So you’re going to purchase a HDB flat and was told about the Home Protection Scheme (HPS).

And if you’re a first time home buyer, you’ll realise this just got real…

Your finances have got to be on point.

Is HPS the best option available? Are there limitations to it or other better alternatives?

I’ll cover them all, read on!

What is Home Protection Scheme (HPS)?

The Home Protection Scheme (HPS) is a mortgage reducing term insurance administered by the Central Provident Fund Board (CPFB).

Its purpose is to protect HDB owners against undesirable events which result in them not being able to repay their home loans.

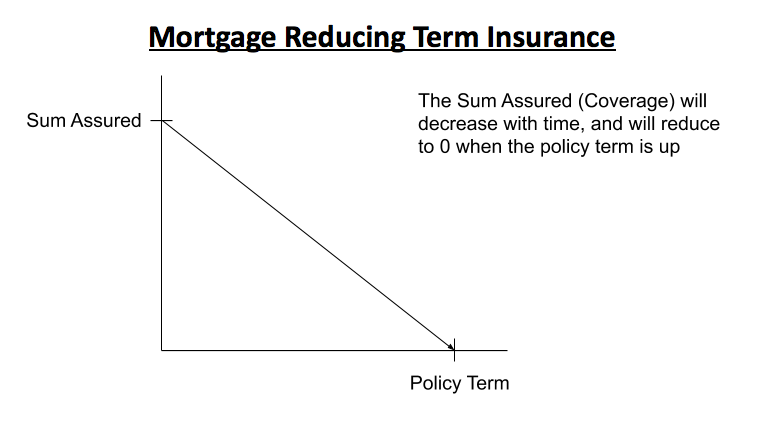

What is a mortgage reducing term insurance, you ask?

Here’s a picture to explain better:

Basically, as you pay off your monthly HDB loan payments, your loan reduces.

And if anything happens to you or your co-owner, part or the full loan can be paid off with the proceeds of the HPS insurance.

This eliminates the worry that the full burden of paying the property loan falling on your co-owner if you’re taken out of the picture.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is It Not?

If you’re a new homeowner, there are other types of insurance that you should also be aware of and are often mistakenly lumped together.

Dependant’s Protection Scheme (DPS)

The Dependants’ Protection Scheme (DPS) is a scheme that most working adults should already have.

If you’re covered under DPS, and Death, Terminal Illness or Total Permanent Disability (TPD) happens, a maximum sum assured of $46,000 will be paid out. The coverage is up to 60 years.

DPS like what its name suggests is meant for your dependants.

Its coverage amount is often too low. And that’s why it’s entirely different from HPS.

Home (and Fire) Insurance

Fire insurance is compulsory when you have an outstanding HDB loan.

The HDB Fire insurance covers the cost of reinstating damaged internal structures, fixtures, as well as areas built and provided by HDB.

But fire insurance does not cover home contents.

On the other hand, home insurance is optional and has a more comprehensive coverage. It complements the fire insurance.

It can cover renovations, furniture and personal belongings, etc.

Premiums for home or fire insurance are usually much lower than HPS and the scope of coverage is totally different.

Is Home Protection Scheme Compulsory?

If you’re using your CPF savings – whether partially or fully – to pay off your HDB (BTO or Resale) or DBSS flat, you’re required to be covered under HPS.

It also doesn’t matter if you’re taking the mortgage loan from HDB or through the banks like DBS, OCBC, UOB, etc.

But, there are exceptions:

- You can be exempted from taking up HPS if you have your own private insurance (more on that later; it could be a good alternative)

- If you’re paying off your HDB loan using only cash, taking up HPS becomes voluntary.

- You’re not required to take up HPS if you’re staying in a private residential property (condominium and landed property), Executive Condominium (EC) or Housing and Urban Development Company (HUDC) flats.

If you fall in the 2nd and 3rd category, you may want to look at private mortgage insurance and level term insurance offered by insurance companies for comprehensive protection.

What Does the Home Protection Scheme Cover?

The coverage of HPS:

- Death

- Terminal Illness

- Total and Permanent Disability

You can be covered under HPS up to age 65 or until the HDB loan is fully paid up, whichever is earlier.

I’ll touch further on what it does not cover later in the article (limitations of HPS).

When Would HPS Start?

According to CPF, the cover of HPS starts when you meet all of the below conditions:

- You are the legal owner of the flat.

- You have completed the loan application with HDB or the approved mortgagee and are now legally responsible for the loan.

- You have made your health declaration which is accepted for HPS coverage.

- You have paid the first HPS premium.

How Does HPS Work?

Here’s what CPF says:

Your share of the HPS cover should at least match the proportion of the monthly housing instalment which is payable with your CPF savings and/or cash. Your share of the HPS cover should at least match the proportion of the monthly housing instalment which is payable with your CPF savings and/or cash. This is because HPS pays off the outstanding housing loan, up to the sum assured, based on the percentage share of cover of the insured in the event of death or permanent incapacity.

CPF

….

The total share of cover per household should add up to at least 100%.

…

However, you may each choose to insure for a higher or lower share based on your individual needs and circumstances, up to 100% share of cover per owner.

What this simply means…

If you’re the sole owner

You’ll need to have at least a 100% cover of the total loan amount and will not be able to have a cover higher than that.

If you’re a co-owner

Both you and your co-owner should be insured based on the percentage of your monthly housing loan payments.

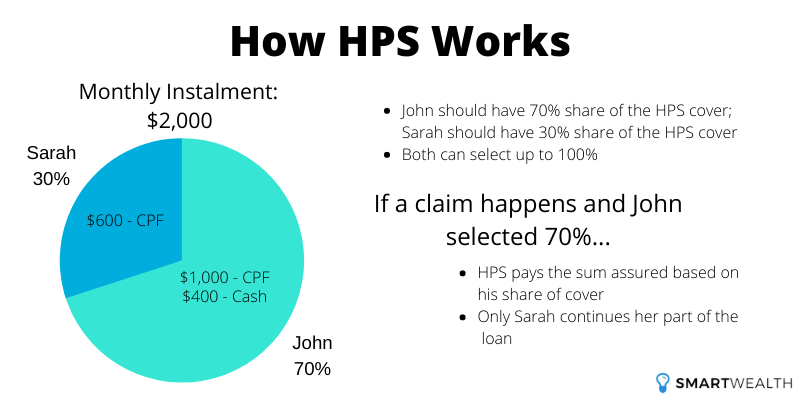

Here’s an illustration:

If John is paying 70% of the monthly housing instalments and Sarah is paying for the remaining 30%, they should be insured 70% and 30% respectively.

However, they can also choose to insure themselves up to 100% of the loan each.

Meaning 100% for John; 100% for Sarah.

So if either partner passes away or become total permanently disabled, the full loan can be repaid.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Paying the Premiums for HPS

One good thing about HPS is that you can use your CPF Ordinary Account (OA) savings to pay for the premiums.

The premium is deducted automatically every year from your OA account (and it has a higher priority over your housing instalment).

If there is insufficient funds in your OA account, you’ll need to make payment for the premiums in cash.

But, you can also use you co-owner’s CPF OA to pay for your premiums as long as they’re your spouse, parent, child or sibling.

As with all insurance, if you don’t pay the premiums on time, your cover will lapse. And if you were to reapply again, your health will be reassessed and your eligibility will be subjected to approval.

As HPS is a mortgage reducing insurance, you will only need to pay premiums for 90% of your HPS cover period.

Example: If your cover period is for 30 years, you’ll only need to pay premiums for 27 years.

EXTRA FACT

This is designed because in the later years, your coverage will be negligible and it wouldn’t make sense to continue paying the same premiums for a “close to nothing” coverage.

How Much Are HPS Premiums?

The exact premiums you’ll need to pay will be based on 4 factors:

| Factors | How it affects | |

| 1. | Outstanding housing loan on the flat | The higher your outstanding loan, the higher the coverage and subsequently the premiums you pay |

| 2. | Loan repayment period of the flat | The longer the coverage period, the higher the premiums |

| 3. | Type of loan (concessionary or market rate) | The premiums for HPS may be higher for those with HDB Market Rate loans |

| 4. | Age and gender of member | The older you are, the higher the premiums. Males generally have higher premiums than females |

For the actual premiums you’ll need to pay, you can go to CPF’s Home Protection Scheme (HPS) Premium Calculator. Your spouse should also enter his/her details.

Here’s an illustration:

John is 30 this year and took a $500,000 HDB loan. The tenure for his loan is at the maximum, 30 years. He wishes to have a 100% coverage of the loan. He only needs to pay for the first 27 years of premiums. And the annual premium works out to be $439, or $36.59/month.

HPS Is Still an Insurance

Like all insurance, your health is subjected to underwriting.

Not only do you have to fully disclose any information regarding your health, you may be asked to go for a medical examination. CPF may also request for a medical report to assess your eligibility to be accepted under HPS.

As usual, there may be exclusions like pre-existing conditions not being covered, etc.

The worst that can come out from this is that you get rejected from HPS.

If you get rejected from HPS, you may still get some form of cover from private insurance. It’s best to speak to a qualified professional to give you an alternative route.

Getting Exemption From HPS

Like mentioned earlier in the article, you can get exempted from HPS if you have an existing private insurance. But if you don’t have any existing insurance but wish to apply for private insurance, you can still get exemption from HPS subsequently.

Below are the conditions to be qualified for HPS exemption.

You can apply for HPS exemption if you already have one or more of the following insurance policies:

- Whole Life

- Term Life

- Endowments

- Life Riders (must be attached to a basic policy)

- Mortgage Reducing Term Assurance (MRTA) / Decreasing Term Rider

These policies must cover your outstanding housing loan up to the full term of loan or 65 years old, whichever is earlier, in the event of death, terminal illness or total permanent disability.

CPF

…

Your exemption from HPS may be revoked if any of the insurance policies used for the exemption is discontinued or altered. Subsequently, the Board would extend a HPS cover to you based on the declared percentage that you were exempted for, subject to the Board’s terms and conditions. If you wish to be exempted from HPS again, you will need to reapply for it.

Steps to take to get exempted from HPS:

- https://www.cpf.gov.sg/eSvc/Web/PortalServices/WelcomePage

- Login with your Singpass

- Click on “My Requests” on the right panel

- Scroll to “Home Protection Scheme (HPS)”

- Click on “Apply to be exempted from HPS”

Note: HPS exemption is still subjected to approval.

You’ll get a full HPS premium refund into your OA account if the exemption application is received by CPF within 1 month from the start of your HPS cover. If not, a pro-rated refund will be given instead.

The 5 Limitations of HPS

Here’s a summary of the advantages of HPS:

- Can use CPF OA to pay for the premiums

- Affordable premiums

- Offers core coverage

However, like most nationwide policies, they cater to the mass and the most basic of needs.

Here are the 5 limitations of HPS:

- Unable to include other coverage

- Can’t have a higher coverage

- Can’t have a cover term of more than 30 years

- Coverage decreases over time

- Premium stays the same over the years

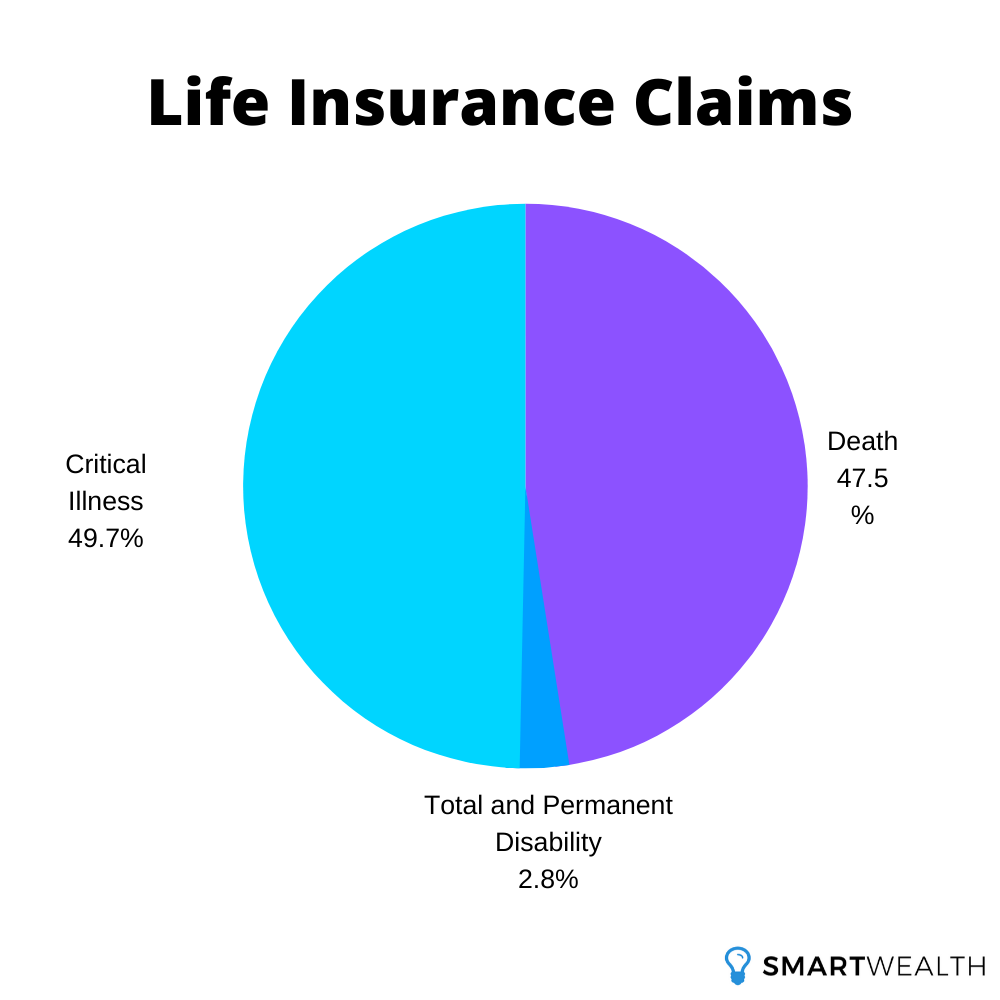

1) Unable to include other coverage

HPS only covers Death, Terminal Illness and Total and Permanent Disability (TPD).

These are the basic forms of insurance coverage.

One important area it doesn’t cover (and you can’t add on) is Critical Illness (CI).

CI can be an important aspect as probability of occurring can be high.

From a study we did on life insurance claims, the number of CI claims exceeded the number of death and TPD claims.

If a CI like Major Cancer happens, you’re likely not able to work and earn an income, what happens to you paying off your loan then?

If you have some CI cover, then at least there’s a payout and it can offset the HDB loan. Thus reducing the burden on your family.

Yes, although the premiums for CI are higher, if you want a comprehensive cover, you need to look at other alternatives.

2) Can’t have a higher coverage

As mentioned earlier, you can only cover up to 100% of the total loan, and not more.

Is there a need for more?

Well think about this…

If you’re a first time home buyer, chances are that you’ve started family planning.

There are much more things to think about and not just your mortgage loan.

Things like daily expenses, kid’s education, retirement, etc.

If your income stops permanently because of a disability, sure, your HPS pays off part or the full HDB loan.

Then what?

What about the other expenses and your future goals? Who’s going to cover them? Your spouse?

That’s why in the bigger picture, these things should still be factored in. And chances are you’ll need a higher coverage. If you’re not sure how much you should be covered, try out our life insurance coverage calculator.

3) Can’t have a cover term of more than 30 years

30 years is the max you can cover for.

HPS is solely meant for the purposes of covering your mortgage loan.

But if you’re thinking about protecting your income till your retirement age or even later, it’s not possible.

4) Coverage decreases over time

Mortgage reducing term insurance (MRTA) including HPS have coverage that reduces over time.

It makes sense.

As you pay off your loan, your liability reduces too.

So your coverage also reduces in the future to reflect that reduced liability.

But picture this.

If in 10 years time, you want to upgrade or buy another property.

The total coverage left is much lesser than before, and you would likely need a much higher cover then.

Firstly, you can’t use the same HPS as it isn’t portable.

So you either have to get another HPS or apply for a private mortgage insurance or a term insurance.

Either ways, it’s going to be more expensive as you’re applying when you’re older.

And then, there’s the concern of insurability.

If in the process of your “ageing”, you encounter even the minor of conditions like high cholesterol, chances are higher that you’ll be rejected from an insurance application.

So in the end, you might have to take on a huge liability but have nothing to fall back on if anything happens.

5) Premium stays the same over the years

Well you know that coverage decreases…

So HPS premiums should also decrease too?

Unfortunately it doesn’t (as with other mortgage reducing insurance).

The premiums stay the same.

You’re basically paying the same premiums for a decreasing coverage.

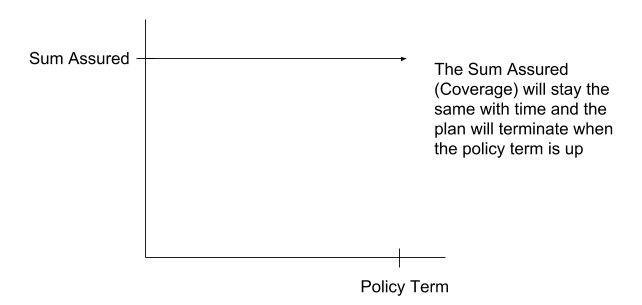

Are There Better Alternatives?

Yes, and that’s why HPS can still be exempted.

If you’re serious about planning your finances, one good option is the level term insurance.

It’s all that mortgage reducing isn’t.

Here are some short pointers of the level term insurance:

- Can have a much higher coverage amount

- Can include various coverage such as critical illness

- Can cover up to age 99

- Coverage amount stays the same throughout the term

There are 2 options you can take now…

Firstly, covering your mortgage loan is just 1 item in the grand scheme of things. What about the rest? If you don’t have any existing life insurance coverage or unsure whether you have enough, do take the first step and estimate how much cover you need.

Secondly, take some time to learn more about private mortgage insurance and level term insurance in Singapore. They might be better alternatives.