By now, you must’ve heard about the Integrated Shield Plan (IP), which is also known as hospitalisation insurance or health/medical insurance.

It is, by far, one of the most important type of insurance to have in Singapore.

Do you really know what it is and how it works?

In this guide, you’ll find out everything.

So, read on!

This page is part of the Health Insurance 3-Part Series:

- Part 1: What is MediShield Life?

- Part 2: Integrated Shield Plans (you’re here)

- Part 3: Best Integrated Shield Plans?

In a Nutshell

Here’s a brief overview:

There are more details you’ll need to know. So, read on further.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

But First, What Is MediShield Life?

In Singapore, the cost of healthcare is getting expensive because of several reasons.

In fact, statistics from various sources show that the medical inflation rate was around 10% in 2019 and 2020.

And from our own national data, the average healthcare inflation rate was 2.21% over the past 20 years.

As a result, the average hospital bill has increased significantly.

If we zoom into cancer, the most common critical illness with a lifetime risk of 1 in every 4-5 Singaporeans, it poses a greater issue. The cost to treat late-stage cancer can reach $100,000 to $200,000 yearly.

These statistics show the importance of health insurance to protect against huge medical bills.

Fortunately, in Singapore, all citizens and permanent residents (PRs) are automatically covered under MediShield Life.

It is a basic medical insurance to cover mainly inpatient and outpatient treatments.

MediShield Life is one of the few national healthcare schemes out there. Its counterparts are ElderShield and CareShield Life, both of which provide long term care support in the form of monthly payouts if one were unable to perform three out of six basic activities of living (ADLs).

What Is an Integrated Shield Plan (IP)?

As MediShield Life is meant to provide for basic hospitalisation needs, it does come with limitations.

On its own, those who wish to have more comprehensive coverage are unable to do so. And that’s when the Integrated Shield Plan (IP) comes in.

It is a private health insurance plan that can be purchased on top of MediShield Life (integrated with it). This ultimately provides additional benefits and more options to cater to your specific needs.

Which Insurance Companies Provide Integrated Shield Plans?

Currently, there are only seven companies that offer shield plans:

- AIA

- AXA

- Great Eastern

- NTUC Income

- Prudential Assurance

- Raffles Health Insurance

- Singlife with Aviva

Take note that you can only be insured under one insurance provider.

Therefore, if you’re thinking of replacing or switching your existing IP, it can have a detrimental effect, especially when you have pre-existing conditions. Speak to a financial advisor first.

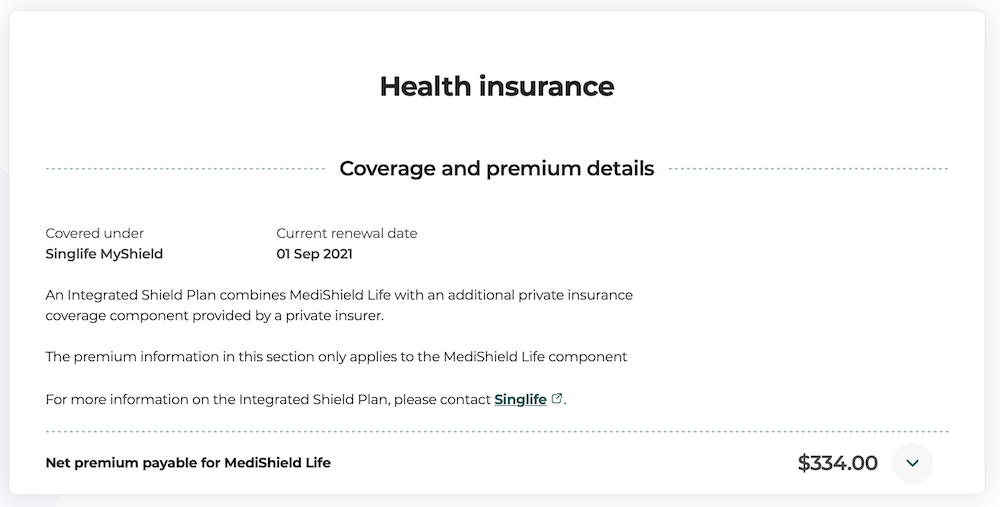

How to Check Whether You Have an Integrated Shield Plan

To check whether you’ve upgraded before, follow these steps:

- Go to https://www.cpf.gov.sg/

- Log in using your SingPass

- Hover to “my cpf”

- Select “Healthcare”

- Look at the “Health insurance” section

If you have an IP, you would see something like this:

Note: It doesn’t give any details on what plan you’re on or whether you have a rider attached. That information has to be gotten directly from the insurance company. Drop them a call or ask your advisor if you wish to know the details.

How Does the Integrated Shield Plan Work?

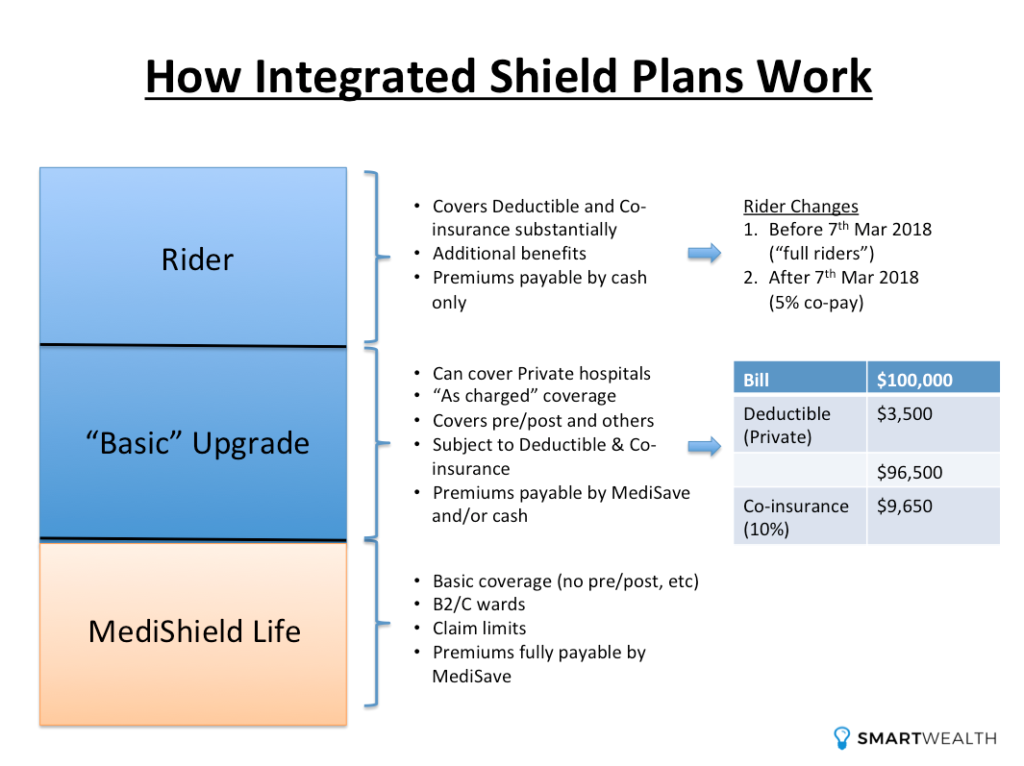

This is an overview of how both the MediShield Life and the Integrated Shield Plan work together:

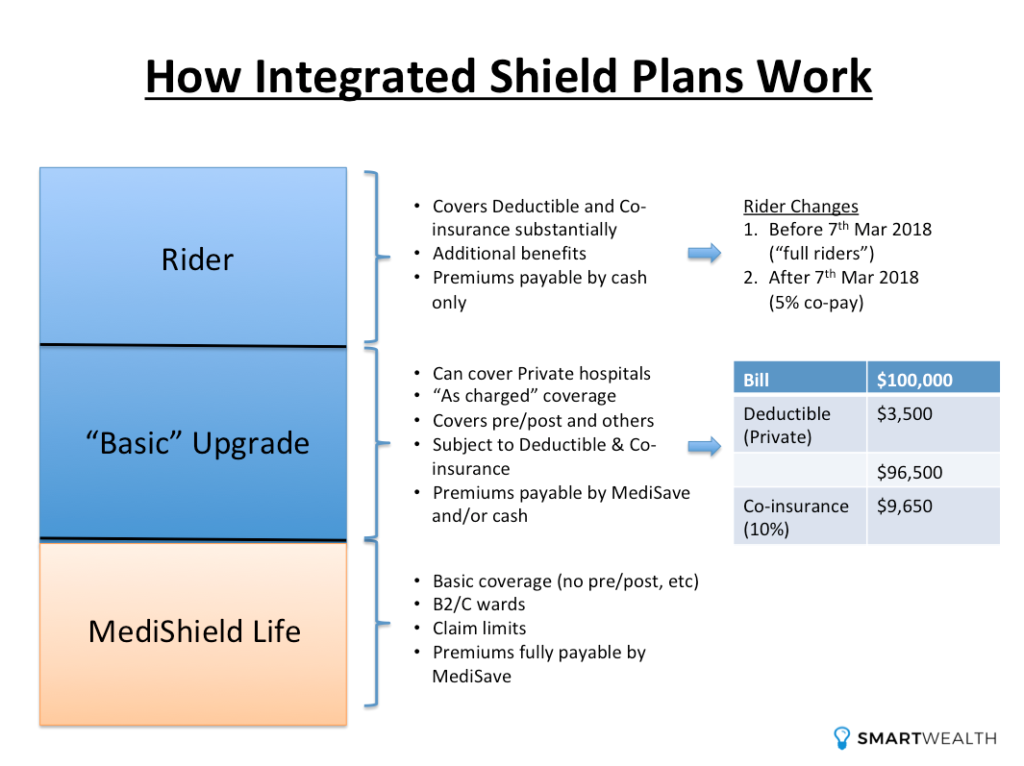

In an Integrated Shield Plan, there are 3 components:

- MediShield Life

- “Basic” Upgrade

- Rider

Note: The “basic” upgrade and the rider components form the Additional Private Insurance Coverage.

Much have been said on MediShield Life here, so I won’t go into the details again.

Here’s a short summary of it:

- It has claim limits

- Provides basic coverage with no pre/post hospitalisation coverage

- Pegged to B2/C class wards

- Premiums fully payable by MediSave

When you purchase an IP plan, the premiums for MediShield Life will be deducted by the insurer too.

Does it mean that there will be duplicate coverage or you’re paying double the premiums?

No.

It just means that the private insurance company handles that MediShield Life component for you, and they will act as the single point of contact.

Let me break down the other two components: the “basic” upgrade and the rider.

The “Basic” Upgrade of an Integrated Shield Plan

Here are some of the options you can upgrade your coverage to:

- Private

- Government A1

- B1

- Standard

So, let’s say you got covered for private hospitals and you choose to go to a government hospital, you’ll still be covered.

However, if you’re only covered for government hospitals and go to a private hospital, you’ll still need to fork out a substantial amount as only a small portion of the bill will be covered (pro-ration factor).

That’s why most people go for the private option, but in the end, it still depends on your needs and budget.

Furthermore, if in the future, you find the premiums too costly, you can always reduce your coverage to government hospitals and pay lower premiums.

There are no problems when you want to downgrade, however, if you’re covered for government hospitals and wish to upgrade in the future, a whole new round of health underwriting will take place again.

And if new medical conditions develop, there’s a possibility that you may not be able to enjoy the higher level of cover.

Main Benefits

1) Get your preferred type of ward

An upgrade allows you to choose what type of ward you want to be covered for. It’ll mean that you’re not limited to B2/C class wards, which are typically 5-9 bedders.

If you prefer the private space to recover, if the need arises, having that option to choose is valuable.

2) Higher claim limits

In MediShield Life, there is a cap to how much you can claim for inpatient and outpatient treatments, and you’ll need to fork out cash for the excess.

If you upgrade, the eligible treatments are usually “as charged” (still subject to deductible, co-insurance, and co-payment).

This provides you with the peace of mind that large bills will be greatly taken care of.

3) Pre and post hospital treatments

MediShield Life does not cover this aspect, but the IP does.

Pre-hospital treatments include certain consultations and diagnostic costs that were incurred before you were hospitalised and they must be related.

Post-hospital treatments include follow up treatments that are needed for you to recover.

The length of period for pre and post hospital treatments may vary from company to company.

Those are the three reasons why Singaporeans apply for IP plans, but there are other additional benefits too.

Premiums

Similarly to MediShield Life, the premiums increase with each age-band. However, the “basic” upgrade of an IP may not be fully payable by MediSave as there are withdrawal limits.

The premiums you’d pay for the “basic” upgrade are on top of what you’re paying for MediShield Life. The withdrawal limit only applies to the additional premium of the private insurance component, and does not include the premiums of MediShield Life. Note: MediShield Life premiums are fully payable by MediSave.

Here are the yearly Additional Withdraw Limits (AWL):

- $300 if your age next birthday is 40 years old or younger

- $600 if your age next birthday is 41 to 70 years old

- $900 if your age next birthday is 71 years or older

EXAMPLE

If you’re 35 years old and the premium for the “basic” upgrade component is $350, you can pay $300 from MediSave and the remainder of $50 will be in cash. If the premium is $250, then it can be fully payable by MediSave.

But in IP plans, there’s still something called the deductible and co-insurance.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Deductible and Co-insurance Apply

What is a Deductible?

The deductible is an amount that you’d need to pay first before the insurance kicks in.

This amount depends on which type of ward you stay in. The purpose of this is to filter out smaller claims to make the overall premiums of the plan affordable.

Here are the deductibles (for age 80 years and below next birthday):

- Class C ward: $1,500

- Class B2/B2+ ward: $2,000

- Class B1 ward: $2,500

- Class A ward: $3,500

- Private: $3,500

What is Co-insurance?

Co-insurance is a percentage of the of claimable amount. You’ll need to pay the co-insurance on top of the deductible. The co-insurance is at 10% for IPs.

Illustration:

| Bill | $100,000 |

| Deductible (Private Ward) | $3,500 |

| $96,500 | |

| Co-insurance (10%) | $9,650 |

So with a “basic” upgrade, you’ll still need to fork out $13,150 ($3,500+$9,650) out of a bill of $100,000. The rest of the amount, $86,850, can be claimed.

The deductible and co-insurance can still be a big amount to pay out-of-pocket, and that’s when the rider component comes in.

The Rider of an Integrated Shield Plan

The rider allows you to get the most comprehensive medical insurance coverage available.

You must have the “basic” upgrade to be able to add on the rider. And both must come from the same insurance company.

Main Benefits

The main reason why most people add on a rider is because they want to reduce out-of-pocket expenses (caused by the deductible and co-insurance).

The secondary reason is that having the rider gives even more benefits.

The Old “Full” Rider

(You can skip this section if you have yet to upgrade or if you’re not interested in the past.)

If you’ve applied for an IP plan with a “full” rider in the past (before 8 March 2018), it would’ve meant that you’re able to cover the full bill, including the deductible and co-insurance, thus eliminating out-of-pocket expenses.

However, because o that, there were two implications, over-consumption and over-charging.

One was able to claim for anything and for the full amount, leading to more claims and bigger claim sizes. At the same time, hospitals may over-charge knowing that the patient is under a “full” rider.

This led to a drastic increase in healthcare costs. Insurance companies had to pay out more and it became unsustainable. That’s why insurance companies made many revisions, usually upwards, to their premiums over the years.

IF YOU REALISED BY NOW

The premiums of IP plans which cover private hospitals and with the “full” rider, have been substantially increased till the point that it may not be feasible to stay on that level of coverage now. Several “value” options may be available. But you should speak to a financial advisor first.

That’s when the industry-wide change came in.

The New Rider (With 5% Co-Payment)

Because of the recent industry changes, the old “full” riders are not available anymore.

As for those who purchased the old riders from 8 March 2018 up to 31 March 2019, they will be transited to the new riders from 1 Apr 2021.

These new riders can still substantially cover the deductible but you’ll need to co-pay 5% of the bill. Most insurers have the co-payment capped at $3,000/year (terms and conditions apply).

Generally, to fulfil these conditions, you’ll need to obtain pre-approvals/authorisation, and preferably select specialists from the insurance company’s panel. The exact conditions differ from company to company.

The new riders still make a lot of sense because they protect you from needing to pay for larger out-of-pocket expenses, and their premiums are relatively cheaper than the old riders.

Premiums

Premiums for the riders are only payable using cash. Likewise, they increase with each age-band.

Can Foreigners Purchase These Shield Plans?

There may be only two options available if you wish to get private medical insurance as a foreigner.

International health insurance and local health insurance.

The advantages with international health insurance are that you’re covered for other countries. However, the premiums that you’ll need to pay tend to be much higher. In comparison to a local health insurance, like the IP, the premiums are affordable but the coverage is meant to be in Singapore.

If you’re a citizen or a permanent resident, you’re able to get an IP for your dependants if they have valid passes in Singapore.

You may also use your own MediSave to pay for such plans.

There may be slight administrative differences, but the core benefits still stay the same.

Company/Group Insurance vs Private Medical Plan

The question that’s asked the most: “what if I’m covered under company/group insurance?”

There are a few things to take note.

Firstly:

Can you foresee being with that company forever?

If you get your own private medical plan, you’ll be covered no matter what happens, whether you fire your employer or your employer fires you. That also means that along the way, if minor medical conditions pop up, you can still be covered under your private plan.

The opposite is not the same.

If you’re just under the company insurance and medical conditions happen along the way, you may not get accepted into a private medical plan when you apply for it in the future.

Secondly:

Some medical benefits from the company insurance may not be sufficient and usually, they have a cap. If your bill goes above that amount, you have to pay for the excess, however large that may be. Furthermore, the medical benefits may not be comprehensive.

Lastly:

You don’t own the policy, the company does. Whatever they want to do with it depends on them.

With a private plan, you own the policy. And with that, comes greater flexibility.

Protection Against Large Hospital Bills Only Solves 50% of the Problem

Eliminating the risk of paying for big hospital bills is one of the most fundamental aspects of financial planning. Reason being, the hospital is the first place you’ll be at if an injury or illness were to happen.

But a hospital plan only covers half of the problem.

What if you’re back home and still unable to work because of a permanent disability or a critical illness?

Who’s going to pay for the daily expenses, commitments, and future goals, if you’re not able to earn an income anymore.

That’s why it’s equally important to have life insurance coverage, via term insurance or whole life insurance, to protect your income.

Do you think you have enough coverage for death, total and permanent disability, and critical illness? Check out our life insurance coverage calculator now.

Finding the Best Integrated Shield Plan in Singapore

Hospitalisation and medical costs are expensive in Singapore. And they’re getting higher every year.

Would you be able to cope financially if something adverse were to happen?

Sure, there is MediShield Life to aid, but is it enough for you? What if you want a better and more extensive cover for your medical needs?

An integrated shield plan paired with a rider will give you the greatest peace of mind.

Get a comparison to find the best integrated shield plans in Singapore now.