When planning for your finances, knowing the average inflation rate is important for multiple reasons.

Not only does it enable you to evaluate whether your investments are beating inflation, it also allows you to project the future cost of your retirement needs or your children’s tertiary education.

How much has the general cost of living increased over the years? And what’s the average inflation rate in Singapore?

Today, we’ll take a deeper look.

Read on!

Summary of Key Findings

The yearly inflation rate in Singapore fluctuates over time.

For 2023 as a whole, the CPI All-Items (or headline/overall) inflation was 4.8%, while the MAS Core Inflation was 4.2%.

On a year-on-year basis in Dec 2023, headline inflation was 3.7%, while core inflation was 3.3%.

For 2024, MAS expects headline inflation to be 2.5-3.5% and core inflation to be between 2.5-3.5%.

Here are the average annual inflation rates in Singapore over the past years:

| Average Headline Inflation Rate (CPI All-Items) | Average Core Inflation Rate (MAS Core Inflation) | |

| Over the last 10 years (2013 to 2023) | 1.44% | 1.65% |

| Over the last 20 years (2003 to 2023) | 2.08% | 1.86% |

| Over the last 30 years (1993 to 2023) | 1.73% | 1.67% |

Read on further for more details.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is Inflation?

Inflation is the rise in the cost of goods and services over time.

While inflation happens most of the time in Singapore, negative inflation, or deflation, can happen too when the general level of prices fall.

According to the Monetary Authority of Singapore (MAS), low and stable inflation is thought to be a core component for long-term sustainable economic growth. The MAS also states that extreme rates of inflation, whether too high or too low, are unfavourable for the economy.

What Is the Consumer Price Index (CPI)?

A key indicator of inflation is the Consumer Price Index (CPI), which measures the change in prices over time of a fixed basket of goods and services typically consumed by resident households.

The CPI data are compiled by the Singapore Department of Statistics.

There are 10 main categories that are tracked:

- Food

- Transport

- Clothing & Footwear

- Communication

- Housing & Utilities

- Recreation & Culture

- Household Durables & Services

- Education

- Healthcare

- Miscellaneous Goods & Services

These categories are further broken down into subcategories.

This fixed basket that is used in the CPI tracks the prices of around 6,800 brands/varieties from 4,200 outlets. How are these prices collected? The data are obtained from various methods:

- Postal enquiries

- Email enquiries

- Electronic returns

- Web scraping data from relevant websites

- Administrative data

- Field interviewers

And because all goods and services are not equally important, a CPI weightage is applied.

2 Ways to Measure Inflation in Singapore

To measure the inflation of a specific area (e.g., cost of healthcare), you’d simply look at the CPI for that category.

Then, we’re able to get the rate of inflation for different categories such as education or healthcare.

However, in order to measure the “general” inflation, two main types of measures are used.

1) CPI All-Items (headline or overall inflation)

2) MAS Core Inflation (core inflation)

What’s the difference between headline inflation and core inflation?

Basically, the CPI All-Items factors in all 10 categories, and the MAS Core Inflation is the CPI All-Items excluding the components of “Accommodation” and “Private Transport”, which belong to the main categories of “Housing & Utilities” and “Transport”, respectively.

The reason why those two components are excluded from the MAS Core Inflation is because they go through short-term fluctuations and don’t form the everyday expenses of most households in Singapore.

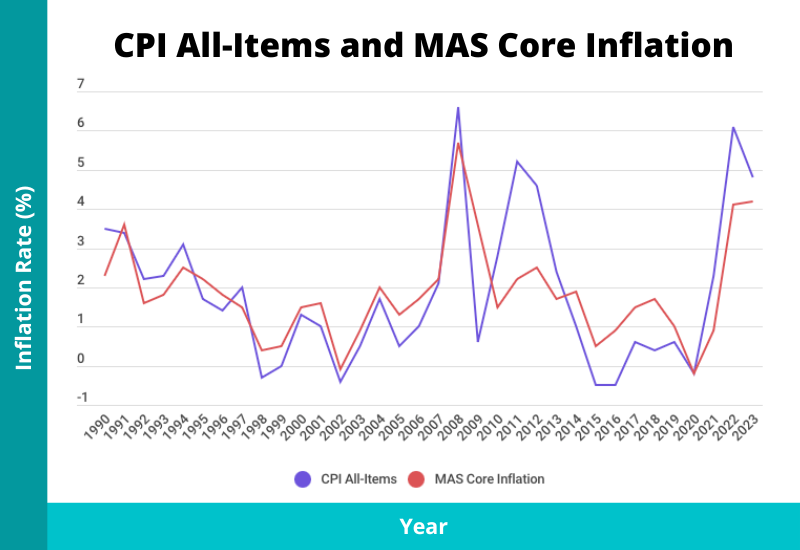

In short, while both the headline and core inflation measures can diverge (move away) in the short run, they tend to converge (move together) in the long run.

We should always look at both measures as they tell different tales.

For example, what can we infer if the headline inflation rises by 1% while the core inflation increases by 8%?

If we look solely at the headline inflation, we may simply assume that the costs of goods and services aren’t rising that much. However, when we factor in the core inflation (which removes the influence of the bigger ticket items of accommodation and private transport), we can come to the conclusion that everyday expenses consumed by most households have increased significantly.

How to Calculate the Inflation Rate?

The inflation rate is the percentage increase (or decrease) in the general level of prices over a specified time, usually expressed yearly and sometimes monthly. It can also be expressed over a longer period of time (e.g., over 10 years from 2010 to 2020).

Here’s the formula to calculate the yearly inflation rate:

Inflation Rate = ((CPI of current year) – (CPI of previous year)) / (CPI of previous year) * 100

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

What’s the Current Inflation Rate in Singapore? (2024)

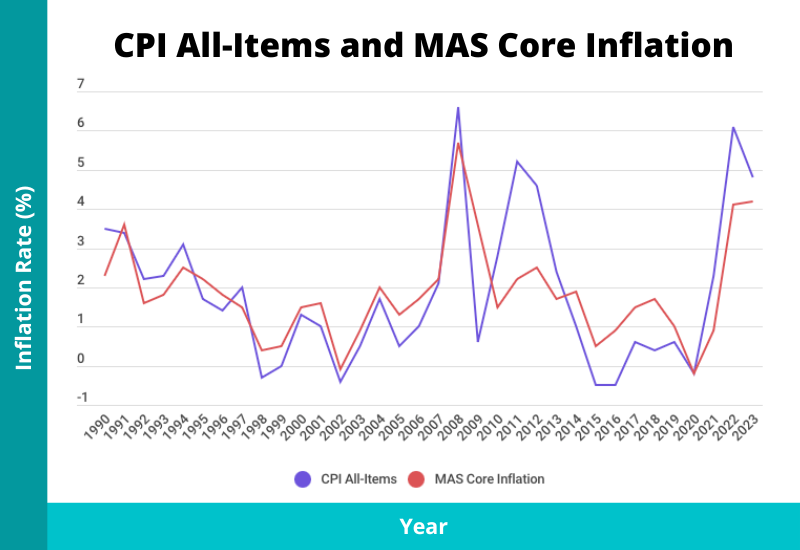

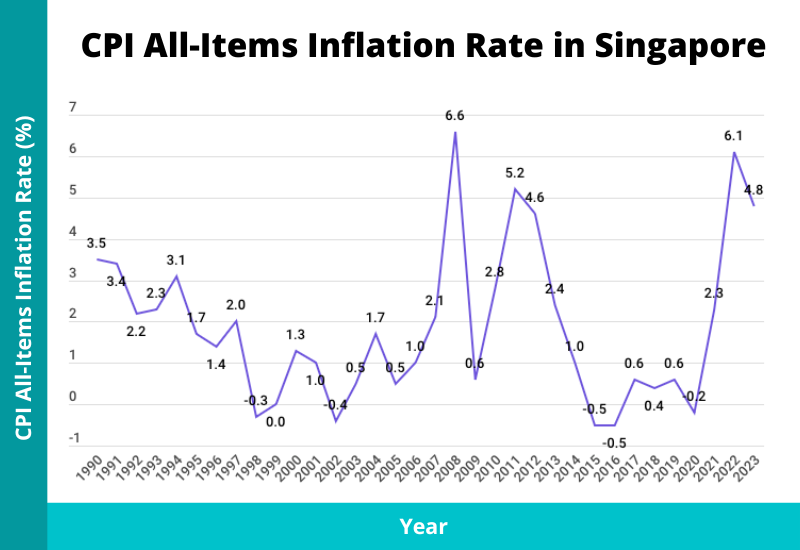

As the CPI All-Items (headline/overall) and MAS Core Inflation (core) are commonly used, here are the historical inflation rates for both of them (from 1990 to 2023).

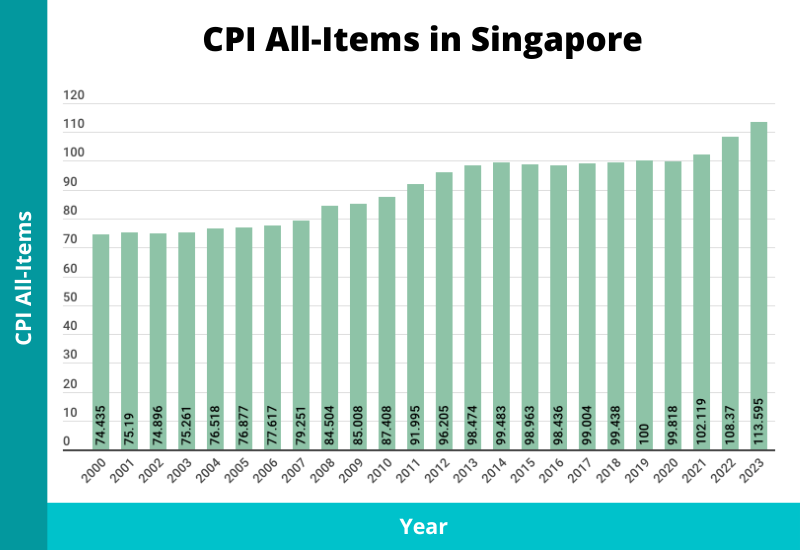

CPI All-Items (headline/overall)

| 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| CPI All-Items | 62.743 | 64.901 | 66.357 | 67.878 | 69.978 | 71.185 | 72.167 | 73.627 | 73.428 | 73.445 | 74.435 | 75.19 | 74.896 | 75.261 | 76.518 | 76.877 | 77.617 | 79.251 | 84.504 | 85.008 | 87.408 | 91.995 | 96.205 | 98.474 | 99.483 | 98.963 | 98.436 | 99.004 | 99.438 | 100 | 99.818 | 102.119 | 108.37 | 113.595 |

| Headline Inflation Rate (%) | 3.5 | 3.4 | 2.2 | 2.3 | 3.1 | 1.7 | 1.4 | 2.0 | -0.3 | 0.0 | 1.3 | 1.0 | -0.4 | 0.5 | 1.7 | 0.5 | 1.0 | 2.1 | 6.6 | 0.6 | 2.8 | 5.2 | 4.6 | 2.4 | 1.0 | -0.5 | -0.5 | 0.6 | 0.4 | 0.6 | -0.2 | 2.3 | 6.1 | 4.8 |

The headline inflation rate in 2023 was 4.8%. Over a period of 30 years from 1993 to 2023, the highest inflation in a year was 6.6% in 2008, while the lowest was -0.5% in 2015 and 2016. Since 2003 to 2023, the CPI All-Items has increased 50.9%.

Below, we look at headline inflation on a year-on-year basis (e.g., Dec 2021 vs Dec 2020).

| 2023 Dec | 2023 Nov | 2023 Oct | 2023 Sep | 2023 Aug | 2023 Jul | 2023 Jun | 2023 May | 2023 Apr | 2023 Mar | 2023 Feb | 2023 Jan | 2022 Dec | 2022 Nov | 2022 Oct | 2022 Sep | 2022 Aug | 2022 Jul | 2022 Jun | 2022 May | 2022 Apr | 2022 Mar | 2022 Feb | 2022 Jan | 2021 Dec | 2021 Nov | 2021 Oct | 2021 Sep | 2021 Aug | 2021 Jul | 2021 Jun | 2021 May | 2021 Apr | 2021 Mar | 2021 Feb | 2021 Jan | 2020 Dec | 2020 Nov | 2020 Oct | 2020 Sep | 2020 Aug | 2020 Jul | 2020 Jun | 2020 May | 2020 Apr | 2020 Mar | 2020 Feb | 2020 Jan | 2019 Dec | 2019 Nov | 2019 Oct | 2019 Sep | 2019 Aug | 2019 Jul | 2019 Jun | 2019 May | 2019 Apr | 2019 Mar | 2019 Feb | 2019 Jan | 2018 Dec | 2018 Nov | 2018 Oct | 2018 Sep | 2018 Aug | 2018 Jul | 2018 Jun | 2018 May | 2018 Apr | 2018 Mar | 2018 Feb | 2018 Jan | 2017 Dec | 2017 Nov | 2017 Oct | 2017 Sep | 2017 Aug | 2017 Jul | 2017 Jun | 2017 May | 2017 Apr | 2017 Mar | 2017 Feb | 2017 Jan | 2016 Dec | 2016 Nov | 2016 Oct | 2016 Sep | 2016 Aug | 2016 Jul | 2016 Jun | 2016 May | 2016 Apr | 2016 Mar | 2016 Feb | 2016 Jan | 2015 Dec | 2015 Nov | 2015 Oct | 2015 Sep | 2015 Aug | 2015 Jul | 2015 Jun | 2015 May | 2015 Apr | 2015 Mar | 2015 Feb | 2015 Jan | 2014 Dec | 2014 Nov | 2014 Oct | 2014 Sep | 2014 Aug | 2014 Jul | 2014 Jun | 2014 May | 2014 Apr | 2014 Mar | 2014 Feb | 2014 Jan | 2013 Dec | 2013 Nov | 2013 Oct | 2013 Sep | 2013 Aug | 2013 Jul | 2013 Jun | 2013 May | 2013 Apr | 2013 Mar | 2013 Feb | 2013 Jan | 2012 Dec | 2012 Nov | 2012 Oct | 2012 Sep | 2012 Aug | 2012 Jul | 2012 Jun | 2012 May | 2012 Apr | |

| CPI All-Items | 115.343 | 114.91 | 115.111 | 114.88 | 114.303 | 113.309 | 113.576 | 113.034 | 112.669 | 112.583 | 112.019 | 111.397 | 111.186 | 110.959 | 109.893 | 110.339 | 109.863 | 108.836 | 108.671 | 107.598 | 106.547 | 106.691 | 105.379 | 104.472 | 104.439 | 103.959 | 102.95 | 102.657 | 102.231 | 101.672 | 101.87 | 101.883 | 101.07 | 101.239 | 101.015 | 100.44 | 100.469 | 100.105 | 99.711 | 100.139 | 99.807 | 99.178 | 99.5 | 99.48 | 99.012 | 99.933 | 100.279 | 100.204 | 100.445 | 100.254 | 99.93 | 100.147 | 100.209 | 99.587 | 100.038 | 100.325 | 99.753 | 99.972 | 99.953 | 99.387 | 99.686 | 99.61 | 99.447 | 99.753 | 99.778 | 99.359 | 99.505 | 99.449 | 98.833 | 99.299 | 99.501 | 99.035 | 99.225 | 99.322 | 98.75 | 99.036 | 99.056 | 98.726 | 98.956 | 99.098 | 98.762 | 99.064 | 99.023 | 99.026 | 98.854 | 98.699 | 98.383 | 98.666 | 98.657 | 98.173 | 98.449 | 97.724 | 98.365 | 98.416 | 98.375 | 98.476 | 98.693 | 98.684 | 98.487 | 98.912 | 98.911 | 98.818 | 99.171 | 99.279 | 98.829 | 99.449 | 99.211 | 99.114 | 99.328 | 99.441 | 99.255 | 99.553 | 99.742 | 99.213 | 99.508 | 99.676 | 99.342 | 99.749 | 99.484 | 99.506 | 99.404 | 99.72 | 99.02 | 98.865 | 98.718 | 97.929 | 97.656 | 97.457 | 97.112 | 98.574 | 99.107 | 98.121 | 97.936 | 97.225 | 97.1 | 97.298 | 96.744 | 96.146 | 95.924 | 95.917 | 95.718 |

| Headline Inflation Rate (%) [Year-on-Year] | 3.7 | 3.6 | 4.7 | 4.1 | 4.0 | 4.1 | 4.5 | 5.1 | 5.7 | 5.5 | 6.3 | 6.6 | 6.5 | 6.7 | 6.7 | 7.5 | 7.5 | 7 | 6.7 | 5.6 | 5.4 | 5.4 | 4.3 | 4 | 4 | 3.8 | 3.2 | 2.5 | 2.4 | 2.5 | 2.4 | 2.4 | 2.1 | 1.3 | 0.7 | 0.2 | 0 | -0.1 | -0.2 | 0 | -0.4 | -0.4 | -0.5 | -0.8 | -0.7 | 0 | 0.3 | 0.8 | 0.8 | 0.6 | 0.5 | 0.4 | 0.4 | 0.2 | 0.5 | 0.9 | 0.9 | 0.7 | 0.5 | 0.4 | 0.5 | 0.3 | 0.7 | 0.7 | 0.7 | 0.6 | 0.6 | 0.4 | 0.1 | 0.2 | 0.5 | 0 | 0.4 | 0.6 | 0.4 | 0.4 | 0.4 | 0.6 | 0.5 | 1.4 | 0.4 | 0.7 | 0.7 | 0.6 | 0.2 | 0 | -0.1 | -0.2 | -0.3 | -0.7 | -0.7 | -1.6 | -0.5 | -1 | -0.8 | -0.6 | -0.6 | -0.8 | -0.8 | -0.6 | -0.8 | -0.4 | -0.3 | -0.4 | -0.5 | -0.3 | -0.3 | -0.4 | -0.1 | -0.3 | 0.2 | 0.7 | 1 | 1.3 | 1.9 | 2.3 | 2.3 | 1.2 | 0.4 | 1.4 | 1.5 | 2.6 | 2 | 1.6 | 2 | 1.9 | 1.8 | 1.6 | 1.5 | 3.5 | 4.9 | 3.6 | 4.3 | 3.6 | 4 | 4.7 | 3.9 | 4 | 5.3 | 5 | 5.4 |

The headline inflation rate in Dec 2023 was 3.7%. The highest figure over the past 10 years was 7.5%, and that was in Sep and Aug 2022.

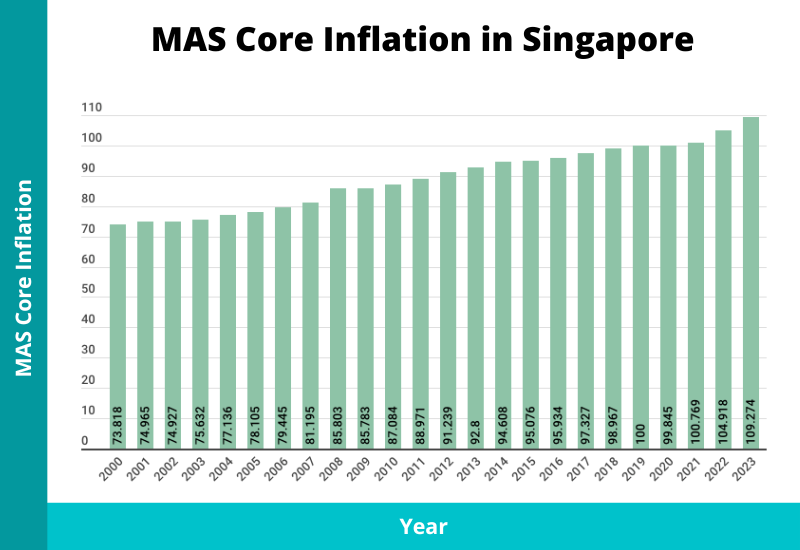

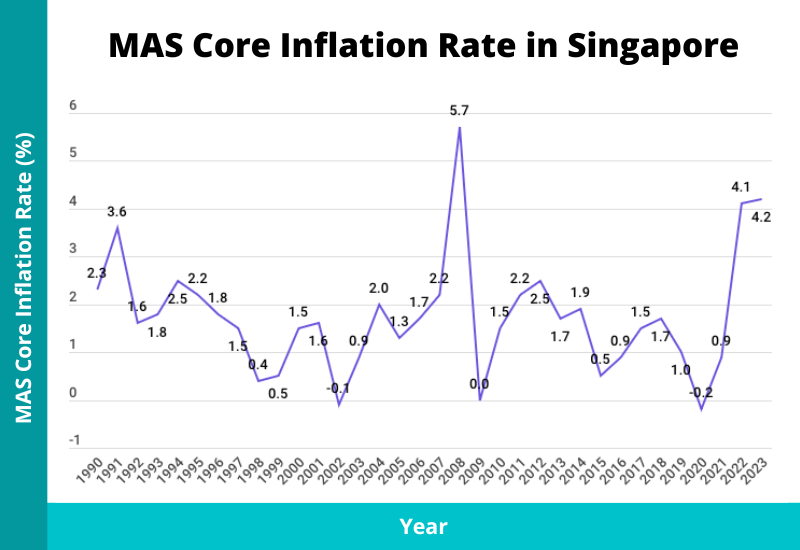

MAS Core Inflation (core)

| 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| MAS Core Inflation | 62.094 | 64.359 | 65.398 | 66.562 | 68.247 | 69.744 | 70.998 | 72.092 | 72.377 | 72.737 | 73.818 | 74.965 | 74.927 | 75.632 | 77.136 | 78.105 | 79.445 | 81.195 | 85.803 | 85.783 | 87.084 | 88.971 | 91.239 | 92.8 | 94.608 | 95.076 | 95.934 | 97.327 | 98.967 | 100 | 99.845 | 100.769 | 104.918 | 109.274 |

| Core Inflation Rate (%) | 2.3 | 3.6 | 1.6 | 1.8 | 2.5 | 2.2 | 1.8 | 1.5 | 0.4 | 0.5 | 1.5 | 1.6 | -0.1 | 0.9 | 2.0 | 1.3 | 1.7 | 2.2 | 5.7 | 0.0 | 1.5 | 2.2 | 2.5 | 1.7 | 1.9 | 0.5 | 0.9 | 1.5 | 1.7 | 1.0 | -0.2 | 0.9 | 4.1 | 4.2 |

The core inflation rate in 2023 was 4.2%. Over a period of 30 years from 1993 to 2023, the highest annual inflation was 5.7% in 2008, while the lowest was -0.2% in 2020.

From 2003 to 2023, the MAS Core Inflation rose 44.5%. Hypothetically, this would also mean that over a period of 20 years, a $10 basket of regular day-to-day expenses in 2003 would cost $14.5 in 2023.

Below, we look at the core inflation on a year-on-year basis.

| 2023 Dec | 2023 Nov | 2023 Oct | 2023 Sep | 2023 Aug | 2023 Jul | 2023 Jun | 2023 May | 2023 Apr | 2023 Mar | 2023 Feb | 2023 Jan | 2022 Dec | 2022 Nov | 2022 Oct | 2022 Sep | 2022 Aug | 2022 Jul | 2022 Jun | 2022 May | 2022 Apr | 2022 Mar | 2022 Feb | 2022 Jan | 2021 Dec | 2021 Nov | 2021 Oct | 2021 Sep | 2021 Aug | 2021 Jul | 2021 Jun | 2021 May | 2021 Apr | 2021 Mar | 2021 Feb | 2021 Jan | 2020 Dec | 2020 Nov | 2020 Oct | 2020 Sep | 2020 Aug | 2020 Jul | 2020 Jun | 2020 May | 2020 Apr | 2020 Mar | 2020 Feb | 2020 Jan | 2019 Dec | 2019 Nov | 2019 Oct | 2019 Sep | 2019 Aug | 2019 Jul | 2019 Jun | 2019 May | 2019 Apr | 2019 Mar | 2019 Feb | 2019 Jan | 2018 Dec | 2018 Nov | 2018 Oct | 2018 Sep | 2018 Aug | 2018 Jul | 2018 Jun | 2018 May | 2018 Apr | 2018 Mar | 2018 Feb | 2018 Jan | 2017 Dec | 2017 Nov | 2017 Oct | 2017 Sep | 2017 Aug | 2017 Jul | 2017 Jun | 2017 May | 2017 Apr | 2017 Mar | 2017 Feb | 2017 Jan | 2016 Dec | 2016 Nov | 2016 Oct | 2016 Sep | 2016 Aug | 2016 Jul | 2016 Jun | 2016 May | 2016 Apr | 2016 Mar | 2016 Feb | 2016 Jan | 2015 Dec | 2015 Nov | 2015 Oct | 2015 Sep | 2015 Aug | 2015 Jul | 2015 Jun | 2015 May | 2015 Apr | 2015 Mar | 2015 Feb | 2015 Jan | 2014 Dec | 2014 Nov | 2014 Oct | 2014 Sep | 2014 Aug | 2014 Jul | 2014 Jun | 2014 May | 2014 Apr | 2014 Mar | 2014 Feb | 2014 Jan | 2013 Dec | 2013 Nov | 2013 Oct | 2013 Sep | 2013 Aug | 2013 Jul | 2013 Jun | 2013 May | 2013 Apr | 2013 Mar | 2013 Feb | 2013 Jan | 2012 Dec | 2012 Nov | 2012 Oct | 2012 Sep | 2012 Aug | 2012 Jul | 2012 Jun | 2012 May | 2012 Apr | |

| MAS Core Inflation | 110.866 | 110.154 | 110.033 | 109.602 | 109.465 | 109.383 | 109.163 | 108.957 | 108.856 | 108.441 | 108.173 | 108.195 | 107.316 | 106.719 | 106.496 | 106.387 | 105.891 | 105.37 | 104.764 | 104.087 | 103.704 | 103.24 | 102.52 | 102.516 | 102.084 | 101.516 | 101.296 | 101.012 | 100.784 | 100.542 | 100.314 | 100.508 | 100.368 | 100.357 | 100.321 | 100.121 | 99.977 | 99.873 | 99.839 | 99.818 | 99.654 | 99.505 | 99.72 | 99.703 | 99.766 | 99.865 | 100.142 | 100.276 | 100.253 | 99.952 | 100.013 | 99.936 | 99.961 | 99.881 | 99.899 | 99.879 | 100.027 | 100.03 | 100.21 | 99.961 | 99.682 | 99.389 | 99.527 | 99.345 | 99.312 | 99.311 | 98.812 | 98.627 | 98.613 | 98.356 | 98.507 | 98.112 | 97.837 | 97.743 | 97.705 | 97.555 | 97.444 | 97.475 | 97.171 | 97.177 | 97.332 | 96.883 | 96.836 | 96.763 | 96.561 | 96.311 | 96.239 | 96.149 | 96.061 | 95.966 | 95.694 | 95.662 | 95.727 | 95.734 | 95.726 | 95.363 | 95.384 | 95.12 | 95.199 | 95.28 | 95.104 | 95.033 | 94.663 | 94.694 | 94.95 | 95.206 | 95.283 | 94.997 | 95.141 | 94.958 | 94.951 | 94.726 | 94.873 | 94.679 | 94.489 | 94.6 | 94.539 | 94.224 | 94.02 | 94.086 | 93.715 | 93.631 | 93.33 | 93.078 | 93.046 | 92.624 | 92.535 | 92.523 | 92.372 | 92.325 | 92.407 | 92.005 | 91.835 | 91.679 | 91.653 | 91.519 | 91.421 | 91.196 | 90.99 | 91.02 | 91.131 |

| Core Inflation Rate (%) [Year-on-Year] | 3.3 | 3.2 | 3.3 | 3.0 | 3.4 | 3.8 | 4.2 | 4.7 | 5 | 5 | 5.5 | 5.5 | 5.1 | 5.1 | 5.1 | 5.3 | 5.1 | 4.8 | 4.4 | 3.6 | 3.3 | 2.9 | 2.2 | 2.4 | 2.1 | 1.6 | 1.5 | 1.2 | 1.1 | 1 | 0.6 | 0.8 | 0.6 | 0.5 | 0.2 | -0.2 | -0.3 | -0.1 | -0.2 | -0.1 | -0.3 | -0.4 | -0.2 | -0.2 | -0.3 | -0.2 | -0.1 | 0.3 | 0.6 | 0.6 | 0.5 | 0.6 | 0.7 | 0.6 | 1.1 | 1.3 | 1.4 | 1.7 | 1.7 | 1.9 | 1.9 | 1.7 | 1.9 | 1.8 | 1.9 | 1.9 | 1.7 | 1.5 | 1.3 | 1.5 | 1.7 | 1.4 | 1.3 | 1.5 | 1.5 | 1.5 | 1.4 | 1.6 | 1.5 | 1.6 | 1.7 | 1.2 | 1.2 | 1.5 | 1.2 | 1.3 | 1.1 | 0.9 | 1 | 1 | 1.1 | 1 | 0.8 | 0.6 | 0.5 | 0.4 | 0.3 | 0.2 | 0.3 | 0.6 | 0.2 | 0.4 | 0.2 | 0.1 | 0.4 | 1 | 1.3 | 1 | 1.5 | 1.4 | 1.7 | 1.8 | 2 | 2.2 | 2.1 | 2.2 | 2.3 | 2.1 | 1.7 | 2.3 | 2 | 2.1 | 1.8 | 1.7 | 1.8 | 1.6 | 1.7 | 1.7 | 1.4 | 1.7 | 1.9 | 1.2 | 1.9 | 2 | 2.2 | 2.4 | 2.3 | 2.4 | 2.7 | 2.7 | 2.7 |

The MAS core inflation rate in Dec 2023 was 3.3%. Since Jul 2014 (2.2%), the highest core inflation was 5.5% and that was in Jan and Feb 2023.

Overall, if we were to combine both graphs of the CPI All-Items and the MAS Core Inflation together, here’s what it’ll look like:

Singapore’s Inflation Rate Forecast (2024)

According to MAS, in 2024, the CPI All-Items inflation was expected to be 2.5-3.5% and the MAS Core Inflation to be between 2.5-3.5%.

What Is the Average Annual Inflation Rate in Singapore?

In financial planning, one of the most common applications for an average annual inflation rate is the ability to project future costs.

It is essential to do so because you can’t just take your current level of expenses and expect it to be the same decades later; costs will rise.

Using a constant average rate of inflation – though it may not be reflective of actual price increases – provides simplicity in planning since inflation rates fluctuate all the time.

In order to calculate the average, you can’t just take the sum of the annual inflation rates over a period and divide it by the number of years.

Instead, this formula should be used: PV (1+r)^n = FV

Where

r = the compound average annual rate of inflation

n = the number of years

PV = the CPI for the 1st Year

FV = the CPI for the 2nd Year

(We can use a financial calculator for this.)

And here are the average annual inflation rates in Singapore:

| Average Headline Inflation Rate (CPI All-Items) | Average Core Inflation Rate (MAS Core Inflation) | |

| Over the last 10 years (2013 to 2023) | 1.44% | 1.65% |

| Over the last 20 years (2003 to 2023) | 2.08% | 1.86% |

| Over the last 30 years (1993 to 2023) | 1.73% | 1.67% |

Why Is Singapore’s Inflation Rate So Low?

When you look at the average yearly inflation rates above, you may wonder why they are so low, because it often doesn’t feel like that in daily life.

One reason for this could be our own unique experiences and perceptions. For example, when we only pay attention to certain items that we don’t purchase often and notice a “sudden” increase, we may think that prices are rising at a fast pace.

Another reason for this “disconnect” is because of a limitation to the CPI’s data.

In compiling the prices of different goods and services, a fixed basket has to be used since it’s almost impossible to track the price of every single item out there. As a result, actual household expenses may deviate from these data (i.e., not all households buy the same items).

Having said that, the data still provide meaningful insights.

How to Project Future Costs?

Taking a look at the average rates, we can see that they don’t exceed 2.00%.

To project future costs, we should include a buffer in order to ensure that we still have enough in case things go sideways. For that, you could assume a rate of 3.00 or 4.00%.

To calculate how much you need for retirement, you can simply take your expected expenses during retirement (in today’s value) and apply an inflation rate of, say, 3.00% over the number of years to your retirement age. Or, you can simply use a retirement planning calculator.

The same concept applies to calculating your children’s education fund.

Apart from projecting future costs, you can also estimate the “real” rate of return on an investment by simply taking the expected rate from that investment and subtracting the inflation rate.

In knowing the average inflation, you can also see how your cash is devaluing over time. To illustrate, if you leave $10,000 in the bank while earning 0.05% per year with an annual inflation of 3%, that “value” is worth only $5,494.28 after 20 years.

What Can You Do About the Rising Cost of Living and How to Beat Inflation?

A moderate amount of inflation is perfectly normal in a growing economy.

Singapore has gone through good economic growth, and its standard of living (and the costs of it) have gone up since its independence.

It’s very likely that inflation will continue for a long time, and along with it, effects such as the rising cost of living and cash in the bank losing value over time.

So what can we do to prepare for this?

Firstly, it’s vital to have the various types of insurance plans in place, so that your income and your wealth can remain protected.

Outside of having sufficient emergency funds and short-term financial goals and commitments, you should consider placing your excess cash into various alternatives that can provide potentially higher returns above the average annual inflation rate.

If you’re planning for your retirement, consider some options to invest your money, depending on your risk appetite.