An ambulance with its horns blaring is speeding on the expressway, and cars are steering away to make space for it.

It’s an emergency.

Someone needs medical attention, and needs it fast. But that’s just one side of the picture.

The cost of hospitalisation and medical services are expensive and ever-increasing. Can the injured afford the hospital bill?

In this guide, I’ll cover all there is to know about the national healthcare scheme, MediShield Life.

So, read on!

This page is part of the Health Insurance 3-Part Series:

- Part 1: What is MediShield Life? (you’re here)

- Part 2: Integrated Shield Plans

- Part 3: Best Integrated Shield Plans?

Singaporeans’ Health: The Big Picture

To start off, here are some facts and figures to get a glimpse of how healthy Singaporeans are.

In 2021, the total population in Singapore is 5,453,600, of which, 3,986,800 are Singapore residents (citizens and permanent residents).

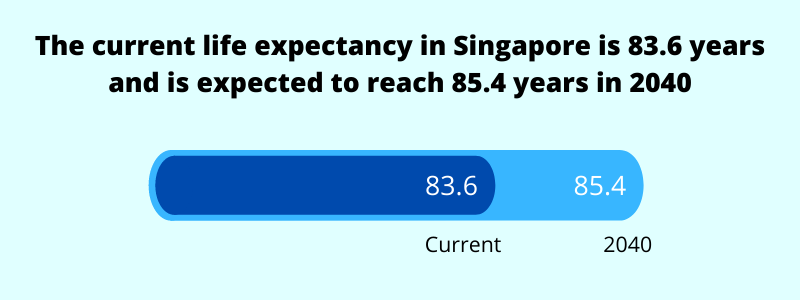

As for life expectancy, the average is 83.6 years (both genders), which is at the third spot of global rankings, with Japan and Switzerland topping the charts.

In addition, our life expectancy is expected to hit 85.4 by 2040.

Based on this data, it seems like Singaporeans can live to a healthy old age.

But, is it entirely true?

Well, although longevity is lengthening, Singaporeans are spending more time in ill health, 10.6 years in fact. That’s roughly 10% of an average lifespan.

Not only that, it creates a burden on not just yourself but those around you.

Let’s take a deeper dive.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Death Might Not Be the Heaviest Financial Burden

The fear of death is real.

We’re naturally afraid that one day we won’t be around, especially when it’s unexpected.

Unfortunately, it messes our minds up – it can either propel us forward or hold us back. Knowing that today may be our last day will enable us to fully experience life.

But on the other hand, when the fear is too strong, it makes us afraid to do things even remotely “risky”.

Know this though: Death is something that can’t be controlled (just don’t go looking for it).

It usually doesn’t happen suddenly, and something usually happens first.

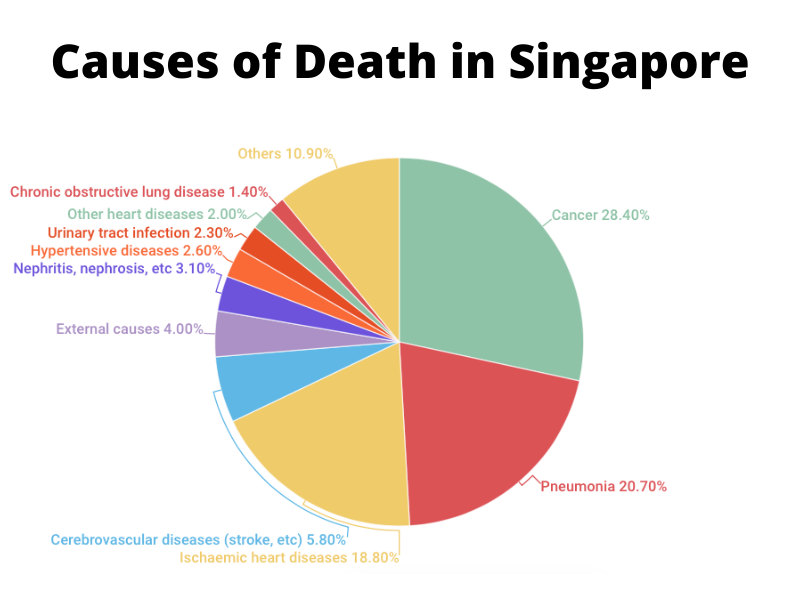

Here are the top 10 causes of death in Singapore:

The hard truth is this:

Death might not the most painful part. It’s the period one has to go through before the inevitable.

Aside from the physical pain, there will be financial battles.

As the saying goes: “it’s cheaper to die than to fall sick in Singapore”.

Treatments can be very expensive and if you’re unable to seal the financial wound, it can be hard on everybody.

From the list, you can see what type of health problems plague Singaporeans.

Cancer is the top cause of death which accounts for almost one-third of all death cases. We’ll talk more about this later on.

Another illness which has gained interest is diabetes. Till this day, there are still many advertisements educating the public about it.

How serious is it?

- 1 in 9 Singaporeans has diabetes

- 3 in 10 over the age of 60 have it

- Singapore is the no. 2 nation with the most diabetics

It can lead to blindness, heart failure, and kidney failure. And some patients may need to go through amputation (about 1,200 diabetics every year).

What do all these imply?

The treatment of these illnesses will require money, and it’ll be costlier over time.

Healthcare in Singapore Can Be Expensive

Medical costs are constantly increasing.

When we look at various healthcare cost statistics, external sources say that Singapore’s medical inflation rate was around 10% in 2019 and 2020.

What does it mean?

A simple way to portray this: if a surgery costs $10,000 in 2019, it would cost $11,000 in 2020. But that’s just for one year, if you compound it throughout the years, the costs can be very significant.

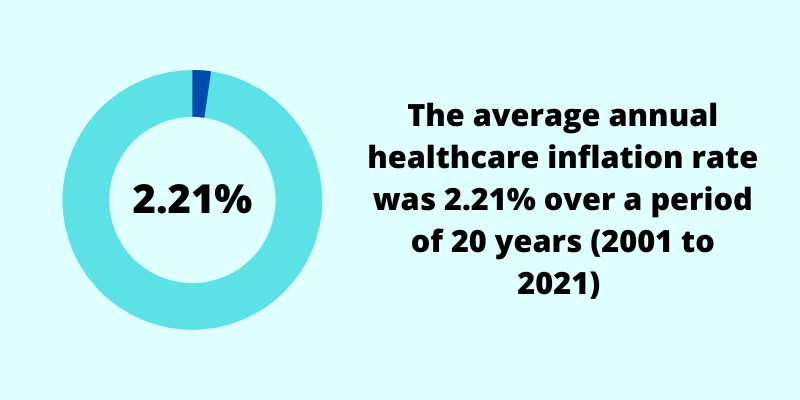

When we look at our own national data, the medical inflation rate was 2.21% over a period of 20 years from 2001 to 2021.

In contrast, the average inflation rate during that same period was 1.54%.

This means that the rising cost of healthcare is outpacing the rising cost of living in Singapore.

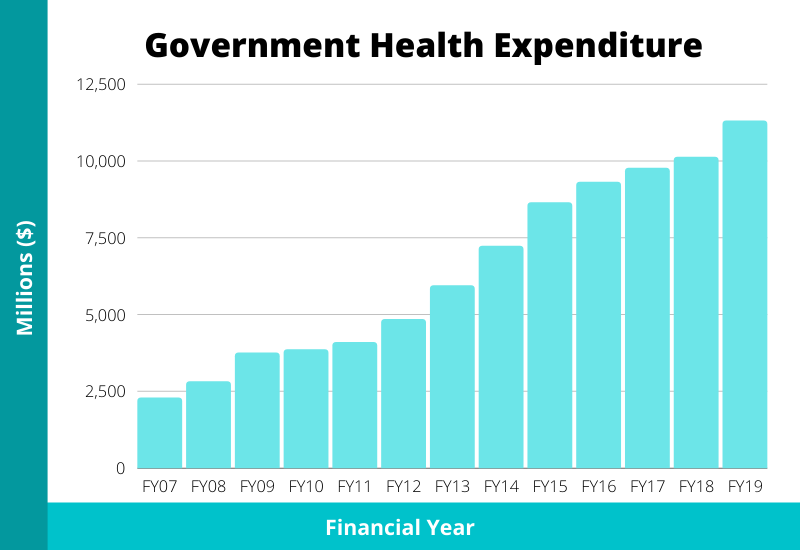

Which is also partly a reason why the government spends a lot on healthcare these days.

In the past few years, they have been spending $10 billion a year.

But the government views this as unsustainable so the best way is to encourage Singaporeans to be healthy by creating awareness.

This can reduce potential health problems, which leads to lower healthcare costs.

But unfortunate events still do happen.

That’s why it’s good to be covered for hospitalisation.

How Much Is the Typical Hospital Bill?

The hospital is the start of everything.

Whether it’s diagnosing an illness, going for treatments, accidents, etc, it’s the first place to be in.

Finding out how much it’ll cost is the concern of every patient.

Here’s an average of hospital bill sizes:

The average bill size of medical specialties:

- Public hospitals: $1,012 to 7,876

- Private hospitals: $3,906 to $24,687

The average bill size of surgical specialties:

- Public hospitals: $1,638 to 10,541

- Private hospitals: $8,109 to $18,993

But those are just averages.

Let’s look at some specific examples.

The Cost of Treating Various Critical Illnesses

As for life insurance, there are five critical illnesses (CI) that make up more than 90% of all CI claims.

And they are:

- Major Cancers

- Heart Attack of Specified Severity

- Coronary Artery By-pass Surgery

- Stroke with Permanent Neurological Deficit

- End Stage Kidney Failure

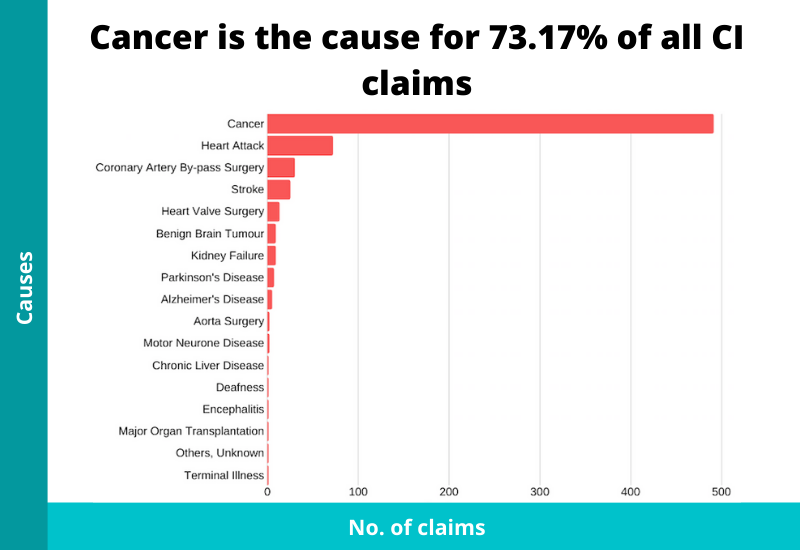

By far, cancer is the most important as it makes up the majority of CI claims.

And its prevalence is high: the lifetime risk of getting cancer is 1 in every 4-5 Singaporeans.

The Cost of Treating Cancer

Different treatments may be required to treat cancer.

It’s usually a combination of surgery, chemotherapy, and radiation therapy. And they’re required for a prolonged period.

As such, late-stage cancer treatments can cost $100,000 to $200,000 yearly.

Cost of Treating Heart-Related Conditions

| Type of Treatment | Type of Hospital | Average Bill Size |

| Heart Bypass | Private | $81.338 |

| Public (Unsubsidised) | $38,251 | |

| Public (Subsidised) | $8,312 |

Cost of Treating Stroke

| Type of Treatment | Type of Hospital | Average Bill Size |

| Stroke | Private | $23,335 |

| Public (Unsubsidised) | $7,804 | |

| Public (Subsidised) | $2,601 |

The costs are high. Do you have the ability to pay for such treatments if something happens?

This is why health insurance is important as it can substantially cover such medical bills.

The government knows this and that’s why MediShield Life was introduced.

What Is MediShield Life?

For the longest time, there was only MediShield.

Then, MediShield Life came along and replaced it on 1 November 2015.

MediShield Life, administered by the Central Provident Fund (CPF), is one of the few national healthcare schemes. Its aim is to provide basic medical insurance to help Singaporeans pay for large hospital bills and selected outpatient treatments.

The other national healthcare schemes are ElderShield and CareShield Life (which replaced ElderShield). Both are meant to provide long term care support in the form of monthly payouts if at least three out of six basic activities of living can’t be done.

5 Key Features of MediShield Life

1) Protect Against Large Medical Bills for Life

If something unfortunate happens, and you end up in the hospital, the bills you would’ve to pay can be hefty.

One of the biggest benefits of MediShield Life is that you’re able to claim for eligible hospitalisation costs, be it as an inpatient or an outpatient.

And this coverage is available to you for life, hence the name. There’s no limit to the maximum coverage age.

2) Automatic Coverage for Singapore Citizens and Permanent Residents

If you’re a Singapore citizen or permanent Resident, MediShield Life will be automatically enrolled for you.

This is to ensure that everyone has some form of protection, and not to be left out.

This coverage is compulsory and you wouldn’t be able to opt out, even though you may have your own medical insurance.

3) Targets B2/C Class Public Wards

MediShield Life is only a basic health insurance.

One of the reasons why this is so is because it’s sized for subsidised treatments in the public hospitals, particularly B2/C wards, which are typically 5-9 bedders.

Why doesn’t it have better coverage?

In my opinion, national policies cater to the masses, so the basic form of protection has to be in place. This also makes the premiums more affordable.

If you want or need a more comprehensive cover, you’re allowed to upgrade your MediShield Life with an Integrated Shield Plan.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

4) Covers Pre-Existing Conditions

Rarely do insurance companies offer any form of coverage for pre-existing conditions.

However, for MediShield Life, they’re able to cover such conditions.

This comes with a cost for those who have more serious conditions such as:

| Broad categories | Indicative examples (not exhaustive) |

| Cancer | Lung cancer, colorectal cancer, breast cancer, stomach cancer |

| Blood disorders | Aplastic Anaemia, Thalassemia Major |

| Degenerative diseases | Parkinson’s Disease, Muscular Dystrophy, Amyotrophic Lateral Sclerosis (ALS) |

| Heart or other circulatory system diseases | Heart attack, Coronary artery disease, Chronic ischaemic heart disease |

| Cerebrovascular diseases | Stroke |

| Respiratory diseases | Chronic obstructive pulmonary disease |

| Liver diseases | Alcoholic liver disease , Chronic hepatitis, Fibrosis or cirrhosis of liver |

| Autoimmune/ Immune System diseases | Systemic lupus erythematosus, Human Immunodeficiency Virus/ Acquired Immune Deficiency Syndrome (HIV/ AIDS) |

| Renal diseases | Chronic renal disease, Chronic renal failure, Chronic nephritic syndrome |

| Serious congenital conditions | Congenital heart disease, Congenital renal disease, Biliary atresia |

| Psychiatric conditions | Schizophrenia |

| Chronic condition with serious complications | Hypertensive heart disease, Hypertensive kidney disease, Diabetes with kidney complications, Diabetes with eye complications |

For those who are deemed to have such serious conditions, they would be required to pay an additional 30% for a period of 10 years.

But they’ll be able to claim from MediShield Life even if the claim arose from their pre-existing conditions.

5) Premiums Are Fully Payable by MediSave

One of the enticing factors about MediShield Life is that premiums can be fully payable by your MediSave balance, at all ages.

Therefore, to enjoy some form of health insurance, you need not use your hard-earned cash.

I’ll cover more on the premiums later.

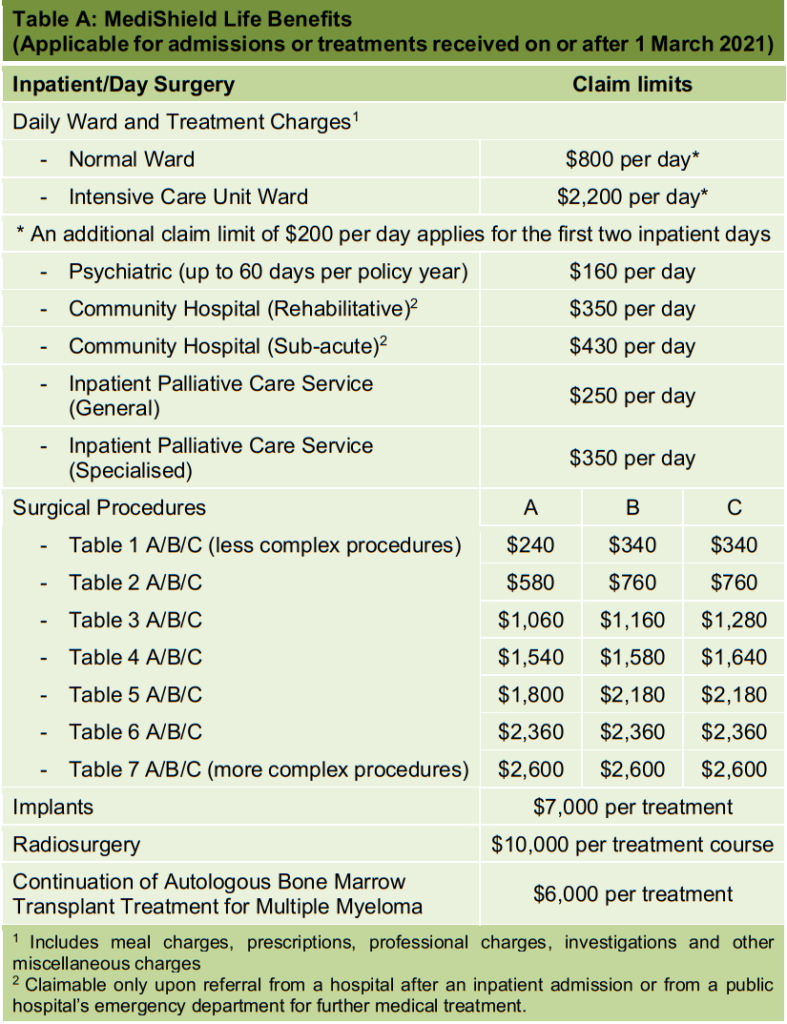

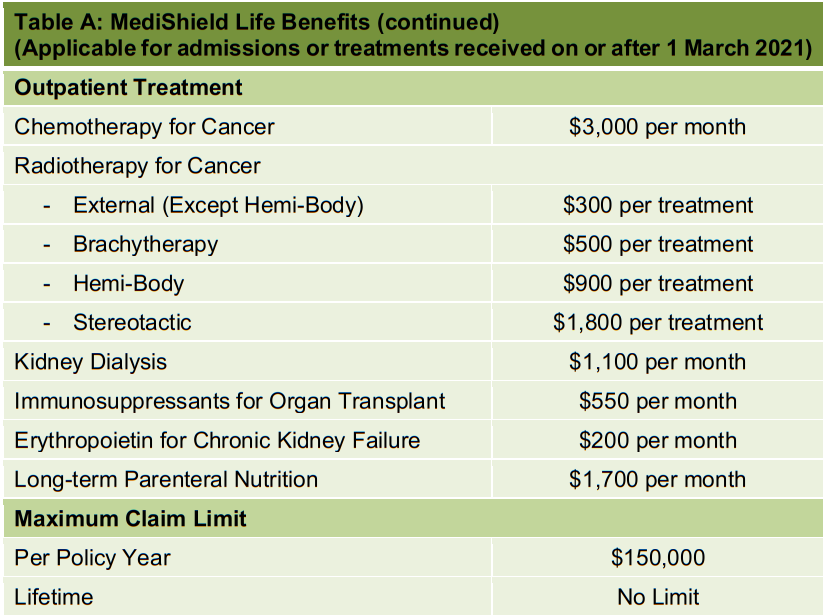

What Does MediShield Life Cover?

The main benefit of MediShield Life is the ability to claim.

Here’s the coverage:

What Doesn’t MediShield Life Cover?

It doesn’t mean that everything that happens in the medical institution can be covered.

Here are some exclusions:

- Ambulance fees

- Cosmetic surgery

- Dental work (except due to accidental injuries)

- Vaccination

- Infertility, sub-fertility, assisted conception or any contraceptive operation, including their related complications

- Sex change operations, including their related complications

- Maternity charges (including Caesarean operations) or abortions, including their related complications, except treatments for serious complications related to pregnancy and childbirth

- Treatment for injuries arising from the insured’s criminal act

- Treatment of injuries arising directly or indirectly from nuclear fallout, war and related risk

- Treatment of injuries arising from direct participation in civil commotion, riot or strike

- Expenses incurred after the 7th calendar day from being certified to be medically fit for discharge from inpatient treatment and assessed to have a feasible discharge option by a medical practitioner

- Surgical interventions, including related complications, for the following rare congenital conditions which are severe and fatal by nature: Trisomy 13, Bilateral Renal Agenesis, Bart’s Hydrops and Anecephaly

- Optional items which are outside the scope of treatment

- Overseas medical treatment

- Private nursing charges

- Purchase of kidney dialysis machines, iron-lung and other special appliances

- Treatment which has received reimbursement from Workmen’s Compensation and other forms of insurance coverage

Such items are not eligible for claims.

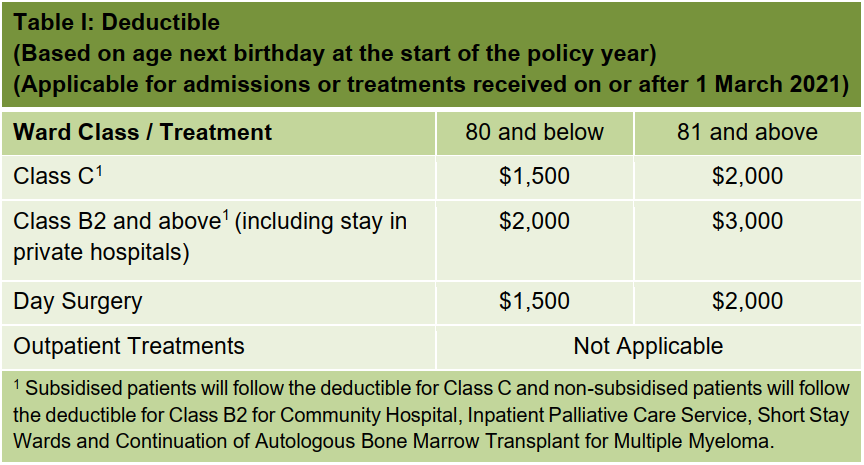

There Will Be a Deductible and Co-insurance

Typical medical plans have these elements and MediShield Life is no different.

Let’s look at how both of them work, and then, an example.

The deductible is a fixed amount an insured needs to pay first before there are any payouts from MediShield Life.

It also means that if your bill is small, the claimable amount from MediShield Life would not be high. Deductibles are there to sieve out the smaller bills from the bigger ones.

Here are the deductibles:

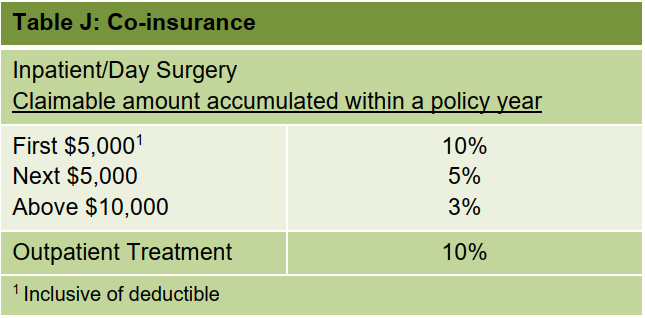

For co-insurance, it’s also something that you’ll need to fork out, on top of the deductible. It’s a percentage of the claimable amount.

Here’s the co-insurance:

EXAMPLE

Mr Tommy incurred a bill of $10,000 (within the claim limits of MediShield Life).

He first has to pay a deductible of $2,000 (B2 Class ward).

Calculating the co-insurance:

$2,001 to $5,000: 10% of $3,000 = $300

$5,001 to $10,000: 5% of $5,000 = $250

Total co-insurance = $550 (300 + 250).

So, Mr Tommy has to pay the sum of the deductible and co-insurance which works out to be $2,550. And MediShield Life will pay out the rest.

This ensures that when the bill size grows, MediShield Life will pay out a bigger portion of it.

The Premiums for MediShield Life

As mentioned previously, premiums for MediShield Life can be fully payable using MediSave.

What if you don’t have enough? Cash will be needed.

However, you’re able to use your own MediSave to pay premiums for your immediate family, and vice versa.

Here are the annual premiums before any subsidies:

| Age Next Birthday | New Annual MediShield Life Premiums (after 1 Mar 2021; before any subsidies) | Old Annual MediShield Life Premiums (before 1 Mar 2021; before any subsidies) | Increase in Percentage |

| 1-20 | 145 | 130 | 11.5% |

| 21-30 | 250 | 195 | 28.2% |

| 31-40 | 390 | 310 | 25.8% |

| 41-50 | 525 | 435 | 20.7% |

| 51-60 | 800 | 630 | 27.0% |

| 61-65 | 1,020 | 755 | 35.1% |

| 66-70 | 1,100 | 815 | 35.0% |

| 71-73 | 1,195 | 885 | 35.0% |

| 74-75 | 1,320 | 975 | 35.4% |

| 76-78 | 1,530 | 1,130 | 35.4% |

| 79-80 | 1,590 | 1,175 | 35.3% |

| 81-83 | 1,675 | 1,250 | 34.0% |

| 84-85 | 1,935 | 1,430 | 35.3% |

| 86-88 | 2,025 | 1,500 | 35.0% |

| 89-90 | 2,025 | 1,500 | 35.0% |

| >90 | 2,055 | 1,530 | 34.3% |

As you can see, with the new changes effective 1 March 2021, premiums for MediShield Life have an increase of up to 35.4%.

Do note that the premiums increase with age-band. It gets more costly as you get older.

For those who require more help in paying the premiums, there are several subsidies available.

Premium Subsidies Are Available

To help those who may have difficulties in paying the premiums, there are several subsidies available to help:

- Lower Income to Middle Income

- Pioneer Generation Subsidies

- Merdeka Generation Subsidies

- COVID-19 Subsidy

As Singapore strives to provide universal coverage for healthcare, these subsidies come in handy for all those who are older and those who require more financial assistance.

This way, the basic safety net for all Singaporeans can be met, and a group of people will not be left out because they can’t cope with the premiums.

How to Make a Claim?

Claiming is everything about a hospital plan.

The claim process is simple as everything can be done electronically.

You’ll just need to inform the medical institution and they’ll do the rest.

If there is an eligible payout, CPF will make the payment to the medical institution on your behalf.

If you have an Integrated Shield Plan, the process is still similar. The only change is that the insurance company will handle everything else.

The 3 Limitations of MediShield Life

The goal of MediShield Life is provide a basic and universal health insurance for all Singapore residents.

While it’s a good initiative, it can’t cater to everyones’ specific needs.

Here are some of the main disadvantages:

1) Limited coverage

If you refer to the MediShield Life coverage at the top, you would’ve seen that the benefits are fairly short.

Only just a few things are covered. On top of that, there are claim limits on the particular type of treatment and ward charges, etc.

And also, a limit to how much you can claim in a year.

2) No coverage for pre and post hospitalisation

Usually, you don’t visit a hospital just to get warded.

Prior to admission, you would’ve gone for several consultations and tests.

Even after admission, there are follow up treatments.

These aren’t covered under the MediShield Life, and will increase your out-of-pocket expenses.

3) Pegged to B2/C wards

Like mentioned, the claims are pegged to B2/C class wards.

So, if you end up in a private hospital, MediShield life will only pay out a very small portion of the bill and you’ll pay the rest, which can be huge.

Covering for Hospitalisation Is Just the Start

By far, hospitalisation coverage is the most important aspect in planning your finances.

It has a higher probability of happening, and the costs can amount to a small fortune.

Having said that, we shouldn’t neglect the other part, which is to protect your income.

What happens if you’re back home and continue to suffer from a permanent disability or a critical illness?

Your ability to earn an income might be crippled. But there are still a lot of financial commitments and liabilities to pay.

This is why you should consider having adequate life insurance coverage too (term insurance or whole life insurance). Not sure how much is enough? Estimate how much life insurance cover you need with our calculator.

What’s Next?

Hopefully by now, you’ve understood what MediShield Life is all about.

It is an important element in financial planning as medical coverage forms the foundation.

Without proper coverage according to your needs, no matter how much you save or invest, there will always be leaks.

So then, the question is this: do you think MediShield Life on its own is enough?

It is as per designed, basic.

If you have the capacity, consider upgrading it. Learn more about Integrated Shield Plans now.