Education has always seen strong demand in Singapore, driven by parents wanting their children to get into top schools, whichever grade they’re in.

Getting into the best schools isn’t easy and requires good grades, so parents often enlist their children into private tuition and enrichment classes.

As a result, the cost of education has risen significantly over the years.

A university education, the last hurdle for most students, is the costliest of all types of education.

Today, we take a deep look into how much a university degree in Singapore can cost and the average cost of getting one.

Note: All prices are quoted in Singapore dollars (SGD).

In a Nutshell

The nationality of a university student will determine the subsidies (MOE Tuition Grant) they can receive. Singapore citizens receive the highest level of subsidies, followed by Singapore permanent residents, and then international students. A student who doesn’t wish to apply for or accept the MOE Tuition Grant will have to pay non-subsidised rates.

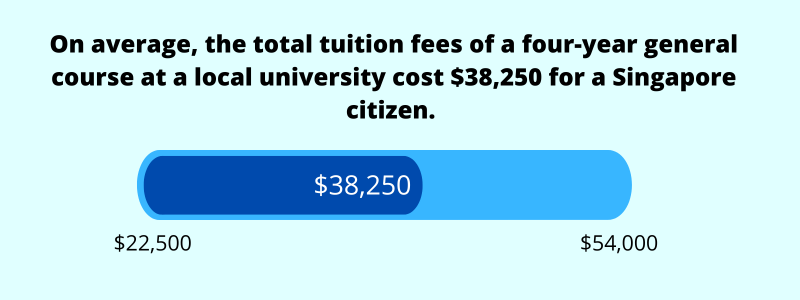

For a Singapore citizen, the total tuition fees of a four-year course at a local university cost between $22,500 to $54,000 (rough average of $38,250). In contrast, a student without subsidies will have to fork out between $121,324 to $182,400 (rough average of $151,862), which is 297% more than what a Singapore citizen pays.

In addition to tuition fees, the estimated cost of living for a student is $10,300 per year; hence, the total living expenses for four years amount to $41,200.

In summary, the total estimated cost of obtaining a university degree as a Singapore citizen is a rough average of $79,450, including the cost of living. This is in today’s value.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

An Overview of the Cost of Education in Singapore

Let’s look at some statistics.

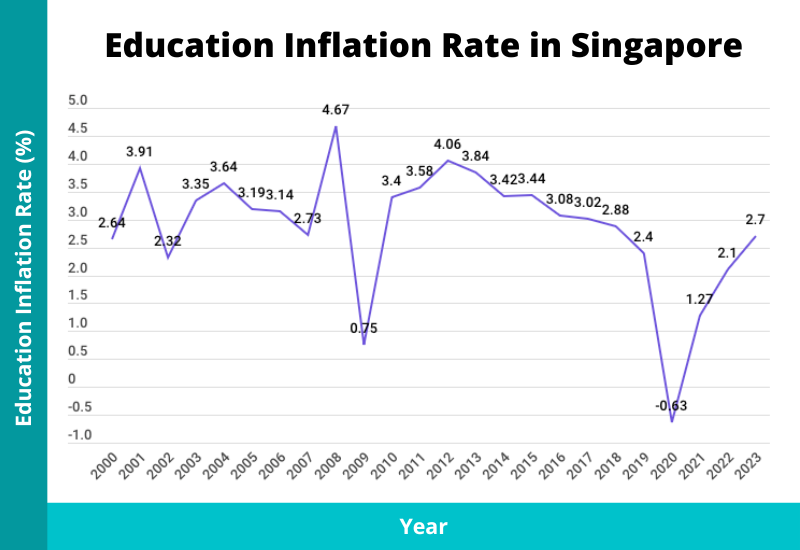

Due to increased demand, the cost of education has increased by 74.7% over the past 20 years, while the headline inflation only increased by 50.9%, suggesting that schooling is becoming more expensive at a faster pace than the general cost of living.

The annual education inflation rate has always been positive since 2000, except in 2020, when the local universities decided not to raise tuition fees.

We’ve also computed that the average annual education inflation rate from 2003 to 2023 was 2.83%. (Knowing this is handy to project the future cost of university fees.)

Over that same period, the average headline and core inflation rate was just 2.08% and 1.86%, respectively.

This could be why the majority (2 in 3) of respondents think that getting a degree is expensive, from a survey we conducted. However, a good number still believe it’s worth it.

University Fees Greatly Differ Between Singapore Citizens, PRs, and Foreigners

There are currently six autonomous universities in Singapore:

- National University of Singapore (NUS)

- Nanyang Technological University (NTU)

- Singapore Management University (SMU)

- Singapore University of Technology and Design (SUTD)

- Singapore Institute of Technology (SIT)

- Singapore University of Social Sciences (SUSS)

These autonomous universities are publicly funded but are given the flexibility to run their own operations and curriculum. Other common terms to describe these universities are “local universities” and “public universities”. Most Singaporeans would prefer to get a degree from a local university as it’s generally more “recognisable”. The two most well-known universities in Singapore are NUS and NTU.

The MOE Tuition Grant is provided by the government to subsidise tuition fees from these autonomous universities for eligible Singapore citizens, permanent residents (PRs), and international students. The grant is automatically applied for Singapore citizens, but Singapore PRs and international students must apply for it. The amount of subsidies will depend on the student’s nationality, with Singapore citizens receiving the largest subsidies, followed by Singapore PRs, and then international students.

Having said that, accepting the tuition grant does come with conditions. While Singapore citizens don’t need to serve a bond after graduating, PRs and international students must work for a Singapore entity for three years after graduation.

Those who don’t wish to apply or accept the tuition grant have to pay the non-subsidised fees.

As such, university tuition fees can be divided into four categories:

- Costs for Singapore citizens (subsidised)

- Costs for Singapore permanent residents (subsidised)

- Costs for international students (subsidised)

- Costs for non-subsidised students

For each of these categories, we’ll compare the fees of different courses from the six schools. We’ll then be able to derive the range of school fees and the average course fees.

Note: To be able to compare university course fees across the board and present our findings in a simple and meaningful way, we’re making a few assumptions. We’ve excluded the costlier courses such as medicine and law. Most degrees in Singapore take three to four years to complete, so in order to be prudent in our estimates, we assumed a four-year course duration when the total estimated course fees were not available. In tabulating the average course fee, we simply took the average of the lower and upper limits of the total estimated course fees.

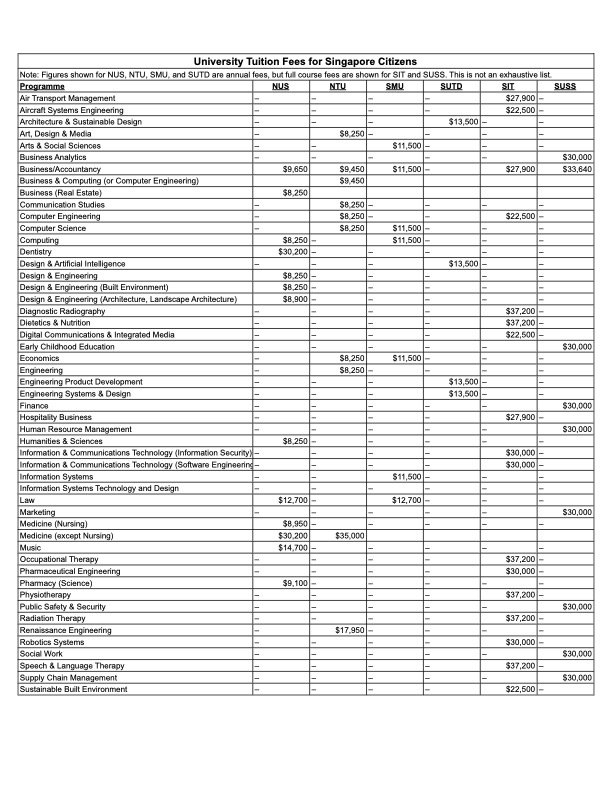

Cost of University Fees for Singapore Citizens (Subsidised)

Here’s a summary of the university course fees for Singapore citizens in 2023:

| School | Annual Course Fees | Total Estimated Course Fees | Average Course Fees |

| NUS | $8,250 to $9,650 | $33,000 to $38,600 | $35,800 |

| NTU | $8,250 to $9,450 | $33,000 to $37,800 | $35,400 |

| SMU | $11,500 | $46,000 | $46,000 |

| SUTD | $13,500 | $54,000 | $54,000 |

| SIT | – | $22,500 to $37,200 | $29,850 |

| SUSS | – | $30,000 to $33,640 | $31,820 |

| Overall | $8,250 to $13,500 | $22,500 to $54,000 | $38,250 |

For Singapore citizens, total tuition fees are between $22,500 to $54,000, an average of $38,250.

Only NUS and SMU offer law degrees, and the annual course fees for both schools are $12,700. Thus, a four-year law degree costs $50,800.

As for medicine, only NUS and NTU offer degrees in this area. NUS annual course fees are $30,200 ($151,000 for five years), while NTU costs $35,000 ($175,000 for five years).

Dentistry is offered only by NUS, costing the same as its medicine course, but the course duration is only for four years. The total course fees amount to $120,800.

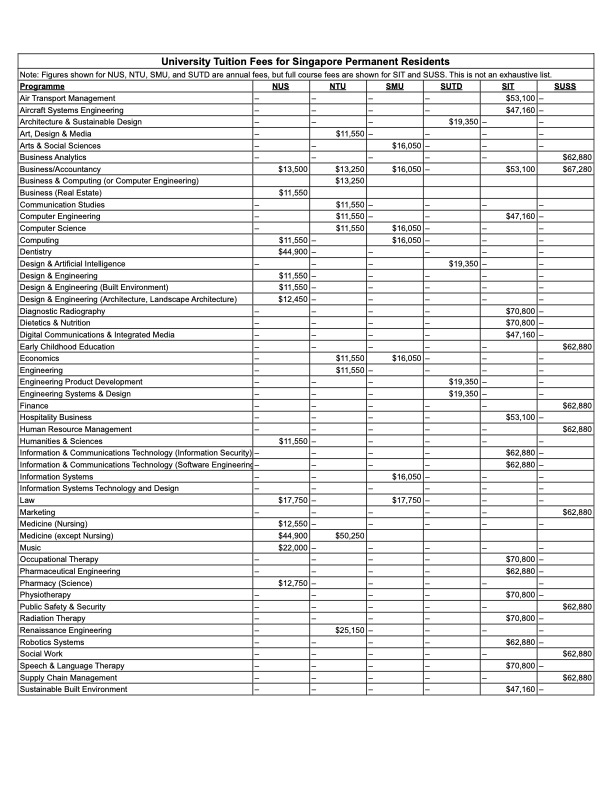

Cost of University Fees for Singapore Permanent Residents (Subsidised)

Here’s a summary of the university course fees for Singapore permanent residents in 2023:

| School | Annual Course Fees | Total Estimated Course Fees | Average Course Fees |

| NUS | $11,500 to $13,500 | $46,000 to $54,000 | $50,000 |

| NTU | $11,500 to $13,250 | $46,000 to $53,000 | $49,500 |

| SMU | $16,050 | $64,200 | $64,200 |

| SUTD | $19,350 | $77,400 | $77,400 |

| SIT | – | $47,160 to $70,800 | $58,980 |

| SUSS | – | $62,880 to $67,280 | $65,080 |

| Overall | $11,500 to $19,350 | $46,000 to $77,400 | $61,700 |

To complete a university education, a Singapore PR can expect to pay between $46,000 to $77,400, an average of $61,700, which is about 61.3% more than what a Singapore citizen pays.

A law degree costs $17,750 per year for both NUS and SMU, so a four-year course is $71,000.

The annual tuition fees for medicine are $44,900 at NUS ($224,500 for five years) and $50,250 at NTU ($251,250 for five years).

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

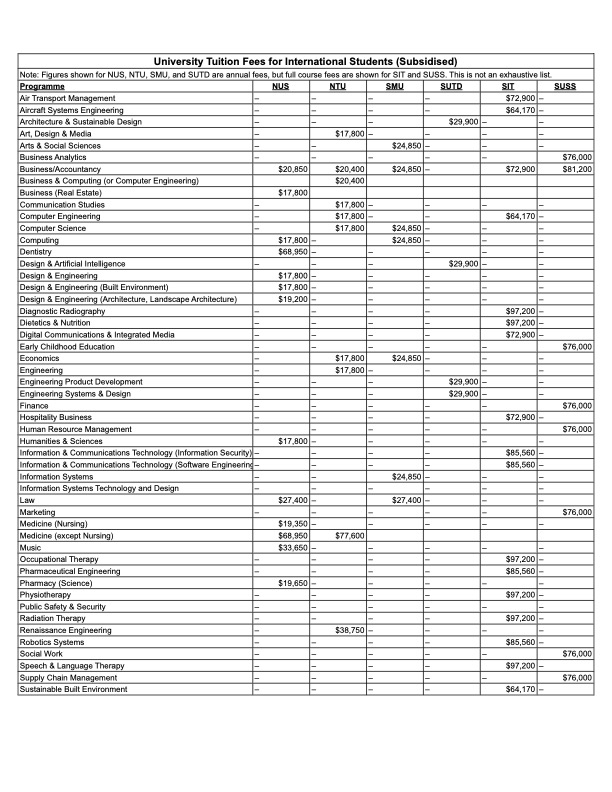

Cost of University Fees for International Students (Subsidised)

Here’s a summary of the university course fees for subsidised international students in 2023:

| School | Annual Course Fees | Total Estimated Course Fees | Average Course Fees |

| NUS | $17,800 to $20,850 | $71,200 to $83,400 | $77,300 |

| NTU | $17,800 to $20,400 | $71,200 to $81,600 | $76,400 |

| SMU | $24,850 | $99,400 | $99,400 |

| SUTD | $29,900 | $119,600 | $119,600 |

| SIT | – | $64,170 to $97,200 | $80,685 |

| SUSS | – | $76,000 to $81,200 | $78,600 |

| Overall | $17,800 to $29,900 | $71,200 to $119,600 | $95,400 |

The total estimated cost for a subsidised international student is between $71,200 to $119,600, an average of $95,400. This is 149.4% more than what a Singapore citizen has to pay.

A law degree costs $27,400 per year, with a total of $109,600 for four years.

A degree in medicine at NUS costs $68,950 per year – $344,750 for the full five years. And at NTU, the cost is $77,600 per year – $388,000 in total.

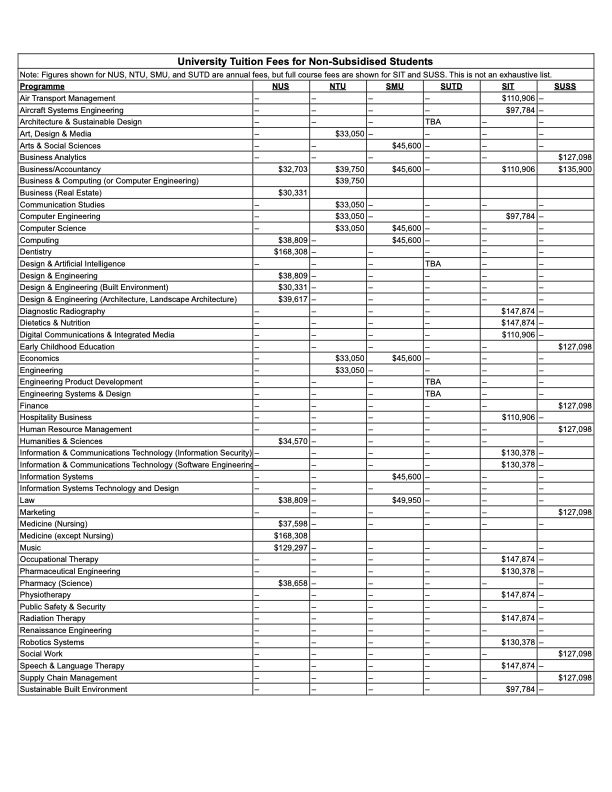

Cost of University Fees for Non-Subsidised Students

Here’s a summary of the university course fees for non-subsidised students in 2023:

| School | Annual Course Fees | Total Estimated Course Fees | Average Course Fees |

| NUS | $30,331 to $39,617 | $121,324 to $158,468 | $139,896 |

| NTU | $33,050 to $39,750 | $132,200 to $159,000 | $145,600 |

| SMU | $45,600 | $182,400 | $182,400 |

| SUTD | TBA | – | – |

| SIT | – | $97,784 to $147,874 | $122,829 |

| SUSS | – | $127,098 to $135,900 | $131,499 |

| Overall | $30,331 to $45,600 | $121,324 to $182,400 | $151,862 |

Non-subsidised students pay the highest course fees. They can expect to pay $121,324 to $182,400, an average of $151,862, which is 297% more than what a Singapore citizen pays.

A four-year law degree costs $153,636 at NUS and $199,800 at SMU, while a five-year medicine degree costs $841,540 at NUS.

School Fees of Private Institutions in Singapore

In general, most students would prefer to enrol into globally-ranked universities such as NUS and NTU.

However to meet the changing needs of consumers, private institutions such as PSB Academy, Singapore Institute of Management (SIM), and James Cook University are offering attractive study options too.

Top ranking overseas universities often partner with local private institutions to offer their bachelor’s and master’s degrees programmes.

As such, their prices may vary greatly. At times, they are as competitively priced as public universities even for those who do not qualify for the MOE Tuition Grant.

Course fees at private institutions can vary from below S$20,000 to S$50,000 for bachelor’s degrees programmes. Studying abroad will be an even more expensive option.

Other Costs on Top of Tuition Fees

Tuition fees are not the only costs you should be concerned about.

Other costs can be broken down into costs related to studying and the cost of living.

University-related costs:

- Application fees

- Miscellaneous fees

- Textbooks, laptop/tablet, study materials, etc

- Overseas exchange programmes

As for a student’s cost of living, here are some estimates:

| Items | Cost |

| Hostel accommodation (single/double occupancy) | $2,900 to $4,200 |

| Food | $3,000 |

| Personal expenses | $2,500 |

| Transport | $850 |

| Study materials | $400 |

| Total estimated costs excluding accommodation (annual) | $6,750 |

| Total estimated costs including accommodation (annual) | $10,300 |

The estimated annual cost of living for a student is $10,300, which is $41,200 for four years.

How to Save for Your Children’s University Education?

In summary, Singaporean students enjoy the greatest amount of subsidies and the average course fees are $38,250. If you want your child to study law or medicine, it’s going to cost a lot more. Moreover, you’d still have to factor in living expenses, which can amount to $41,200 for four years.

The total cost of a university education then becomes about $80,000 in today’s value.

The first step to save for your children’s education is to decide where you want to send them. Next, after finding how much it’ll cost, you’ll have to forecast future costs by factoring in inflation. You can simply use our education fund calculator.

From that calculation, you’ll be able to determine how much you should have when your child is ready to enter university.

Also, do check out various ways to help you fund your children’s education (e.g., a child education savings plan).

Do remember, before you start to save for your children’s education, ensure that you have the basic insurance policies in place.