Of all the critical illnesses in Singapore, cancer is the most important to pay attention to.

Not only does it cause the highest number of deaths in a year, but the costs of treating it can also be astronomically high.

Furthermore, with the recent introduction of the Cancer Drug List (CDL) affecting MediShield Life and Integrated Shield Plans, one who requires a drug not on the list may not be able to claim it and have to pay for it out-of-pocket.

In this article, we’ll cover:

- Factors that influence the costs of cancer treatment

- The different types of treatment available and the estimated costs associated with them

- How to finance the cost of cancer treatment

- … and more

So, read on!

In Summary

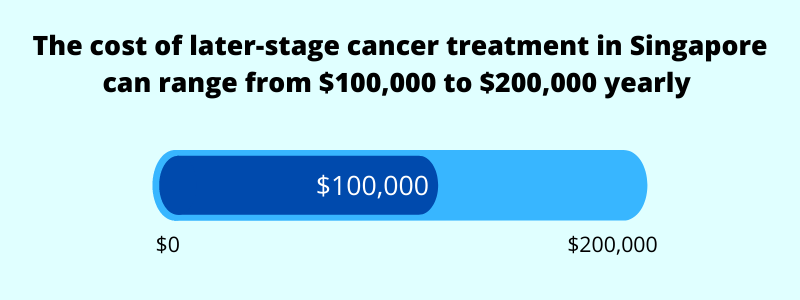

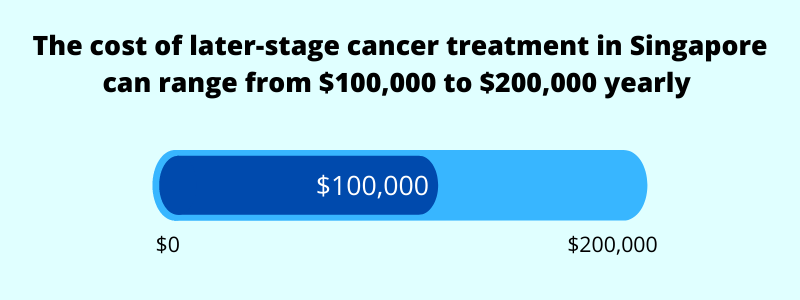

Late-stage cancer treatment in Singapore can cost $100,000 to $200,000 a year (or $8,400 to $16,700 a month)

But there’s more to it, so read on further.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Why Is Cancer a Big Issue in Singapore?

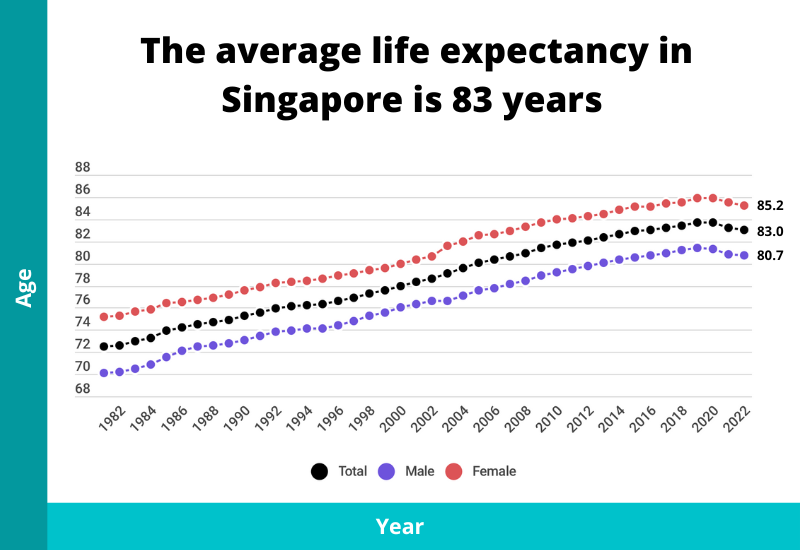

While Singaporeans enjoy a high average life expectancy (currently at 83 years) compared with other countries, that comes with downsides.

Firstly, Singaporeans spend more years in ill health now – 10.6 years to be exact.

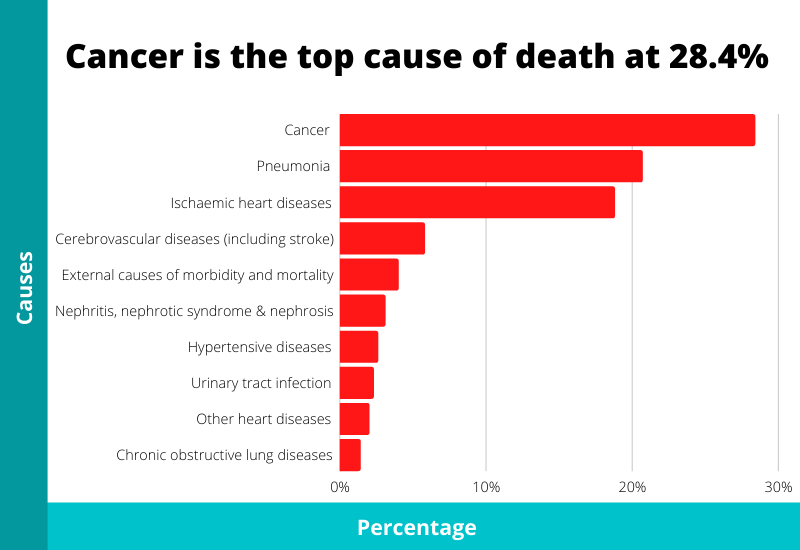

Secondly, cancer contributes to 28.4% of all deaths, and it is the leading cause of death in Singapore.

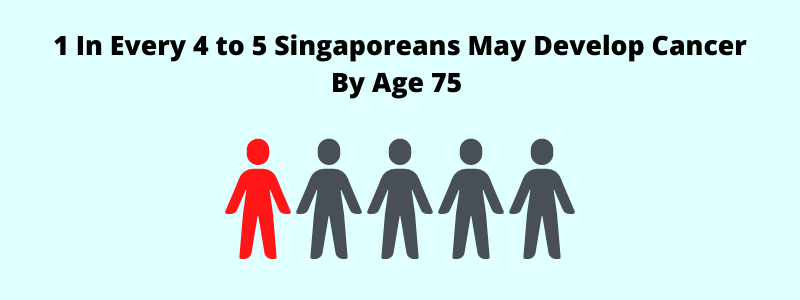

And lastly, the lifetime risk of developing cancer in Singapore’s population is estimated to be one in every four to five people.

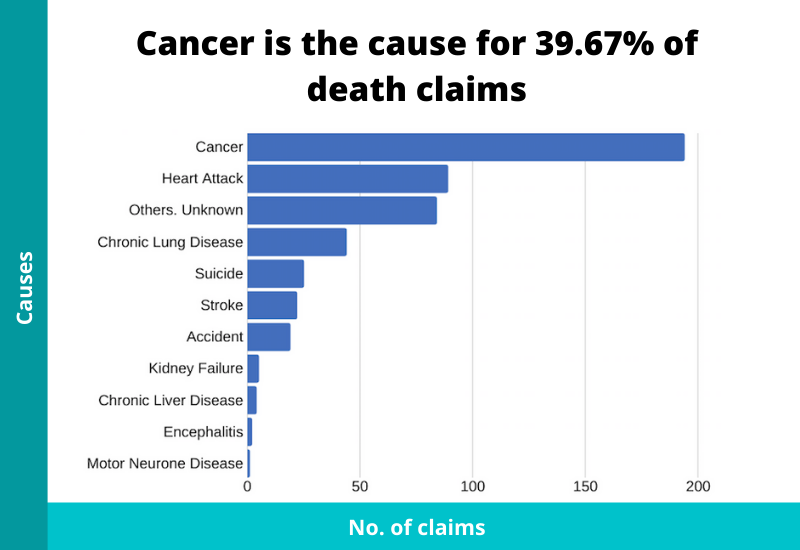

When we look at statistics on life insurance claims, cancer is the top cause of death claims (accounting for 39.67% of all death claims).

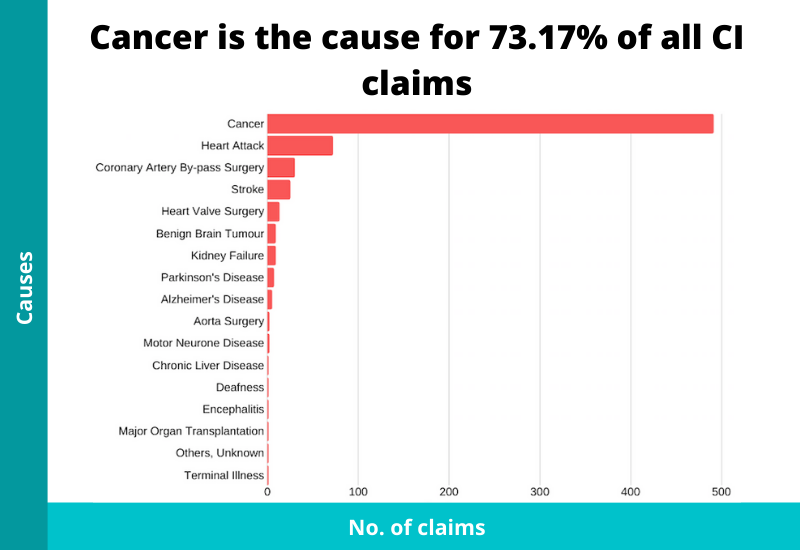

And it accounts for 73.13% of all critical illness claims.

With all of these facts and statistics, how can one ignore the topic of cancer?

Other than the health concerns, the financial impact of developing cancer will be heavy.

There are 2 types of costs: the cost of treating cancer and the cost of not being able to work because of it.

We’ll address both of them.

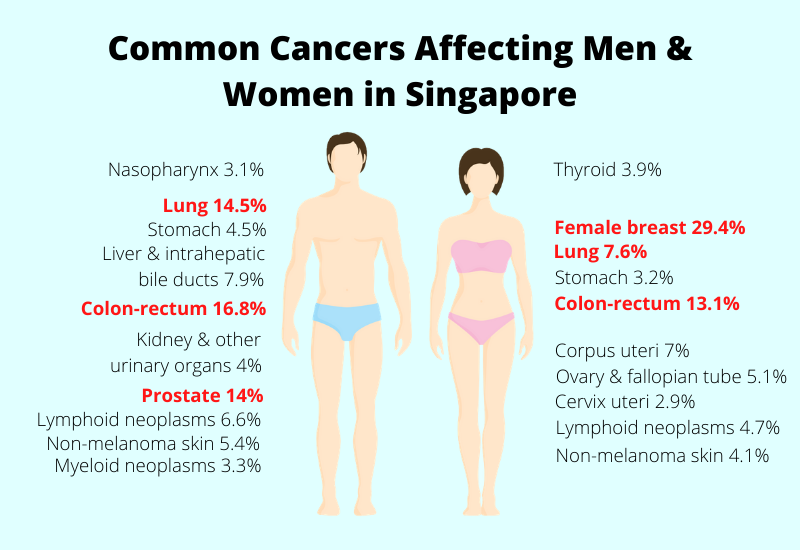

The 4 Most Common Cancers in Singapore

Before we move on to the costs, let’s just narrow our focus down to the more common cancers in Singapore.

Here are the top 10 cancers for men:

| Type of Cancer | Percentage |

| Colo-rectum | 16.8% |

| Lung | 14.5% |

| Prostate | 14% |

| Liver & intrahepatic bile ducts | 7.9% |

| Lymphoid Neoplasms | 6.6% |

| Non-melanoma skin | 5.4% |

| Stomach | 4.5% |

| Kidney & other urinary organs | 4.0% |

| Myeloid Neoplasms | 3.3% |

| Nasopharynx | 3.1% |

And here are the top 10 cancers for women:

| Type of Cancer | Percentage |

| Breast | 29.4% |

| Colo-rectum | 13.1% |

| Lung | 7.6% |

| Corpus uteri | 7.0% |

| Ovary & fallopian tube | 5.1% |

| Lymphoid Neoplasms | 4.7% |

| Non-melanoma skin | 4.1% |

| Thyroid | 3.9% |

| Stomach | 3.2% |

| Cervix uteri | 2.9% |

From this data, here are the top 4 cancers in Singapore:

- Colo-rectum

- Breast

- Prostate

- Lung

Factors that Influence the Cost of Cancer Treatments

In general, medical costs are increasing at a much faster pace than overall goods and services, which is why we experience higher hospital bills.

But let’s just talk about cancer for now.

Most of us believe that cancer treatments are expensive due to how intensive they can be and the lengthy duration for a full recovery. Not only that, complications can arise along the way as relapses do happen and conditions can get worse.

But not all cancers are the same.

Here are some factors that will influence the costs of treating cancer:

1) The Stage of Cancer

Generally, at diagnosis, the later the stage of cancer the patient is in, the higher the costs for treating it.

At an advanced stage, a more aggressive approach might be needed, thus requiring more intensive treatments. Such treatments might be unconventional and they incur more costs.

2) Potential for Complications

There are many types of cancer.

If cancer resides at or near a vital organ, the complexity of treating or remove it increases.

And if complications arise, the patient’s condition might be severely weakened, leading to greater care and support needed.

3) Preferred Hospitals and Wards

“I want the best.”

When it comes to our health and survival, we want the best (if possible). The thought of death is scary not just for ourselves but for our family members too.

It is common for Singaporeans to search for the best oncologists.

But the price of treatment from a private hospital can be hard to digest.

There are still other costs (which can be more costly) than just the inpatient charges.

4) Type of Treatments Needed

Depending on the patient’s condition, there is a multitude of available treatments.

A combination of a few may be needed.

It should be known that the earlier you detect cancer, the greater the probability of reducing/eliminating the damages, and that means fewer treatments are needed.

In the later stages, more solutions will need to be administered.

Needless to say, the longer the duration of the treatments, the higher the costs.

The Different Types of Costs in Cancer Treatments

There are various ways to treat cancer and they can be split into two sections: Diagnosis and Treatment.

1) Cost of Diagnostic Tests & Screenings

With regards to cancer, if we wait for symptoms to appear, it might already be too late.

Detection takes more than just checking for lumps.

That’s why it’s good to go for regular screenings and check-ups because earlier detection (and treatment) leads to better outcomes.

Examples of such diagnostic tests:

- Blood tests

- Health screenings

- MRI scans

- CT scans

- PET-CT scans

- Colonoscopies

- Mammograms

- Biopsies

- etc

A concoction of various tests might be needed to detect and diagnose properly.

NOTE

Even after treatments are done, you might still need to do these tests regularly to check for cancerous cells

In most cases, imaging tests will come first. These are the CT, MRI, PET-CT scans, etc. They are done first because they are less intrusive ways to detect cancer.

At Singapore General Hospital (SGH), a PET-CT scan costs $2,400.

If imaging tests aren’t enough, a biopsy might be needed. A biopsy is done to extract a sample of tissue from the affected area. The tissue will then go through further analysis to determine whether it’s cancerous or not.

It can be done as a day surgery or as an inpatient, depending on how invasive it is to get the sample.

Here are some of the average costs of biopsies:

| Type of Cancer | Type of Hospital | Average Bill Size |

| Breast | Private | $5,378 |

| Public (Unsubsidised) | $2,052 | |

| Public (Subsidised) | $658 | |

| Lung | Private | $5,479 |

| Public (Unsubsidised) | $2,347 | |

| Public (Subsidised) | $689 | |

| Colorectal | Private | $2,936 |

| Public (Unsubsidised) | $1,620 | |

| Public (Subsidised) | $673 | |

| Prostate | Private | $3,970 |

| Public (Unsubsidised) | $1,695 | |

| Public (Subsidised) | $539 |

2) Cost of Surgeries

Once the cancer is properly diagnosed, the patient might be recommended to go for surgery.

Cancer surgery is the oldest and most effective type of treatment.

It is an operation to cut open the body and remove the cancer and/or healthy tissues surrounding it (to ensure all the cancer is removed).

For example in breast cancers, a surgeon might remove a portion of the breast or the whole breast.

How the surgery is performed can also affect the cost, whether it’s an open surgery or a minimally invasive one.

Surgeries can also be paired with other treatments such as chemotherapy or radiation therapy.

Here are some of the average costs of surgeries by cancer type:

| Type of Cancer | Type of Hospital | Average Bill Size |

| Breast | Private | $25,231 |

| Public (Unsubsidised) | $11,411 | |

| Public (Subsidised) | $2,585 | |

| Lung | Private | $28,108 |

| Public (Unsubsidised) | $8,832 | |

| Public (Subsidised) | $3,194 | |

| Colorectal | Private | $43,708 |

| Public (Unsubsidised) | $23,693 | |

| Public (Subsidised) | $6,059 | |

| Prostate | Private | $58,355 |

| Public (Unsubsidised) | $27,495 | |

| Public (Subsidised) | $9,400 |

3) Cost of Chemotherapy

Chemotherapy is the use of drugs (infusion into a vein, taking a pill, etc) to kill cancer cells. It can also be used to control the spreading of cancer, shrink a tumour, or ease pain.

There are different types of chemotherapy and a patient might need a combination to treat it.

Chemotherapy affects the whole body and that’s why cancer patients usually feel weak. It can also cause side effects such as hair loss or other severe complications.

The costs of chemotherapy depend on the type of drugs needed and how often they’ll be administered.

For example, it can be a monthly cycle for a schedule of a few months.

Here are some of the average costs of chemotherapy:

| Type of Hospital | Average Bill Size |

| Private | $8,318 |

| Public (Unsubsidised) | $2,859 |

| Public (Subsidised) | $1,142 |

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

4) Cost of Radiotherapy

Radiotherapy or radiation therapy uses high doses of radiation to kill cancer cells.

Usually, it involves beams of high energy directed to the affected area so it doesn’t affect the whole body, unlike chemotherapy.

The radiation damages the DNA of the cancer cells causing them to die. The results might not be immediate and it could take weeks after the treatment is done.

Although it seems like a great way to treat cancer, there’s a lifetime limit to how much radiation that targeted area can take.

The cost of radiotherapy is expensive and can cost $25,000 to $30,000.

5) Cost of Other Treatments

Surgeries, chemotherapy and radiation therapy are the most common methods to treat cancer.

But collectively, they may not be enough for certain patients.

So there may be a time when other treatments are recommended.

Examples of other treatments:

- Immunotherapy

- Hormonal therapy

- Laser therapy

- Stem cell transplant

- Blood product donation and transplant

- Photodynamic Therapy

- etc

Let’s take a closer look at immunotherapy.

Immunotherapy is a type of biological therapy which uses substances made from living organisms to treat cancer.

It makes use of the body’s immune system to fight cancer.

Like other cancer treatments, it comes at a high cost and can range from $7,000 to $15,000 every 3 weeks.

An extended period of treatment will cause major issues with the bank account.

The Average Cost of Treating Cancer in Singapore

As you can see, a lot of variables come into play when treating cancer.

It’s difficult to just put one number as an average.

However, Seedly has worked with the Singapore Cancer Society to get insights into the costs.

The cost of treatment for later-stage cancer in Singapore can easily range from $100,000 to $200,000 yearly (or $8,400 to $16,700 monthly).

How to Finance the Costs

After knowing the costs that are involved in diagnosing and treating cancer, what are your financing options?

As mentioned earlier, there are 2 types of costs: the cost of treatment and the cost of not being able to work.

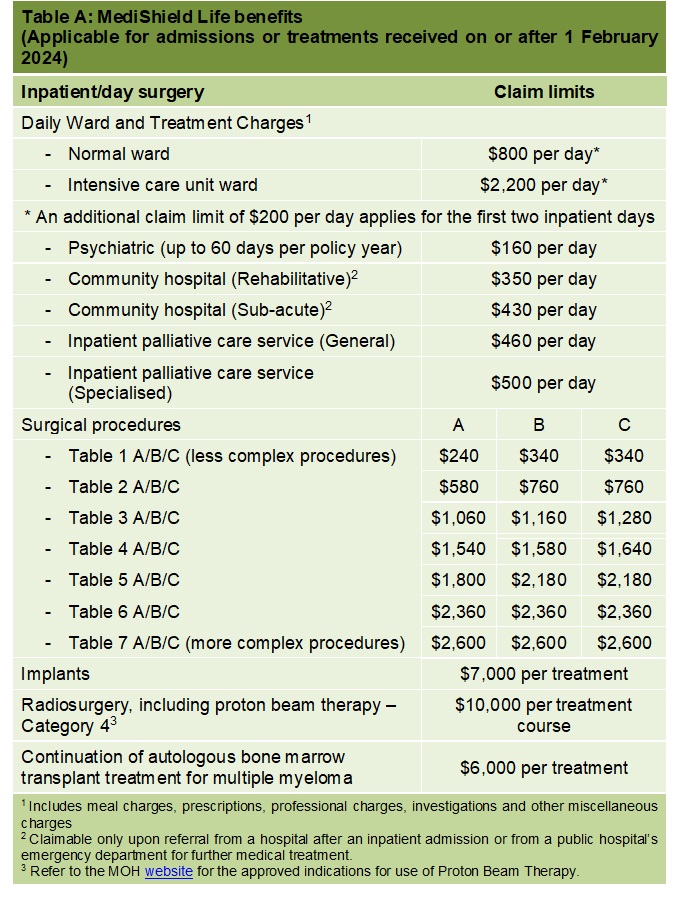

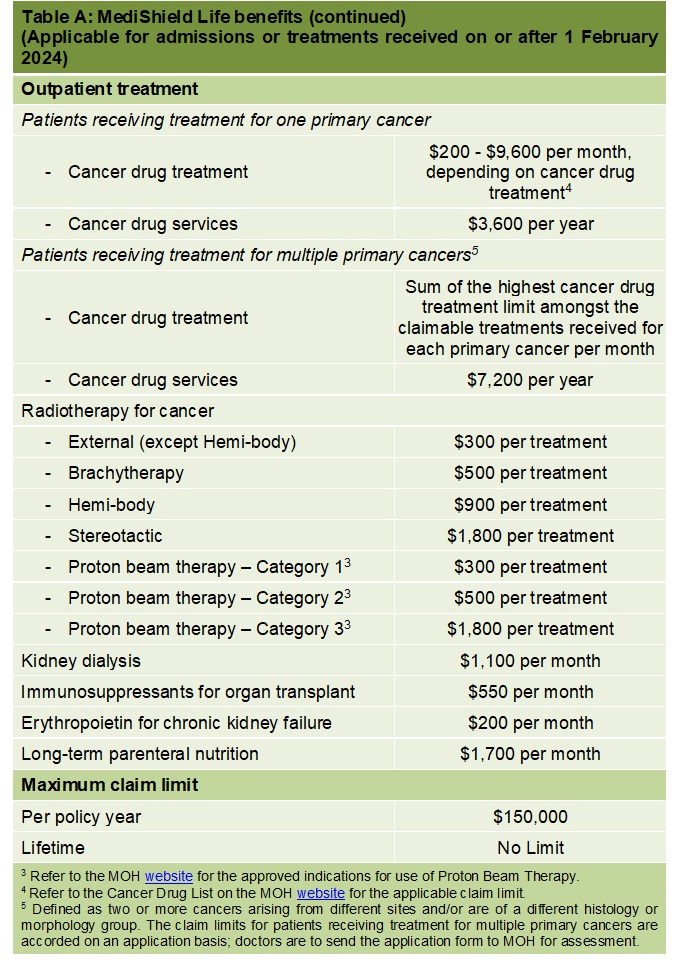

1) MediShield Life

If you’re a Singapore Citizen or Permanent Resident, you may be asking, “Does MediShield cover cancer treatments?”

And the answer is yes, up to the claim limits. MediShield Life only provides very basic protection.

The benefits are usually geared towards Government B2/C wards.

So if you intend to go to a Government A or a private ward, you’ll need to pay much more.

Here are some benefits of MediShield Life:

Even after you’ve hit the claim limits, you may still use your MediSave balance to pay part of the bill, but that still has its limits.

2) Integrated Shield Plan

An upgrade to MediShield Life is the Integrated Shield Plan (IP) offered by insurance companies.

Private medical insurance helps to provide added protection and the ability to cover private wards.

You can also add on a rider to substantially cover for deductibles and co-insurance, which will reduce out-of-pocket expenses.

Best of all, you’re able to use your MediSave balance to finance a portion of the premium and the rest will be in cash.

There are also benefits that the IPs have that MediShield Life doesn’t have, such as coverage for pre and post-hospitalisation costs.

NOTE

If you have pre-existing conditions, it may be hard to get coverage. That’s why if you’re healthy, that’s the best time to get covered.

3) Government & Other Financial Assistance

1. MediFund

If a patient is unable to pay for the medical bills even after MediShield Life claims and using MediSave, he/she can seek financial help from MediFund.

MediFund is an endowment set up by the Government to assist patients who have difficulties with their remaining hospital bills.

2. Medication Assistance Fund

In the Medication Assistance Fund, eligible Singaporeans can receive further subsidies for expensive drugs that are not on the Standard Drug List but have been accessed to medically require them.

3. Other Organisations

There are charities out there such as the Singapore Cancer Society which help patients even further. You can consider donating to help the less fortunate.

4) Life Insurance

The previous 3 points deal with the cost of paying for cancer treatments.

But there’s also another cost which is the inability to work to earn an income.

Even if you’re covered for the hospitalisation costs, what about the other daily expenses, commitments, and future goals? They can’t just stop, and life still has to go on for you and your family.

Is your family able to cope with a higher financial responsibility if you can’t contribute to the household income?

And, not all medical costs are covered by such health insurance. There are still other items including alternative treatments that are excluded.

That’s when another form of insurance, namely life insurance with critical illness coverage, comes in. It provides a lump sum payout if death, total and permanent disability or critical illness were to happen.

This payout can be then used to pay for ongoing expenses and other commitments.

Most term insurance and whole life insurance allow you to attach a rider to cover critical illness. Some plans can cover all stages of a critical illness (early, intermediate, and late).

And if you just want to cover critical illness, there are standalone early critical illness plans out there.

Wrapping Up

So there you have it.

Hopefully, you’ve gained some insights into the different types of cancer treatments and their costs in Singapore.

The financial resources needed to treat cancer and being out of work run very high.

If you’re worried about the costs of medical expenses, learn more about MediShield Life and the various Integrated Shield Plans.

If you’re worried about losing your income due to an illness like cancer, ensure that you have sufficient life insurance and critical illness coverage.

You can check out our life insurance calculator to estimate how much critical illness coverage you need.