The Lasting Power of Attorney (LPA) is such a powerful instrument.

If you lose mental capacity and you don’t have an LPA, it’s going to cost your family time and money.

But with this simple document, obstacles are eliminated. And it’s affordable to make one.

Here’s all you need to know about making a Lasting Power of Attorney (LPA) in Singapore.

So, read on!

Too Long; Didn’t Read

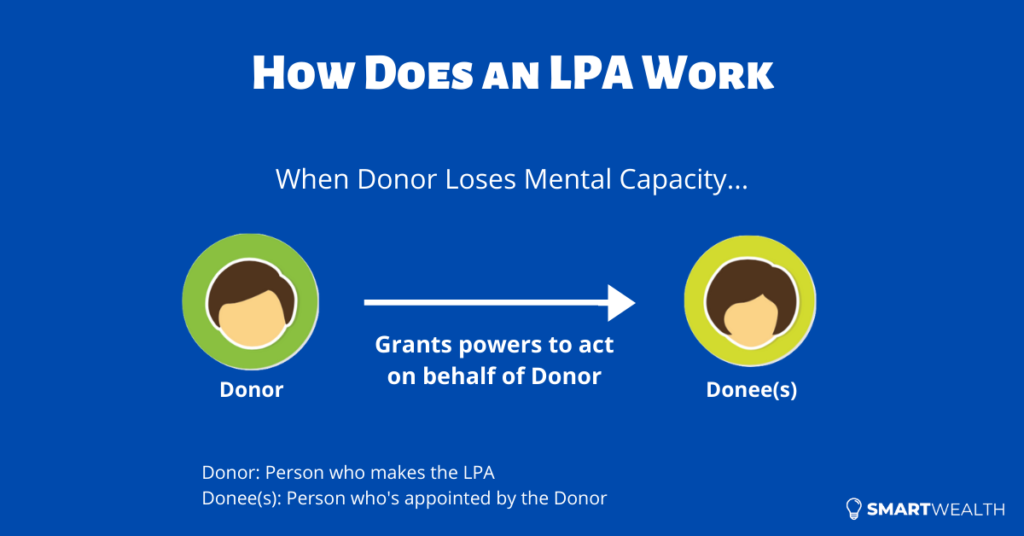

In an LPA, a donor (the person who’s making the LPA) appoints a donee(s) to act on behalf of the donor if he/her loses mental capacity. The donee(s) is able to act in areas of personal welfare and/or property & affairs matters.

But of course, it’s not that straightforward.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is Lasting Power of Attorney (LPA)

A Lasting Power of Attorney (LPA) is a legal instrument that allows the donor (the person who’s making the LPA) to appoint a donee to make decisions and act on behalf of the donor when he/she is mentally incapacitated.

According to the Mental Capacity Act in Singapore, the definition of mental incapacity is when a person is unable to make a decision for himself in relation to the matter because of an impairment of, or a disturbance in the functioning of, the mind or brain. And it doesn’t matter whether the impairment or disturbance is permanent or temporary.

Some examples where mental incapacity can kick in:

- Stroke

- Mental illnesses

- Dementia

- Accident which causes head trauma

- etc

And these are the areas where the donee(s) can be granted powers:

- Personal welfare

- Property & affairs matters

- Both

Requirements to Be a Donor or Donee

Here are some requirements to be a donor:

- Be at least 21 years old

- Of sound mind

- Must not be an undischarged bankrupt if you wish to grant powers regarding property & affairs matters

Here are some requirements to be a donee:

- Can be one or more persons

- Be at least 21 years old

- Someone who is competent, reliable and whom the donor trusts

- Must not be bankrupt if appointed to act for property & affairs matters

If there are more than 1 donees, they can either act together, or separately.

Even if there’s no one you can think of to act as a donee, there are professional donees (e.g lawyers or social workers) who’ll charge a fee to be appointed and render service.

Difference Between Power of Attorney and Lasting Power of Attorney

While the Power of Attorney (POA) and Lasting Power of Attorney (LPA) may seem similar, they’re entirely different.

In POA, there’s also a donor and a donee. However, it kicks when the donor still retains mental capacity, but lacks the “physical” capacity.

In other words, the donor can appoint someone to act on behalf of him/her such as handling personal matters like accessing bank accounts, buying and selling properties, etc, when the donor is unable to do so.

Here are some examples when a POA comes in handy for the donor:

- going overseas but in the process of buying/selling a property

- go into prison for the long term

- getting placed in a nursing home

- etc

In these cases, the donor might not be able to be physically there to attend to important matters, so the donee is there as a “replacement”.

Note: The POA will be invalid when the donor loses mental capacity or when death happens.

On the other hand, the LPA kicks in only when the donor loses mental capacity.

Is an LPA Necessary?

Is it a good idea to go through the hassle to get an LPA made?

Short answer: Yes.

But here’s the long answer..

In a scenario where you got into an accident, and slipped into a coma, there may be several matters that are required from you:

- signing of authorisation forms

- deciding on what type of treatment

- accessing of bank accounts to pay for medical treatments

- etc

But all these can’t be done by you because you lacked the mental capacity.

A next-of-kin can’t just do these in place of you.

This is because even if you lose mental capacity, your assets still belongs to you. No one in the family should have access to it, even though it’s for your own use such as the paying of medical bills.

And if you don’t have an LPA, a court order needs to be made and then someone has to be appointed to make such decisions for you.

In general, there are 4 disadvantages to not having an LPA:

- Arguments may arise between family members on the best course of action

- The person who’s appointed by the court may not act in your best interests

- With the court order, it’ll cost much more money; can cost $10,000

- The court may take a long time to appoint someone; can even take 2 years

Here’s a real life story of someone who didn’t make an LPA.

But if you have an LPA, getting a court order is not needed and thus, these disadvantages will be eliminated.

And it’s not even expensive to make one (more on that later).

Difference Between LPA and a Will

The Will is a written document that specifies your wishes only when death occurs.

The LPA comes in when mental incapacity occurs.

Death is straightforward. But when you’re in a situation where death doesn’t happen, yet you don’t have consciousness (like in the above examples), the Will doesn’t kick in.

That’s why an LPA fills this gap, and both go hand in hand.

There Are 2 LPA Forms Available

Form 1 and Form 2.

The main difference is that Form 1 is a standard form granting general powers with basic restrictions, while Form 2 is non-standard and is customisable.

You’re likely to make a Form 1 LPA as 98% of applications are Form 1 applications.

Here are more differences between Form 1 and Form 2:

| Form 1 | Form 2 |

|---|---|

| Standard form | Non-Standard form |

| General powers with basic restrictions | Customisable powers given |

| Can appoint up to 2 donees with 1 replacement donee | Can appoint more than 2 donees and more than 1 replacement donee |

| Application fee can be from $75 (waived for Singapore Citizens till 31 Mar 2023) but other charges may apply | Usually drafted by a lawyer |

| Application fee can be from $200 |

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

3 Steps to Make an LPA in Singapore (And the Costs Involved)

There are 3 main steps to apply for an LPA:

- Fill up either Form 1 or Form 2

- Get the form certified

- Submit the relevant forms

Below are more details and the fees involved in each step.

1) Fill up either Form 1 or Form 2

From the section above, you’d probably know the differences.

And likely go with the Form 1.

You can download both forms at the Ministry of Social and Family Development website.

They’re free to download.

However, Form 2 requires a lawyer to draft certain sections.

In these forms, there are several pointers to note:

- donees’ signatures are required

- witnesses are still required

- etc

2) Get the form certified

You’ll need to find a Certificate Issuer (CI) to certify the form for you.

This is to ensure that the donor fully understand what he’s doing such as:

- purpose of making the LPA

- intention of appointing the donees named

- powers given to the donees

- no fraud or undue pressure was made

There are 3 groups that can certify the LPA:

- Accredited Medical Practitioner

- Lawyer

- Psychiatrist

There is a fee charged on getting the form certified by these groups.

It can cost $25-$300 (usually depending on which group).

3) Submit the relevant forms

Within 6 months of signing the LPA, the form and all relevant documents need to be mail to the Office of the Public Guardian (OPG).

OPG’s Mailing Address:

20 Lengkok Bahru #04-02

Family @ Enabling Village

Singapore 159053

The OPG will then follow up on payment and other details.

There are application fees involved:

| LPA Form 1 Fee | LPA Form 2 Fee | |

|---|---|---|

| Singapore Citizens | $75 (waived until 31 Mar 2023) | $200 |

| Singapore Permanent Residents | $100 | $250 |

| Foreigners | $250 | $300 |

Can an LPA Be Revoked or “Challenged”?

In an LPA, you’d have to choose someone whom you trust to act on your behalf.

However, this can also be a limitation.

When you lose mental capacity, this someone might “change” and not act in your best interests.

This may be avoided with several solutions.

An LPA can be revoked at any time, if you still have the mental capacity. So, if you know that the appointed donee has changed or the relationship has turned sour, you can make a revocation.

A revocation is usually accompanied by a submission of a new LPA.

However, if you choose not to submit a new LPA, a lawyer or a medical practitioner has to be the witness to your revocation. This is to ensure you know the implications of revoking without making a new LPA.

On the other hand, if you’ve already lost mental capacity, what happens if a donee doesn’t act in your best interests?

The Office of the Public Guardian (OPG) can apply to court to revoke the donee’s power.

Such situations are less common but if a donee doesn’t act in the best interests of the donor – fraud, dishonesty, physical abuse, etc – such actions have to be taken.

What Happens After Losing Mental Capacity With an LPA

We make LPAs because we want to make preparations when we’re still mentally capable. If we’re not, LPAs can’t be made anymore and court orders have to been applied for when the time comes.

So in cases when mental incapacity happens and we have an LPA, what comes after?

These are 3 broad stages:

- Have a doctor certify the mental health condition

- Approach the institution such as a bank and provide them the relevant documents

- The institution will verify the validity of the LPA and will then grant the donee access

What’s Next?

Making a Lasting Power of Attorney is part of Advance Care Planning (ACP) – deals with situations where you’re “neither dead nor alive”.

Other parts of ACP are the Advance Care Workbook (spells out how you want to be medically treated) and the Advance Medical Directive (grants permission to remove life sustaining treatments)

But in the bigger picture of things, there are 3 crucial aspects.

I call it the F-E-A: Financial Planning, Estate Planning and Advance Care Planning.

Each area has its importance.

For example, you’d need proper financial planning done up to provide the means for medical treatments when you’re critical ill or mentally incapacitated. This is in the form of having sufficient life insurance coverage and hospitalisation coverage.

And if you’ve lost mental capacity, how are your assets going to be distributed when death happens after? If you die without a Will, it’s distributed according to the law. And this is why most would also write a Will while they’re trying to do up LPAs.

All these 3 areas have to be catered for.