Find out how much you need to save for your child’s education with our university education fund calculator.

Have a big shortfall? Check out different ways to fund your child’s education.

Finding the Current Cost of a University Education

For most students, getting a degree is one of the last hurdles in their long education journey. Most people also say it’s a costly endeavour.

As parents, funding our children’s university costs, if possible, will lift a heavy burden on their shoulders.

The costs needed to obtain a degree consist mainly of two parts: tuition fees and the cost of living (as a student). Depending on where you plan to send your child for further studies, these costs can be considerable.

Let’s look at some estimates.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Local (Singapore)

With strong demand, the cost of education has increased by 74.7% from 2003 to 2023.

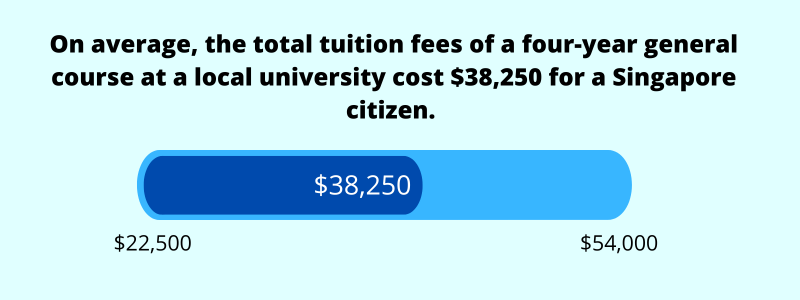

For a Singapore citizen studying in a local (public) university, tuition fees are still significant even after factoring in subsidies from the MOE Tuition Grant.

The university fees for a four-year general course are about $38,250, on average, so this figure can be used as a starting point. If you would like your child to be a doctor one day, take note that a five-year medical course at NTU costs a total of $175,000.

To find out more about the cost of university tuition fees in Singapore, check out this page.

Living expenses have to be factored in too. Not doing so is akin to sending your parents on a vacation, but only paying for the flight – it’s not going to be complete.

Here are typical annual expenses of a student:

| Items | Cost |

| Hostel accommodation (single/double occupancy) | $2,900 to $4,200 |

| Food | $3,000 |

| Personal expenses | $2,500 |

| Transport | $850 |

| Study materials | $400 |

| Total estimated costs excluding accommodation (annual) | $6,750 |

| Total estimated costs including accommodation (annual) | $10,300 |

While the cost of living for a student will differ, the estimated annual living expenses are $10,300 in Singapore. This will amount to $41,200 for four years of study.

Other Countries

The most popular countries for overseas studies are the United Kingdom (UK), United States (US), and Australia.

One benefit from studying abroad is the exposure your child will get, but it goes without saying that it will certainly cost more.

If you can afford it, why not?

Here are some estimates of the tuition fees and the cost of living for law degrees.

| Tuition Fees (for 4 years) | Living Expenses (of a student; for 4 years) | Total (tuition + cost of living) | |

| United States | USD $261,568 | USD $119,344 | USD $380,912 (SGD $506,613*) |

| Australia | AUD $184,000 | AUD $81,164 | AUD $268,164 (SGD $273,527*) |

| United Kingdom | £79,840 | £49,104 | £128,944 (SGD $242,414*) |

You can learn more about the cost of sending your child for overseas studies here.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

What Inflation Rates to Use to Project Future Costs?

The costs of a university education will not be the same years down the road, and they will rise with time.

The inflation rate reflects how fast these costs rise.

While you can use a single inflation rate to project future costs of both tuition fees and living expenses, they do experience different rates of increase. Therefore, I’d choose to separate it out.

You can use the education inflation rate for tuition fees and the core inflation rate for the cost of living.

Over the past 20 years from 2003 to 2023, the average education inflation rate was 2.83%. Even if we look at previous 20-year periods, the average rate didn’t exceed 4%. Thus, we can use a rate of 4% or 5%.

As for the general cost of living, from 2003 to 2023, the average core inflation rate was 1.86%. So, we can use a 2% or 3% rate.

It’s prudent to include a buffer, as it’s better to have more than to have less. Any excess can always go towards your retirement.

How Big Is Your Shortfall?

After knowing the projected future costs, simply subtract it with how much you have already saved for education, which will show you your shortfall.

Are you very far away from your goal?

If so, by breaking the shortfall down into smaller monthly amounts, it will seem more manageable. But don’t stall. Start saving now, because it’ll only get harder with time.

If the monthly amount that you’ll need to save still seems difficult or you wish to budget a smaller amount, you’ll have to find alternate ways to fund the costs.

How to Fund Your Child’s Education?

As long as you’ve set aside emergency funds, simply saving a regular fixed amount of money in the bank doesn’t benefit you much.

That’s because you have a fixed time horizon to save/invest. Amongst other ways to fund a university education, an endowment plan is popular because it’s usually capital guaranteed upon maturity, and yet offers potentially higher returns.

Outside of saving for your child’s education, protecting your income with life insurance and having adequate medical insurance will ensure that your child’s university fees will be provided for, rain or shine.