The topic of dying is not often talked about, much less dying without a Will in Singapore.

It’s easily neglected because you’ll never be the one who experiences it.

But if you do care about your loved ones, it‘s something to pay attention to because they will face obstacles.

In this article, I’ll cover:

- An overview of the process

- What happens to your assets (CPF, HDB, Bank accounts, etc) after death

- How they will be distributed

- The disadvantages of not having a Will

- .. and more

So, read on!

Too Long; Didn’t Read

When you’re taken out of the picture, all assets will be frozen.

No one has the right to control it anymore, until an Administrator is appointed. The Administrator is usually a next-of-kin and is someone who will do all the heavy administrative tasks.

Tasks include creating an estate bank account, going to various banks and withdraw, pay off all liabilities, etc.

At the end of the day, if there are any remaining assets (hopefully you’ve done proper financial planning), they’ll be distributed accordingly to the intestate law or the Muslim law.

Sounds simple, but there’s much more to it. Read on to fully understand the details.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What is Dying Without a Will

There is a technical term for dying without a Will and that’s dying intestate.

On the other hand, dying with a Will is dying testate.

And even if you have a Will, but certain items in the Will are not properly written or invalid, it’s partial intestacy.

So part of your assets are distributed according to your Will, and parts of it are distributed according to the law.

Overview of the Administrative Process After You Die Without a Will

The estate administration process can be tedious but it’s needed to be done by someone.

The following will not be the full detailed process, but an outline of the important parts your loved ones have to go through to unlock assets.

1) Determine the Domicile

If you’re a Singaporean and have worked in Singapore for your whole life, then this section wouldn’t matter much to you.

Basically, you should be domiciled in Singapore.

But if you’re residing overseas and have assets in those countries, or if you’re a foreigner who’s residing in Singapore and have assets here, things can get complicated.

This is because the laws of other countries may apply.

So if you belong to this category, make sure estate planning is properly done (such as having multiple Wills in different countries).

2) Determine the Size of the Estate

Are there any debts and liabilities left behind?

Are there even assets remaining?

If the holdings are simple, there’s no debts or liabilities, and the estate is below $50,000, the Public Trustee’s Office (PTO) can come in and assist with the administration.

They’ll still charge a low fee but your family can leave it to them.

If the estate is more than $50,000 and/or can’t be done through PTO, then your family needs to go through the legal process of obtaining the Grant of Letters of Administration.

For proper financial planning to be done, it’s always important to maintain a “balance sheet” of your assets and liabilities. This will be even more important after your death as your Administrator has to compile all of it.

It will be troublesome when your administrator doesn’t have an indication of what you have so he/she has to write in to all financial institutions to check whether you have accounts with them.

3) Decide Who Shall Be the Administrator

In obtaining the Grant of Letters of Administration, an Administrator(s) is required.

The roles of an administrator is crucial and he/she has to settle administrative tasks such as:

- communicating with financial institutions

- preparing the schedule of assets

- settling funeral expenses

- paying off debts and liabilities

- distributing remaining assets

- .. and more

The administrator is likely to be a next-of-kin, and usually the one who has the most entitlement, such as the spouse.

Having said that, the “rightful” administrator can waive his/her rights to be the administrator.

For example, a mother could be grieving and so the eldest can be the administrator instead.

But there may be issues.

An administrator is not compensated with a larger share but still has to go through the entire process for the sake of all beneficiaries.

Thus, he may not want to be the administrator. And so, another person has to step up.

On the other hand, a sibling may want to step up to be the administrator, but the other siblings may object to it (because of distrust).

Because of these, fights do happen.

In any case, up to 4 Administrators can be appointed.

If there are beneficiaries who are minors (below 21 years old), 2 Administrators or a trust company are needed.

4) Apply for the Grant of Letters of Administration

The grant of letters of administration is a court order to formally appoint the Administrator(s).

Your administrator can apply on their own or with the help of a lawyer (at a fee; deducted from the estate)

Which one would he/she go for?

It depends on how big the estate is and how convenient they want it to be.

If they’re still grieving, then having someone to assist and guide through the process can be valuable.

This whole process can take several months before getting approved. It also means that your family might not have access to any funds during this time. Which is also why, insurance nominations and CPF nominations are important tools to provide faster access to funds.

In any case, the approval will give permission for the administrator to have control of the assets.

He/she can then set up an estate bank account which all transactions can flow through.

5) Pay Off Debts and Liabilities

What happens to your loans, debts and liabilities after death?

They don’t just disappear.

Examples of such liabilities:

- Property mortgage loans

- Car loans

- Taxes

- Credit card debts

- Bills

- etc

Your surviving family members generally don’t inherit these liabilities. However, they’re likely to be paid off using the estate’s monies before any asset distribution is made.

An exception would be in the case of joint property mortgage loans.

The surviving party has to assume the responsibilities of paying off the loan. This is why having mortgage insurance or term insurance is extremely crucial so that the burden of paying off the loan will be eliminated upon death.

So it’s important to have proper financial planning done up if not your family will not see any remaining assets.

6) Distribute Remaining Assets According to the Law

If there are any assets left, they’ll be distributed according to the law – intestate law or the Muslim law.

But because different assets are treated differently, it’ll not be that simple.

I’ll touch more on the asset distribution in the next section.

What Happens to Your Assets After Death

Not all assets are lumped together and treated as one.

So here are some common assets that may be treated differently after death (assuming no Will is done):

CPF Monies

Your CPF balances and unused CPF LIFE premium are different from regular cash at bank and will be treated differently.

It all depends on whether you’ve made a CPF nomination.

If you’ve made one, then the CPF monies will go to your nominees.

If you didn’t, the CPF monies will be transferred to the Public Trustee’s Office (PTO) and they’ll distribute it according to the intestate succession act or Muslim law. It will not form part of the estate.

There are 3 disadvantages of not nominating:

- distributed according to the law and not to your wishes

- high costs incurred

- longer time for your beneficiaries to receive the money

These are the reasons why a CPF nomination is important.

After all, nominating is free and can be done online now.

Proceeds from Insurance Policies

This is also another asset where the distribution depends on whether you’ve made a nomination or not.

If you haven’t, the insurance company may out up to $150,000 to a “proper claimant” – usually an immediate family member – for liquidity purposes. The rest may be held until a Letter of Administration is shown.

On the other hand, if you’ve made an insurance nomination, the insurance company will pay out to the nominees, without needing to go through the legal process.

This can be a good and a bad thing.

If your nominees are all adults and can manage money well, it shouldn’t be an issue to nominate.

But if you have nominees that are minors or vulnerable people, then there could be issues.

Generally, consider making nominations on some policies for liquidity purposes, and then leave the other policies un-nominated to be dealt with through a Will or a Trust. Doing this allows proper distribution through monthly payments or staggering of payments.

Money in Bank Accounts

It depends on whether you have a joint account or an individual account.

Let’s start with joint accounts first.

Joint Bank Accounts

In joint accounts, you would usually have another account holder who has access to the funds.

In most cases, when the bank is notified of the death, the surviving account holder can close the account and be given the remaining balance.

This is not an absolute and in some cases, it can be challenged. So although it’s easy to implement, it should not be the main way to “transfer” funds to the surviving party upon death.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Individual Bank Accounts

This is when you’re the sole owner of the account.

Likewise, if the bank knows of the death, they would freeze the account. No transactions can be done until the Grant of Letters of Administration is shown.

In some cases, the bank can release the funds to a next-of-kin if the account has less than $5,000, but this is still up to the bank to decide.

Properties (HDB, Condos, Landed)

Properties will be treated according to the type of holdings – joint tenancy or tenancy-in-common.

Joint Tenancy

In a joint tenancy, each owner have equal interests in the property, regardless of how much has been paid.

Example: If the husband passes away, the HDB flat will be transferred to the surviving wife.

Tenancy-in-common

In a tenancy-in-common, each owner has an specified share in the property.

It can be 50/50 or 80/20, etc.

So when death happens, the deceased’s share doesn’t go to the surviving parties (like in joint tenancy) but distributed according to the intestate succession act or muslim law.

Other Assets

The assets mentioned above have special conditions attached to them, and are dealt with differently.

For other assets, it becomes simpler if it’s solely owned.

Examples:

- Car

- Stocks and Shares

- Investments

- etc

If you don’t have a Will, they will be distributed according to the intestate succession act.

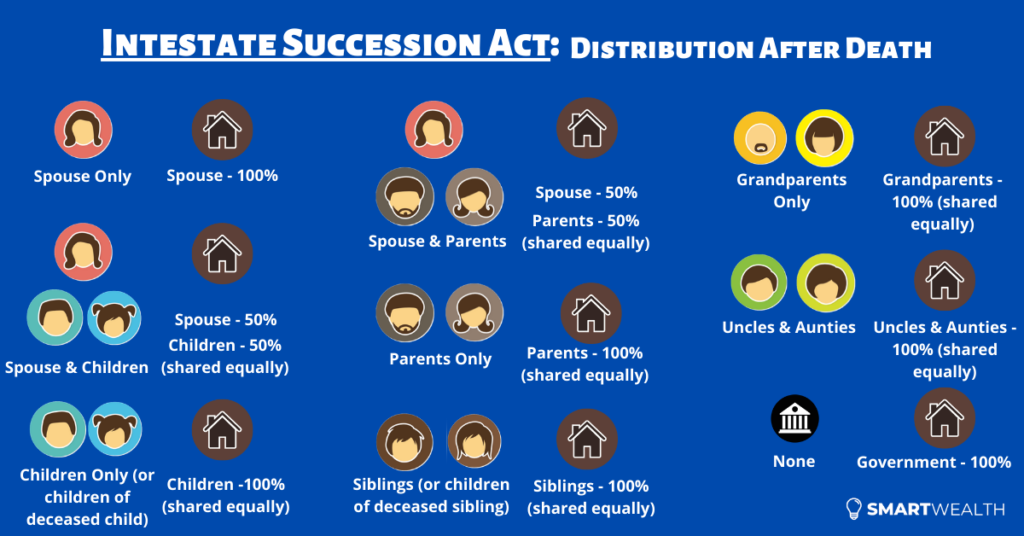

Assets Are Distributed According to the Intestacy Law in Singapore

The intestate law in Singapore is called the Intestate Succession Act (ISA).

It specifies the distribution of your assets to beneficiaries.

Here’s an overview:

If you’re a Muslim, then the ISA doesn’t apply to you. There’s a separate law.

If there wasn’t a Will written, most of your assets will go according to the intestate law, except those assets specially mentioned above.

The 6 Disadvantages of Dying Without a Will

1) Assets go to unintended beneficiaries

Most assets will be distributed according to the intestate law. And it will be strictly enforced.

Your money may not go to the intended parties.

Instead, it could even go to beneficiaries of whom you don’t even want to give a single cent.

But it’s the law.

And you can’t change anything about it because you didn’t specify the distribution with a Will.

2) Disputes may happen

Because assets may go to unintended parties, there will like be disputes and unhappiness.

When money is involved, the “ugly” side of humans may be shown.

And the law doesn’t know the intricacies of your relationships with your family.

There could be someone in your family (such as your parents) or people outside the family circle that deserves part of your assets.

But because you fail to include them with a Will, they’ll not get anything.

3) Longer time to distribute

The process of obtaining the letters of administration could take longer than if you were to have a Will.

This is because there are a lot of unknowns and nothing is specified.

Things such as finding your assets and liabilities, who would be the administrator(s), finding the rightful beneficiaries, gathering the proper documents, etc, have to be done.

All these take time, and affect how soon your beneficiaries can see any funds.

4) Higher costs incurred

With more time needed for all these administrative tasks, it may incur a higher cost.

And usually, lawyers do charge a higher fee for assisting with the Grant of Letters of Administration compared to when there’s a Will (Grant of Probate).

5) Can’t appoint a guardian for your young children

In cases where both parents die at the same time, who would take care of your kids?

That guardian has to be decided by the court and may not be who you wished him/her to be.

Disputes over who shall by the proper guardian will follow.

But that will derail from the most important task – the actual taking care of the kids.

In the worse case, your children may end up in a home.

In a Will, you can specify who the guardian would be if death happens.

6) Can’t stagger the payments

If you have a sizeable estate (especially with proper financial planning), you should be mindful of how your assets should be distributed.

Without a Will, payments cannot be staggered i.e pay monthly of $2,000 till age 30, then release the full sum.

This is an important point for beneficiaries who are old parents, spouses and children who may not able to manage a sudden increase in wealth.

And it attracts all the weird people who hang around them for money.

In the end, it could be a double-edged sword.

There are ways around this through a writing a Will or setting up a Trust.

What’s Next?

Generally, having a Will provides much more benefits than not having one and then leaving the decisions to the law.

In death, the only wish you have left is for your family to live on comfortably with whatever you’ve provided.

Making a Will is affordable and costs only a few hundreds (for a basic one).

Depending on your needs, more complexity may be needed and proper estate planning can be done with other instruments such as living trusts.

But as a start, do ensure that the basics are done – CPF nominations, insurance nominations, and writing a Will.