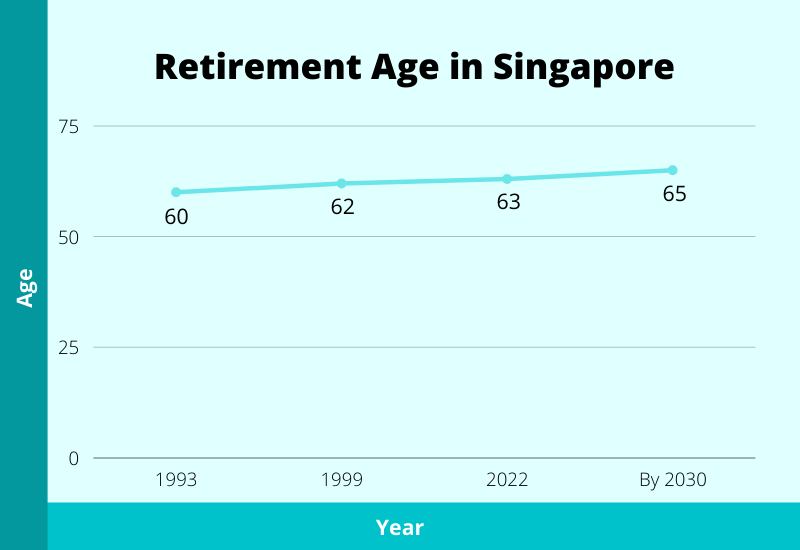

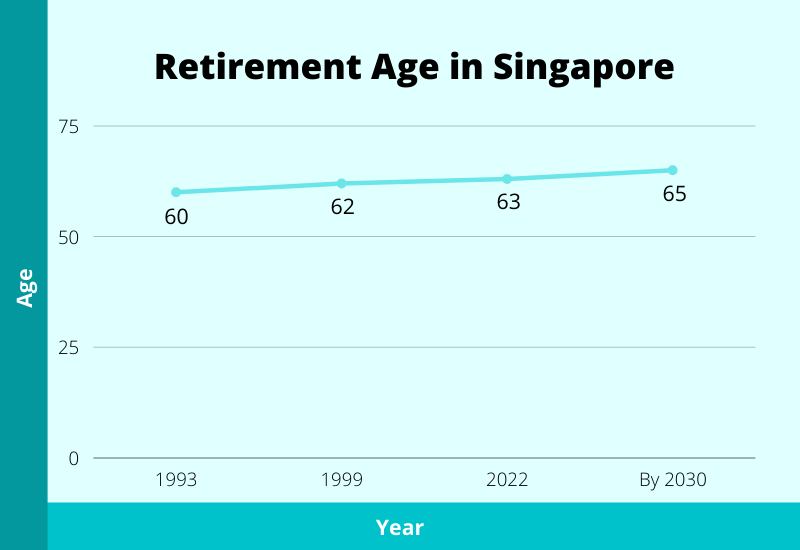

The statutory retirement age in Singapore has been changing over the years.

It’ll get pushed further in time to come.

Although you should always plan for your own retirement (which includes the age you wish to retire), these changes do matter because they may affect your retirement planning.

What are the changes and how do they affect us?

Read on to find out!

Too Long; Didn’t Read (Summary)

| Retirement Age | |

| 1993 | 60 |

| 1999 | 62 (current) |

| 2022 | 63 |

| By 2030 | 65 |

| Re-employment Age | |

| 2012 | 65 |

| 2017 | 67 (current) |

| 2022 | 68 |

| By 2030 | 70 |

These are just the surface-level changes.

What matters are the implications they have on us which will be covered later in the article.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

The Difference Between Retirement Age and Re-employment Age

According to the Retirement & Re-employment Act, your employer is not allowed to dismiss you (due to age reasons) if you’re below the minimum statutory retirement age.

You can enjoy this protection if you satisfy these requirements:

- You’re a Singapore Citizen or a Singapore Permanent Resident

- Joined your employer before you turned 55 years old

And if you’ve reached the minimum retirement age, you can still continue to be employed (re-employment).

Employers must offer re-employment to eligible employees up to the re-employment age.

Here are the requirements to qualify for re-employment:

- Singapore Citizen or Singapore Permanent Resident

- Before hitting the retirement age, have served current employer for at least 3 years

- Assessed by your employer to have satisfactory work performance

- Medically fit for work

- Born on or after 1 July 1952

However, if you’re eligible but your employer isn’t able to re-employ you, there are 2 alternatives:

- With your agreement, transfer the re-employment obligation to another employer

- Last resort: offer you a one-time Employment Assistance Payment equivalent to 3.5 months’ salary (minimum of $5,500; maximum of $13,000)

Here are the retirement and re-employment ages..

What Are the Latest Retirement and Re-employment Ages in Singapore

| Retirement Age | |

| 1993 | 60 |

| 1999 | 62 (current) |

| 2022 | 63 |

| By 2030 | 65 |

| Re-employment Age | |

| 2012 | 65 |

| 2017 | 67 (current) |

| 2022 | 68 |

| By 2030 | 70 |

The above shows you the history, current and the future statutory retirement and re-employment ages in Singapore.

In the National Day Rally 2019, PM Lee Hsien Loong mentioned that these new changes will be implemented gradually. On a side note, there won’t be any change to the current CPF withdrawal policies or ages.

How Does Our Retirement Age Compare With Other Countries

While not all countries adopt the concept of re-employment, having a retirement age is common.

Others may have a separate retirement age for men and women too, unlike Singapore.

And similarly, as life expectancy across the world has been rising, governments are planning to raise the retirement age.

Here are some of the retirement ages of other countries:

| Current Retirement Age | Future Retirement Age | |

| France | 66 years and 7 months | 67 years (2023) |

| Germany | 65 years and 8 months | 67 years (2031) |

| Great Britain | 65 years and 7-12 months | 67+ years (2028); 68 years (2046) |

| Italy | 67 years | 67+ years (2022) |

| Netherlands | 66 years and 4 months | 67+ years (2022) |

| Canada | 65 years | – |

| Iceland | 67 years | – |

| United States | 66 years | 67 years (2027) |

5 Impacts of Having a Retirement Age (And Its Changes) on Us

Have you wondered what’s the purpose of having a statutory retirement and re-employment age?

We’ll discuss this and how any changes to them would affect us.

1) Provides further protection for those who need it

One of the core reasons for an official retirement age is to ensure older folks are not discriminated in the workplace, and to retain employability for those who need more financial help.

Imagine if you’re in a situation where you don’t have enough retirement funds, yet no one wants to hire you because of your age, how are you going to find the money for your necessities?

Thus comes the minimum retirement age, so that companies aren’t able to dismiss you before that age.

And when life expectancy increases, it means that we’re living longer and thus need to spend more during our retirement years. If the retirement age stays the same, we need to accumulate much more during our working years.

This inevitably means that we need to:

- subject ourselves to higher risk in investments to accumulate more

- earn an even higher income

- etc

And not all of us can do that.

That’s why the retirement age has to be increased, so that we have more time to accumulate for an extended retirement period.

But some of us don’t have a lack of retirement funds.

Some may want to continue to work because they like what they’re doing or it’s a way of passing time.

An extended retirement age will allow that to happen.

In all, it enables those who wish to work longer to be able to do so.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

2) It only serves as a guide to when to stop work

If you have no idea of when your golden years should start, then you can fallback to the official retirement age.

It’s always good to have a goal in mind, if not there’s no way of measuring the distance.

But there are 3 considerations to have:

Firstly, if you’re enjoying the work you’re doing and want to work as long as possible, a retirement age may not be so critical, especially when finances aren’t an issue. However, there comes a time when you’re aren’t able to continue working.

Secondly, you may want to have the option of stopping work if you want to. It can only happen when you’ve achieved your retirement goal by your retirement age. Only then, you can do whatever you want which also includes any form of work.

And lastly, because life is unpredictable and can’t be fully planned out, there remains some uncertainty.

You may not continue to work and earn an income to fulfil your retirement goals because of 2 situations: due to old age and because of death/total permanent disability/critical illness.

If it’s due to old age, there’s nothing much that can be done. This emphasises the importance of early planning for retirement.

But if it’s because of the latter, then that risk can be eliminated or reduced, through having adequate life insurance coverage. So if the undesirable happens, an insurance payout is able to cover expenses needed during your retirement years.

Check out how much life insurance coverage you need. And learn about the various types of life insurance such as term insurance, whole life insurance, and early critical illness plans.

Health insurance which includes MediShield Life and the Integrated Shield Plan still remains a core component.

3) Separating retirement age from re-employment age

The concept of having a retirement age is simple.

But why is there a re-employment age in Singapore?

The idea is this:

If there was just a retirement age only, and it’s increased because of an increase in life expectancy, businesses may face issues such as cost and productivity as they’re “forced” to keep older workers.

As the businesses are the ones who hire workers and not the government, they remain quite an important factor to consider.

And that’s why there are intense debates on this issue – older workers who wish to continue working vs businesses might get negatively affected.

So that’s why there’s a re-employment age that could satisfy both parties, to a certain degree.

4) Your retirement planning could be affected

The main financial tool provided by the government for retirement is CPF.

Although you may use the various CPF accounts for different needs, its main purpose is to provide a basic retirement income, with fixed withdrawal ages and because of that, it plays a part in how we plan for our retirement.

(Side note: Learn more how CPF for retirement works)

With the minimum retirement age increasing, PM Lee has specifically said that the CPF withdrawal ages and policies will not be affected. Although, CPF contribution rates would increase.

But other government policies may react to this change (or have already reacted) of the retirement age to be 65 by year 2030.

An example: HDB loan’s maximum repayment period is 30 years or up to 65 years old, whichever is shorter.

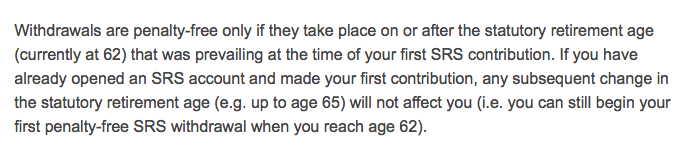

Another example is the Supplementary Retirement Scheme (SRS) which is meant to supplement retirement funds, and provide tax relief benefits.

Basically the SRS withdrawal age follows the statutory retirement age.

Here’s a quote from IRAS:

Basically what it means is that if you make a contribution to your SRS now, you can still withdraw from your SRS at 62 years old with the usual terms and conditions, even if the statutory retirement age changes in the future.

So if possible, just open a SRS account now. It’s easy and you can do so with just a $1 deposit.

5) Changes only give us more options

If you’ve done proper financial and retirement planning, the changes in retirement and re-employment age won’t affect you.

It’s because you would’ve settled on a retirement age already, and is working towards achieving everything before that age.

Because the CPF withdrawal age isn’t changing, it means that it won’t affect when we receive the payouts.

But for those who haven’t done any planning, and are in need of earning an income or wish to work even more in the later years, the increase in retirement age only benefits them.

It gives much more options.

Having said all these, more significance should be given to the next point..

Plan for Your Own Retirement Age Instead

You could always let the government decide your retirement age for you, and that’s fine.

But a part of us would want to make our own decisions, if possible.

And guess what, you have that power.

While knowing the statutory retirement age is important because government schemes – CPF, SRS, etc – come into play in the totality of retirement planning, it would still form only a part of the big picture.

When you’ve spent many years working, retirement years are your reward.

As such, you may want to plan it out the way you desire. That could include retiring earlier, so you can enjoy the fruits of your labour for a longer period.

Whichever age you choose, the process to achieve it is the same.

Here’s how..

How Do We Start Planning for Retirement

What’s the best age to start planning for retirement?

The age you’re at right now.

It goes without doubt that retirement planning should always start as soon as you’re introduced to it.

Because of the power of compounding and a longer time period to accumulate, the financial burden is significantly lessened compared to if you were to start at a later age.

Here’s an overview of a 7-step process to plan for your retirement:

- Decide when are your 2 “stop” ages: retirement age and life expectancy (when you think you’re going to leave this world)

- Dream of your desired retirement lifestyle, and come up with a figure of how much you’ll need per month during retirement years

- Compile all your current financial assets

- Input all your figures into a retirement planning calculator

- Settle on an asset allocation

- Make wise investment choices to add more to your retirement funds

- Track and monitor your finances along the way

What’s Next?

If you have enough assets right now to last your remaining years, retirement age doesn’t matter at all.

But how many of us can say that?

A retirement goal is one of the biggest financial goals, and could amount to more than a million when the time comes.

And thus, it can’t be achieved overnight.

Which leads us to the only option: slow, steady, and planned route.

It first starts with deciding an age you desire to retire at, and everything else will fall into place if you follow the steps to retirement planning.

As we’re humans, if we don’t have a goal, plans in place, or deadline, we tend to get slacken off.

So take the first step, and check out our guide to retirement planning in Singapore to learn more.