Although the world is moving towards a workforce that focuses more on skills and talent (hence the rise of the gig economy), many parents still hope to be able to send their children to university.

Apart from opening up opportunities for their children by arming them with a degree, many who have gone to university would also acknowledge tremendous benefits that are not purely related to the economy.

Critical thinking, networking, and deepening of knowledge are all valuable experiences that would benefit any individual. So if you are intent on sending your child to university, and scratching your head about how to begin funding his/her education, this article is for you.

How Much Does a University Education Cost?

We recently surveyed 1,088 adults in Singapore. 2 in 3 respondents say that getting a degree is expensive. However, the good news is that 71.3% of those who say a university education is expensive believe it’s worth it.

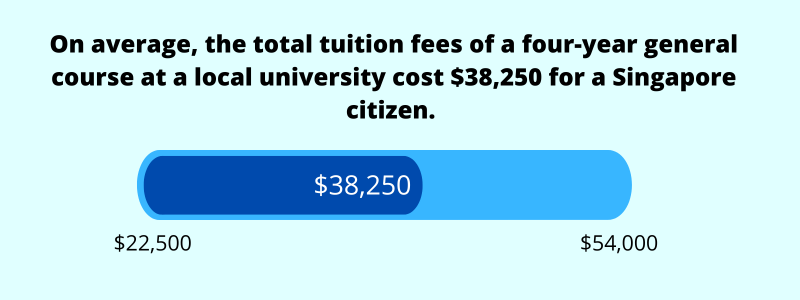

We also explored the different costs of university degrees for different specialisations. Our research found that the average cost of university degrees in Singapore stands at $38,250.

This number only accounts for tuition fees by the six local universities for 2021. It has not accounted for private universities in Singapore, overseas education, nor more expensive degrees such as dentistry, medicine, and law. These are typically more expensive and can cost three times to four times the total tuition fees of the price listed above.

(Use our free education fund calculator to estimate the total cost of a university education).

In Singapore, these are the various ways to fund a university education:

- Bursaries

- Scholarships

- Loans

- Savings

- Investments

- Child Education Endowment Plans

We explore each of the methods below and the pros and cons of relying on these ways to bring your child through university without worrying about the fees.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

1) Bursaries

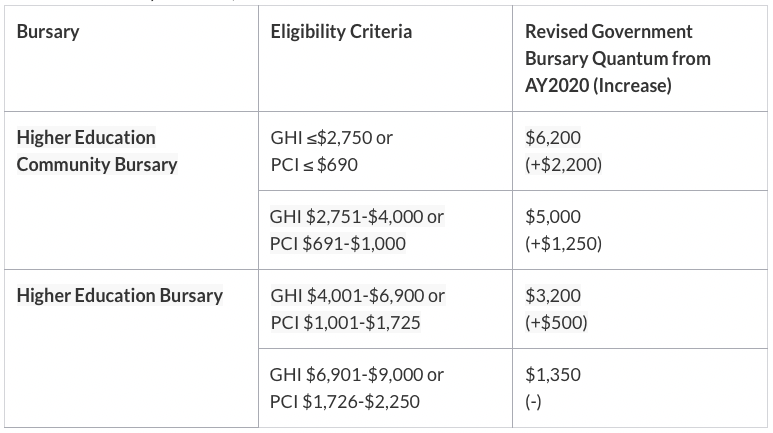

As the Singapore government places high importance on education, bursaries are available for local Singaporean citizens who need some help funding their tuition fees. There are two types of bursaries: government-funded bursaries, and university-funded bursaries.

Government-funded bursaries include both the MOE bursary and community bursary, of which each student is only allowed to receive and choose one. Government-funded bursaries look at both Gross Household Income (GHI) and Per Capita Income (PCI) to determine the amount of bursary a student is eligible for.

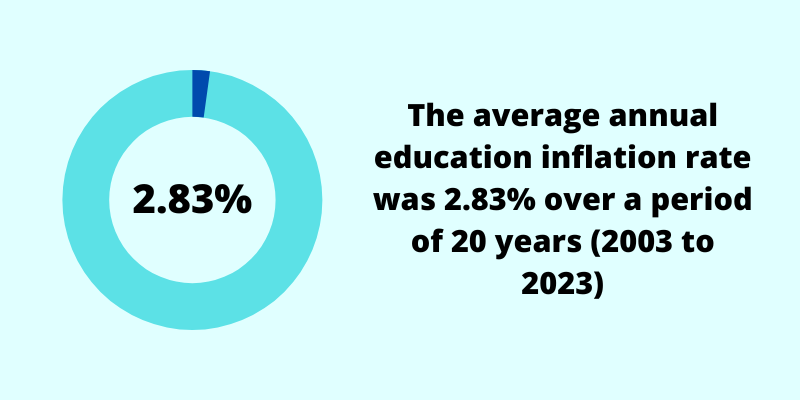

From the table above, notice that if you are a middle-income family, the bursary is not enough to cover the tuition fees. Even if your child qualifies for a bursary of $1,350, and the annual fees are approximately $8,200, this still leaves you with $6,850 to cover per year. This figure has also not accounted for inflation rates.

Furthermore, these bursaries are given every year. You will need to re-apply every year, and the bursaries figures may change depending on shifts in your GHI/PCI and other circumstances.

Likewise, university-funded bursaries are evaluated based on the GHI and stated circumstances. These bursaries are funded by donors and alumni. Bursaries awarded are at least $900 per annum. However, unlike the government-funded bursaries, recipients have to fulfill other responsibilities such as providing assistance at university events or attending meet-up sessions with the donors, if requested.

2) Scholarships

A Singaporean’s parents’ dream is for their child to be able to land a scholarship so that all expenses related to university education would be taken care of. BrightSparks is a platform that consolidates a list of scholarships that students may be eligible for, and how they can apply for them.

However, it is important to note that most scholarships come with strings attached. Once your child signs a scholarship contract, he/she is likely to have to serve a minimum 3-year bond and maintain a decent GPA.

There have been cases where students either 1) find out that their chosen course is not their cup of tea, 2) decide that the company and their own values don’t align, or 3) face circumstances that make it difficult to maintain their GPA or complete their bond.

When these situations occur, parents have to be prepared to fork out a large sum of money (which can range from $50,000 up to $200,000) to break the bond. This will end up being more costly on your purse, and also in other hidden ways such as affecting the child’s mental health especially since it is difficult to break the bond.

3) Loans

Another popular alternative, especially for parents who wish to teach their child financial independence at an early age, is to take a study loan. There are 3 types of loans available: tuition fee loan, study loan, and borrowing via the CPF Education Scheme.

MOE Tuition Fee Loan

All Singaporean students can apply for the MOE tuition fee loan. The loan for undergraduates covers 90% of their tuition fee, and the interest rate is delayed and only commences at the point of graduation. This loan is only available at the local banks – DBS and OCBC. In 2021, the interest rate (per annum) stated for DBS and OCBC is 4.38% and 4.5% respectively. Students have a choice of repaying the loan for 10-20 years.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Study Loan

Other banks also offer study loans but are different from the MOE tuition fee loan in that the loan can only cover up to 20% of the fees payable by the student. Study loans are usually taken on top of the MOE tuition fee loan, often to cover other university expenses such as living in university residences, funding for overseas exchange programmes, and purchase of course materials.

CPF Education Loan Scheme

Last but not least, parents also have the choice to use the CPF Education Scheme. This scheme allows parents who have sufficient money in their CPF Ordinary Account (OA) to pay for the subsidised tuition fees. Unlike the loans stated above, you or your child would need to not only repay the amount withdrawn, but also the “accrued interest in cash”. Repayment also begins after graduation.

4) Savings

Next, parents can also choose to use their savings to pay for their child’s university education.

The positive part about using savings is that you have liquidity. Cash is not locked in at any one time. However, the downside of this is that 1) you may want to use the savings to pay for other purchases before your child goes to university, and 2) banks give very low interest for saving accounts.

5) Investments

Those who are savvy at trading in the stock market might also be planning to use their investments to fund their child’s education.

However, investments do carry risks. They are often volatile, and there have been cases where people have lost their entire capital and more. You will have to entertain the possibility that relying entirely on your investments to fund your child’s university may not even be an option if your accounts are in the red.

6) Child Education Endowment Plans

Last but not least, child education savings plans are often a popular choice for most parents.

An endowment plan is an insurance savings plan that helps you to commit to saving regularly, and is usually capital guaranteed upon the point of university entry. You have the choice to choose between shorter and longer years of paying premiums.

Although the interest rate is not very high, it’s likely better than leaving your money in the bank. Even if your child does not need your help to fund his/her education in the end, you have the choice to use the funds for other matters, whether it is for your retirement, or to gift it to your child for their wedding, home, graduation and more. Learn more here.