So you’ve already contributed to your SRS account with the intention to reduce taxes, but you realise doing so only solves half of the problem.

The other half of the problem is that your SRS funds are only earning 0.05% per year of interest.

Because of that, and if nothing is being done, inflation would negate any tax benefits you get from contributing to your SRS account.

There’s a variety of investment options for SRS monies out there, but somehow, the SRS endowment/annuity plan interests you the most.

In this guide, you’ll learn everything about the SRS endowment/annuity plans in Singapore, including what it is, how it works, and the pros and cons.

So, read on!

This page is part of the SRS 4-Part Series:

- Part 1: What is SRS?

- Part 2: Best SRS Investment Options

- Part 3: The SRS Annuity (Endowment)

- Part 4: The Best SRS Annuity (Endowment)?

- What Types of Insurance Plans Can You Buy with SRS Funds?

- What Is a Single Premium SRS Endowment Annuity Plan?

- How Does a SRS Annuity Plan Work?

- The Returns on a SRS Retirement Plan

- Are the Returns Subjected to Income Tax?

- The 7 Key Features of a SRS Annuity Plan

- The 2 Main Disadvantages of Plans Purchased With SRS Monies

- Summary of the Pros and Cons of SRS Plans

- The Best SRS Endowment (Annuity) Plan?

What Types of Insurance Plans Can You Buy with SRS Funds?

There’s a wide array of insurance plans you can purchase with cash.

Can you do the same with SRS funds? Unfortunately, no. There are limitations.

Taken directly from the Ministry of Finance, here are the conditions for any insurance products purchased with SRS funds:

- Only single premium products are allowed (including recurrent single premium products, encompassing both annuity and non-annuity plans).

- Life cover (including total and permanent disability benefits) will be capped at 3 times the single premium.

- Plans can allow for a contribution continuation feature/benefit upon disability.

- Other types of life insurance e.g. critical illness, health and long-term care are excluded.

- Trust nomination is not allowed for life insurance products purchased using SRS funds.

So if you’re asking what type of insurance you can buy with SRS, there’s really only one type of option.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is a Single Premium SRS Endowment Annuity Plan?

First off, your SRS monies are meant for your retirement. It’s not called the Supplementary Retirement Scheme for nothing.

The funds are meant for your own consumption, and not to be left for your family (you can’t make a nomination). Extra fact: if death happens, the SRS balances form part of your estate and will be distributed according to the will or the estate law (if there’s no will).

Therefore, because of the above conditions, insurance companies typically design a product that has a very low (or negligible) insurance coverage, but will be geared towards providing higher retirement income payouts.

You should be looking towards getting higher returns on your SRS monies. For insurance coverage matters, there are other cash products that are more suitable, such as term plans or whole life plans.

How Does a SRS Annuity Plan Work?

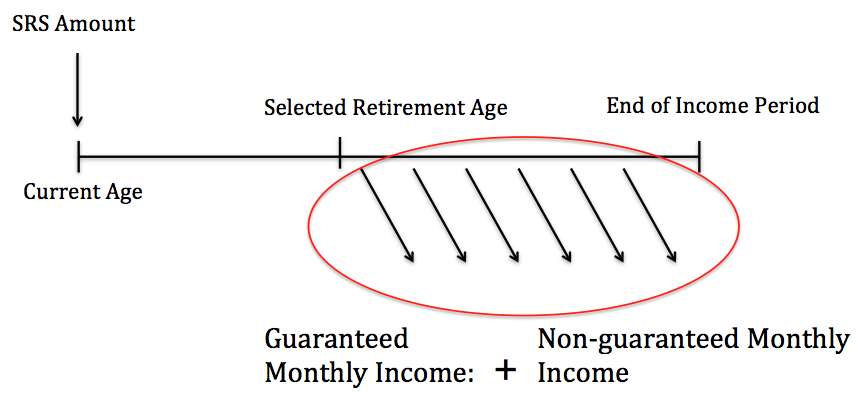

Here’s an illustration of how a SRS annuity plan works:

At the start, you’ll need to allocate a single premium lump sum for the annuity plan. There’s no regular premium option.

Then, at the selected retirement age, you can start receiving a regular stream of retirement income into your SRS account. This income will consist of guaranteed and non-guaranteed amounts.

You’ll receive this income for a fixed number of years (which is your income payout period). The income (and the plan) will stop at the end of the income payout period.

Although, there may be other options and variations, the above structure will go in line with the mechanics of SRS withdrawals.

The Returns on a SRS Retirement Plan

One unique benefit of a SRS endowment plan, when compared to other SRS investment options, is that it’s usually capital guaranteed upon maturity.

Meaning, you won’t lose your principal as long as you hold it for the entire period. But what’s more important is the returns you can get from the plan.

With the combination of guaranteed and non-guaranteed income, an annuity plan tries to achieve potential returns of around 2.5-4% per year.

The expected returns will vary according to factors, such as the length of accumulation period, income payout period, etc.

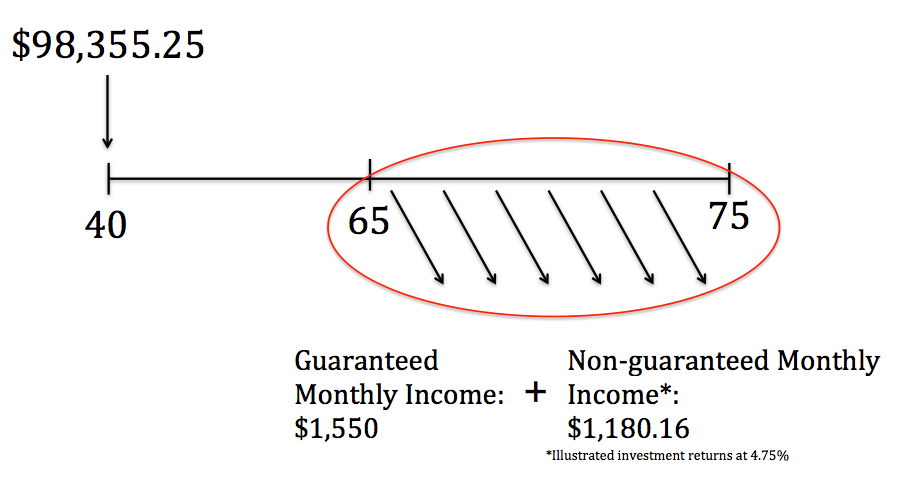

Here’s an illustration (it shouldn’t be taken as a recommendation):

Profile of John

- 40 years old

- Selects a retirement age of 65

- Wants to receive 10 years of income from 65 to 75

- Plans to set aside $98,355.25 from his SRS account

From 65 to 75, he’s able to receive a total guaranteed income of $186,000 (1,550*12*10).

This is almost double of what he has put in.

At the same time, he’s also entitled to receive a total non-guaranteed income (illustrated investment return at 4.75%) of $141,619 (1,180.16*12*10).

This puts the total illustrated income to be at $327,619 (186,000 + 141,619).

But he only needed to put in $98,355.25 at the start.

From that particular illustration, the plan’s guaranteed yield at maturity is at 2.15% and the total illustrated yield at maturity is at 4.10%.

Of course, terms and conditions apply.

Are the Returns Subjected to Income Tax?

In case you don’t already know, all payouts from the annuity plan (or from any other investment made using SRS funds) will go back into the SRS account. From there, you’ll have to withdraw it out.

If you’ve read my other guide on what is SRS all about, you’ll know that the returns from your SRS investments, including those from the endowment plan, are tax-free.

However, the amount withdrawn will still be taxable.

If you withdraw after the prescribed retirement age (will be 63 effective 1 Jul 2022; 62 is applicable if you made contributions before 2022), although you won’t incur the penalty fee of 5%, 50% of the withdrawn amount will be taxable.

I’ve explained this in detail in that guide, but to put it simply, you need not pay any taxes on withdrawals of up to $40,000/year (assuming there’s no other income and you spread your withdrawals over a 10-year period).

That’s why, it’s much better to spread your withdrawals over time than to withdraw it all at once.

This is also why annuities are well-suited for SRS funds.

Get a comparison of the best SRS endowment annuity plans in Singapore.

The 7 Key Features of a SRS Annuity Plan

These are several factors to consider if you want to purchase an annuity:

1) Insurance Coverage

As mentioned earlier, insurance coverage should not be a priority. The priority goes to the returns you can receive.

Therefore, you won’t see any high insurance coverage amount in such plans. For example, the death benefit is usually 105% of all the premiums you’ve paid plus any bonuses declared.

With negligible coverage, these policies are often guaranteed to be issued. No matter what kind of health conditions you have, minor or major, it doesn’t matter.

You can still apply and it’ll go through, as there is no medical underwriting.

2) Capital Guaranteed

Back in the day, endowment plans may not be capital guaranteed.

So technically, in the event that an issuer does not declare any bonuses every year, the amount you get back may be lower than the amount you’ve put in.

However these days, most plans are capital guaranteed upon maturity.

So long as you hold it for the period that’s intended, you don’t need to worry about losing your principal.

On top of that, policies have an extra layer of protection.

Insurance products bought with Supplementary Retirement Scheme (or with cash) are usually protected by the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC).

In the event that a life insurer were to fail, MAS’s preferred course of action is to transfer the insurance business of the failed insurer to another.

That’s layer one.

And if the business cannot be transferred? SDIC may take over and cover existing policies (with caps).

MAS’s objective is to ensure policy owners are not heavily impacted.

3) Guaranteed Retirement Income

I see this as the most important aspect of an annuity plan.

Being able to know how much you’re going to receive many years down the road is important, so that you can plan properly for retirement.

If not, everything will just be a guesstimate.

It’ll be hard to plan for your retirement if everything is uncertain (or have no guarantees).

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

4) Non-Guaranteed Retirement Income

All non-guaranteed income would be seen as a bonus on top of the guaranteed income.

If you’ve bought an endowment or a savings plan before, you’ll know that the non-guaranteed bonuses play a role to the total returns you can get.

Insurance companies do strive to maintain bonuses every year, as if they don’t, it could negatively affect their reputation.

However, the fact is this: the wordings are in black and white.

Non-guaranteed is still non-guaranteed.

This is why I place a higher emphasis on the guaranteed portion.

5) Selected Retirement Age

For an endowment plan bought with SRS funds, you would want the selected retirement age to be at least 62 years old.

Why? Because there won’t be a 5% withdrawal penalty and only 50% of the withdrawn amount is taxable.

But, not all SRS endowment plans have the option to start paying out the income at 62 or 63 years old.

Most plans have the option to start at 65, which in my opinion, is still an acceptable age, especially when the official retirement age in Singapore will be changing to 65 by 2030.

6) Income Payout Period

There are several options here.

Depending on the plan, the payouts can be for 10, 15, 20 years, or for lifetime, starting from the retirement age.

Generally, a longer income payout period translates to a lower retirement income, with all things the same.

So the question is whether you want to have a long payout period?

For me, I would prefer a 10-year income payout starting from 65 to 75 because that would be the prime period.

Beyond that, I may not need that much anyway (or probably can’t even enjoy it).

7) Other Additional Benefits

Most plans are just plain-vanilla, as the focus is on the savings element.

Some plans do have secondary benefits.

For example, if a severe disability happens during the income payout period, you’re entitled to receive additional payouts.

The 2 Main Disadvantages of Plans Purchased With SRS Monies

1) Opportunity Costs

First off, if your risk tolerance is low, you wouldn’t be comfortable with volatile investments in the first place.

But if your risk appetite is higher, and for example, you gave up investing in ETFs and opt for the endowment, if in the future the ETF performs well, it’s an opportunity cost to you.

(However, the opposite can be true as well)

2) Locked-In Periods

Annuity plans have locked-in periods.

It’s usually not advisable for you to surrender the plan before its maturity.

This is because your surrender value might be lower than the amount you’ve put in.

So if you do intend to put your SRS funds into such plans, you must hold it for the long haul.

But in return, if you’ve held it for the entire period, you’re entitled to receive the guaranteed and non-guaranteed benefits.

Summary of the Pros and Cons of SRS Plans

| PROS | CONS |

|---|---|

| Capital guaranteed upon maturity | Opportunity costs, if alternate investments perform well |

| Have a decent guaranteed yield at maturity | Early surrender usually translates to surrender value lesser than the amount put in |

| Participates in non-guaranteed bonuses | |

| Able to set it and leave it – thus giving you time to concentrate on the more important things in life | |

| Policies are further protected by the Policy Owners’ Protection Scheme |

The Best SRS Endowment (Annuity) Plan?

When planning for your retirement, contributing to SRS is a fine option as you can reduce taxes and supplement your retirement.

To get more out of your SRS contribution, you can invest your funds.

If you don’t wish to take unnecessary risks, SRS annuities are a great option because they offer guarantees and allow you to participate in upsides.

Take the next step by finding the best SRS endowment annuity plan by getting a comparison now.