Heard about Advance Care Planning (ACP) in Singapore?

You should.

Because it’s for everyone, and not just the weak and old.

It’s meant to plan for future healthcare needs, but it’s much more than that.

In this article, I talk about ACP in a broader view.

So, read on!

What is Advance Care Planning (ACP)

As the name suggests, ACP is the planning for future health and personal care if you become very ill one day.

This is important because if you’re not able to communicate due to a lack of mental capacity, how would your loved ones and healthcare professionals know your desired care preferences?

That’s why it’s supposed to be done at this present moment when you still have the mental capacity to do so. And it should be done at any stage in life, even when you’re young and healthy, because anything can happen at anytime.

Advance care planning requires conversations with loved ones and care providers, and documentation – non-legally binding or legally binding – so that in the future when the need arises, your preferences are already made known.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Benefits of Advance Care Planning

There will come a time when all of us will deteriorate.

The question is when. It can also be progressive or sudden.

These are uncertainties that you’ll face. And it doesn’t just affect you but the people around you too.

Planning for your future care needs will have these advantages:

- Your personal core values and beliefs are still intact when your loved ones and doctors are deciding the type of treatment needed

- Reduces the stress on your family members as it takes away any guesswork

- Have someone appointed to act on your behalf on important matters so your family wouldn’t argue

- Withdrawing the use of extraordinary life-sustaining treatment when the time comes

- etc

The 3 Main Tools to Help in Advance Care Planning

Advance care planning need not be complex, and can be a simple process.

So, how do we start on this journey? What does it involve?

There are 3 tools that can help:

- Advance Care Planning (Workbook)

- Lasting Power of Attorney (LPA)

- Advance Medical Directive (AMD)

Throughout the conversations in ACP, topics of LPA and AMD will come up. They’ll be important components as well.

Let’s go into more details on these tools.

1) Advance Care Planning (Workbook)

For this part of ACP, it’s non-legally binding.

For those who are relatively healthy, ACP can be done informally.

It can even be just having conversations with your family members.

But penning down your preferences might serve as a reference in the future for your loved ones or healthcare professionals, as such matters may be forgotten over time.

This is where the Advance Care Planning Workbook comes in.

It guides you to make a complete self reflection on your care needs. This information can then be shared with your loved ones and/or doctors, so they’re aware of it.

To formalise this, an ACP discussion can be done with a facilitator. For patients with more complex conditions, it’s more advisable to approach a facilitator.

The facilitators will follow through with everything. And your preferences can also be recorded in the National Electronic Health Record system.

Another benefit is that you’re able to appoint a Nominated Healthcare Spokesperson (NHS). This is someone who understands your care preferences and act as your voice when you’re unable to make decisions (i.e lose mental capacity) on matters pertaining to healthcare.

The appointing of a NHS may seem like an overlap with your donee in the Lasting Power of Attorney (LPA), but they’re not mutually exclusive. Both the NHS and donee should be the same person, if not there may be conflicts.

More details on the LPA soon..

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

2) Lasting Power of Attorney (LPA)

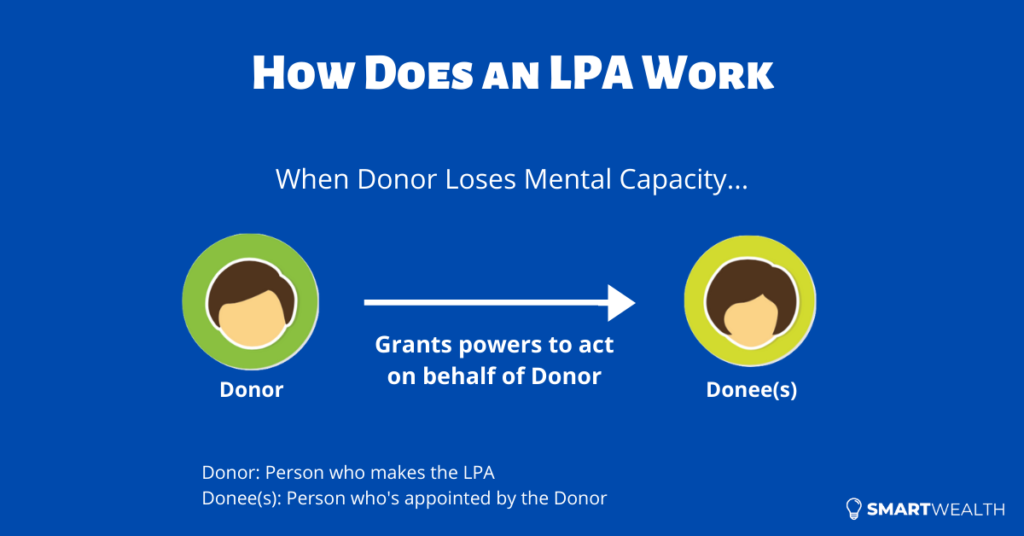

In a Lasting Power of Attorney (LPA), you (as a donor) are able to appoint a donee(s) to act in your best interests when you’re mentally incapacitated – temporary or permanently.

An LPA is a legal instrument, and thus is legally binding.

The donee(s) is able to act in areas of personal welfare and/or property & affairs matters.

The powers of the donee may overlap with the Nominated Healthcare Spokesperson (NHS) of the ACP, and that’s why the donee should also be the NHS.

Can you make do with just one? Let’s take a look..

If you’ve done an ACP and have a NHS (but no LPA), and you lose mental capacity, property matters such as accessing of bank accounts to pay for medical bills can’t be done by your family members. A court order has to be made which will incur more time and can be very expensive.

If you’ve done an LPA (but not ACP), and you lose mental capacity, how would your donee know of your care preferences? Sure, your donee has the power to act on your behalf, but he/she may be acting blindly.

And that’s why, both should complement one another.

3) Advance Medical Directive (AMD)

When you’re already at the brink of death, and have no chance of surviving, would you still want to prolong the imminent?

At that stage, you probably don’t have the mental capacity to make known that you want to throw in the towel too.

This doesn’t just affect you, but the people around you too.

Can your loved ones throw in the towel for you? They probably can’t bear to do so, which can cause further financial and emotional burdens.

Even if they want to help you throw in the towel, euthanasia is illegal in Singapore.

Which brings to the option of the Advance Medical Directive.

The Advance Medical Directive (AMD) is a legal document that specifically tells the doctor not to use any extraordinary life-sustaining treatment to artificially prolong your life, when you’re terminally ill and unconscious.

The AMD can only be signed in advance when you’re mentally capable.

This allows you to die naturally and in peace, when it’s really time to go.

AMD is like a “living will” and although Advance Care Planning seems similar too, it’s non-legally binding. So you can see it this way: ACP kicks in when things doesn’t get too serious until when it does, AMD can come in.

The Importance to Plan For Other Aspects

ACP usually comes into play when you’re “neither alive nor dead”.

It is harsh but it can very well happen.

There are 2 other aspects that interplay with one another: financial planning and estate planning.

So what if you’ve done proper advance care planning (i.e letting know your loved ones about what types of care should be administered), but when the time comes, you don’t have proper insurance plans (hospitalisation coverage and/or life insurance coverage to get the desired treatments).

Also, if you don’t save and invest (e.g plan for retirement), you may not have much to show in your later years.

That’s why financial planning is an important area. Without it, you can’t do much.

The other area is estate planning.

When you’re critically ill, there’s a greater chance that you’d be taken out of the picture. At that point of time, do you think you’re capable to make all the necessary arrangements such as CPF nominations, insurance policy nominations and making a Will? Once you’re mentally incapacitated, all these can’t be done anymore.

And if you die without making a Will, your assets will be distributed according to the law, and not according to your wishes.

Therefore, financial planning, estate planning and advance care planning integrate with one another.

What’s Next?

ACP is non-legally binding; LPA and AMD are legally binding.

They’re not mutually exclusive and are meant to work with one another.

Don’t delay to put in place these tools because time is limited, and it’s running out as we speak.

In the meantime, do look into other areas of financial planning – having adequate life insurance coverage, a solid hospitalisation plan, and plan for your retirement.

And also take a look at estate planning, to map out what’s going to happen when death inevitably happens.