When you’re self-sufficient, you start to focus your thoughts on others.

Contribution is the end goal.

That’s when a single premium whole life insurance comes in.

It enhances the legacy you leave behind so it enables others to grow.

Read on to learn more about it!

This page is part of the Jumbo Whole Life Insurance 2-Part Series:

Too Long; Didn’t Read

You may already have a sum set aside for your loved ones. The single premium whole life insurance enlarges this amount as it pays out a bigger amount when death happens… so your beneficiaries can enjoy the fruits of your labour, even more.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What is Your Purpose?

There comes a point in life when the money you’ve earned (or will be earning) is already more than enough.

So you start to go beyond self-interests and think about others…

You have already set aside a sum of money that you don’t really need.

The primary aim is to leave that behind for your loved ones, a charity or a religious organisation.

But there’s also a secondary aim (for just-in-case scenarios).

And that’s to be able to access it in the future. You probably wouldn’t need to use that money but it’s good knowing that it’s still there if needed.

What is Single Premium Whole Life Insurance?

In a typical whole life insurance, the life assured (usually, you) is covered till he passes away or till he reaches 100 years old.

There will be a lump sum payout upon death (death benefit).

Usually, a whole life insurance policy is funded by regular premiums spread out over a fixed period of years. But in a single premium (SP) whole life policy, the premiums are fully funded at the start.

We call this a “jumbo” whole life plan.

So if you already have an amount you want to set aside for others, you can use that to fund the policy as the single premium.

You’re able to get a higher sum assured/death benefit multiple times of that single premium, creating an even larger estate.

Also, rather than leaving that money in the bank account (or whatever liquid asset) earning lower interest rates, you can still take advantage of potentially higher returns.

In summary, this allows you to impact your beneficiaries further by locking in a high death benefit (when your health is still good) while maximising the money you set aside.

The Other Options to Leave Behind Legacies

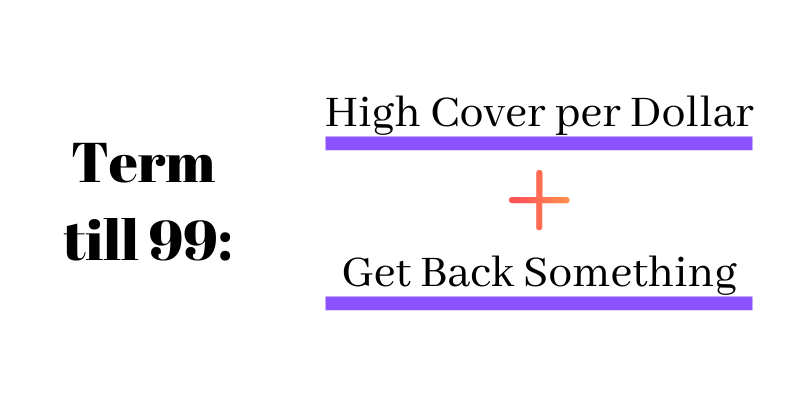

One other alternative is the term insurance till 99 years old.

Similarly to the jumbo whole life plan, It’s meant for legacy planning as one would’ve already passed on before that age.

But nowadays, a term till 99 can come with a “guaranteed survival payout”.

So even if you hit the 100 years old mark, it doesn’t expire and would instead pay out 100% of the sum assured. This ensures that the premiums you’ve paid will not go down the drain.

The main difference between a SP whole life insurance and a term till 99 is that the term insurance has no cash value. Which means… you’ll never see the payout. Only your beneficiaries will.

In a SP whole life, although it’s primarily meant for your beneficiaries too, it still accumulates cash value. This allows you to surrender the policy if you need the cash in the future.

Another difference is that the term till 99 years policies usually require regular premium payments till 65, 75 or 99 years old. In the SP whole life, you just fund the policy in one-shot and nothing is required from you anymore.

Another plan to consider is the 3-generation lifetime income insurance plan.

The 3G plan provides a lifetime of income. It’s usually placed on the life of your child to maximise the value you can extract out.

Such plans can supplement your retirement income, provide income for the next generation, and still have a death benefit for the generation after that.

The 2 Types of SP Whole Life Insurance

There are 2 types whole life insurance that is funded by a single premium: one relies on a participating fund and the other is investment-linked.

1) The One With the Participating Fund

Most insurance policies that have a savings element are called participating policies. These are your endowment savings plan, retirement/annuity plans, including whole life insurance.

Basically, the insurance company collects all the premiums from policy owners and pools them all in one fund. They then reinvest this pool of monies into different asset classes and ultimately give you guarantees and non-guaranteed bonuses.

This is the most common type of policy around.

Take note that this is how the cash value is generated and it’s different from the sum assured/death benefit.

2) The One That Is Investment-Linked

On the other hand, the investment-linked policy (ILP) doesn’t have any form of guarantees other than the sum assured/death benefit.

The “cash value” is fully dependent on the performance of the funds invested. As such, it can fluctuate and there is no limit to how much you can lose.

Because of this, most Singaporeans turn to the participating fund type for such purposes and it’s the only type we’re referring to in this article.

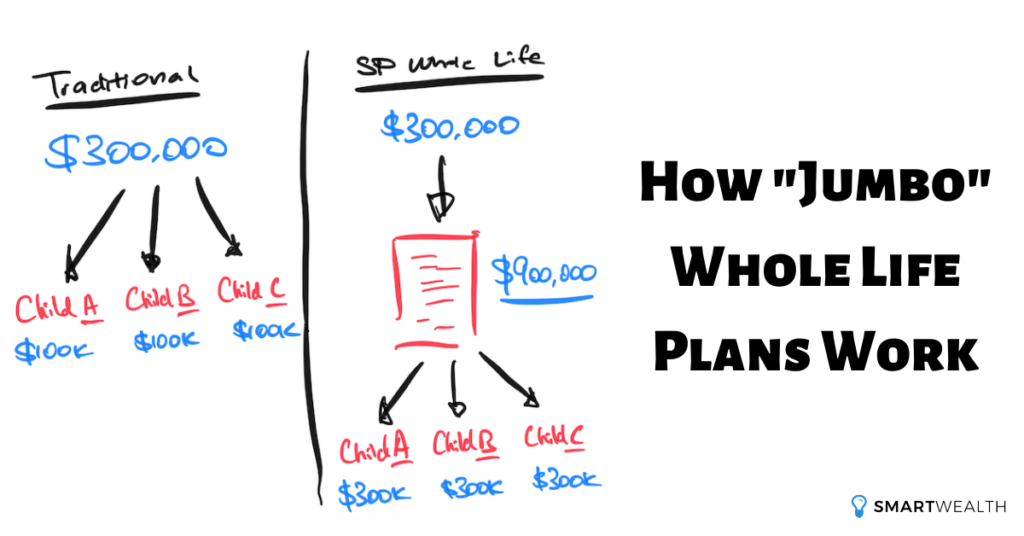

Illustration: How Single Premium Whole Life Plans Work

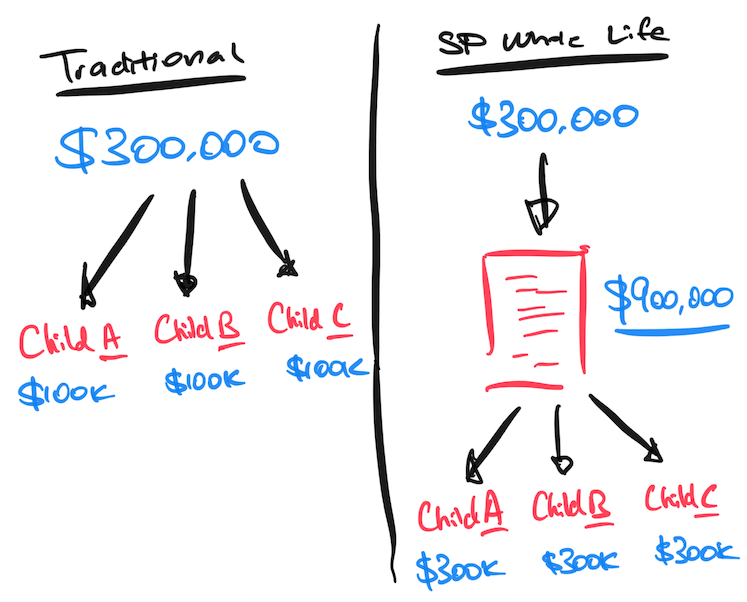

Let’s say you already have an amount of $300,000 to leave for your 3 children. Each will get $100,000 when you’re not around.

But if you put that amount into the single premium whole life plan, you may get a death benefit of $900,000. Upon your death, each child can get $300,000 instead. 3 times more than before.

That’s just a general overview but let’s look at specifics.

The Specifics

Note: This is not meant to be financial/investment advice. It’s meant for information/illustration purposes.

Profile:

- 40 Age Last Birthday, Male, Non-Smoker

- Intends to set aside $199,594.22 as the single premium.

Death Benefit:

From Day 1 to Age 85: $1,000,000

…

At Age 86: $1,188,631 (Sum Assured + Non-Guaranteed Bonuses @ 4.75%)

…

Cash/Surrender Value:

Day 1: Guaranteed: $159,675

…

20 Years Later: Guaranteed: $199,594 + Non-Guaranteed Bonuses (@ 4.75%): $60,232 = $259,826

…

Disclaimer: Information is presented in an oversimplified way. Terms and conditions apply. The non-guaranteed amounts are illustrated at 4.75% investment returns.

The 7 Pros

Let’s start with the positives of such a tool.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

1) Instantly Increase the Size of Your Estate

If you already have that amount planned for your beneficiaries, you can leverage on the policy to create an estate that is a multiple of that amount.

There’s no other tool out there that can do this.

Capitalise on the fact that death is 100% guaranteed to happen.

2) Grow Your Money

If said amount is just sitting in the bank account or in assets such as fixed deposits earning a lower interest rate…

Why not do something about it?

Yes, you wouldn’t want to put it through investments because it’ll be very volatile.

But if you don’t intend to touch it, putting it in such a plan can grow that amount over the longer term.

Think about it:

If you put that amount into the SP whole life plan, and death happens, your loved ones gets an even bigger payout. But if nothing happens and you need to the money in the future, you can still consider the option of surrendering.

3) Adjustable to Your Needs

There are different kinds of assets that can form an estate.

Let’s take a look at properties.

It usually comes with a higher price tag. But if what you want to leave behind is a smaller amount, it can’t be done.

In a single premium whole life policy, you’re able to decrease or increase the sum assured (based on the single premium) depending on your needs.

You don’t even need to go through the hassle of buying properties; the process is straightforward.

4) Specify Who Receives What

Insurance policies allow you to make nominations.

It’s essentially to indicate who should receive how much percentage of the death benefit.

This makes distribution very clear.

And beneficiaries will not argue i.e whether to sell or keep a property. It reduces the chances of disputes and court battles.

5) Protect Against Creditors

Following the previous point on nominations, you can also do a trust nomination.

Most nominations out there are revocable nominations. But you can also do a trust nomination if you wish.

In a trust nomination, the rights of the policy are transferred to your nominated parties.

This means that the surrender value will go to them instead.

But on the flip side, in the event of a bankruptcy, any policy proceeds are generally protected from creditors.

6) Accumulates At a Faster Rate

As mentioned earlier, a regular premium whole life plan spreads the premium over a period of time.

Because of that, it generates lesser bonuses compared to the single premium option because the compounding effect is diminished.

The single premium option is fully funded from the start and so the bonuses are paid out based on that full amount and more bonuses will be compounded throughout the years.

This allows the cash value to accumulate much faster than the regular premium option.

7) Cash Out Even Before Death

While the majority apply for such policies for the enhanced death benefit, there is still a “just in case” option of accessing the cash value.

If you really need the money, you can still consider to surrender the policy in the future and get some money back.

How much you can get back depends on how long you held it for – the longer you hold, the higher the cash value.

The 3 Cons

Here are some of the downsides.

1) Health Underwriting is Required

As it’s still a life insurance policy, health conditions will still need to be assessed after submitting an application.

If everything is okay, then that’s great.

But if you do have a medical condition, then there may be a loading (higher premiums) and/or exclusions, which may affect your outcome.

Therefore, although a single premium whole life seems like a good idea, not everyone can enjoy this leverage.

If you have relatively good health, then you’re able to take advantage of such an offering.

2) Only For Specific Purposes

As mentioned before, there’s a primary and a secondary objective:

1) Leave behind more when death happens (primary)

2) Able to grow and utilise the amount set aside (secondary)

Outside of these reasons, it might not make too much sense.

But if you want to cater to those specific purposes, this can be one of the best options.

3) Less Liquidity

Once the policy is paid up and is in-force, there will be limited options for you.

In fact, on Day 1, the guaranteed surrender value may be 75-80% of the single premium you’ve paid.

This is because on the insurance companies’ end, they’ll need to cater for the long term and such a “break” will cost them. So that’s a price to pay on your end.

An early surrender should not be in your mind in the first place. If you’re thinking of surrendering early, the policy is not suitable for you at all.

But the surrender value will grow and may hit a breakeven point or an amount more than the single premium.

But that’s just in case.

Remember why you wanted the plan? It’s about leaving a greater estate multiple times of that single premium.

Summary of the Pros & Cons

| Pros | Cons | |

| 1. | Instantly Increase the Size of Your Estate | Health Underwriting is Required |

| 2. | Grow Your Money | Only For Specific Purposes |

| 3. | Adjustable to Your Needs | Less Liquidity |

| 4. | Specify Who Receives What | |

| 5. | Protect Against Creditors | |

| 6. | Accumulates At a Faster Rate | |

| 7. | Cash Out Even Before Death |

Wrapping Up

If you want to leave a larger estate behind, a single premium whole life insurance enables that.

It’s meant to maximise the impact when you’re not around so that your loved ones, a charity, or a religious organisation, can continue to strive forward with the legacy you leave behind.

Keen to know more? Find out which are the best single premium whole life plans in Singapore now.

The jumbo whole life plan is closely tied to estate and legacy planning – deals with what’s going to happen after death. Most people don’t really care when they’re dead but it makes a world of difference for your family members, so take some time to know more about it too.