Many parents of this era are great planners.

Apart from purchasing the basic insurance plans, many Singaporean parents also put their child on the waiting list for the best preschools, enrichment classes, and even design their own Montessori-styled education at home.

Likewise, these parents also begin to save for their child’s university education fund.

While your child may only begin their university education 20 years later, starting the planning now will help to ensure that there is enough to fund the entire university education.

Is Having a Degree Worth It?

Some parents may still have doubts about sending their child to university.

With the gig economy on the rise, a university degree may seem costly and irrelevant. A survey we conducted revealed that 2 in 3 adults in Singapore say a university education is expensive.

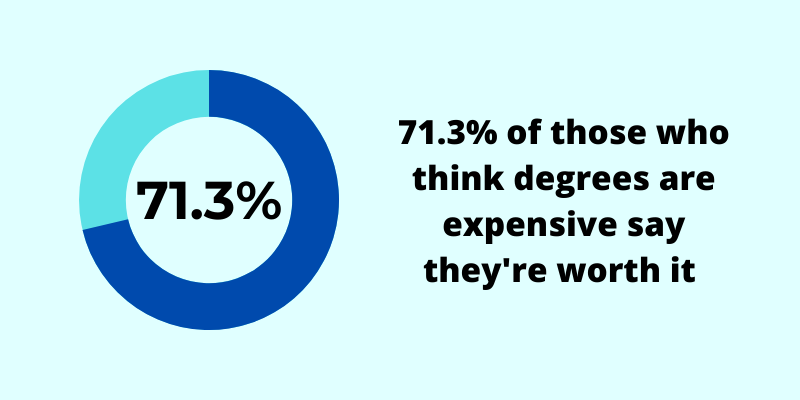

However, a good number of people still believe in the benefits of having a university education. 71.3% of those who say a university education is expensive believe it’s worth the high cost.

Apart from the fact that having a degree gives you an edge in job interviews, a university education also provides a person with stronger critical thinking skills, the ability to hold and evaluate different perspectives, and the chance to network with future entrepreneurs and leaders.

If you share the same beliefs and want to give your child the opportunity to obtain a degree, here are 5 steps to fund your child’s university education.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Step 0: Make Sure Your Foundation Is Strong

Before we can even begin to think about the fund, it is important that your foundation is strong. Otherwise, it is futile to even have a university education fund.

Your arsenal should include an emergency fund, adequate life insurance coverage, and a good hospitalisation plan to cover unexpected medical bills.

These should be in place before you start saving or investing, whether it is for education or retirement. Without these in place, all your savings will be wiped out should an unexpected unfortunate event occurs.

Step 1: Decide What Type of University Education to Provide

Although it might be difficult to ascertain what your child might be interested in reading at university, it is a good call to make a decision with your partner on what type of university education you would like to minimally provide for.

There is a huge difference in cost depending on these different factors:

- Local vs. overseas education

- A general degree vs. specialised degrees such as law, medicine, dentistry, etc.

Understanding the cost would then enable you to project how much you have to save in order to give your child a good start in pursuing the degree of his or her choice.

Step 2: Find Out the Cost of Tuition Fees and Living Expenses

Next, it is important to get the exact numbers in relation to tuition fees. In this article, I have tabulated the cost of university fees in Singapore.

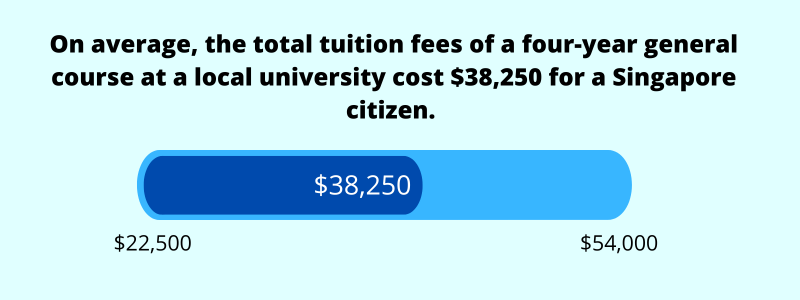

On average, university tuition fees for a 4-year general course at a local university can cost $38,250.

When you factor in living expenses, estimated at $41,200 for 4 years, the total cost of a university education amounts to $79,450.

For those who want to give your child a chance to study at a university overseas, I have also tabulated the cost of university fees in the USA, UK and Australia. Both articles provide a breakdown of the tuition fees in 2021, and the expected living expenses for the 3-4 years of university education.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Step 3: Project Future Costs by Factoring Inflation In

Unfortunately, it is highly unlikely that the tuition fees of today would remain the same or decrease in price.

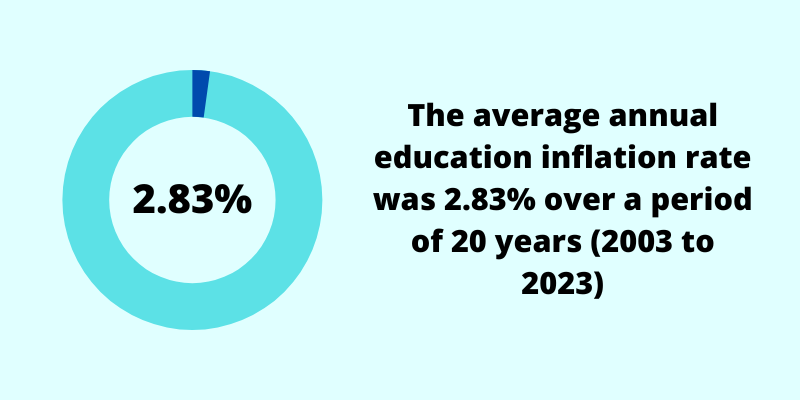

In fact, since 2003, the cost of education has risen by 74.7%, an average increase of 2.83% per year.

Likewise, the inflation rate for living expenses has also been on an upward trend. The average core inflation rate since 2003 was 1.86%.

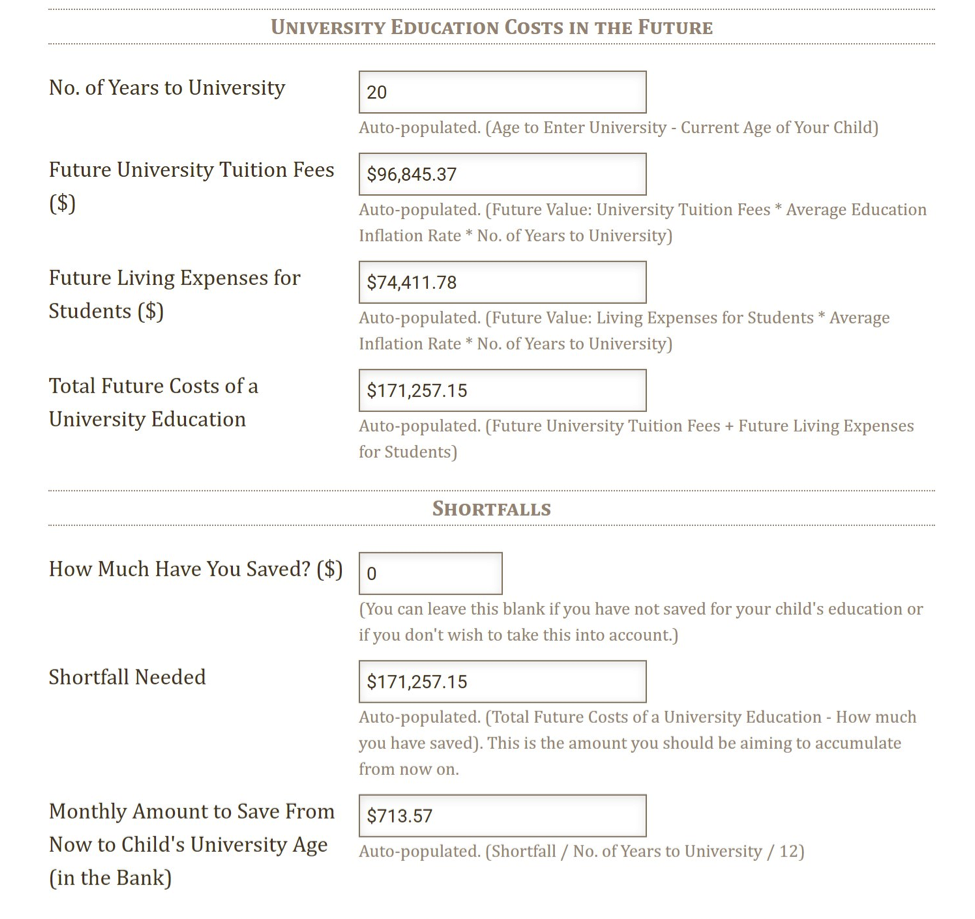

Thus, it is important to project future costs by factoring inflation in, to avoid a nasty surprise 20 years later that the fund you have been saving for is not enough to see your child through for the 3-4 years, and worse still, having to dip into your retirement fund to do so. To make it easy, I have developed a free education fund calculator for you.

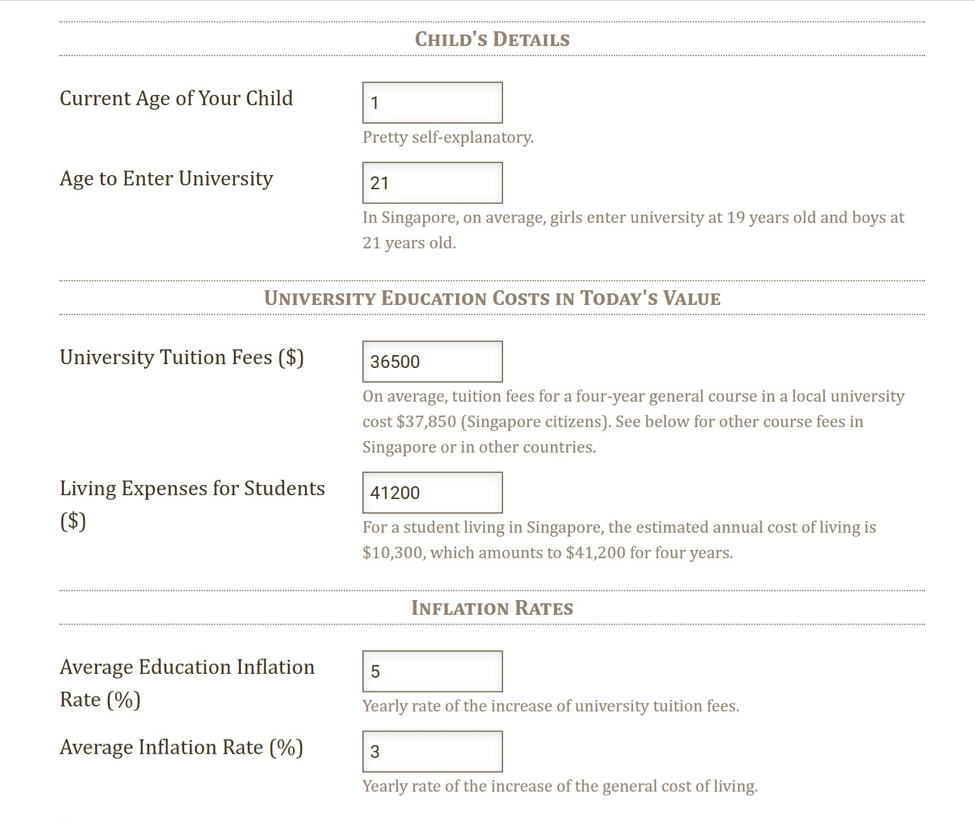

To illustrate, let’s consider that your child would want to pursue a degree which costs $36,500 (current value). Assuming that your child is currently 1 year old and male, to be able to fund the entire tuition fees and his living expenses for 4 years, you would need to save a total of $171,257.15 by his university entry age. To reach this amount, you’ll need to save $713.57/month.

Step 4: Weigh Your Options

Such a huge figure may be daunting to look at. It might also make you wonder whether you can afford your favourite daily luxuries like a cup of Starbucks coffee.

There are several ways that you can start saving for your child’s university education fund without having to give up some of your treasured daily luxuries. In this article, I explore the pros and cons of 6 methods of saving for a university education.

Among the 6 methods, an endowment plan meant for education could possibly provide a good balance of guarantees and having potentially higher returns. However, there are also some downsides you would need to be aware of. Given that every parent’s situation is very different and unique, it is important that you weigh your options, preferably with a financial advisor if you are unsure.

Step 5: Implement the Desired Solution

Gone through all the steps? It is important to execute the plan after having done all the work.

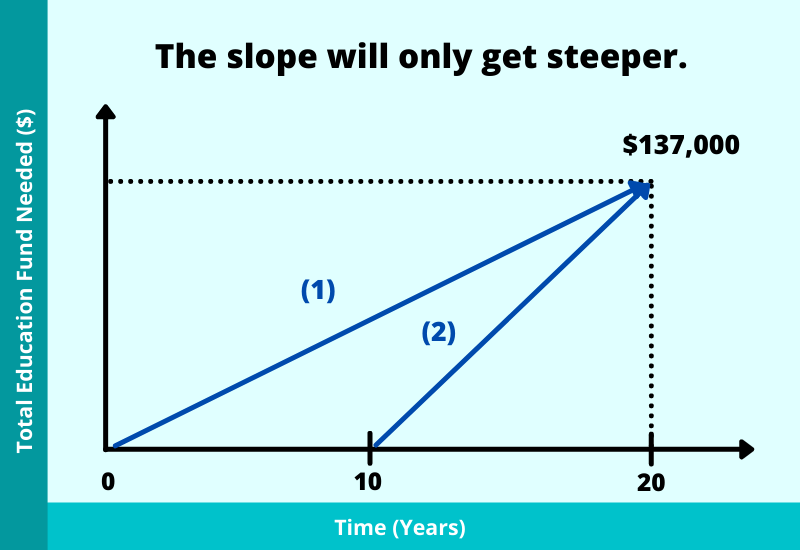

Saving now is the best thing you can do for yourself and your child. Delaying it will only get more difficult with time.

If you only begin 10 years later, the amount of money you need to put in every month will be significantly higher in order to reach the same amount you want to save for.

In fact, you might risk not being able to even fund the same amount projected as your expenditure is likely to increase with time too.

Wrapping Up

It is inevitable that the cost of university education is going to remain expensive, and might be even more costly in 20 years. Saving for your child’s future should start as early as possible.

If you are stuck at Step 0 – unsure about how strong your foundations are – or you’re lost as to how to build your child’s education fund, let us do the work for you.

We believe in holistic financial planning to suit your needs. We offer a free comprehensive financial planning session that will ensure a rigorous assessment of your financial health and pave the best way forward to achieve your financial goals.