Do you know how to efficiently allocate your monthly salary?

This is perhaps one of the most underrated best practices to improve your personal finances. However, most Singaporeans go for years or even decades without knowing how to, causing potential financial problems along the way.

On the surface, having money coming in every month and having expenses that do not go over it seems like a good enough “financial plan”. Unfortunately, gone are the days when simply “living below your means” is enough.

Careful use of every dollar that comes in ensures that money will always be well-spent.

And that’s why sticking to a budgeting rule, such as the 50/30/20 rule, is so critical.

Read on to find out why!

Are You Saving Too Little or Too Much?

Do you know if you’re saving too little or too much?

According to this OCBC survey, Singaporeans are saving 28% of their monthly income, on average. However, two in three said they don’t have enough savings to last them beyond six months. This is very precarious because, as we have seen in 2020, there is no time limit on economic disasters. Saving is key to financial soundness. Of course, you should already know that.

However, there is a flip-side. There are those people who are dead focused on saving. Saving is not the end-all-be-all of being financially sound. It is actually just a small part of it. Financial growth is what you should be aiming for.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

How Do Singaporeans Typically Spend and Save?

The good news: the average Singaporean knows that saving is a must. According to the same OCBC survey, Singaporeans are good at saving.

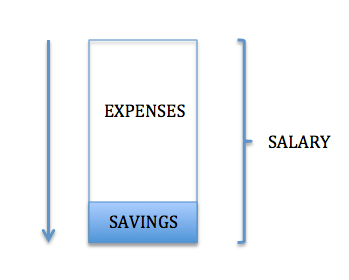

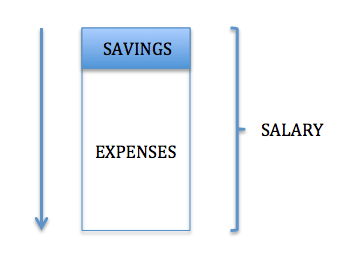

Unfortunately, there will be some who don’t have a plan and will spend their paycheck on whatever that comes along, leaving little or no savings at the end of the month.

The better way to save, in my opinion, is to reverse that order. We should save first and then spend the rest.

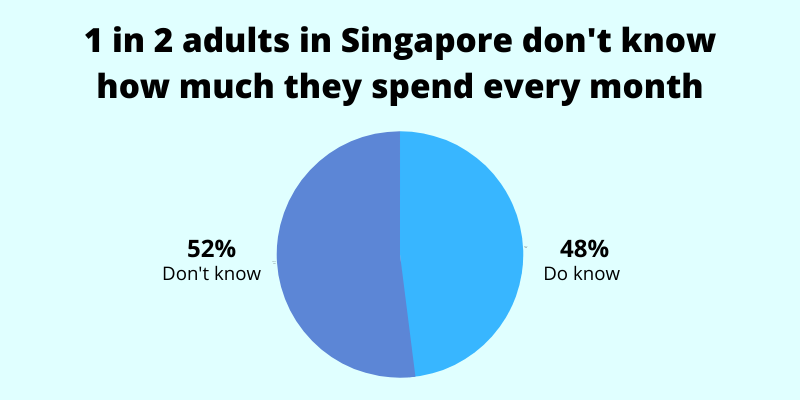

To give an additional perspective, from a survey we’ve done, one in two adults in Singapore don’t even know how much they spend every month.

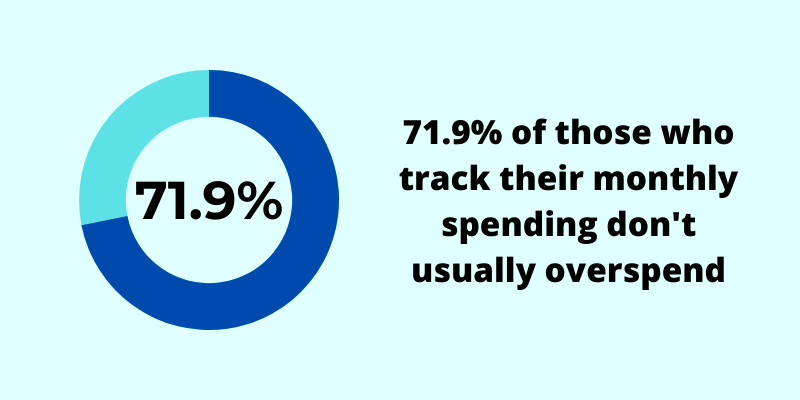

This is unfortunate because the survey findings also showed an overwhelming majority of people who plan and track their expenses don’t usually overspend.

All in all, being haphazard in planning for your finances leaves very little margin for the unexpected. The moment a relatively big unexpected expense comes up, you dig right into your savings. Even worse for those who do not have savings, one minor hiccup might drive them into debt.

This is why we all need to have a plan in terms of how we handle money. It does not have to be overly sophisticated, it just needs to be right.

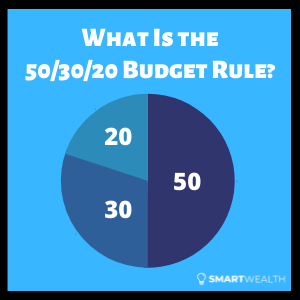

What Is the 50/30/20 Budgeting Rule?

One such plan is the 50/30/20 budgeting rule.

It is a simple rule popularised by the US Senator Elzabeth Warren in her book “All Your Worth: the Ultimate Lifetime Money Plan.” While it seems to be of western origin, the principle translates completely to Singapore’s context. It is a simple rule whereby you divide your income into three:

- 50% goes into necessities,

- 30% goes into wants, and

- 20% goes into savings/investments.

It works because it is so simple. It puts your income into three basic baskets and that’s it. At the same time it ensures you have allocation for every single type of expense you have. Any expenditure you can think of will fall into one of those three.

50% into Necessities

Following the 50/30/20 rule, half of your income will go to necessities.

Needless to say, these are the expenses you cannot do without. This includes rent, utilities, food, transportation.

Depending on your occupation and other personal circumstances, you may have more or less than others.

For example, a parent will have an extra set of necessities covering his or her child’s needs like tuition. Also, some jobs will require certain tools or equipment which also go into necessities.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

30% into Wants

Next, 30% goes into “Wants.”

These are the things you would like to have but could get by without. Things like vacation, parties, and entertainment go here.

Personally, when examining expenses, I like to advise people that there are 2 different kinds of “wants”: those that are apparent and those that seep into the necessities.

The latter is where it gets a bit misleading. There are some necessities wherein the “wants” can insert themselves. This happens when there are different options at different price points that will satisfy the same need.

To demonstrate, transportation is clearly a necessity. However, the choice of transportation can be mixed with a “want,” something that is not necessary: the MRT, a taxi or a new car.

Another example is a computer. Most jobs will require a decent computer, however, the price of a laptop will range from a few hundred dollars to several thousand.

To clarify, I am not advocating unflinching frugality here, what I want to highlight is the need to examine how you fill necessities and how your “wants” influence those decisions.

20% into Savings/Investments

The last 20% goes into your savings and investments. This is the portion that is intended for growing your wealth. According to this article by Singsaver, we should each have at least 6 months salary worth of savings.

This is the ideal liquidity we should have at any given time. Not for spending spontaneously but in case of emergencies. Beyond that, most financial experts would agree that redirecting funds to fuel financial growth is the smarter move.

Note, however, that investments are not exclusively made in banks and shares of companies. Some of the things we consider as “wants” can be investments for some.

For example, while designer bags are usually viewed as superfluous spending, fashion bloggers and stylists might consider them as investments. Also, a new car, motorcycle, or scooter might be an investment for someone whose income is dependent on him being able to get around fast.

4 Benefits of the 50/30/20 Rule

The 50/30/20 rule is a rule in practice.

The beauty is in its simplicity and so is its efficacy. There is no complicated mental math to be done every time you take out your wallet, swipe your card, tap it or whatever new way to pay in nowadays.

This is key because the best rule does not actually have to be the most perfect, sophisticated or scientific rule. The best rule in the end is one that you will be able to follow and practice.

Do not lose sight of the fact that the goal is to get you into the habit of budgeting. Budgeting is indispensable to being financially sound:

- It instills discipline in spending – By having a strict set of rules to follow eliminates gray areas in your own spending. When faced with a particular potential expense, it makes decision making very straightforward.

- It cuts down unnecessary expenses – Budgeting forces you to have a good look at every single expense because you will have to put it in one of three columns. You will find that in deciding whether something fits in the necessities or if it fits in the “wants” bucket ultimately forces you to ask yourself: “is this really necessary?” every single time.

- It makes means of reaching financial goals more deliberate and not haphazard. – Being deliberate in the actions you take in terms of your finances makes sure you are growing your wealth efficiently. This in turn allows you to reach your financial goals sooner.

- It gives you better control of spending for “wants” – Last but not least, budgeting and having an allocation for your “wants” let’s you “live a little” without having to feel guilty about it. At the same time, doing so gives you exact limitations on how much you can spend on wants.

The Limitations of Any Budgeting Rule

The 50/30/20 rule is a sound principle to live by. However, it may not be the best fit for everyone.

Some will find that the proportions set by this rule do not fit their current situation. Some people may have necessities that take up more or less than 50% of their income. There are those whose “Wants” just don’t come up to 30% of their income.

There are other income allocation rules that will work just as well for those people. Take for instance, the 40/30/20/10 rule wherein 10% is for insurance, 20% is for investments, 30% is for expenses and 40% is for loans. There is even a 70/20/10 rule where the 70% goes to servicing loans.

There are many rules out there, so do not set yourself up for failure by trying to make your finances fit into a system that clearly will not work.

The important thing is to choose the one that will work for you, but stick to it. Resist the temptation to change the rules whenever you need to put more in one bucket over the other. The formula is not as important as you forming the discipline in spending.

Find one that works for you and which you can sustain. The best plan is worth nothing if you cannot do it. But keep in mind to adjust accordingly when there are significant lifestyle changes.

What’s Next?

Luckily, there are many ways to make sticking to your budget as easy as possible.

For those who do everything on their mobile phones, there are countless numbers of apps that do this effectively. Mobile apps like Seedly have great and intuitive user interfaces that get you started in an instant.

If you just want a quick tabulation, you can use an online budget/expense calculator.

If you’re the type to sit down and take time to work on your budget and update it regularly, you can use free downloadable excel templates that are set in a format where you just have to key in expenses and a few other details.

Take advantage of these tools as you can always find one for free on the internet. Choose one that is easy to use. This way, you’ll be able to regularly keep track of your personal finances, see how the expenses are flowing in, and be able to plan accordingly.

If you want to learn more about budgeting, check out this guide over here. There’s a handy infographic too.