Saving money requires disciplined action or inaction (not spending).

If you’re saving for retirement, that takes years of monk-like patience and commitment.

But through it all, the act of saving just doesn’t cut it.

Your savings should be put into better use, right at the very beginning.

So, here are some of the best investments you can make for retirement, ranging from the most secure to the riskier ones.

Read on!

How Much Should You Save for Retirement

Saving for retirement is vague. There’s more to it.

To start off, what is retirement to you? What’s your ideal retirement lifestyle?

Do you want to sail off to the seas and enjoy what the world can offer?

Brainstorming what you want can give you an indication of how much you’ll need in the future.

But in the whole retirement planning process, there are smaller elements that play a part, which makes the process not as simple.

Having said that, the most important aspect is to focus on this: achieving your retirement goal.

It won’t be easy because it’s usually a big figure, and thus, highlights the importance of retirement planning which should be initiated many decades before your retirement age. If not, it might be too late.

If you’ve not gotten your figure of how much you need to retire in Singapore, try out retirement planning calculator.

That way, you can see how much of a shortfall you’re lacking.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Compound Your Interests in the Long Run

To cover up the shortfall in retirement funds, you need to bring in more money.

In my opinion, the best investments you can make to earn more money is in your career and/or business.

That’s because you should’ve been an expert in what you do.

Once that’s taken care off, your income would’ve grown considerably, resulting in more disposable income coming in.

The next step: not spend it frivolously and simply save.

However, that’s just one half of the equation.

The other half is to invest it (whether it’s in safer financial instruments or riskier ones)

Why?

Because of the low interests given by parking your money in the bank account, coupled with the inflation rate (rising costs of living).

If you do nothing, you’re guaranteed to lose monetary value in the long run.

Think: 10 years back, coffee priced at $0.50, but now it’s $1.

And..

It’s also about earning interests on interests.

If you use our compound interest calculator, you can see how your money will grow exponentially with higher returns.

Simply investing a sum of money every month will help you achieve a greater goal that may seem hard to achieve at the start.

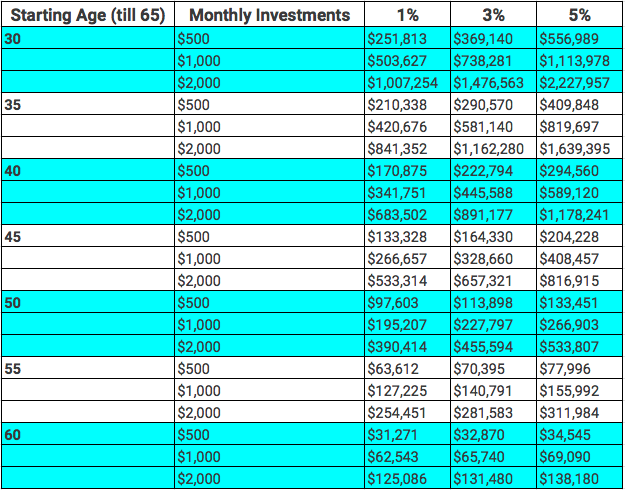

Here’s an illustration if your retirement age is at 65.

Knowing this is important for you to get your feet wet, and start doing something about investing.

The next logical step is to decide what type of investments to make.

Before You Get Your Feet Wet, Ensure You Have Sufficient Insurance Coverage

Before starting on any investments, it’s vital to have adequate insurance coverage in place.

At the foundational level, hospitalisation coverage (MediShield Life and its upgrade, Integrated Shield Plan) has to be in place. It’ll ensure that huge bills from accidents, injuries, and illnesses can be reduced significantly so you don’t have to dig into your savings or investments.

The next would be income protection.

This can be done primarily through term insurance, whole life insurance, or early critical illness plans.

Permanent loss of income primarily comes from 3 reasons: death, total and permanent disability, and critical illnesses. When such things happen, income usually stops.

Who’s going to pay for your family’s monthly expenses and commitments then?

So, in such situations, payouts from these insurance plans can replace the loss of income. Check out how much life insurance coverage you should have.

There are other insurance plans out there but these are the core ones to take note of.

They are there so that the majority of your hard-earned savings and investments will not be easily wiped out.

A Commonly Used Investment Strategy for Retirement

You may have other financial goals such as providing for your kid’s education, or leaving more for your dependants when you’re not around anymore (you should take a look at estate planning instead).

But when you combine everything together, it may not be so simple anymore. You may want to approach a financial advisor.

So from here onwards, it’s only from a retirement perspective.

Here are 3 factors to consider to help you select the best retirement investment options:

- Time

- Risk

- Return

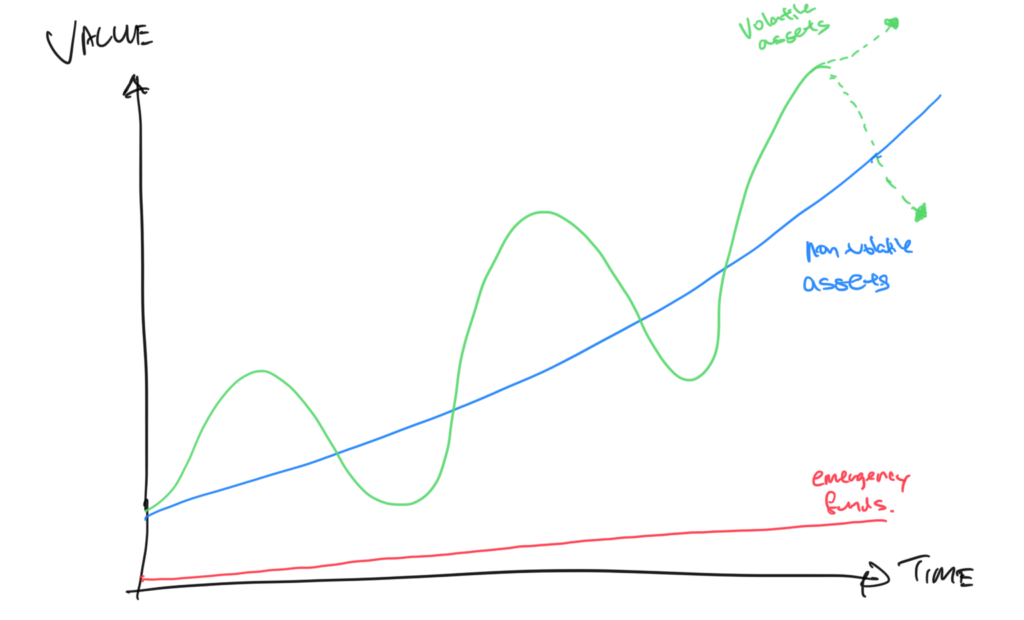

Going even deeper, there are 3 types of broad assets you can hold:

- Emergency funds

- Non-volatile assets

- Volatile assets

I’ve written a post on one retirement investment strategy, but the overview is this:

When you’re young, you can take more risks (and thus have higher potential earnings). But when you get older and depending on how much of a shortfall you have, you may want to reduce such volatile investments and place them in non-volatile ones to lock in profits and simply have stability.

With that said, let’s finally move on to the different options.

7 Best Investment Options for Retirement

Where should you invest your savings meant for retirement?

The answer to that question usually comes after knowing your risk profile, preferences, and how much financial knowledge you have.

It ultimately depends on the risk-return tradeoff, and what you’d be holding can be a combination of various types of investments.

Here’s a list of the common options:

- Savings Accounts

- Fixed Deposits (and Short Term Insurance Savings Plans)

- Bonds

- Retirement Plans (Annuities)

- Individual Stocks and Shares

- Index Funds, ETFs, and Unit Trusts

- Real Estate Properties and REITs

And an overview of each type below..

1) Savings Accounts

While that plain vanilla savings account you have since young gives you close to nothing interest of 0.05% per year, it provides 2 benefits.

Firstly, you should keep some emergency funds in such accounts so that you’re able to withdraw/deposit almost instantly. In emergencies, this is crucial because the event will be unexpected. You wouldn’t want to wait for a week to be be able to access funds meant for emergency purposes.

Secondly, although you don’t need liquidity because retirement is still far away, this becomes different when you’re reaching/reached your retirement age. You’ll need to have some funds in such savings account for day-to-day expenses. And it could also be a good time to liquidate some volatile assets to non-volatile ones.

In recent times, high yield interest accounts come with a multiplier/tiered structure. It’s a good marketing strategy to get you to deal with the bank more such as spending a certain amount, using the account as a salary crediting account, etc.

The higher interest that it can provide is great and all, but I wouldn’t get too fanatic about it because it could steer you away from the bigger picture: earn more; spend less.

Additionally, such rates are usually “promotional” and have been drastically revised downwards.

Because of opportunity costs, a majority of your funds shouldn’t be parked in a savings account.

2) Fixed Deposits (and Short Term Insurance Savings Plans)

Most of us would know about what a fixed deposit is.

It’s offered by banks to give you interest on the principal amount you deposited with them. The interest you can get usually depends on the length you’re planning to deposit with them and the principal amount.

A longer term and bigger principal amount equate to higher interest that would be given.

Such fixed deposits are low risks as you’re likely to not lose your principal, and could usually terminate it at any point of time.

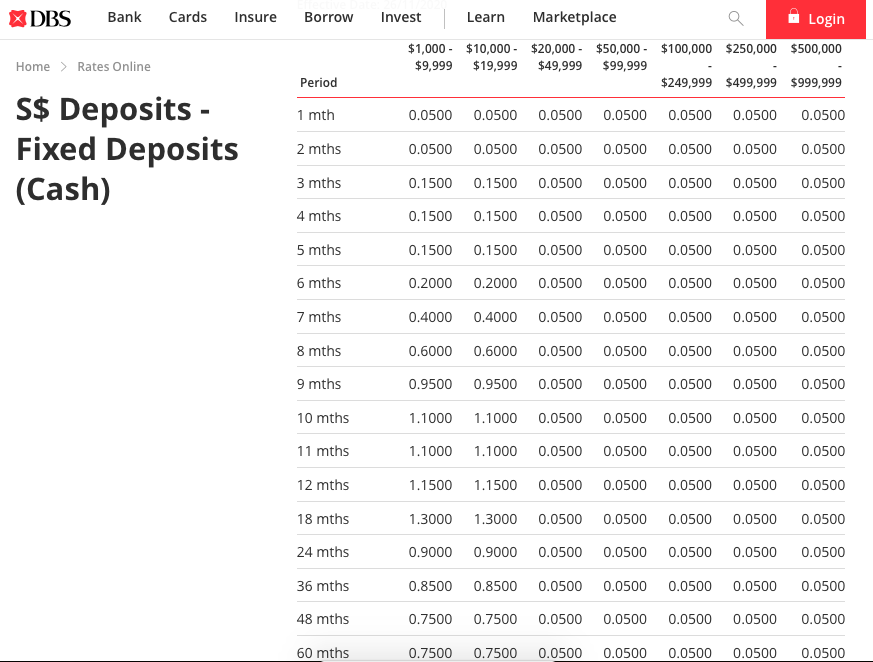

However, the interests may not be that attractive nowadays.

Here are some fixed deposit rates offered by DBS (as of November 2020):

In recent years, new types of insurance plans that emulate saving accounts and fixed deposits are introduced into the market.

Depending on the plan, they can give slightly higher interest compared to the bank if you leave it for a fixed period of time (like a fixed deposit).

Or higher interest than a savings account while still providing the option of withdrawal/depositing (like a savings account).

These options are great ways to park your emergency funds in.

However, take note that these are meant to be attractive to acquire new users. The companies may revise these rates downwards in the future.

And they may come with “reinvestment risk” which I’ll touch on soon.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

3) Bonds

When corporations or governments want to raise money, they may issue bonds.

Basically, by buying the bonds, you’re “lending” them money, and in return, these bonds usually pay out coupons (interests).

The important consideration when you want to buy bonds is the ability of the bond issuer to pay out the said coupons and the principal when they’re due, and that’s primarily reflected in the credit ratings.

With a good credit rating, the company/government can pay out lower coupons (better cost of borrowing for them) compared to one which has a bad rating, and vice versa.

Bonds can be purchased via these methods:

- Individual bonds from SGX

- Bond ETF funds

- Bond unit trusts

- etc

Although these investments may have fluctuations, they’re usually less volatile compared stocks and shares.

In addition, there’s also the Singapore Savings Bond (SSB) which is part of the Singapore Government Securities (SGS) which consist of various government bonds and bills.

When you buy a SSB, you get paid an interest for a period of up to 10 years. At any point of time, you can withdraw the principal without any penalties.

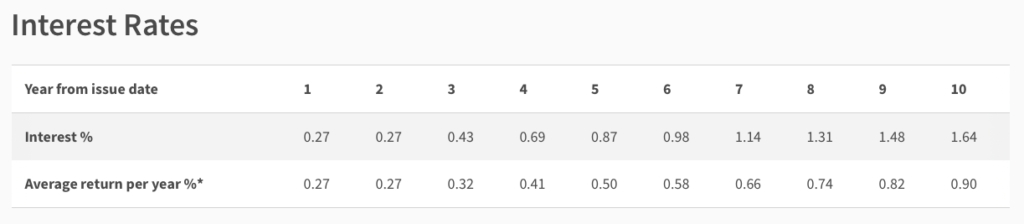

Here’s an example of the SSB rate for January 2021:

From an investment perspective, it makes sense to hold it for the full 10 years to get the highest returns – look at the average p.a return in the 10th year column (0.90%).

However, SSB may have lost its shine.

As new bonds are issued every month, the rates will differ. And the rates have been dropping.

To illustrate this, here are the average p.a returns (for 10 years) for the past year:

| Month / Year | Avg p.a Return for 10 years (%) |

|---|---|

| Oct 2020 | 0.90 |

| Sep 2020 | 0.88 |

| Aug 2020 | 0.93 |

| Jul 2020 | 0.80 |

| Jun 2020 | 1.05 |

| May 2020 | 1.39 |

| Apr 2020 | 1.63 |

| Mar 2020 | 1.71 |

| Feb 2020 | 1.75 |

| Jan 2020 | 1.76 |

| Dec 2019 | 1.71 |

| Nov 2019 | 1.74 |

To further add more information, the average p.a return (for 10 years) in December 2018 was 2.57%.

And there’s also a “reinvestment risk”.

Basically, you’d know when you require funds, and that’s for retirement income during your retirement years.

That would’ve meant that you don’t really need liquidity or short term solutions because they introduce another issue – you’d need to find similar or better alternatives once these solutions mature.

So if possible, consider longer term solutions as they can command better rates that can be “locked in”.

4) Retirement Plans (Annuities)

The primary purpose of a retirement annuity plan is designed to offer retirement income for a definite period of time, starting from the selected retirement age.

It can be funded on a regular basis (yearly) for a fixed period, or as a single lump sum.

The attractiveness of such plans is that it allows you to participate in guaranteed and non-guaranteed returns.

Most of such plans are also capital-guaranteed upon maturity. Meaning, as long as you’ve fulfilled your premium obligations and held on to the plan for the entire policy term, your capital is protected.

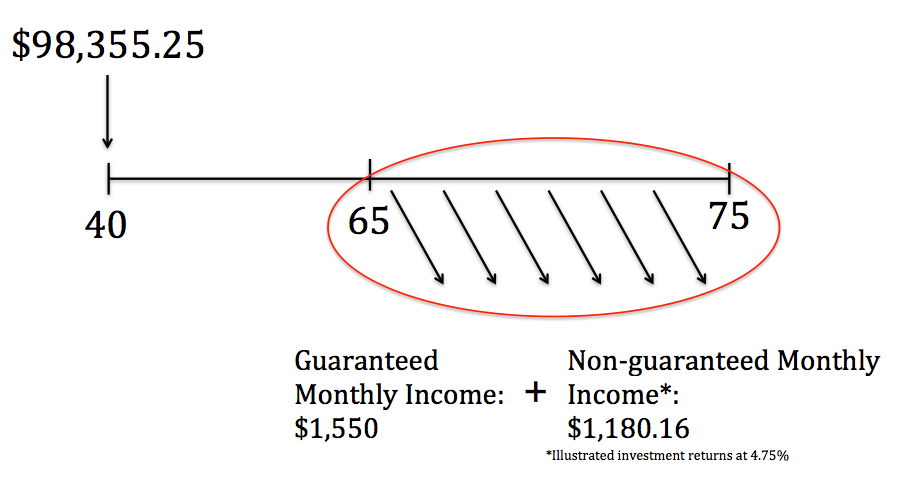

Here’s an illustration of what such plans can offer:

If you decide to set aside a lump sum of $98,355.25 into the plan at 40 years old, you can receive the following income from 65 to 75 years old:

Guaranteed monthly income: $1,550

Non-guaranteed monthly income: $1,180.18 (illustrated @ 4.75% investment returns)

Total monthly income: $2,730.18 (guaranteed + non-guaranteed)

Total income received: $327,621.6

Total premium paid: $98,355.25

So you can see that the annuity plan can offer decent returns in return for you committing to it for a longer period of time. At the same time, the downside risk can be significantly reduced. It’s also flexible to your needs and you can also fund it on a regular basis instead of a lump sum.

The main drawback is this:

These plans are meant for long term commitment. If you decide to withdraw/surrender the plan before its maturity, you may incur losses, and may get back lesser than what you’ve put in.

So know the risks involved, and not over-commit.

However, if you’ve done proper retirement planning such as setting aside emergency funds, projecting how much you need, having catered for other financial goals, there isn’t much to worry as retirement is the last most important financial goal that most people have.

So far…

We’ve covered some of the non-volatile investment options.

They are safer alternatives that have lesser volatility.

The following options come with higher volatility, and are meant for those who are willing to take risks.

The risks of fluctuations in the value (which may be undesirable when you need it), and also a potential loss in capital.

As a general guide, as you get closer to your retirement age, you should consider liquidating some of your volatile assets into non-volatile ones to lock in profits.

5) Individual Stocks and Shares

Stocks and shares can offer higher potential returns in the form of capital appreciation (rise in share price) or paying out dividends.

They generally come with higher risks compared to non-volatile assets, and can be bought in exchanges such as SGX.

When you buy a stock, you’re essentially buying a piece of the underlying business, as if you have ownership of it.

By studying the companies’ financials, its strengths and weaknesses, general outlook, like what a business owner would do, you’re able to determine whether the current share price of that business is a value buy or not.

It does take time and resources to do it well, and at the end of the day, like every other businesses, there aren’t guarantees. But that’s okay, because that’s the price of doing business.

It can have upsides as well as downsides, but hopefully if you’ve done your research well, you should’ve chosen businesses where the probability of upsides are higher.

Unless you’re certain that a particular company/stock deserves your full investment, you might want to diversify further by including other stocks to spread the risk. If not, if that one stock doesn’t do well, it’ll cause a massive drop in your overall portfolio.

This diversification can be done by purchasing other stocks, or simply by investing into a fund (next section).

6) Index Funds, ETFs, and Unit Trusts

To make things simple, I lump all these together in the same category although they do have their own characteristics.

In such funds, you’re simply investing in a basket of goods which could comprise of multiple stocks/shares, bonds, commodities, etc. The funds could also focus on a particular geographical area, industry, objective, etc.

They could also differ in the type of fund management – passive or active.

An example of passive fund management can be an STI index fund, which tries to replicate/hold the STI Index.

An example of active fund management could be a fund management company investing in various technology companies in China.

Although fees from active fund management are usually higher, this is because there are more research, expertise and administrative costs involved.

Funds are great if you want to spread out your risks.

7) Real Estate Properties and REITs

As Singapore is a small and land-strained country, its land is highly prized.

As the population increases, the increase in land demand (coupled with limited land-supply) would cause the prices of land (and properties) to increase as well. Compared to other forms of investments, properties can seen as “safe” investments because of the above reasons, and they are physical investments – you can see and touch it.

There are generally 2 types of real estate properties: residential and commercial. Returns on investments can be made from property value appreciation (rise in the value) and rental income.

The following will be my opinions..

Residential properties would always be in higher demand, as they are a necessity.

However, there are certain disadvantages:

- rental yields have decreased

- additional buyer stamp duty

- rental income depends on availability of tenants

- have to deal with tenants

- etc

Investing in residential properties do have their pros and cons. On a side note, you can consider 3-generation lifetime income plans that can try to emulate “rental income” without the hassles.

On the other hand, my opinion is that commercial properties – which can be bought individually or through a through a Real Estate Investment Trust (REIT) – may not be as attractive as once before.

Why?

With the introduction of digitalisation and e-commerce, commercial properties may be under constraint.

An example:

E-commerce has been more prominent as the adoption gets higher, especially in Covid-19 times. Even if you may visit physical stores to get a look and feel of an item, you may end up buying the item from another online vendor at a cheaper price. So that physical store still incurs rent but doesn’t generate the sales revenue. In the end, if the business doesn’t do well, it’ll close and the landlord doesn’t receive rent, and has to find another tenant. The cycle may repeat again.

Another example:

With Covid-19, certain businesses realise that they can still operate without a physical office space. While issues of productivity may arise, businesses can cut a significant portion of their expenses by reducing their office space or eliminating it entirely. These all leads to lower demand of commercial spaces, which may lead to lower rental income and thus reduce the viability of REITs (most REITs are commercial-related).

All in all, the list of these investment options for retirement isn’t exhaustive, and there are others out there. But those are the common ones you should take note of.

Why Retirement Plans (Annuities) Have a Good Mix of Risks and Returns

Depending on your current life stage, different investment options may be suitable.

Even so, individuals are different and should go through a needs-based analysis first.

One may prefer stocks investments while the other may prefer REITs.

So it’s all on a case-by-case basis.

Having said that, retirement annuity plans are unique in the way that they’re usually capital-guaranteed upon maturity, thus offering a safe haven for your hard-earned money.

At the same time, they allow you to participate in non-guaranteed gains.

As the annuity plan can be tailored to your specific retirement age, length of accumulation period, amount to save, they can cater to the specific needs of most people.

What’s Next?

Planning for your retirement is a daunting task.

It seems that there are lots of things to take note of, but in reality, it can be simplified, as they are core components.

Take time to look through our guide to retirement planning in Singapore – information you’ll need to know.

If you wish to know more, check out what are retirement plans (annuities).