We always make life insurance decisions emotionally.

“What if I’m taken out of the picture, how would my family cope financially?”

And we tend to neglect the logical part.

That’s why today, we’re taking a whole new look at concrete numbers to give us greater insights on life insurance – coverage for death, total and permanent disability, and critical illness.

We spent 57 hours studying 36 months of life insurance claims statistics in Singapore.

And not forgetting to double-check our numbers.

Here are some very interesting findings…

Key Findings

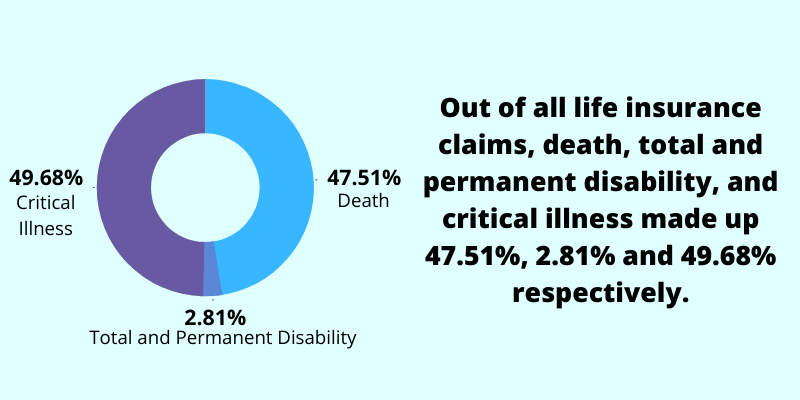

1. Out of all life insurance claims, death, total and permanent disability (TPD) and critical illness (CI) made up 47.51%, 2.81% and 49.68% respectively.

2. Here are the average claim payouts:

- Life insurance: $50,855.98

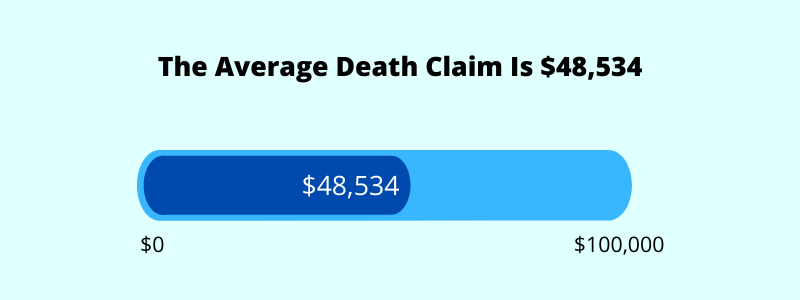

- Death: $48,534.11

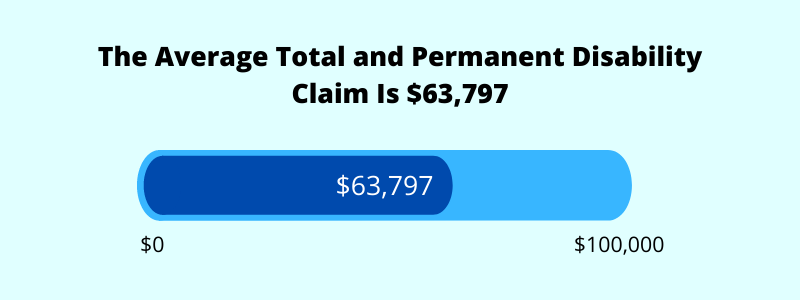

- TPD: $63,797.76

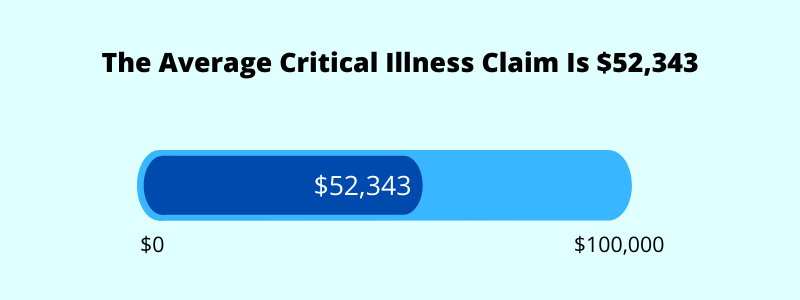

- CI: $52,343.37

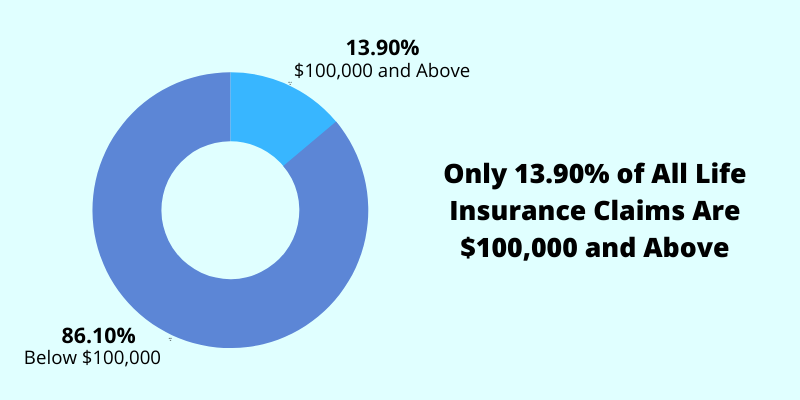

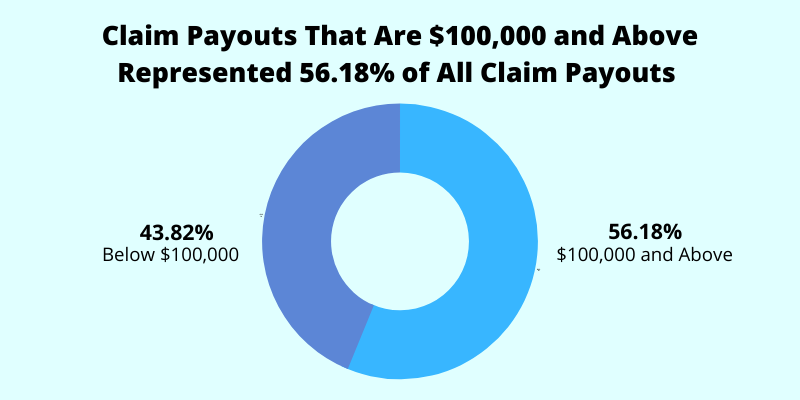

3. Only 13.90% of all claims are $100,000 and above. The claim payouts from these policies accounted for 56.18% of all claim payouts. On the flip side, it also means that 86.10% of claims are lower than $100,000, and they represented only 43.82% of all claim payouts.

4. For policies that are $100,000 and above, cancer is not just the top cause of all death claims (accounting for 39.67%), but for all critical illness claims (accounting for 73.17%) as well.

5. For policies that are $100,000 and above, most claims – death, TPD and CI – happen in the $100,000 to $199,999 range.

Read on further for more details and other statistics.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

The Objective of This Study

We buy life insurance because of the what-ifs…

And when others question why we bought it?

The answer is usually along the lines of, “because my agent tell me one”.

So therefore, the aim of this study is try to quantify these what-ifs and provide a more objective view into insurance.

It’s to derive meaning from raw data (that usually don’t mean much on its own) so that you can say you bought life insurance because of so and so.

The Data We’re Analysing

Most insurance companies do not publish detailed claim statistics.

There’s only one company that does…

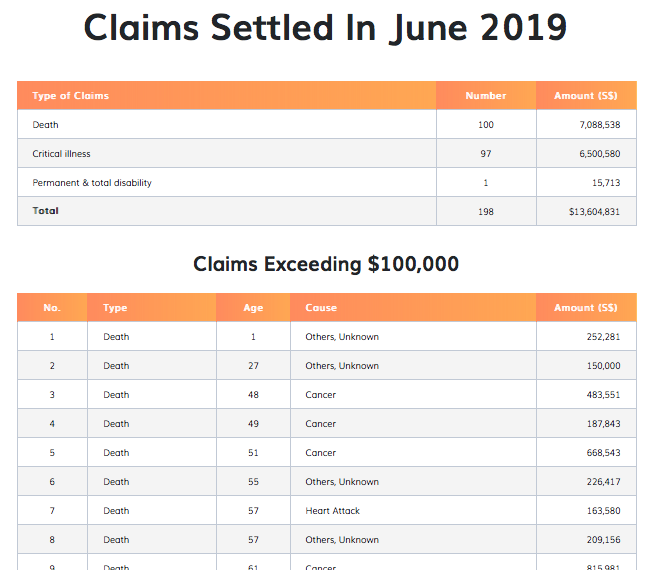

The period of data that’s available online (as of 27 Jan 2022) is from Jan 2016 to Jun 2019.

We’re only looking at Jul 2016 to Jun 2019 (a total of 36 months/3 years) to make it easier for analysis.

The data that’s available consists of the following:

- Total number of claims for life insurance (death, total and permanent disability, and critical illness)

- Total claim payouts broken down by the type of claim

- Specific details on individual claims ($100,000 and more) such as age, cause, exact claim amount

Here’s a look at what NTUC provides for each month:

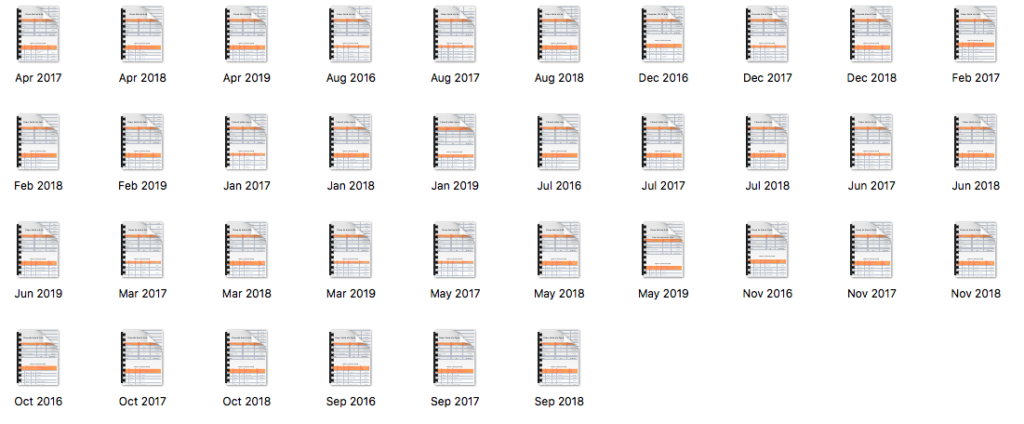

And here’s a look at what 36 months of data look like:

We organised and tabulated everything to present our findings that’s simple and easy to understand.

4 Limitations to This Study

As with any study, we can’t have a perfect scenario.

Assumptions have to be made and we need to work with what’s available.

We’re not researchers but we try to produce the results accurately and show them as it is.

Here are 4 limitations:

1) Data only from one company

First off, the data comes from only one company as there are none available from others.

It’s always good to have data gathered from different sources as one company might not reflect the same outcome as with other companies. Also, customers may have multiple policies from different insurers.

However, in my view, it still gives a very good perspective.

One thing to note is on the definitions.

Death, Total and Permanent Disability, and Critical Illness (only 30+ of them) are pretty standard across the board. However, whether early critical illness is included in the data is unclear.

The types of policies:

… are also not known.

2) Representing only claims

Secondly, the figures and details you would be seeing are only from people who had insurance and made a successful claim.

It does not represent the probability of death, getting disabled or contracting a critical illness. That’s outside the scope of this study.

Another thing to note is that the data represents past policies and doesn’t represent how future claims will be like.

3) Specific details are only available for claims that are $100,000 or more

Individual details like the cause, age and claim amount are only available for claims that are $100,000 or more.

This is a limitation as the younger folks generally might not have higher coverage. And thus, the data might be skewed towards the older folks.

So just take note…

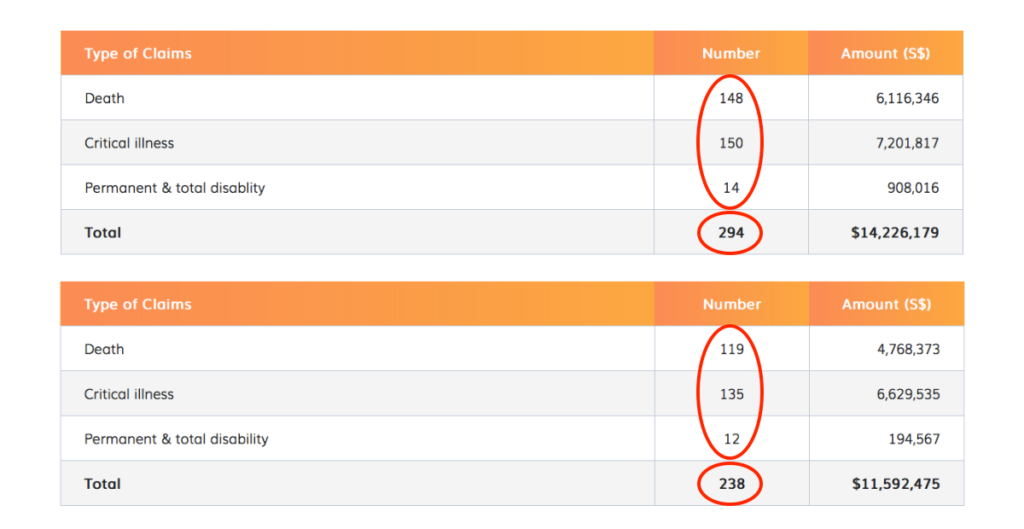

4) Minor discrepancies

During the compilation of data, we discovered a few numbers that can’t be tallied.

For example…

In Jul 2016 and May 2017, the numbers didn’t add up.

So we took the sum of the three rows because that can be attributed.

And…

The sum of the “Total” across 36 months didn’t match the sum of each individual claim amount.

So we took the total figure when added up individually which amounted to $246,670,471. The other figure amounted to $246,611,159.

These minor discrepancies shouldn’t matter much as their impact is extremely small on the bigger picture.

Let’s go ahead and show you what we found…

1) Death accounts for 47.51% of all life insurance claims

The total number of life insurance claims throughout these 36 months is 8634. Of which, 4102 are from death.

This translates to a percentage of 47.51% (4102/8634).

At the same time, there is an average of 1367.34 (4102/3) death claims per year.

2) The average death claim payout is $48,534.11

The total payout of death claims throughout these 36 months is $199,086,911.

This also meant that the average death claim payout per year is $66,362,303.70.

The average death claim payout is $48,534.11 ($199,086,911/4102).

KEY TAKEAWAY

Death represents a huge percentage of life insurance claims. What’s important to note here is the average death claim payout of $48,534.11. Assuming that there are no other insurance payouts, that amount may be insignificant especially when other family members depend on it. It might not last long.

3) Total and permanent disability accounts for 2.81% of all life insurance claims

Of the total life insurance claims (8634) throughout these 36 months, only 243 are from total and permanent disability (TPD).

The percentage of this is 2.81% (243/8634).

At the same time, there is an average of 81 (243/3) TPD claims per year.

4) The average total and permanent disability claim payout is $63,797.76

The total payout of TPD claims throughout these 36 months is $15,502,854.

This translates to an average TPD claim payout of $5,167,618 per year.

The average TPD claim is $63,797.76 ($15,502,854/243).

KEY TAKEAWAY

TPD has always been claimed the least. In my opinion, the chances of a TPD claim is lower compared to the other two. And this is reflected in the premiums you pay for TPD coverage – very affordable. Just like death, the average claim payout can be seen as low especially when you’re unable to perform any form of work to earn an income, yet you still need to pay for daily expenses and other commitments for the rest of your life.

5) Critical illness accounts for 49.68% of all life insurance claims

There are 4289 claims from critical illness (CI) out of the total life insurance claims (8634).

The percentage of this is 49.68% (4289/8634).

At the same time, there is an average of 1429.67 (4289/3) CI claims per year.

6) The average critical illness claim payout is $52,343.37

Throughout these 36 months, the total payout of CI claims is $224,500,696.

Bringing the average CI claim payout per year to be at $78,833,565.30.

The average CI claim payout is $52,343.37 ($224,500,696/4289).

KEY TAKEAWAY

Critical illness accounts for the highest percentage of all life insurance claims. Rightfully so because you don’t need to experience death to be able to claim from CI, and the probability of a CI happening may be high. This is also the reason why premium for CI coverage is higher than the rest. Having said that, it’s still important to have some CI cover as it can potentially strip away your ability to work for a prolonged period.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

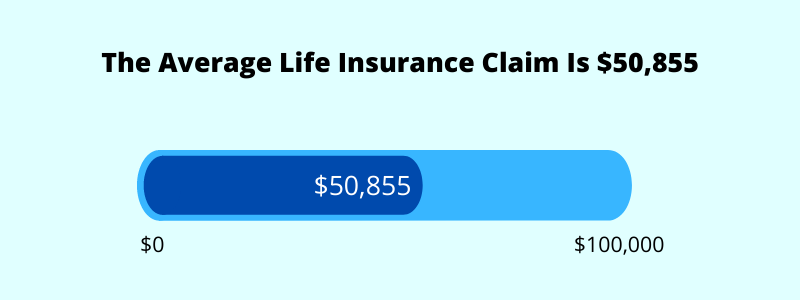

7) The average life insurance payout is $50,855.98

Let’s take a look at the overall picture.

The total life insurance payouts for the 36 months is $439,090,461.

And take that number to divide by the total number of claims of 8634.

And we’ll get the average life insurance payout of $50,855.98.

KEY TAKEAWAY

Life insurance consists mainly of death, TPD and CI. If any of that happens, it’s likely that you’ll lose the ability to earn an income. Your payouts come into play. After that is used up, you need to utilise your hard-earned assets (cash at bank, investments, properties, etc). All in all, the average life insurance payout of $50,855.98 might not be enough to replace the potential loss of a lifetime income.

8) Only 13.90% of total claims are $100,000 and above

Out of 8634 claims, only 1200 are $100,000 and above.

This represents only 13.90% (1200/8634) of the total claims. On the other hand, 86.10% of claims are below $100,000.

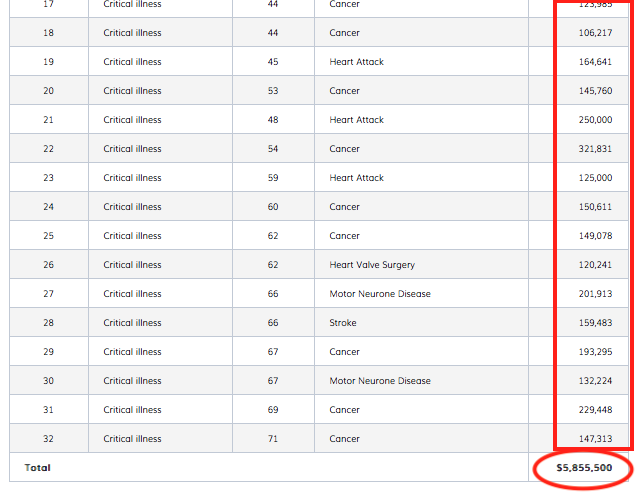

9) The total claim payouts which are $100,000 and above account for 56.18% of all payouts

The total claim payouts ($100,000 and above) are at $246,670,471.

This represents 56.18% ($246,670,471/$439,090,461) of the total claims payout.

This also means that claims below $100,000 amounted to 43.82% of all claim payouts.

KEY TAKEAWAY

The above 2 findings reinforce the point that most Singaporeans may be underinsured. With only a small percentage of claims being $100,000 and above, yet they already account for more than half of all total payouts, one can only wonder how the situation would be like for the rest who receive less than $100,000 of claims.

Note: From this point onwards, specific data are only available for claims of $100,000 and more. Therefore, the following findings shouldn’t represent the overview of all claims and should never be taken out of context.

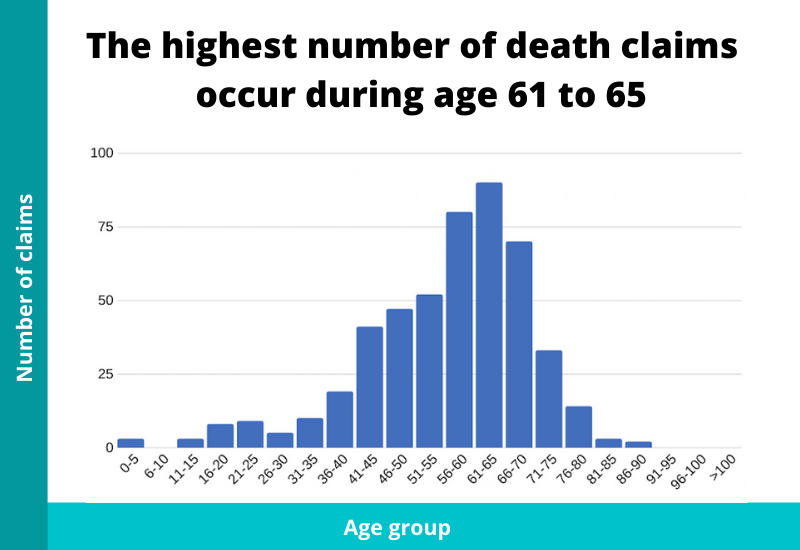

10) The highest number of death claims happen during age 61 to 65

| Age | No. of Claims |

| 0-5 | 3 |

| 6-10 | 0 |

| 11-15 | 3 |

| 16-20 | 8 |

| 21-25 | 9 |

| 26-30 | 5 |

| 31-35 | 10 |

| 36-40 | 19 |

| 41-45 | 41 |

| 46-50 | 47 |

| 51-55 | 52 |

| 56-60 | 80 |

| 61-65 | 90 |

| 66-70 | 70 |

| 71-75 | 33 |

| 76-80 | 14 |

| 81-85 | 3 |

| 86-90 | 2 |

| 91-95 | 0 |

| 96-100 | 0 |

| >100 | 0 |

KEY TAKEAWAY

What’s interesting is that although the life expectancy in Singapore is at 83.6 years, the majority of death claims happen before that. There may be 2 reasons to explain this. One is that term insurance would’ve expired and thus, if death were to happen after, there’s no claim. Second is that if one were to hold a whole life insurance, they might have surrendered the plan earlier. Both of these scenarios might lead to lesser death claims nearer to the life expectancy age.

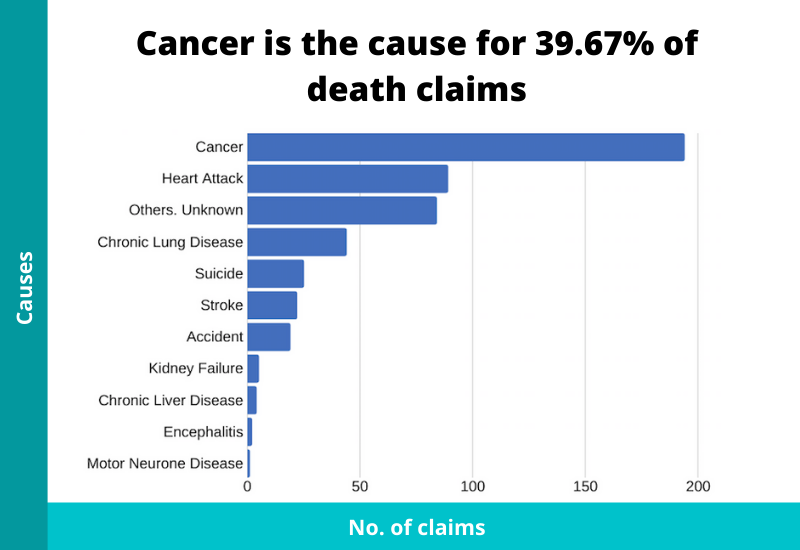

11) Cancer is the cause for 39.67% of all death claims

| Cause | No. of Claims |

| Cancer | 194 |

| Heart Attack | 89 |

| Others. Unknown | 84 |

| Chronic Lung Disease | 44 |

| Suicide | 25 |

| Stroke | 22 |

| Accident | 19 |

| Kidney Failure | 5 |

| Chronic Liver Disease | 4 |

| Encephalitis | 2 |

| Motor Neurone Disease | 1 |

There were 489 death claims. Of this figure, 194 is because of cancer. Thus, cancer accounted for 39.67% of all death claims, and is the number one cause of it.

KEY TAKEAWAY

People don’t die because of “old age”, they die (even when passing away peacefully) because there was an underlying issue. Which is why in death certificates, there’s always a specific cause. In Singapore, cancer has always been the talk of town. It’s something to pay close attention to. Either to prevent or cure it.

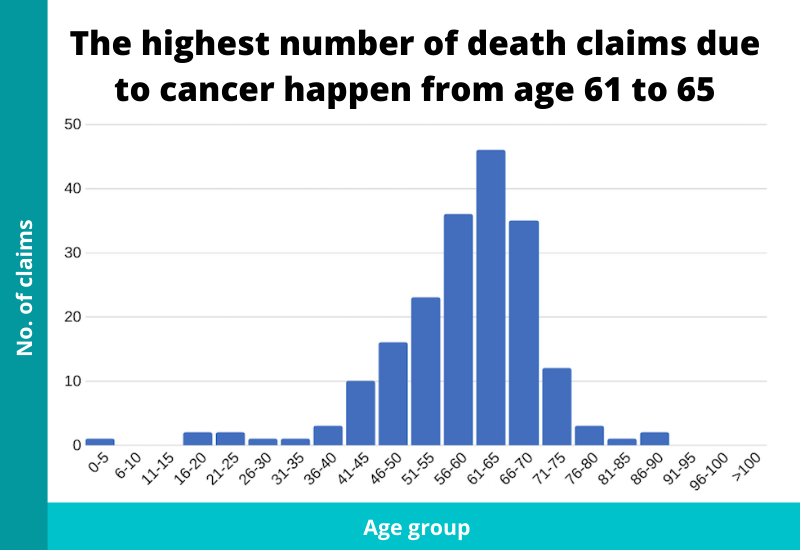

12) The highest number of death claims due to cancer happen from age 61 to 65

| Age | No. of Claims |

| 0-5 | 1 |

| 6-10 | 0 |

| 11-15 | 0 |

| 16-20 | 2 |

| 21-25 | 2 |

| 26-30 | 1 |

| 31-35 | 1 |

| 36-40 | 3 |

| 41-45 | 10 |

| 46-50 | 16 |

| 51-55 | 23 |

| 56-60 | 36 |

| 61-65 | 46 |

| 66-70 | 35 |

| 71-75 | 12 |

| 76-80 | 3 |

| 81-85 | 1 |

| 86-90 | 2 |

| 91-95 | 0 |

| 96-100 | 0 |

| >100 | 0 |

KEY TAKEAWAY

The cause of death claims – cancer and all types – from different ages don’t differ much because cancer represented the biggest percentage of all death claims.

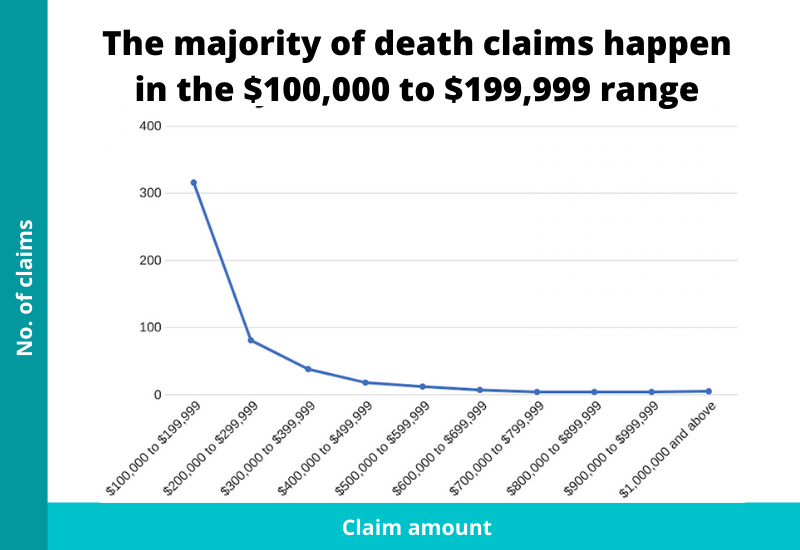

13) The majority of death claims happen from $100,000 to $199,999

| Amount Claimed | No. of Claims |

| $100,000 to $199,999 | 316 |

| $200,000 to $299,999 | 81 |

| $300,000 to $399,999 | 38 |

| $400,000 to $499,999 | 18 |

| $500,000 to $599,999 | 12 |

| $600,000 to $699,999 | 7 |

| $700,000 to $799,999 | 4 |

| $800,000 to $899,999 | 4 |

| $900,000 to $999,999 | 4 |

| $1,000,000 and above | 5 |

KEY TAKEAWAY

Even for those who are covered for more than $100k, most are still in the $100k-200k region. The count drops off sharply after each range. Singapore is expensive with all the daily necessities, expenses for kids, etc. If you’re the sole-breadwinner or part of a dual-income household, is the payout enough?

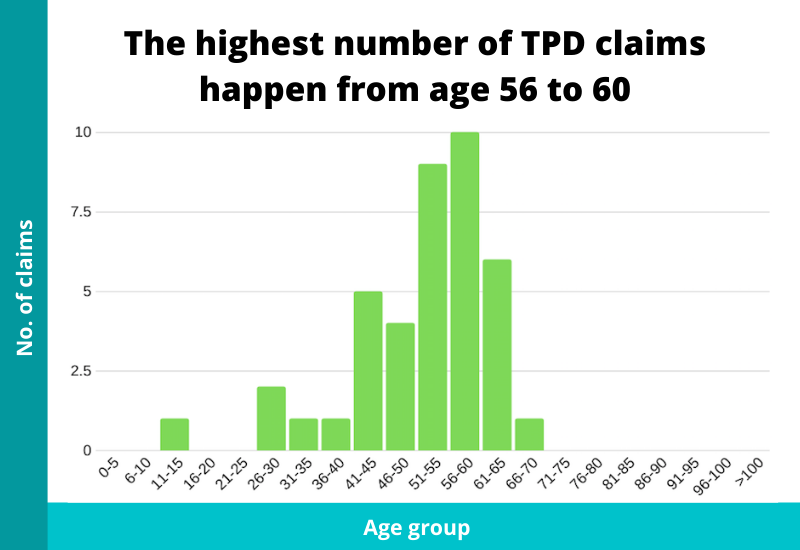

14) The highest number of total and permanent disability claims happen during age 56 to 60

| Age | No. of Claims |

| 0-5 | 0 |

| 6-10 | 0 |

| 11-15 | 1 |

| 16-20 | 0 |

| 21-25 | 0 |

| 26-30 | 2 |

| 31-35 | 1 |

| 36-40 | 1 |

| 41-45 | 5 |

| 46-50 | 4 |

| 51-55 | 9 |

| 56-60 | 10 |

| 61-65 | 6 |

| 66-70 | 1 |

| 71-75 | 0 |

| 76-80 | 0 |

| 81-85 | 0 |

| 86-90 | 0 |

| 91-95 | 0 |

| 96-100 | 0 |

| >100 | 0 |

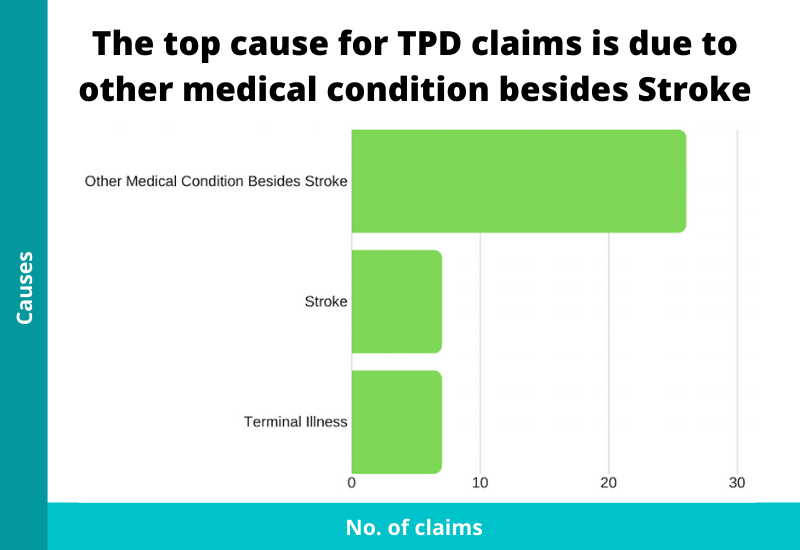

15) The top cause of TPD (claimed) is due to other medical conditions besides Stroke

| Cause | No. of Claims |

| Due to Other Medical Condition Besides Stroke | 26 |

| Due to Stroke | 7 |

| Due to Terminal Illness | 7 |

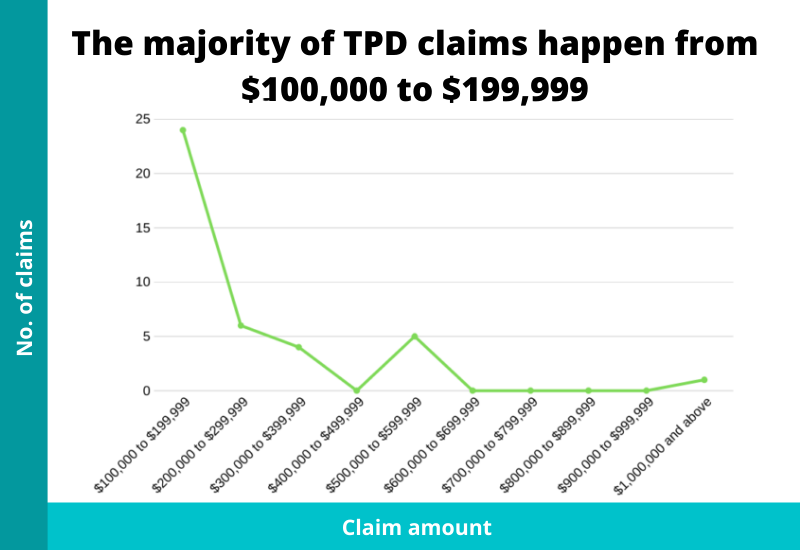

16) The majority of TPD claims happen from $100,000 to $199,999

| Amount Claimed | No. of Claims |

| $100,000 to $199,999 | 24 |

| $200,000 to $299,999 | 6 |

| $300,000 to $399,999 | 4 |

| $400,000 to $499,999 | 0 |

| $500,000 to $599,999 | 5 |

| $600,000 to $699,999 | 0 |

| $700,000 to $799,999 | 0 |

| $800,000 to $899,999 | 0 |

| $900,000 to $999,999 | 0 |

| $1,000,000 and above | 1 |

KEY TAKEAWAY

The data for TPD is not significant to show any interesting findings. And the causes of TPD are vague too. Do take note that most TPD coverage from insurance companies lasts only till 65 or 70 years old.

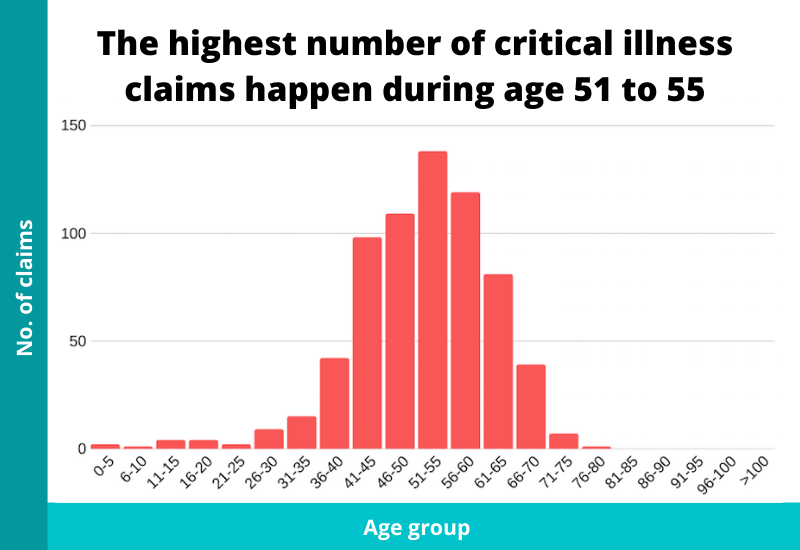

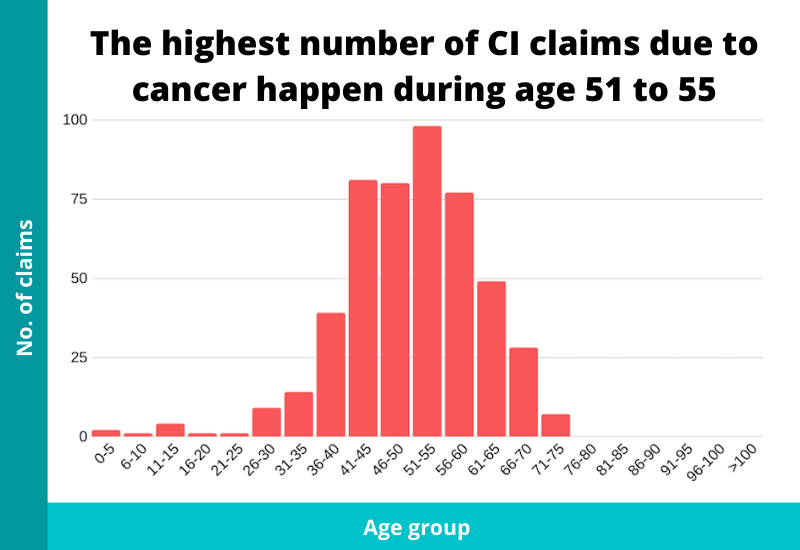

17) The highest number of critical illness claims happen during age 51 to 55

| Age | No. of Claims |

| 0-5 | 2 |

| 6-10 | 1 |

| 11-15 | 4 |

| 16-20 | 4 |

| 21-25 | 2 |

| 26-30 | 9 |

| 31-35 | 15 |

| 36-40 | 42 |

| 41-45 | 98 |

| 46-50 | 109 |

| 51-55 | 138 |

| 56-60 | 119 |

| 61-65 | 81 |

| 66-70 | 39 |

| 71-75 | 7 |

| 76-80 | 1 |

| 81-85 | 0 |

| 86-90 | 0 |

| 91-95 | 0 |

| 96-100 | 0 |

| >100 | 0 |

KEY TAKEAWAY

The majority of CI claims happen at an earlier age as compared to that of death (61 to 65). Also, a large percentage of CI claims are from age 41 to 65.

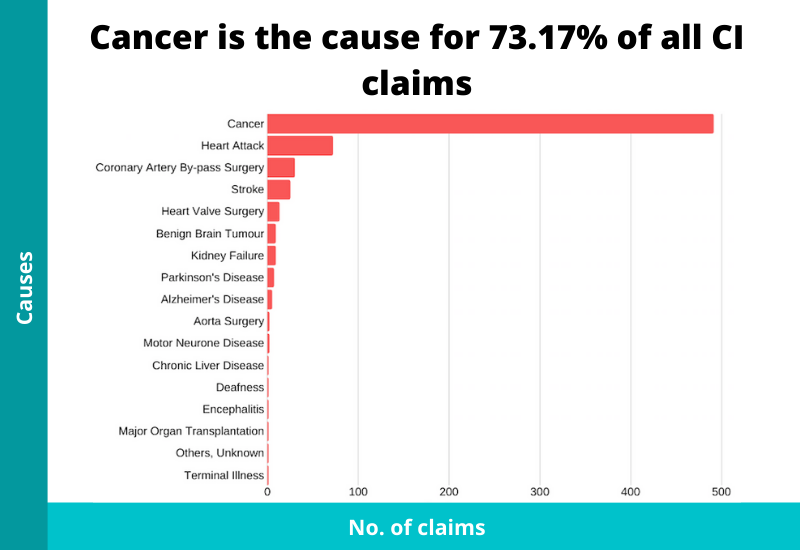

18) Cancer is the cause for 73.17% of all CI claims

| Cause | No. of Claims |

| Cancer | 491 |

| Heart Attack | 72 |

| Coronary Artery By-pass Surgery | 30 |

| Stroke | 25 |

| Heart Valve Surgery | 13 |

| Benign Brain Tumour | 9 |

| Kidney Failure | 9 |

| Parkinson’s Disease | 7 |

| Alzheimer’s Disease | 5 |

| Aorta Surgery | 2 |

| Motor Neurone Disease | 2 |

| Chronic Liver Disease | 1 |

| Deafness | 1 |

| Encephalitis | 1 |

| Major Organ Transplantation | 1 |

| Others, Unknown | 1 |

| Terminal Illness | 1 |

Of all the CI claims (671), 491 is due to cancer. This means that cancer represented 73.17% of all CI claims, and is the number one cause of it.

KEY TAKEAWAY

As usual, cancer is the main culprit for CI claims. The numbers shown here go inline with what Life Insurance Association has stated that more than 90% of all CI claims come from cancer, heart attack, stroke, kidney failure, and coronary artery by-pass surgery. In our data, 93.45% (627/671) of the CI claims are from only those five.

19) The highest number of CI claims due to cancer happen from age 51 to 55

| Age | No. of Claims |

| 0-5 | 2 |

| 6-10 | 1 |

| 11-15 | 4 |

| 16-20 | 1 |

| 21-25 | 1 |

| 26-30 | 9 |

| 31-35 | 14 |

| 36-40 | 39 |

| 41-45 | 81 |

| 46-50 | 80 |

| 51-55 | 98 |

| 56-60 | 77 |

| 61-65 | 49 |

| 66-70 | 28 |

| 71-75 | 7 |

| 76-80 | 0 |

| 81-85 | 0 |

| 86-90 | 0 |

| 91-95 | 0 |

| 96-100 | 0 |

| >100 | 0 |

KEY TAKEAWAY

Just breaking down the most important cause of CI claims – cancer. Thus far, you would’ve realised by now that critical illness, especially cancer, is something that you need to be aware of. Cancer is the top cause not just for CI claims, but for death claims as well. So that’s why the probability of death happening after contracting cancer is much greater than any other causes.

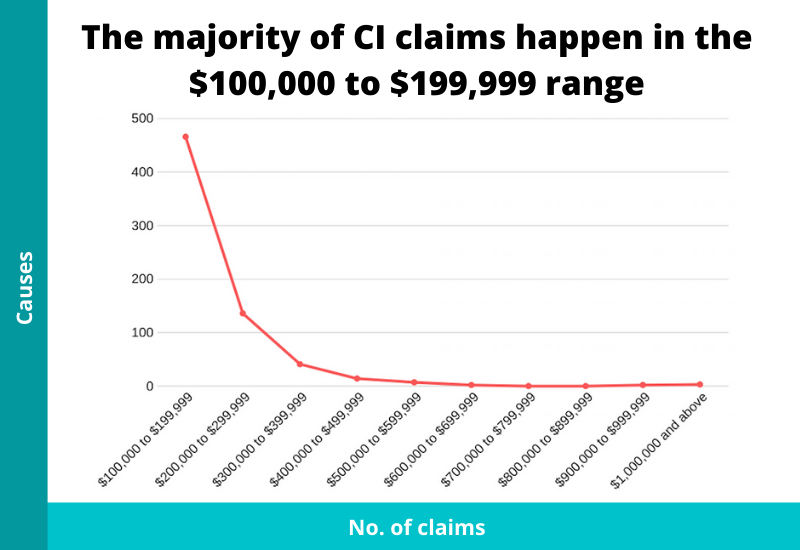

20) The majority of CI claims happen from $100,000 to $199,999

| Amount Claimed | No. of Claims |

| $100,000 to $199,999 | 466 |

| $200,000 to $299,999 | 136 |

| $300,000 to $399,999 | 41 |

| $400,000 to $499,999 | 14 |

| $500,000 to $599,999 | 7 |

| $600,000 to $699,999 | 2 |

| $700,000 to $799,999 | 0 |

| $800,000 to $899,999 | 0 |

| $900,000 to $999,999 | 2 |

| $1,000,000 and above | 3 |

KEY TAKEAWAY

As usual, the range of claimed amounts is similar to death and TPD. One thing to note here is that you may not need the same coverage for death or TPD as if one were to contract CI, he either recovers or the worst happens after five years (general rule of thumb).

Conclusion

So there you have it.

Hopefully you’ve gained some insights into life insurance claims statistics in Singapore.

Nobody wishes to claim from insurance.

However, the underlying reason why we buy it is because when misfortunes happen, the claims from insurance can assist us and our families.

The question you should be asking yourself..

“Am I sufficiently covered right now?”

Feel free to use our life insurance coverage calculator to estimate how much you life insurance you should have.