By now, many Singaporeans would’ve known the importance of planning for their retirement.

However, it’s still a huge topic which consists of many moving parts.

Because of that, it can be difficult to get started as there’s no easy plan of attack.

So today, you’ll gain some perspectives on how to create an investment strategy for retirement purposes.

Read on!

Knowing Your Numbers to Retire

Without a clear goal, it’s hard to know whether you’re off the pace or not.

To start planning for your retirement, you should already know how much you need to retire. If you don’t, check out our retirement planning calculator.

Do also note to constantly update your current assets and liabilities, as well as your cash flow. This not only enables you to keep track and monitor your finances, but can also be a summary for your family (in case you’re mentally incapacitated or taken out of the picture suddenly).

When you’ve made the right “investments” to your main income drivers – your career and/or business – you’re likely to have a cash surplus which should be put to better use.

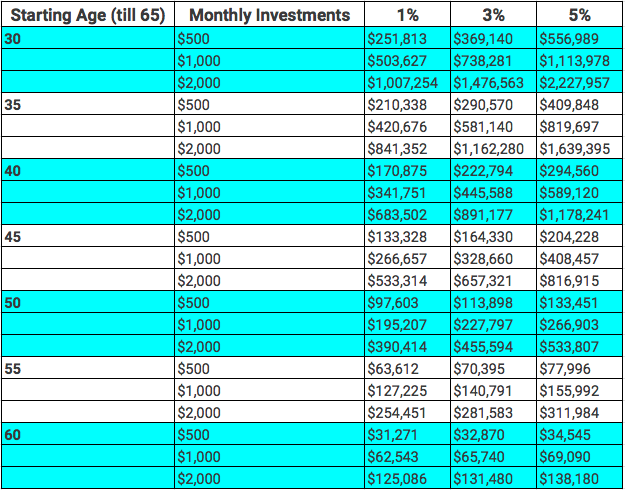

Using a compound interest calculator, you can see how much money you would’ve accumulated for retirement with just a small amount set aside monthly:

But this question always comes up: how and what should I invest for retirement?

To address it, let’s dive deeper.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

3 Factors to Consider Before Parking Your Retirement Funds

In my opinion, the selection of an investment vehicle for your retirement monies should depend on these 3 factors:

- Time

- Risk

- Return

Here are more details on each factor:

1) Time

Probably the most important factor as it directly affects the other factors.

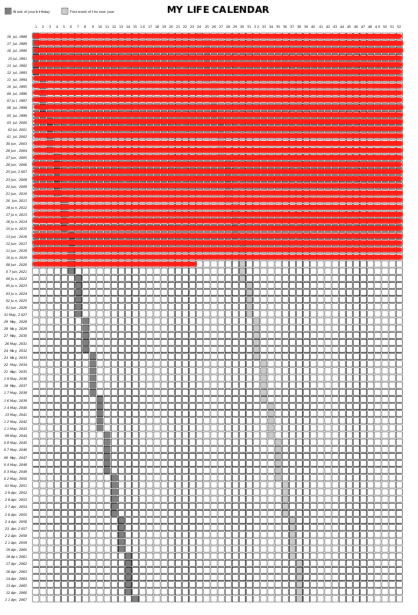

Just a gentle reminder: time is extremely limited.

Here’s an example of a typical “life calendar”.

It highlights the fact that we don’t have that much time left in this world.

There are 2 known ages: age of death (estimated) and age of retirement.

Based on statistics, the life expectancy of Singaporeans (both male and female) is 84 years.

The retirement age is something that you decide on. Retirement will happen whether you like it or not. You may say you don’t want to retire and that’s fine. You can continue to do the things you love to do. But perhaps at some point, your health may not allow it. And that’s why it’s still important to have the option of not needing to work.

With these 2 ages in place, it’ll mean that there’s a limited period of time from now to your desired retirement age.

So if you don’t plan ahead of time, you may not be able to retire at all. The reality of it: we see the elderly working through their old age.

If time is on your side – as you’re still young – then you’d be better off knowing how to plan for retirement early. With a longer time horizon, you have the time to make mistakes and take on higher risks.

Another thing that’s related to time: liquidity.

When you’re planning solely for retirement (not considering other financial goals), there isn’t really a need for your assets to have liquidity.

It isn’t important to liquidate your assets in the short run because you know you’re only utilising the retirement monies in the later years.

Because of that, you don’t need to look for short term solutions like yearly fixed deposits, or short term solutions of 5-10 years. These short term investments come with reinvestment risks.

Therefore, you can look at longer time horizons that can potentially give out higher returns.

2) Risk

How do you determine how much risk can you take?

A simple way is to go through a risk profile using the Know Your Client (KYC). You may have done it before when purchasing financial products.

These questions are designed to get your current perspectives on how much you’re risk you’re willing to take.

If you’re considered low risk, does it mean that you should only go for low risk products which can’t beat inflation?

If you’re considered to be able to take higher risk, does it mean you should go for riskier investments all the way?

That being said, if you don’t have time on your side, and you know that you’re unable to hit your retirement goals with your current projections, there might be a need for higher risks (depending on your appetite).

3) Return

Your expected return on your investments would primarily depend on the type of risks you’re willing to take.

The most ideal situation: to achieve high returns with the lowest risk.

Can it happen? Maybe, maybe not.

However, to me, the closest to that statement is this: the highest ROI you can achieve with investments would be in your career and/or real businesses where you have expertise in what you do. Thus, you should pay considerable amount of attention to those first.

But if you have residual cash surpluses, it shouldn’t be left in the savings account.

If you’re conservative, you shouldn’t expect the highest returns. Perhaps something to beat inflation.

If you’re a higher risk taker, although you can expect higher potential returns, you must be willing to accept the risks involved.

To put it simply..

If you lack the time, then there might be a need for higher risks to achieve what you require.

If you have the time and have done proper projections, you can achieve your retirement goals without excessive risk taking. Now, if you want to cater for other financial needs such as leaving more for your dependants, then that’s when estate planning comes in.

3 Broad Types of Assets for Retirement

After considering the above factors, it’s time to find out how to allocate your assets for retirement.

Note that this is solely for retirement, and not in considering other financial goals you have like kid’s education, etc.

Although there may be overlaps with other goals, to factor them in is out of the scope of this article, and a more deeper look into your situation is advisable as everybody’s situation is different. You’re should approach a financial advisor for this.

Generally there are 3 types of assets you should like at:

- Emergency funds

- Non-volatile assets

- Volatile assets

1) Emergency funds

While emergency funds don’t necessarily give you much returns, they provide some liquidity in worst case scenarios.

This shouldn’t be funds that are used for your expenses. It should be funds that are left untouched, just for unpredictable and undesirable circumstances.

It should be placed in something that is very liquidable like the savings accounts, fixed deposits, high yield interest savings account, etc, that are easily deposited and withdrawn, preferably instantly. Its purpose is to provide a safety net.

The general consensus is 6-12 months of expenses.

Why?

Because generally in Singapore, you’re able to find another job during that period.

It’s there to counter the temporary loss of income.

If there’s a permanent loss of income – death, total & permanent disability, critical illness – then insurance would’ve kicked in. You ought to have adequate insurance coverage prior to starting any wealth accumulation plans.

This can be done through income protection like term insurance or whole life insurance, and having hospitalisation coverage, etc.

This is because if there isn’t any insurance coverage, a single illness or accident may wipe out whatever you’ve painstakingly saved.

2) Non-volatile assets

The appeal with non-volatile assets is the stability it provides.

It should provide stable growth that outpaces the rate of inflation.

So while the cost of living increases, these assets will be able to offset it (and hopefully more).

Additionally, there is predictability in how much you would have for retirement, which provides greater clarity.

It should form a larger portion of your portfolio especially in the later years.

Assets in this class can be CPF OA and SA accounts, bonds, cash annuities (retirement plans), etc.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

3) Volatile assets

In these assets, there are volatility in the value of the assets and a potential loss in principal.

Some types of volatile assets:

- stocks and shares

- unit trusts, mutual funds, ETFs

- property investment

There are higher risks in such investments, but they come with potentially higher upsides.

Depending on your risk appetite and time to retirement, such assets can be beneficial to achieve more.

How Most Retirement Investment Strategies Play Out

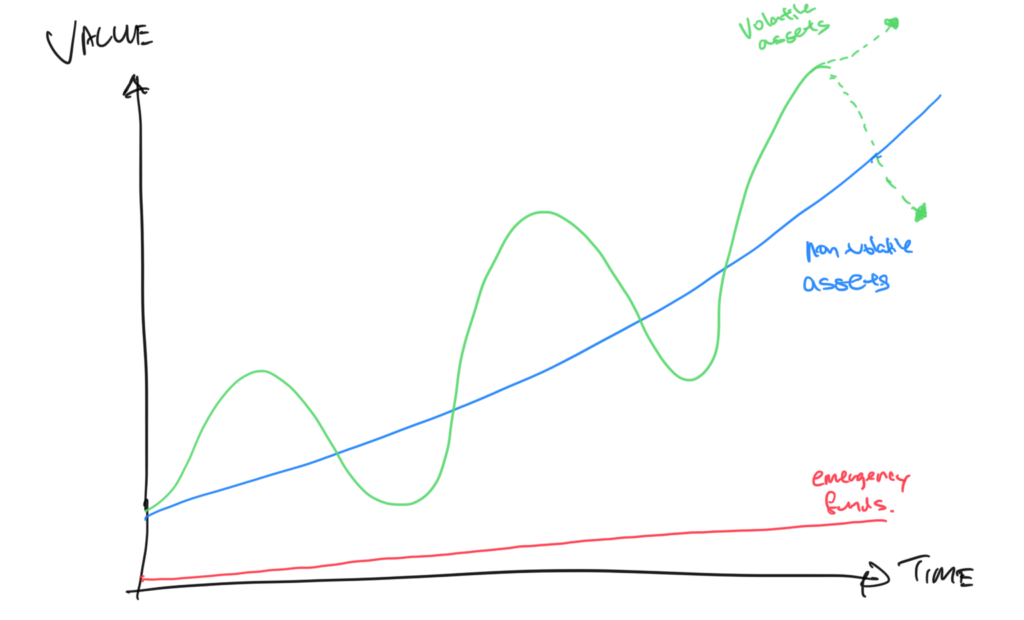

To consolidate the factors and the different broad types of assets, we’ll get this graph:

Now, this trajectory is generic, and won’t apply to everyone as situations are different. For example, for those who are conservative, they may hold lesser of volatile assets.

Having said that, I felt that the graph is good to give you another perspective.

For emergency funds, there isn’t much to say.

Throughout the ages, your expenses get higher over time (because of inflation and hopefully increased quality of life), the absolute amount of emergency funds you would want to have handy should increase with it as well since it’s based on 6-12 months of expenses.

So what we should be looking at is what stage of life you’re at and what types of assets you should hold, whether it’s volatile or non-volatile.

Another way to look at this: saving and investing for retirement is like running a race.

The goal of the race is simply to complete it no matter if you run fast or slow – achieving your targeted retirement sum at the targeted retirement age.

Failure to complete the race will lead to consequences:

- extending your retirement age (if health allows it)

- lowering your ideal retirement lifestyle

These implications could mean that you may not be able to travel and do the things you love to do. When you’ve spent most of your life working, are you okay with that?

The below gives you rough perspective on how to plan for retirement based on your age group (retirement age being 65).

25-35 years old

In this age group, there is ample time to accumulate for retirement as it’s likely to be decades later.

Even if you’re starting small, the power of compounding helps you tremendously. You can always do more along the way.

Because of the longer time horizon and your risk profile, you may be able to take higher risks to achieve higher potential returns with volatile assets.

For salaried employees, you’ll start to contribute to your CPF OA and SA accounts which eventually make up the Retirement Account and subsequently your retirement income. However, because you’d be using a majority of the funds (OA) to pay for your property, this severely limits the amount of retirement funds you should have in the future.

To supplement it, consider longer term strategies like topping up your CPF accounts or creating alternate assets such as cash annuities.

35-45 years old

At this age, a major asset should’ve already be provided for and that’s your residential property.

Hopefully you’ve done well in your career and an increased income should reflect that. If you have yet to start allocating part of your assets for retirement purposes, it’s time to start now.

As the time horizon is still a good 20-30 years away from retirement, you can still take on some risks. Just know that you might want to build on the foundation of non-volatile assets too.

This is because with the nature of volatile assets, its value fluctuates. At retirement age, there’s no guarantee that you won’t experience a drop in value. If the value drops, it’s highly unlikely that you want to sell off even a part of it. So generally, you may want to depend on some non-volatile assets for retirement income.

45-55 years old

When you’re at this stage, it’s very close to running in your last lap. This is because there’s only 10-20 years left to save up for retirement.

If you don’t put in considerable action in it now, you may need to prepare for the consequences.

This is the point where most may consider to liquidate their volatile assets especially those that have performed well to lock in profits. These proceeds can then be redirected into non-volatile assets which are safe and secure.

55-65 years old

This is the final lap. You’re only left with less than 10 years to save for retirement.

If you haven’t saved up anything or started doing anything, then it’s going to be an uphill battle.

Not only is the monthly amount you need to save extremely high, you have an extremely short amount of time to achieve it. To achieve your required retirement sum, you may need to succumb to unwanted risks.

During this time, health problems can creep in which inhibits your ability to work. So if you don’t have enough to retire and you can’t earn an income, what’s going to happen?

So it’s always good to start early.

After retirement

What types of assets should you hold during your retirement years?

Well, this heavily depends on your objectives and risk profile.

If you’ve achieved your retirement sum (after proper planning), which meant that prior to death, you’re able to achieve your intended quality of life, do you really still need to take risks with your assets? Only you can answer that.

If you’re thinking of leaving more money for your family or dependants, then it’s an entirely different aspect altogether. You should take a look at estate planning. This’ll allow you to leave a greater legacy behind.

The use of legacy insurance plans allows this. If you’ve a set amount of money intended to be left behind, you can enhance it further by capitalising on your death.

What’s Next?

I’m sure there are many investment strategies for retirement out there.

This article only provides another perspective for you.

Retirement planning is obviously a much bigger topic which involves multiple moving parts. Only some of the broad options are mentioned here.

If you wish to know what types of investments you can consider for retirement – whether volatile or non-volatile – check out some of the best retirement investment options in Singapore. You can also learn more about retirement annuity plans.