Buying a property requires a huge financial commitment, and for most of us, it’ll be one of the biggest assets we’ll own.

If you’re like the rest of us, our property loans can last for decades. During that time, a lot can happen. Uncertainties, such as being unable to pay off the mortgage loan due to unfortunate events, can be very worrying.

Having a mortgage insurance eliminates that financial risk.

If you’re looking for more information about mortgage insurance in Singapore, you’re in the right place.

In this guide, we’ll cover what is mortgage insurance all about, how it works, the different types of options (including HPS), and more.

So, read on!

This page is part of the Mortgage Insurance 2-Part Series:

- Part 1: Guide to Mortgage Insurance

- Part 2: Finding the Best Mortgage Insurance

- What Is Mortgage Insurance?

- How Does Mortgage Insurance Work?

- Is Mortgage Insurance the Same With Home Insurance or Fire Insurance?

- Who Are the Providers of Mortgage Insurance in Singapore?

- 5 Reasons Why Mortgage Insurance Is Important in Singapore

- Mortgage-Reducing Term Assurance (MRTA) vs Level Term Insurance

- What's Next?

What Is Mortgage Insurance?

A mortgage insurance is a policy that pays out a lump sum if undesirable events happen.

What does it cover, you ask?

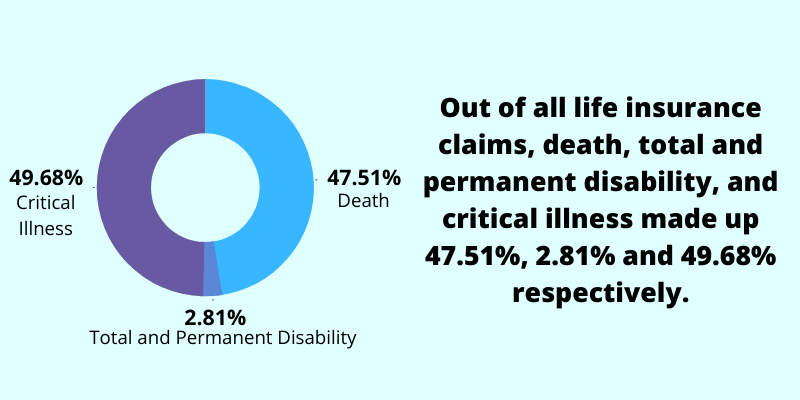

Typically, it covers death and total and permanent disability (TPD). You could also include coverage for critical illnesses.

That lump sum payout can then be used to pay off the outstanding loan and your family can continue to have a roof over their heads.

One thing to note is that there’s no cash value in such plans. In return, you’re compensated with higher coverage at lower premiums.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

How Does Mortgage Insurance Work?

Traditionally, when people were talking about mortgage insurance, they were referring to mortgage-reducing term assurance (MRTA).

Today, a level term plan is primarily used as “mortgage insurance” to cover the mortgage loan. I’ll touch more on the differences later in the article.

For now, here’s how a MRTA works:

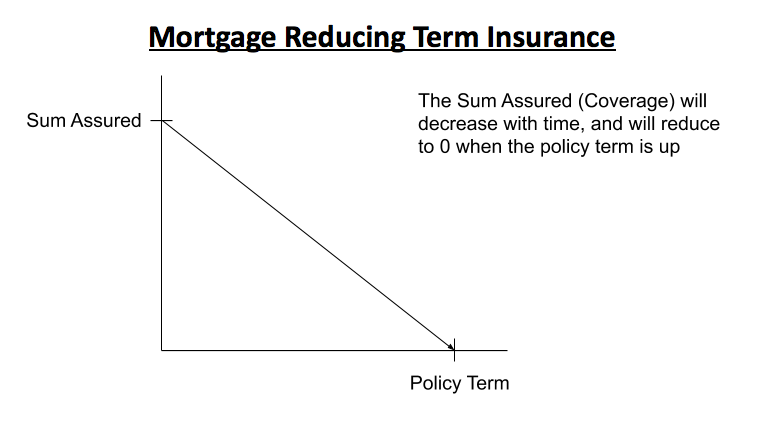

At the start, the sum assured (coverage amount) of the MRTA policy is typically the same as the property loan.

This coverage amount constantly reduces at the selected interest rate (e.g., 3%) over the duration of the policy. This also means that payouts from the policy might not match the actual outstanding loan.

Upon reaching the end of the policy term (usually matched with the property loan tenure), the coverage will be $0 and the plan will expire.

Important note: While the coverage reduces over time, the premiums stay the same throughout. Thus, after a period of time, the cost per dollar of sum assured gets higher. This is also why there’s no need to pay the premiums of most MRTA policies in the last two years.

With the growing popularity of level term plans, insurance companies are shifting away their focus from MRTA.

Is Mortgage Insurance the Same With Home Insurance or Fire Insurance?

While both mortgage insurance and home insurance may mean the same to you, they do have clear distinctions in the insurance world.

As long as you have an outstanding HDB loan, you’re required to purchase the HDB fire insurance. The premiums are very affordable and the policy pays out upon an insured event, such as if the internal building structure is damaged because of fire.

If you’re staying in a private condominium, a fire insurance might have already been purchased by the management.

Because fire insurance protects only the basic structures, it does not cover everything else, including your personal belongings, furnitures, etc.

And that’s when home insurance comes in.

A home insurance or “home contents insurance” will be useful if damages were done to your property (and its contents). It also provides payouts if other unfortunate events, such as earthquakes and floods, happen.

On the other hand, a mortgage loan insurance is beneficial if something happens to you. It provides a lump sum to offset your loan if you’re taken out of the picture.

These types of insurance are important, but in my view, there should be a greater emphasis on mortgage insurance because if something were to happen to the income-earner, it’ll be more catastrophic.

Who Are the Providers of Mortgage Insurance in Singapore?

There are two main providers of mortgage insurance in Singapore: Home Protection Scheme (HPS) by CPF and policies from insurance companies.

1) Home Protection Scheme (HPS) From CPF

Home Protection Scheme (HPS) is provided to protect CPF members and their families from losing their HDB flat if death, terminal illness, or total permanent disability, happens.

This coverage only lasts up to age 65 or till when the home loan is paid up, whichever is earlier.

HPS is compulsory if you want to utilise your CPF savings to pay for your monthly loans on your HDB flat. It doesn’t matter whether you’ve taken a HDB loan or a bank loan.

However, HPS doesn’t cover private residential properties, which also include executive condominiums (ECs) and Housing and Urban Development Company (HUDCs).

If you’re only paying cash for your monthly repayments, HPS is optional. HPS or a private mortgage insurance is still highly recommended, though.

To get a rough estimate of your HPS premium, visit this link from the CPF website.

With any insurance application, you’ll need to fully disclose information pertaining to your health. The application is subjected to approval, which could still lead to a rejection or exclusions.

The good point about HPS is that you can use your CPF Ordinary Account (OA) savings to pay for the annual premiums. If your OA savings are depleted, you can opt to use cash instead.

Is there be a better option to HPS?

There is an alternative, and that’s private mortgage insurance offered by insurance companies.

If you have that or eligible life insurance plans, you can apply for an exemption from HPS if certain conditions are met.

One option could be getting a level term insurance. That way, you’re able to cover other financial aspects apart from the mortgage loan, and is likely to be a more holistic approach.

2) Private Mortgage Insurance (From an Insurance Company)

If you’ve taken a bank loan for a private residential property, you can’t apply for HPS, so the only option is to get a private mortgage insurance. This is usually not compulsory but it’s highly recommended.

Your bank would’ve proposed an insurance plan underwritten by their partner. For example, UOB with Prudential and DBS with Manulife. You’re getting the plan from the insurance company, and not the bank.

One downside to this is that banks usually partner with just one company. Thus, you may not always get the most competitive rates. You should get quotes from different companies, and there are out other benefits (outlined later) if you were to source on your own.

Get a comparison of the best mortgage insurance in Singapore.

5 Reasons Why Mortgage Insurance Is Important in Singapore

Whether you want to stick to HPS or with what you have, that decision is entirely up to you.

Here are some reasons why having a private mortgage insurance could make sense:

1) Protects your biggest asset

In land-scarce Singapore, it is a given that properties are expensive, and their prices are in the six-figures, at least.

Furthermore, million-dollar homes are becoming more common. In fact, a record of 261 HDB flats were sold in 2021.

This means that your property will likely be one of the biggest asset classes you’ll ever own.

However, this “asset” can also be a “liability” because of the huge housing loan you’ve undertaken.

If you’re unable to repay the monthly loan payments, the financial institution has the right to repossess your home and sell it off.

This means that if you were to pass on, become permanently disabled, or critically ill, which potentially leads to not meeting mortgage obligations, your family might need to find another place.

Mortgage insurance will eliminate this risk, and be able to repay back the outstanding loan when something happens to you, keeping your home intact.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

2) Eliminates the issue of properties being illiquid

Some people may think that it’s easy to sell off their properties if something were to happen, which might not always be the case.

Months could have passed before you can see any cash from its sale as time would be needed for marketing and conducting viewings to find prospective buyers.

Meanwhile, your family still needs to make the necessary monthly repayments and they need ready cash for that.

Even if you can find buyers, in a market downturn or fire sale, you might incur a net loss.

With a mortgage insurance, as long as all relevant documents are provided, claim payouts typically take a few weeks or less. This ensures that your family has liquid cash to pay for the neccessities.

3) Private mortgage insurance can be cheaper

When you apply for a mortgage loan, the banks would usually recommend you to get a mortgage insurance, but they are usually tied to just one insurance company. This means that you may not get the best deal available in the market.

There may be cheaper alternatives if you were to source it on your own. However, price is not everything. There are additional benefits too.

4) “Transferable” even if you upgrade in the future

The trend now is to upgrade to a bigger home once the BTO’s minimum occupation period is up.

Because HPS is tagged to the HDB flat, if you upgrade or shift house in the future, that existing HPS can’t be used.

You’ll need to reapply or get another insurance. This would likely translate to higher premiums due to age. Even so, if health deteroriates, exclusions or rejections are a possibility. Even minor conditions, like high blood pressure or high cholesterol, can affect the chances of you being insured again.

With your own mortgage insurance, if you were to sell off your property, the policy still stays and you would’ve already locked in cheaper premiums.

5) Increased flexibility of coverage

Banks usually offer mortgage insurance with just the bare minimum coverage of death and total and permanent disability.

Even in the HPS, it only covers death, terminal illness, and total and permanent disability.

Are they enough? What about coverage for critical illnesses which may have a high probability of claiming?

With your own private mortgage insurance, you have the option to include critical illness coverage, control the length of cover, increase the coverage amount, etc.

Everyone is different and so are their needs.

Mortgage-Reducing Term Assurance (MRTA) vs Level Term Insurance

In order to cover the mortgage loan, you’d typically have to decide between a MRTA or a level term insurance.

The coverage amount in a MRTA reduces over time, and will eventually reach $0 when the plan’s tenure is up.

On the other hand, the sum assured in a level term plan stays constant throughout the entire policy term. The coverage stops after the end of the policy term.

There are pros and cons to each type of plan.

Below are some factors to consider before deciding which is the better option for you:

1) Intention to shift or upgrade your property in the future

As the sum assured of the MRTA reduces, if in the future, you intend to change property, the sum assured of the MRTA plan may not be enough to cover the loan of the new property, leaving you with a shortfall.

At that point of time, you could try to increase the sum assured with your existing plan or get a new plan. This brings about two sets of problems: higher premiums due to age and insurability. Any conditions, such as high blood or high cholesterol, could lead to even higher premiums when you submit a new application.

2) Premiums of both types of plans

The coverage of a MRTA reduces, but the premiums stay fixed. This means that it should be cheaper than a level term, right? That’s not always the case.

There are instances where a level term is still cheaper. This is because there’s greater competition in the level term market. Furthermore, insurance companies are phasing out mortgage-reducing plans.

But it still ultimately depends on other factors, such as your age, coverage amount, and period of cover. The only way to be sure is to get quotes and compare between insurance companies.

3) Other financial responsibilities and liabilities

When one intends to get a mortgage insurance, usually only the loan amount is factored in. But, there are other financial concerns that you may have as well.

Do you currently have adequate life insurance in the first place to cover for ongoing expenses, commitments, children’s education, and retirement?

If you don’t, a higher coverage amount on a level term could cover all the essentials. So, if anything to you, other financial aspects can still be catered for.

What’s Next?

Phew, that was a long one.

Hopefully, you’ve gained some knowledge on mortgage insurance.

If you want to protect your biggest asset and ensure your family retains it if unforseen events happen, take the first step by getting the best mortgage insurance in Singapore. The comparison (with quotes) of different companies will come in handy. You’ll also get quotes for level term insurance.