Retirement planning should always be done as soon as possible.

If not, you may find yourself in a sticky situation where you don’t have enough financial resources for your desired retirement lifestyle.

While there are many ways to save for retirement in Singapore, a retirement annuity plan provides a decent combination of guarantees and potential upsides.

In this guide, you’ll learn everything about the annuity plan, including what it is, how it works, the pros and cons, etc.

So, read on!

This page is part of the Retirement/Annuity Plan 2-Part Series:

What Is a Retirement Annuity Plan?

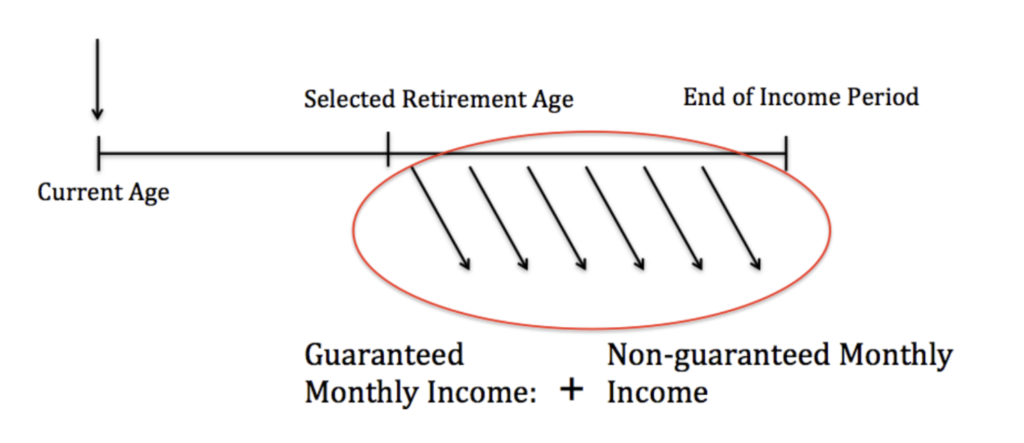

A retirement annuity is designed to supplement retirement income in your later years. It is basically an insurance policy that provides regular payouts (usually monthly) for a specific period of time (e.g., 10 years, 20 years, lifetime, etc) from the desired retirement age.

The plan is typically funded through regular premiums at earlier ages. This is so that you’re able to start small, be able to accumulate a larger amount over time, and enjoy higher potential returns.

One example of annuities is the CPF LIFE. It’s able to provide CPF members turning 65 years old with lifetime payouts, which are derived from their CPF savings. However, depending on one’s needs, it may not be enough (check out our retirement calculator to calculate how much you need). This is especially so when you use a chunk of your CPF OA savings to pay for your property, leaving you with lesser CPF savings meant for retirement.

This is why private annuities offered by insurance companies can be a good complement, and it is the focus of this article.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

How Does a Retirement Annuity Work?

Here’s a simple overview of how retirement plans work:

The premiums that are contributed by policyholders are pooled together into what’s called a participating fund (it’s the same concept with endowment savings plans). The insurance company then reinvests these funds into various asset classes, such as bonds, equities, properties, etc.

In return, as long as you don’t surrender or terminate the plan before its maturity, the guaranteed payouts you would receive usually exceed what you’ve put in, and on top of that, there are still non-guaranteed payouts.

In essence, the risk of losing your capital will be borne by the insurance company, yet you’re still able to enjoy potential upsides.

Get a comparison of the best retirement annuity plans in Singapore.

Factors to Consider When Purchasing a Retirement Plan

There are different types of annuities out there. Here are some things to take note of.

1) Premium mode

There are two main modes of premium payment: single premium and regular.

Single premium is straightforward. You decide to allocate a lump sum into the plan. For example, if you plan on using your SRS funds to invest in an annuity, only the single premium option is available.

With all else the same, a single premium option tends to give better returns compared to a regular premium option (e.g., $100,000 vs $10,000*10). But, this may not be feasible for most people, which is why the regular premium option is more commonly utilised.

The most common types of regular premium are monthly and yearly. While monthly is more wallet-friendly, paying yearly tends to reflect better numbers (e.g., premium discount or better returns).

2) Premium payment term

This is basically how long you want to contribute to the plan.

It can be one year (i.e., single premium), five years, 10 years, 20 years, etc.

The shortest timeframe may not always be the best as you might not be able to accumulate enough for your retirement needs.

3) Retirement age

In today’s market, retirement plans are typically geared towards people who are still far away from their desired retirement age.

For example, immediate annuities (which pay out immediately) are extremely rare or have become obselete.

Here are some of the common retirement ages that you can select:

- Age 55

- Age 60

- Age 65

- Age 70

4) Income payouts

The regular income, usually paid out monthly, you receive from the plan will be one of the most important factors to consider.

That income is made up of guaranteed and non-guaranteed portions.

In most cases, the total guaranteed income should exceed the total amount you’ve put in, as long as you hold the plan till its maturity. This means that your money is in safe hands. On top of that, the non-guaranteed income you may receive can be significant.

5) Income payout period

You’re able to decide how long you wish to receive the income.

Since CPF LIFE provides lifetime payouts, most people who are looking at private annuities opt for shorter payout durations, such as 10 years or 20 years.

Having a shorter income payout period can have multiple benefits. One such benefit will be that the regular income is higher (compared to lifetime payouts) and thus, will be more impactful during your golden years (especially earlier on when you’re healthy and be able to spend more).

Pros and Cons of Retirement Annuitiy Plans: Are They Worth It?

Here are some advantages and disadvantages you should know.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Pros

1) A form of diversification

There’s a wide range of investments in the market, ranging from low-risk savings accounts to equities.

With regards to building financial resources for your retirement, a mixture of these investments could be beneficial.

Bank accounts give security and are very liquid, but that’s about it. If you put too much in them, inflation (average of 1.52%/year over the past 30 years) will reduce its value over time.

On the other hand, volatile investments (e.g., stocks) give potentially higher interest but its value can fluctuate, so the risk of losing capital is still possible. If you’re doing your own investments, it also takes up time and effort.

Thus, striking some form of balance by holding different sets of investments could be great for the stability of returns (as well as your emotional/mental health).

Retirement plans could give that balance by providing guarantees (they’re often capital guaranteed upon maturity) and allowing you to participate in upsides in the form of non-guaranteed bonuses. Sure, these returns may not be as high as what volatile investments can achieve, but at least that money is still growing rather than collecting dust in the bank. Furthermore, it would be a passive approach, so it frees up time to spend on yourself and your family.

2) Predictable income during your golden years

Because of the structure of annuity plans, there’s predictability.

This is important as retirement will come at a specific time, and you’ll likely need to have income for a specific duration as well.

If you already know how much you need for retirement, you can better plan for that with annuities.

Why? If you were to place too much money into volatile investments, there is a possibility that the value will drop when it’s time for you to retire. What would you do, then? Sell them off at a loss? Or hold on to them?

Don’t forget, you’ll still need money to retire on and it has to come from somwehere.

3) Can be tailored to your needs

Everyone is different. Your needs for retirement will not be the same as the person next to you.

Here are some of the different needs people have:

- Wanting to start saving for retirement early or late

- The amount of budget that can be set aside

- The length of the savings period

- Choice of retirement age

- Duration of retirement income

Thankfully, most retirement plans are flexible enough to address the unique concerns and requirements you may have.

4) Guaranteed issuance with no medical underwriting

As we grow older, our health may deteoriate.

If you have a pre-existing condition (or even small ailments) and tried to apply for insurance before, you’ll know it can be difficult to get accepted.

Modern annuity plans eliminate this problem as most of them have negligible insurance coverage (death benefit is typically slightly more than what you’ve put in).

This means that most of the premiums you would be paying goes to making your money grow.

Having said that, in financial planning, you should already have proper and adequate insurance coverage before starting to accumulate wealth.

Cons

1) Early surrender may result in a loss of capital

While insurance companies can provide structured payouts and absorb some investment risks on their end, there are conditions that you must adhere to.

These plans are made to be held for the long term. A premature withdrawal/surrender/termination will have a negative impact, such as the amount you receive back is lower than what you’ve put in.

Therefore, before deciding to take up such a plan, you shouldn’t forsee yourself surrendering it early or even during the income payout period. To reduce the risk of that happening, you shouldn’t overload yourself and you should always have emergency funds on hand.

2) Projected bonuses are not guaranteed

These plans provide guaranteed payouts, which usually exceed the total amount of money you’ve put in, if you hold it for the entire duration.

On top of that, you would also receive non-guaranteed payouts, which can be substantial.

That amount depends on the participating fund’s performance. While insurance companies try to pay out these bonuses because of various reasons (e.g., reputation), it is still non-guaranteed in nature. This is something you have to be comfortable with – what you eventually receive could be lower than the illustrated returns in the policy documents.

What’s Next?

Are retirement plans worth it?

Even after reading this article, you may not get the full picture because one of the key considerations is missing, and that’s the potential returns you can receive.

Only by comparing that between the various insurance companies will you be able to make an educated decision.

So, take the first step by comparing the best retirement annuity plans in Singapore now!