What’s this SRS that your friends and colleagues are talking about?

How can it help you to save on taxes AND provide for your retirement needs?

If you’re earning an healthy amount of income, you need to know about SRS.

In this guide, I’ll touch on everything important about the Supplementary Retirement Scheme (SRS). If you’re a foreigner, read this page on SRS instead.

So, let’s get on with it!

This page is part of the SRS 4-Part Series:

- Part 1: What is SRS?

- Part 2: Best SRS Investment Options

- Part 3: The SRS Annuity (Endowment)

- Part 4: The Best SRS Annuity (Endowment)?

What is SRS?

While the CPF Ordinary Account and Special Account are meant to provide for the basic needs of retirement, the Supplementary Retirement Scheme (SRS) is what the name suggests – it supplements it.

Started in 2001, the only way to fund the SRS account is through cash.

With the many tools available to achieve your retirement goals, why should you contribute to SRS?

That’s because of the SRS’s core benefit: Tax Savings.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Who can Contribute to SRS?

If you’re a Singapore Citizen, Singapore Permanent Resident or a Foreigner who’s earning an income, you can contribute to SRS in the current year.

These are the requirements:

- At least 18 years of age;

- Not an undischarged bankrupt;

- Not suffering from a mental disorder; and

- Capable of managing yourself and your affairs.

Apart from that, your employer can also make contributions to your SRS account on your behalf.

Although your employer’s contributions are still taxable, you will enjoy the tax relief.

How does SRS Work?

Most see SRS as a tool for “tax reduction”.

That can be true.

But if you were to zoom out, it’s a “tax deferment” scheme instead.

You’ll understand why this is so once you’ve gone through this guide.

Let me explain the whole picture by breaking it down into 3 simple parts:

- Contributions

- Tax Relief

- Withdrawals

How Much Can You Contribute to SRS?

As mentioned, all contributions can only be made in cash.

These contributions add on to your tax reliefs.

Does it mean that you can just contribute as much as you want?

No.

There is a maximum yearly contribution limit (YA 2017 onwards):

For Singapore Citizens/SPRs

- $15,300

For Foreigners

- $35,700

These contributions must be made by 31 December of the year or as your operator requires, to be eligible for tax reliefs.

SRS Tax Reliefs

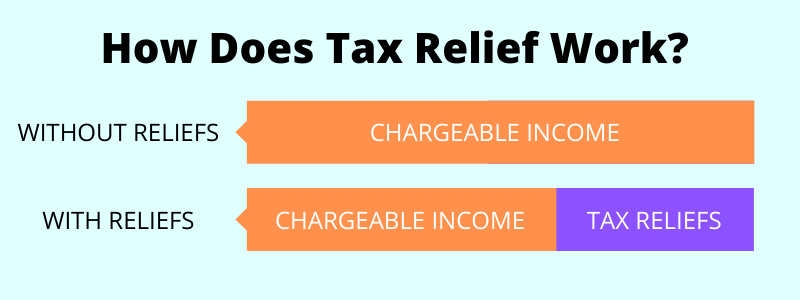

The diagram below explains everything.

When you make a contribution to SRS, your total personal reliefs increase, which then reduces your total taxable income.

And when your total taxable income decreases, the amount of taxes you need to pay decreases as well.

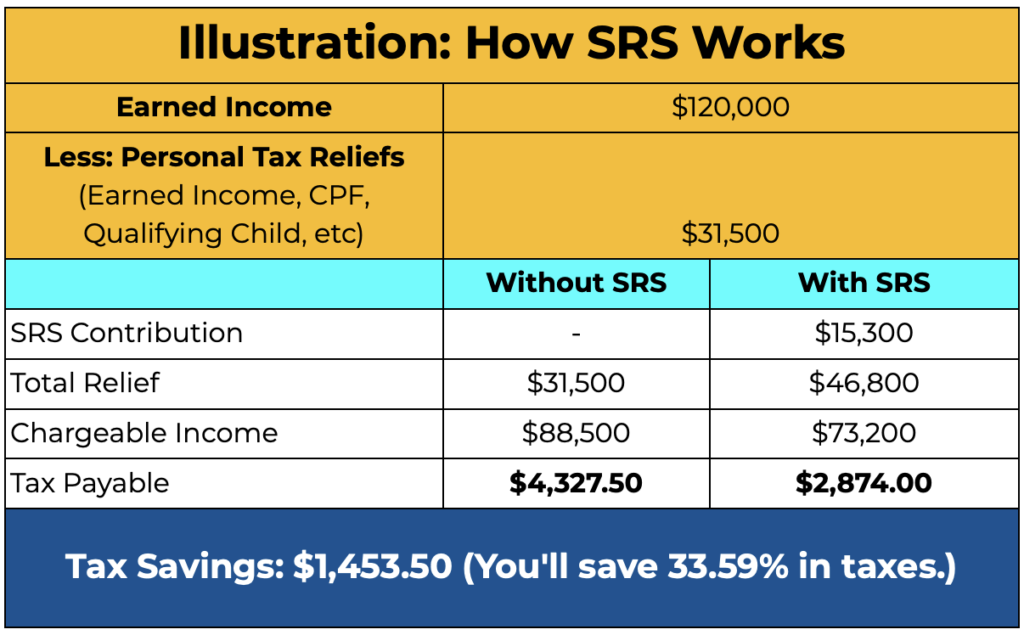

Let me give you an illustration:

And how do these figures differ according to different income levels?

Assuming all the various income earners currently have $0 in personal reliefs:

| Annual Income | Income Tax (before $15,300 SRS Contribution) | Income Tax (after $15,300 SRS Contribution) | Tax Savings |

| $20,000 | $0 | $0 | $0 |

| $40,000 | $550 | $94 | $456 |

| $60,000 | $1,950 | $879 | $1,071 |

| $80,000 | $3,350 | $2,279 | $1,071 |

| $100,000 | $5,650 | $3,890.50 | $1,759.50 |

| $150,000 | $12,450 | $10,155 | $2,295 |

| $200,000 | $21,150 | $18,396 | $2,754 |

As you can see, the greater your income, the higher your absolute tax savings are.

It also means that for a dollar of SRS contribution, it has a greater positive impact on higher income earners.

Let me illustrate with 2 people contributing $15,300 each to their SRS accounts with 1 earning $100,000 and the other at $200,000:

| Annual Income: $100,000 | Annual Income: $200,000 | |

| SRS Contribution | $15,300 | $15,300 |

| Tax Savings | $1759.50 | $2,754 |

| Tax Savings Per Dollar of SRS Contribution | $0.115 | $0.18 |

So you can see that for a dollar of SRS contribution, the higher income earner enjoys greater tax savings by 56.52% ((0.18-0.115)/0.115)

Perhaps that might give you an incentive to earn more?

If you want to check out how much tax savings you can get, take a look at the SRS Tax Relief Calculator here.

But as mentioned, there’s a contribution cap.

And on top of that, there’s another limit you must know: Personal Relief Cap of $80,000

Here are IRAS’s own words:

Please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions). There will be no refund for SRS contributions made. Please evaluate whether you would benefit from tax relief on your SRS contributions, and make an informed decision.

IRAS

If you’ve already hit the personal relief cap of $80,000 (without SRS contributions) and you still contribute to SRS, you don’t gain any more tax benefits.

Mothers who have more than 1 child and earn a high income have a higher chance of hitting this personal relief cap.

Once you’ve made a contribution, your SRS balance earns a 0.05% interest per year. Without investing (which you’re allowed to do so), it eradicates any tax benefits in the long term.

There are a variety of SRS investments you can do that range from low to high risk.

Withdrawals from SRS

Contributions to SRS give immediate tax benefits but SRS is ultimately geared towards retirement.

Earlier, I mentioned that SRS is a more of a “tax deferment” rather than “tax reduction”.

And in this section, I’ll explain why.

This section is split between withdrawing before and after the prescribed retirement age.

Currently, the prescribed retirement age for SRS is at 62 years old. My opinion is that this may change in the future due to the recent announcement that the Government would increase retirement age to 65 by 2030.

Withdrawing before the Prescribed Retirement Age

If you have a definite intention to withdraw SRS funds before 62 years old, then contributing to it might not make sense.

This is because all early withdrawals are 100% taxable and a 5% penalty will be imposed on the withdrawn amount too.

This eliminates the tax benefits that you might’ve gained prior.

But if you’re in a dire situation and really need the money, then it’s still an option.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Withdrawing after the Prescribed Retirement Age

This is the period when withdrawals are intended to happen.

After the retirement age, withdrawal amounts are only 50% taxable and don’t incur any penalties.

This is why I say SRS is more of a “tax deferment”.

Although you would receive immediate tax benefits in the prior years, the taxes may still come at a later age.

But it isn’t as bad as it seems (read further on).

The whole idea is to push higher payable taxes to later years (beyond 62) so that you’ll end up paying lower taxes overall as your total income would be much lower during your retirement years.

Lump Sum vs Regular Withdrawals

Once you hit the prescribed retirement age, hopefully you’ll have a handsome amount waiting for you.

Should you draw out one lump sum or not?

In most cases, you shouldn’t draw out a lump sum if you don’t need the money.

When you draw out a large sum of money, that amount is still 50% taxable.

Here’s an illustration:

| Lump Sum Withdrawal (within the year) | $400,000 |

| Taxable Income (50% of Withdrawn Amount; assuming no other income) | $200,000 |

| Total Taxes | $21,150 |

Therefore, you’ll still need to pay a huge amount of taxes if you do a one time withdrawal.

So the idea is to spread out withdrawals over a period of time rather than a lump sum withdrawal.

The 10-Year Withdrawal Strategy

The government allows withdrawals over a period of 10 years.

The 10-year period starts from the 1st withdrawal made (after the prescribed retirement age).

So if you have that same $400,000, here’s an illustration of how it works:

| 65 | 66 | 67 | 68 | 69 | 70 | 71 | 72 | 73 | 74 | |

| Withdrawn Amount | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 |

| Taxable Income (50% of Withdrawn Amount; assuming no other income) | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 |

| Total Taxes | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

So assuming you have no other income, and you withdraw $40,000 a year for 10 years, you need not pay any taxes.

But if you have more than $400,000 in the SRS account, you can still greatly take advantage of spreading out your withdrawals to pay lesser overall taxes.

Pros and Cons of SRS

Pros

- Contributions to SRS are eligible for tax relief

- Supplement your retirement funds

- Investment returns are tax-free (but withdrawal amounts may be taxable)

- Only 50% of withdrawals are taxable at retirement

- Withdrawals are penalty-free after retirement

- Can use SRS for a variety of investments from low to high risks

Cons

- Early withdrawal amounts are 100% taxable and a 5% penalty fee is imposed

- Only can use cash to contribute

- SRS contributions made can’t be refunded

How to Open and Top Up SRS Account?

In Singapore, there are only 3 SRS operators:

- UOB

- OCBC

- DBS

Which SRS account is better?

There’s no best as they’re all the same so you can just select which one you’re most comfortable with.

You can only select one but you’re free to transfer from one operator to another.

But before you go on to make an account, be sure to check out the next section on why you should invest your SRS funds.

Why You Should Invest Your SRS Funds

I get it.

You’re thinking about the immediate tax benefits when you contribute.

Once that’s done, you call it a day.

But by not doing anything to the SRS balance, you’re only solving half of the problem.

The other half of the problem is that the balance is earning 0.05%/year for many years to come.

And as the same old saying goes, the inflation will eat everything up.

The benefits of contributing can be wiped out because of inflation > earned interest rate (illustration here).

So the worst you can do is to leave your SRS money in the account.

As to where to invest it?

You need not invest it with the bank (they have a high chance of promoting SRS investments to you but may have limited options).

You can equip yourself with knowledge and check out some of the best SRS investment options first.