…Compare and Save Precious Time & Money

1179+ Singaporeans have benefitted from our comparisons

- Avoid multiple agents yet be able to compare across 18 insurance companies

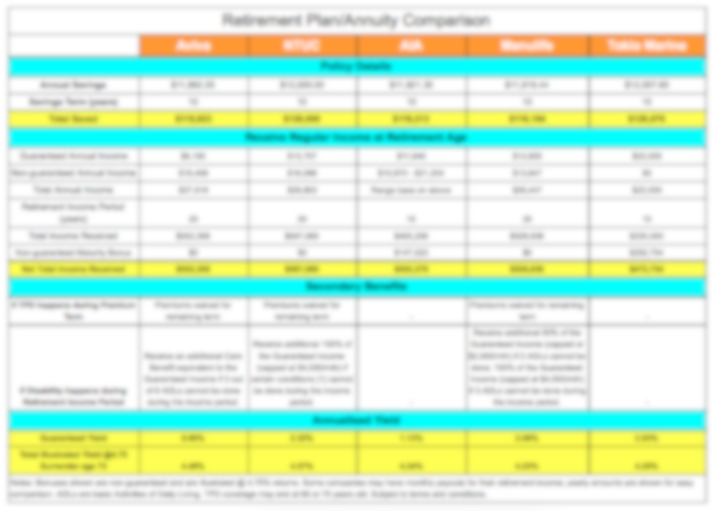

- Our DeepDive™ provides an in-depth comparison of the best retirement annuity plans in Singapore

- Tailored to your specific needs with personalised quotes and premiums

- Get a bigger payout to supplement your retirement income during your golden years

We’re Mentioned On

The Purpose of a Retirement Plan

Retirement is almost guaranteed to happen.

If you have an inadequate amount of retirement funds when that time comes, it doesn’t mean you can still continue to work. Poor health can come into the picture.

This is why saving for your retirement has to start much earlier.

By disciplining yourself to save a fixed amount of money into a retirement annuity plan, you’re able to grow your savings, so that when the time comes to enjoy your retirement, you’re able to do so.

(If you’re new to retirement plans and want to know more about it instead, read this guide first.)

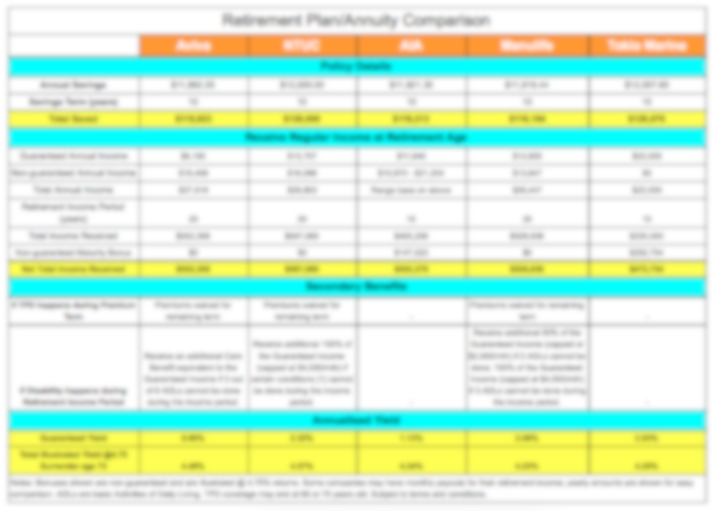

Best Retirement/Annuity Plans in Singapore (Comparison for 2024)

If you like the idea of a retirement plan, what’s next?

Finding the best one of course!

You’re using your hard-earned money and you’ll definitely want to make the best decision (with no regrets in the future).

But annuity plans come in all shapes and sizes… and one size doesn’t fit all.

The only way to find the best one for you is to do an in-depth comparison across the different plans offered by the different insurance companies.

And that’s what we’re good at.

Here’s a non-exhaustive list of retirement annuity plans that we can compare:

| Insurance Company | Plan Name |

| AIA | Retirement Saver (IV) Platinum Gift of Life (II) |

| Singlife with Aviva | Singlife Flexi Retirement (previously MyRetirementChoice III) Singlife Flexi Life Income (previously MyLifeIncome III) |

| AXA | Retire Treasure (II) – withdrawn |

| Manulife | RetireReady Plus (III) Signature Income (III) Ready LifeIncome (II) |

| NTUC Income | Gro Retire Flex Luxe Solitaire Gro Annuity II |

What’s in Our Retirement Plan Comparison DeepDive™

Unlike others, our DeepDive™ gives you the Good and the Bad…

So you will be equipped to make better decisions.

What we’ll cover in the comparison:

- How much do you want to set aside to save

- How long do you want to save for

- Potential income you may get during the retirement period

- How long can you receive this income

- Any secondary benefits

- Potential disadvantages

- Anything else you wish to know…

We spent hours scrutinising policy documents so that you don’t have to.

But, We Do Things Differently

Unlike others, we don’t publish these comparisons online (comparisons from other sites are usually generic in nature, may contain outdated information, and their quotes aren’t specific to your profile and your needs). Also, we don’t send these these personalised comparisons directly to your email.

We do this on an appointment basis (via zoom video call or a meet-up) to first understand your situation before going through the comparison with you. This ensures that we can provide appropriate advice there and then.

It may sound troublesome to you, but hear us out.

3 Reasons Why We Need to Meet

(Either through a zoom video call or a meet-up)

You just want to look at the numbers… you got no time… you don’t want to meet strangers.

Perhaps you’re here because you were doing research online or came looking for more information when someone – friend or agent – told you about this.

So you may thinking, “just email the comparison and quotes to me!“

As consumers ourselves, we understand the convenience of that.

But a mere comparison table will not help you make a concrete decision (one that you can set in stone).

Here are 3 reasons why there’s a need to meet:

1) Give Accurate Recommendations

Can you be absolutely sure of what you want? Could there be something that you may have missed?

A wrong decision might lead to a lifetime of regrets.

If you go to a doctor and without asking you anything, the doctor gives you medicine for this, this and this.

Would you have full confidence in the solution? No.

And that’s why there’s a need to understand your situation first before we give a recommendation – we’re not in the business of pushing products.

2) Requirement of MAS

In the Financial Advisers Act, it is stated that in order for a recommendation to be made, information on the client has to be gathered first.

Any inaccurate or incomplete information may affect the suitability of the recommendation.

Over the years, MAS has imposed stricter regulations to ultimately protect Singaporeans (and that includes you).

It is there for a reason and that is to ensure that you don’t end up with an unsuitable plan.

3) Touch on Fine Prints

What’s the purpose of a comparison table?

It’s to present information in an organised and simple way, so that you can make a decision based on it.

But can you really make an informed decision from it?

If you can easily do that, there wouldn’t be a need for two-digit pages of policy documents (for just one plan).

There are fine prints and clauses that might make or break your decision.

And that’s why we meet to not only show you the comparisons but to go through any critical pointers that you must be aware of.

We don’t want to overpromise and underdeliver.

We Compare 18 Insurance Companies to Find the Best Retirement Annuity Plan for Your Needs

This Is Great if You:

- Don’t know which plan is the best

- Don’t wish to waste precious time and money going to individual companies for quotes

- Don’t wish to tear your hair out looking through product documents

Our Trusted Providers

- AIA

- Singlife with Aviva

- Friends Provident

- China Life

- Generali Worldwide

- China Taiping

- NTUC Income

- Manulife

- LIC

- Old Mutual

- Swiss Life

- HSBC Life

- AXA

- Tokio Marine

- Singlife

- Transamerica

- Etiqa

- FWD

Frequently Asked Questions

It is a policy that is meant to pay out a regular income, which consists of guaranteed and non-guaranteed amounts, for a specified duration. It is meant to supplement your retirement income.

There are many ways to build your retirement income, and the plan is one of those options. There are always pros and cons to each option. As the plan is often capital-guaranteed upon maturity, it appeals to the conversative investor who does not wish to take on high risks. The plan is also geared to provide potential returns higher than the inflation. Having said that, do speak to a financial advisor first.

Yes, there’s no fee involved.

It typically takes around 45 minutes. However, it can be longer for more complex situations or if you have further questions.

Depending on your situation, we may or may not recommend solutions. If we do, it’s entirely up to you to go ahead with it. As consumers ourselves, we dislike high-pressure tactics.

Yes! If you do have them, do bring them along (or a policy summary) as we can provide more accurate feedback.

This can be done over a zoom video call or a meet-up.