Saving for the future can be difficult when we’re left on our own to do it.

Fortunately, there are several national schemes in Singapore that help individuals build their retirement nest eggs.

One such scheme is the Supplementary Retirement Scheme (SRS), which is open to both Singaporeans (citizens and permanent residents) and foreigners.

Although the scheme is mostly similar for both groups, there are important differences to take note of.

(This article is meant for foreigners, so if you’re a Singaporean [citizen or PR], do check out this page instead.)

Read on to find out more!

What’s the Supplementary Retirement Scheme (SRS) All About?

For most Singaporeans, Central Provident Fund (CPF) savings form the primary source of basic retirement income.

However, for foreigners, as they don’t need to contribute to CPF, they have to rely on other means to ensure they have enough funds to retire.

The Supplementary Retirement Scheme (SRS) is one of the many available ways to grow retirement savings, and expatriates can participate in it.

Apart from setting aside funds for retirement, contributing to your SRS account has other benefits:

- SRS contributions are eligible for tax reliefs

- Returns from any investments made from SRS funds are tax-free before withdrawal

- After the statutory retirement age, only 50% of the withdrawn amount is taxable

However, there’s a cap to how much you can contribute to your SRS account:

| Residency Status | Maximum Yearly Contribution for SRS |

| Singapore citizens/permanent residents | $15,300 |

| Foreigners | $35,700 |

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

How Do SRS Tax Reliefs Work?

The amount you contribute to your SRS account can be considered a tax relief, which reduces your total taxable income.

Note: There are a variety of tax reliefs you may be eligible for, but there is a maximum cap of $80,000 in tax reliefs you can accumulate in a year.

With a lower taxable income, the amount of taxes you’ll need to pay will be lowered.

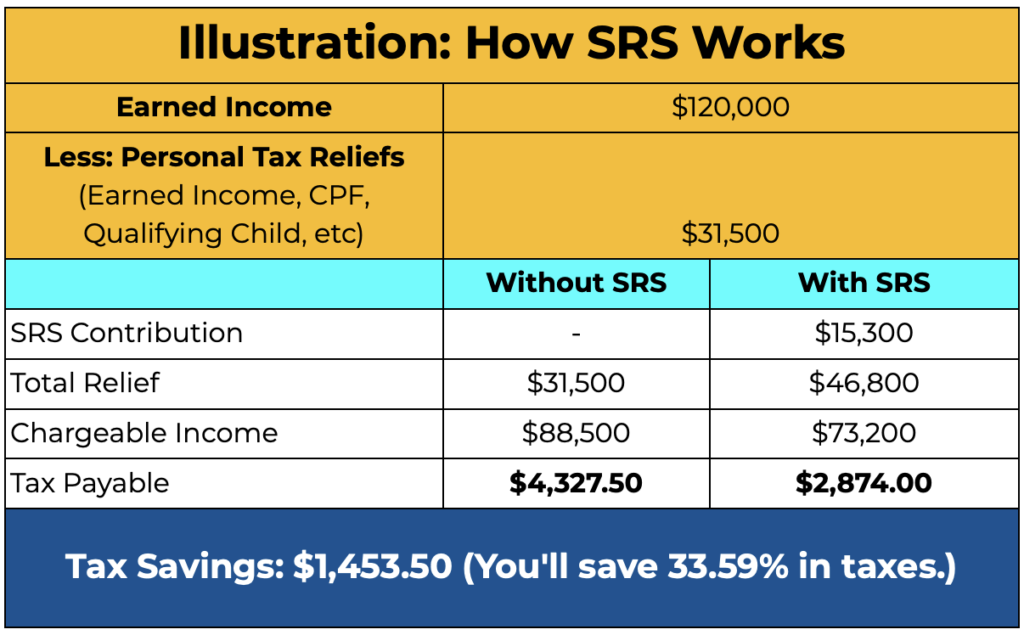

Here’s an illustration of how SRS tax reliefs work:

As you can see, contributions to your SRS account provide you “immediate tax reduction”. However, when you factor in withdrawals in the future (which are taxable), SRS is merely a “tax-deferment scheme”.

It still makes sense though.

You may be able to pay lower taxes in your prime working years (usually at a higher income tax bracket).

In the next section, we’ll look at how these withdrawals work and how they’re taxed.

SRS Withdrawals for Foreigners Are Slightly Different

If you’re a foreigner, here are four typical scenarios where you’re likely to make a withdrawal.

1) Withdrawal on or after the statutory retirement age

This is the period when withdrawals are intended to happen.

If you make withdrawals from your SRS after the statutory retirement age, only 50% of the withdrawn amount is taxed, and there are no penalties for withdrawing. From your first penalty-free withdrawal, you have a 10-year window period to withdraw.

The statutory retirement age in Singapore is set to increase to 63 in 2022, and eventually to 65 by 2030. How does this affect you? If you open and contribute now, even if the retirement age changes in the future, you’re entitled to enjoy penalty-free withdrawals at the retirement age before the change.

Depending on how much you have in your SRS account, in the best case scenario, you can potentially pay no taxes on withdrawals. Assuming you have no other income, if you withdraw up to $400,000 equally over 10 years ($40,000 a year), your taxable income for a year will be $20,000 (50% of the withdrawn amount) which equates to no income taxes payable based on the current income tax rate.

However, if you choose to withdraw that $400,000 in one lump sum, your taxable income for that year will be $200,000, so you will pay more taxes that way compared to spreading it over 10 years.

2) Withdrawal before the statutory retirement age (with no conditions)

While SRS funds are intended to be withdrawn after the retirement age, if you find yourself in a sticky situation, you may withdraw your funds with a 5% penalty, and the withdrawn sum is 100% taxable.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

3) Withdrawal before the statutory retirement age (with conditions)

If you’re a foreigner (PRs aren’t included), you have an additional way to withdraw SRS funds.

You’re able to withdraw your SRS funds with no penalties, and only 50% of the lump sum is taxable if you satisfy all of the following conditions:

- You make a full withdrawal

- Your SRS account must have been open for at least 10 years starting from your first contribution

- For a continuous period of 10 years prior to withdrawal, you must not have been a Singapore citizen or PR

4) Withdrawal due to other reasons

The above withdrawals are the most common ones.

However, there are more concessions when you’re faced with dire situations.

Here are other types of withdrawals:

| Reason for withdrawal | Amount subjected to tax |

| Medical grounds | 50% of withdrawn amount, with no penalty |

| Bankruptcy | 100% of withdrawn amount, with no penalty |

| Terminal illness/death | 50% of full withdrawal less exception, with no penalty |

For more information, you can check out this IRAS page.

Contributions to Your SRS Account Should Be Invested

Funds sitting in your SRS account earn 0.05% interest per year.

When you factor in inflation (the average over the past 20 years was 1.48%/year), your SRS monies, if left idle, will devalue over time. That may eliminate any benefits gained from contributing to your SRS account.

For foreigners, if you plan to work in Singapore for the long haul, consider investing these funds to get potentially higher returns, according to your risk appetite. There are many investment options available.

Furthermore, gains from investments made with SRS monies are not taxable, but do note that withdrawals are still taxable.

While you can set aside SRS funds into an annuity, it does come with a much higher degree of long-term commitment. If you’re looking at more liquidable options, investing in unit trusts and ETFs are possible.

Other Things to Take Note Of

Most expatriates come to Singapore with the sole purpose of earning an income to support their family.

Thus, wealth accumulation matters such as contributing to and investing in SRS funds are always of high interest.

Having said that, other aspects of financial planning are important too.

As your income will be the most critical element to support everything, having adequate life insurance along with proper medical coverage ensures that life (at least financially) can continue for your family members when the unexpected happens.

Secondly, contributing to your SRS is just a small area of wealth accumulation. There are other ways to grow your savings (if you have yet to start). You can make better use of the money left in your bank account (outside of emergency funds and short-term financial goals).

What’s Next?

If you have yet to open an SRS account, it’s extremely easy.

It can be opened and a contribution can be made within minutes if you have a bank mobile app with any of the three SRS operators:

- DBS

- OCBC

- UOB

Even if you contribute and open an SRS account with just $1 now (in 2022), you can enjoy penalty-free withdrawals starting from age 63, even if the statutory retirement age rises in the future.

Apart from that, if you have yet to go through a comprehensive financial planning (or if it has been awhile), check out our FullCircle planning. We’re able to cover other areas such as insurance, savings, investments, and retirement planning.