by accounting for the average salary paid.

Singapore is often known for having a high standard of living.

However, did you know that Singapore was named the most expensive city for 6 out of 7 years by the Economist Intelligence Unit since 2014? Underlying reasons for acquiring this label are due to land scarcity and a lack of natural resources, driving the cost of living up.

Over the past 20 years, headline inflation has been on an upward trend, averaging at 1.48%.

In the segments below, we will crunch the numbers related to housing, food, taxes, and healthcare costs in 2021.

Cost of Housing and Accommodation

Property prices in Singapore are rather high.

However, there is quite a variation in the prices and cost per square metre depending on the following factors:

- Which region you decide to reside in (Central, North, North-East, West and East)

- How close it is to the Mass Rapid Transport (MRT) system

Generally, the most expensive accommodation in Singapore (whether it is for rent or to own the property) is closer to the Central Business District (CBD).

This includes both Central and North-East areas in Singapore that have the most convenient connections to the CBD. This includes not just the Orchard area, but even residential areas like Bishan and Serangoon.

Due to the long working hours in Singapore, many choose an accommodation nearer to their workplace and has easy access to the public transport system.

Renting

If you are an expatriate, renting a property is probably your top choice.

There can be huge differences in terms of pricing, depending on your selection of several factors:

- Space (i.e. one room vs. a whole apartment)

- The type of property

- The region

For those with a tight budget, renting a room in Singapore’s Housing Development Board (HDB) flats, a public housing system, is probably your best bet. Even then, you would likely have to be content with sharing the space with other tenants, or the owner’s family.

Generally, the rental rate for a common room in a HDB flat is between $600-$800. For a master bedroom with private access to the toilet, you can expect to pay between $900-$1,300.

If you prefer to rent a room in a private property such as a condominium, with access to amenities such as the gym and swimming pool, you can expect to pay between $950-$2,000.

If you prefer to have privacy, it comes at a higher cost. In general, to rent a whole HDB flat, you can expect to pay between $1,500-$2,800 depending on whether you choose a 3-room, 4-room, 5-room, or executive flat.

For a whole 3 to 4-bedroom condominium, you will have to be prepared to fork out $3,300 (Stars of Kovan) to $17,000 (asking price for The Trillium) a month.

In the table below, you will find the estimated monthly rental rates for a studio apartment and three-bedroom apartment in the most popular towns in each region.

| Region | Town | Studio Apartment | 3-Bedroom Apartment |

| Central | Newton | $3,900 | $6,000 |

| East | Tampines | $1,500-$2,300 | $2,800-$4,000 |

| West | Jurong East | $1,499-$2,400 | $3,400-$5,400 |

| North | Woodlands | $1,600-$3,200 | $2,800-$5,000 |

| North-East | Ang Mo Kio | No Stats Available | $3,350-$5,400 |

Buying a Property

If renting seems too much of a hassle and you would prefer to own property, there are several options for you.

Under the public housing scheme, Singaporeans (and Singapore Permanent Residents) can purchase an apartment under HDB. Potential buyers have a choice between choosing a resale flat or a Built-To-Order (BTO) flat.

Due to the shortage of foreign labour in 2021, many buyers have decided to consider purchasing resale flats as BTOs can take up to 6 years for completion (pre-pandemic, buyers of BTOs were able to collect keys to their homes within 3 years).

Property prices have also risen significantly in 2021.

The Business Times reported a jump of 6.7% for private properties and this seems to be fuelled by investments from foreigners. The Straits Times also reported that 82 HDB flats were sold for more than a million dollars.

The tables below present the most recent market prices of purchasing a BTO, a resale, and a private condominium.

BTO Starting Prices

Here are some prices for November 2020 Launch:

| Location | 2 room | 3 room | 4 room | 5 room |

| Sembawang | $92,000 | $163,000 | $260,000 | $336,000 |

| Tengah | $108,000 | $194,000 | $288,000 | $394,000 |

| Toa Payoh | N/A | $324,000 | $466,000 | $627,000 |

| Bishan | $121,000 | $374,000 | $528,000 | N/A |

| Tampines | $130,000 | N/A | $334,000 | $460,000 |

Resale HDB Prices

For comparison, I have extracted the following data from the HDB website on the 2021 resale flat prices in the first quarter. The data presents the median prices of one town in each region.

| Location | 3 room | 4 room | 5 room |

| Toa Payoh (Central) | $280,000 | $603,500 | $808,000 |

| Tampines (East) | $350,000 | $450,000 | $555,000 |

| Jurong East (West) | $333,000 | $420,300 | $564,000 |

| Woodlands (North) | $290,000 | $380,000 | $465,000 |

| Serangoon (North-East) | $350,000 | $450,400 | $557,900 |

Condominium Prices

The prices of condominiums are quite different from HDB, depending on the level the apartment is at (generally the higher floors fetch higher prices) and how many years are left on the lease. Those with either a longer lease left (i.e. 99 years) or are freehold will cost more.

| Location | Studio | 2 room | 3 room | 4 room |

| Toa Payoh (Central) | $950,000 | $1.6 million | – | $2 million |

| Tampines (East)* | – | $910,000 | $910,000 | $1.12 million |

| Jurong East (West)* | $850,000 | $1.18 million | $1.12 million | $1.15 million |

| Woodlands (North) | – | $788,000 | $965,000 | $1.5 million |

| Serangoon (North-East) | $995,000 | $1.5 million | $1.7 million | – |

Expected monthly repayment

From the data above, property prices are not cheap in Singapore.

Thankfully, Singaporeans who have been working for some time would be able to draw on their CPF Ordinary Account (OA), and if you plan it well, you may not even need to draw from your bank savings.

If you take a high loan and do not have enough in your CPF OA, you can expect to pay between $500 up to $5000 per month according to the price you purchased your property at.

Note that in Singapore, there is a maximum loan you can take for your property, which is called the loan-to-value (LTV) ratio. An LTV ratio of 75% means that you can take a loan of up to 75% of the property price or value, whichever is lower. You should also take note of the Total Debt Servicing Ratio (TDSR) and the Mortgage Servicing Ratio (MSR).

For HDB loans, the maximum LTV is 90%. The remaining 10% downpayment can be made using cash and/or CPF OA. The HDB loans have a fixed interest rate of 2.6%. For example, if you take a loan of $285,000 from HDB, with a repayment period of 25 years, you can expect to have a monthly repayment of $1,293.

For bank loans, the maximum LTV is 75%. The remaining 25% downpayment can be made with cash and/or CPF OA, but with a minimum of 5% in cash. For a bank loan, you can opt for a floating interest rate or fixed interest rate. This can change based on the bank’s discretion.

Financing a 2-bedroom Condominium Apartment in Serangoon

If you decide to purchase a 2-room condominium apartment at Serangoon, you will only be able to take a 75% loan on the value or price, whichever is lower, and have to make a downpayment of at least 5% in cash. The remaining 20% downpayment can be made using cash and/or CPF OA balances.

In the table below, we break down the monthly repayment you would have to fork out for such a purchase.

| Purchase Price | $1.6 million |

| Loan Amount | $1.2 million |

| Annual Interest Rate | 1.6% |

| Monthly repayment [if the loan is paid over 25 years] | $4,855.82 |

Note: If you are an expat, you will have to pay an additional tax of 20% (also known as the Additional Buyer Stamp Duty) regardless of the number of properties you purchase. You are not allowed to buy any apartments under HDB. That leaves you with private condominiums and landed properties (subject to approval) in Singapore.

Cost of Transportation

Unlike most countries, transportation costs in Singapore can either be very affordable if you choose to use public transport or be a financial burden if you decide to own a car.

Public Transport

Thankfully, public transport in Singapore is very affordable.

A single trip on the MRT/bus does not exceed $2.17. If you are a Singapore citizen or permanent resident and decide to travel purely by MRT and buses, you can get a adult monthly concession card that costs $128. This gives you unlimited rides on the MRT and buses.

Taxis and Private Hire Cars

If you have a higher budget, you might choose to travel to your workplace or places of interest via taxis and private hire cars.

Private Hire Cars are available in Grab, Gojek and Ryde.

However, the cost can vary tremendously depending on the demand (i.e. you can expect to pay $30 for a short ride if it is raining heavily) for rides at your location. If you decide to take a taxi, you also have to be aware of additional surcharges of 25-50% during peak periods or after midnight.

On average, you can expect to pay $12-$28 for a taxi/Grab ride.

In 2014, a journalist from The Straits Times worked out how much he would have to pay monthly if he only took taxis. He calculated that he would have to set aside at least $1,030 a month. In the present day, if we account for inflation of 1.48% per year, this figure goes up to $1,141.

Owning a Car

If you are a married couple or have a growing family, $1,141/person per month is not a figure you are willing to pay. As such, many Singaporeans consider buying a car instead.

However, did you know that it costs a lot of money to own a car in Singapore?

These are the following costs that you would need to take note of when you decide to purchase a car, whether it is new or a second-hand one:

- Listed Price of Car

- Certificate of Entitelment (COE)

- Annual Road Tax

- Annual Insurance

- Maintenance of Car and Repairs

- Petrol Prices

- Parking Charges

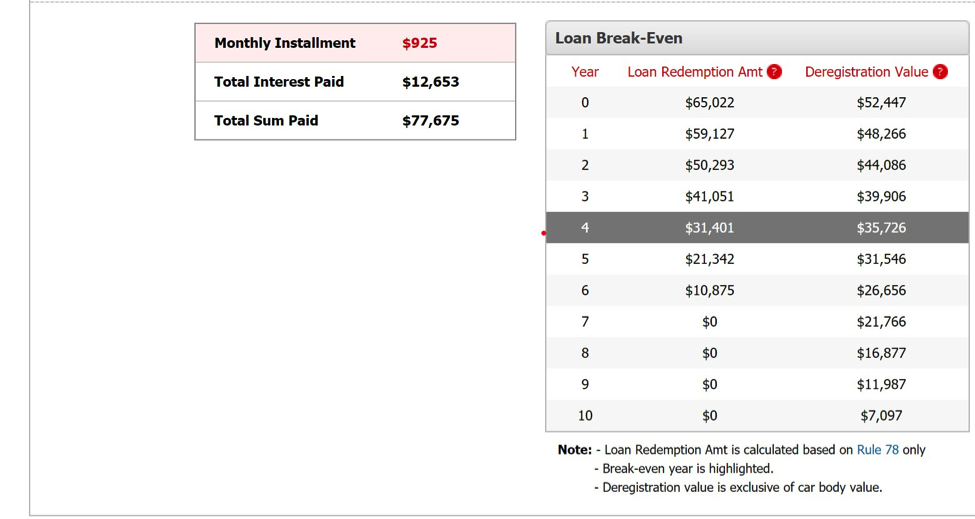

The tables below give you a breakdown of how much a new Toyota Vios E car and a second-hand car would cost you in 2021.

Estimated Cost of a New Toyota Vios E

| Item | Cost |

| Listed Price of Car | $92,888 (If a loan of $65,022 is taken, with an interest rate of 2.78% and a loan term of 7 years, monthly repayment is $925) |

| Certificate of Entitlement | $41,801 (already factored into the listed price) |

| Annual Road Tax | $682 |

| Annual Insurance | $1,000-$1,500 (depending on your age and how long you have owned a car) |

| Maintenance of Car and Possible Repairs | $150-$200 per 10,000 km (approximately 3 months if you only drive to and from work) |

| Petrol Price | $80/week |

| Parking Charges | $80/month (HDB season parking rate) |

| Total Monthly Cost | $925 (loan repayment) + $56.85 (road tax) + $125 (insurance) + $50 (maintenance) + $320 (petrol) + $80 (HDB parking) = $1,556.85 |

Estimated Cost of a Used Toyota Vios J (6 years left on COE, 13 year old car)

| Item | Cost |

| Listed Price of Car | $40,000 (If a loan of $35,000 is taken, with an interest rate of 2.48% and a loan term of 3 years, monthly repayment is $1,045) |

| Certificate of Entitlement | – |

| Annual Road Tax | $1,156 |

| Annual Insurance | $1,000-$1,500 (depending on your age and how long you have owned a car) |

| Maintenance of Car and Possible Repairs | $150-$200 per 10,000 km (approximately 3 months if you only drive to and from work) |

| Petrol Price | $80/week |

| Parking Charges | $80/month (HDB season parking rate) |

| Total Monthly Cost | $1,045 (loan repayment) + $96.35 (road tax) + $125 (insurance) + $50 (maintenance) + $320 (petrol) + $80 (HDB parking) = $1,716.85 |

Cost of Food

If you like to cook, the cost of food per month can be kept pretty low. Below, we explore some categories of the cost of food such as groceries, dining out at hawker centres, fast food chains and other restaurants.

Groceries

These are the average retail prices of the 7 likely items in your pantry:

| Item | Price |

| Premium Thai White Rice (5kg) | $13.61 |

| Wholemeal Bread | $2.07 |

| Whole chicken | $6.31 |

| Fresh Milk | $3.37 |

| 10 eggs | $2.42 |

| Cooking oil (2kg) | $5.98 |

| Spinach (1kg) | $3.81 |

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Dining Out

If cooking is not for you, dining out is your only option. These are the prices you can expect to pay at hawker centres, fast food chains and restaurants.

| Food | Price |

| Chicken Rice [Hawker Centre] | $3-$4 |

| Bowl of Bak Chor Mee [Hawker Centre] | $3-$4.50 |

| Fillet-O-Fish meal at McDonald’s | $5 |

| Wee Nam Kee Chicken Rice Set Meal for 4 | $45 |

| Meal at a cafe/restaurant | $15-$30 |

Cost of Utilities

Utility bills are something all Singaporeans cannot escape from. Below we look at the average cost of electricity, water and gas, as well as the very things we can’t live without (mobile phone subscription and Internet).

Electricity, Water, and Gas

One can expect to pay monthly bills of between $59-$120 if you live in a HDB flat, and between $120-$450 if you live in a private property.

The figure below shows the average tariff paid by consumers in 2021.

Mobile Subscription, Broadband Internet, and Cable

The Internet and our mobile phones are something we cannot live without. These also add to the monthly cost of living. SIM-Only Plans can cost between $10-$30 depending on the amount of data you select. Broadband Internet plans can cost between $34-$64. If you also enjoy watching TV, you can expect to fork out another $11.98 (for a Netflix subscription) and between $20-$30 for a cable TV plan.

Cost of Healthcare

It is also important to set some money aside for healthcare. It is inevitable that we may fall sick, no matter how much healthy living we practise.

The cost of healthcare has risen by 57.46% since 2000, and the average medical inflation rate was 2.3% per year.

The following table gives an estimated cost of healthcare charges in Singapore.

| Healthcare Provider/Service | Estimated Cost |

| Single consultation at a General Practitioner’s Clinic | $25-$60 |

| Health Screening | $25-$400 |

| Visit at the A&E at public hospitals | $121 |

| Specialist consultation at public hospitals | $39 to $161 |

Cost of Recreation

What do Singaporeans do for recreation?

Some like to take a hike or kayak at our beautiful MacRitchie Reservoir while others prefer to spend their time indoors where the air-conditioner is.

If you prefer to spend your leisure time watching movies, going to the gym, having a drink with your friends at the club, you would have to set aside the following amount for these activities.

| Activity | Estimated Cost |

| Movie Tickets | $9-$13.50 |

| Gym Membership | Between $90-$300 |

| Alcoholic Drinks | Between $5 (when there are deals) to $30 |

| Rock-Climbing Gyms | Approximately $24/visit |

Cost of Childcare and Education

The other expense you will need to account for if you have children, is the cost of education.

Since 2000, the cost of education has increased by 80.7%, and the average education inflation rate was 3% per year.

We break down the following costs according to the different levels of education below.

There are great differences in prices for the childcare centres – it depends on whether you choose a childcare centre under the anchor operator/partner operator or a premium childcare centre (e.g. Maple Bear/ Montessori centres).

Childcare

| Childcare Provider | Estimated Monthly Cost | Available Grants |

| Babysitter/Nanny | $2,000-$3,000 | NIL |

| Domestic Helper | $600-$1,000 | $60 monthly levy to the government |

| Full-Day Infant Care Centre | $1,250-$2,000 | Up to $600 |

| Full-Day Childcare Centre | $720-$4,000 | Up to $300 |

Local Government Schools

The fees below are extracted from the Ministry of Education.

Primary School Fees:

| Maximum Monthly Fee | |

| Singapore Citizen | $13 |

| Singapore PR | $218 |

| International student (ASEAN country) | $478 |

| International student (non-ASEAN) | $788 |

Secondary School Fees:

| Maximum Monthly Fee | |

| Singapore Citizen | $25 |

| Singapore PR | $400 |

| International student (ASEAN country) | $800 |

| International student (non-ASEAN) | $1470 |

International Schools

In the table below, we examine the fees per annum for 3 popular international schools in Singapore: The Singapore American School, Canadian International School and Australian International School.

The fees do not include enrollment, registration, facility fees and other possible expenditures (such as exam fees).

| School | Primary Education | Secondary Education |

| Singapore American School | $34,262 | $36,104 |

| Canadian International School | $36,500 | $40,700 |

| Australian International School | $36,403 | $42,195 |

Local Public Universities

There are 6 local public universities in Singapore:

- National University of Singapore (NUS)

- Nanyang Technological University (NTU)

- Singapore Management University (SMU)

- Singapore University of Technology and Design (SUTD)

- Singapore Institute of Technology (SIT)

- Singapore University of Social Sciences (SUSS)

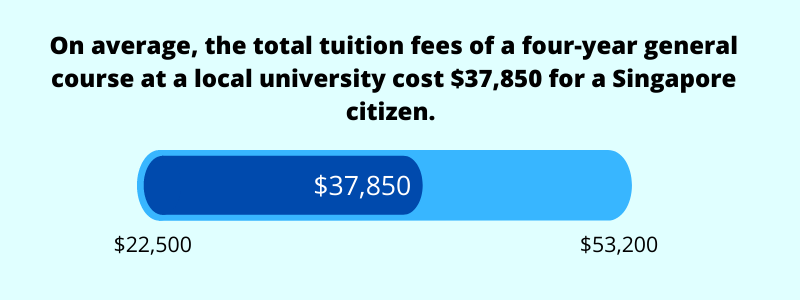

The total estimated fees quoted below are for a 4-year general course (after the MOE Tuition Grant):

| Public University | Singaporeans | PR | International Students | Non-Subsidised Students |

| NUS | $32,800 to $38,400 | $46,000 to $53,800 | $70,200 to $82,200 | $119,400 to $152,800 |

| NTU | $32,800 to $37,600 | $46,000 to $52,800 | $70,200 to $80,400 | $131,800 to $147,320 |

| SMU | $45,800 | $64,000 | $98,000 | $179,080 |

| SUTD | $53,200 | $75,000 | $114,800 | – |

| SIT | $22,500 to $36,960 | $47,160 to $70,800 | $63,558 to $96,300 | $96,878 to $145,606 |

| SUSS | $30,000 to $33,440 | $62,880 to $66,880 | $75,200 to $80,000 | $125,760 to $133,760 |

Other Costs

These are some other costs that you may want to consider:

Hiring a Domestic Helper

| Monthly Salary | $580-$1,000 |

| Government Levy (payable per month) | $60-$300 |

| Insurance | $350-$400/annum |

| Provision of their daily meals, accommodation etc. | Approximately $200-$400 |

Income Tax

All Singapore residents have to pay income tax. You have to pay $200 (if you only earned $30,000 for the entire year) to $36,550 (if you earned $280,000). You can refer to the IRAS Income Tax Rates for a better idea of how much income tax you are liable to pay.

Clothes

If you like to shop, clothes are another expense to consider. In Singapore, you can expect to pay between $30-$60 for a dress at a local Singapore brand. Alternatively, there are also options for you to loan wardrobes every month. Style Theory offers a subscription rate of $59/month.

Insurance

Last but not least, getting insurance is a must due to the high medical costs in Singapore. You do not want your savings to be entirely wiped out due to an unforeseen circumstance. This can set you back between $2,000-$5,000 a year (for a single adult) depending on what plans you purchase.

So, How Much Does It Cost to Live in Singapore?

After reading through the entire article, do you think it is expensive to live in Singapore?

For most Singaporeans, it is costly but made manageable thanks to the many government subsidies and grants available. It is possible to live on $1,300 per month.

However, as an expat, you will have to expect to pay premium rates to enjoy the high standard of living here in Singapore.

Here is a quick summary of the average monthly cost of living in Singapore (2021).

For a single adult

| Low-Range | Mid-Range | High-Range | |

| Accommodation (rental/owning property) | >$700 (rental rate for 1 room in HDB flat) | >$1,200 (for rental of a master bedroom near an MRT/ monthly repayment of mortgage loan for a 4-room HDB flat) | >$3,400 (for rental of a whole condominium apartment) |

| Transport | >$110 (for bus and train only) | >$450 (accounts for some trips via taxi or Grab) | >$1,500 (ownership of a car inclusive of the cost of petrol, insurance and maintenance) |

| Food | >$300 (3 meals a day) | >$550 (accounts for some meals at cafes and restaurants) | >$1,500 (meals are taken mostly at cafes and restaurants) |

| Mobile Plans | >$15 | >$30 | >$80 |

| Recreational Activities | >$120 (Netflix, movies, and some drinks) | >$330 (Netflix, more drinks, one gym membership) | >$1,300 (Netflix, even more drinks, gym, shopping, travel) |

| Total | $1,245 | $2,560 | $7,780 |

For married couples and families

| Low-Range | Mid-Range | High-Range | ||

| Insurance (with no medical complications) | Couple | >$250 (for a life plan that covers death and permanent disability, and hospitalisation plan) | >$650 (for a life plan, hospitalisation plan, accident plan, and critical illness plan) | >$1,000 (very comprehensive plans) |

| Family of 4 | >$340 | >$1,000 | >$2,000 | |

| Childcare Costs | Family of 4 | >$80 (childcare for 2 children with CHAS subsidies and working mother grant) | >$1,800 (full-day childcare at an EDCA registered centre, with working mother grant) | >$4,500 (full-day childcare for 1, nanny for the younger ones and a helper) |

| Total (inclusive of the individual costs tabulated above) | Couple | $2,740 | $5,770 | $16,560 |

| Family of 4 | $3,200 (taking into account that food is only cooked at home) | $7,920 | $22,060 |

Note: Figures on this page are, at best, estimates. We did not factor in the full range of expenses, and tabulated costs may include overlaps. Although we try to be as accurate as possible, do not take these figures seriously.