These days, a term insurance plan is one of the core insurance policies to have.

Whether you’re still serving NS or have ORD’ed, you must have heard about the Singlife with Aviva’s MINDEF & MHA group term insurance.

Are the cheap premiums justifiable for it to represent the sole life insurance component in your financial portfolio?

Let’s take an objective look and find out now!

(Note: this article has been updated to reflect the new changes as at 1 Jan 2023.)

- A Primer on Term Insurance

- How Does Group Term Insurance Work?

- A Brief History and Introduction to the MINDEF/MHA/SAF Group Term

- The 6 Types of Coverage and Their Premiums

- How to Apply for the MINDEF/MHA Group Insurance

- How to Claim

- Singlife with Aviva's MINDEF/MHA Group Term Insurance vs Personal Term Insurance

- Wrapping Up

A Primer on Term Insurance

Plain vanilla coverage is the essence of insurance – you pay a small amount to cover a big misfortune.

Along the way, features such as cash value are added to insurance policies, creating plans like whole life insurance. This sparked a great debate on which is the best for life insurance coverage: term vs whole life insurance.

But in recent years, term plans have regained dominance – going back to old school.

Term insurance strives to provide the highest coverage with the lowest cost, which is great, because a few hundred thousands may not be adequate in today’s context if one’s income is stripped away.

But first, it’s always good to get an estimate of how much life insurance coverage you need.

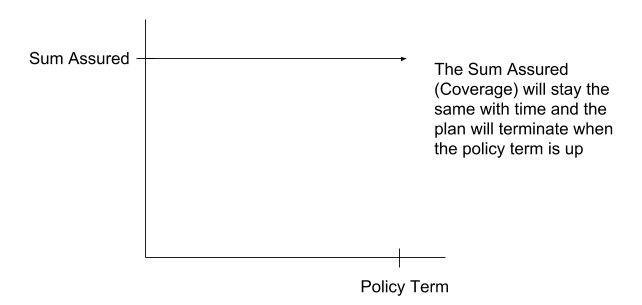

The downside of a term plan is that it doesn’t accumulate any cash value and the cover ends when the policy term is up.

So, you’re paying for a peace of mind, and if nothing happens, that’s also fine as you would’ve enjoyed good health over the years.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

How Does Group Term Insurance Work?

In term insurance, there are two main classifications:

- Personal

- Group

They are “same same, but different”.

An employer or an institution (in this case, MINDEF/MHA) can purchase group insurance and provide coverage for its members.

The major difference is how the policies are underwritten.

In personal insurance, the insurers pay greater attention to the individual’s age, medical conditions, financial health, etc.

However, for group policies, assumptions about the general health of the group are made.

In addition, the insurer’s risk is spread across the group (of many participants). And that’s why it usually results in a cheaper rate of insurance.

If you base your decision solely on premiums, it’s hard for personal insurance to beat group insurance.

But is it always the best?

I’ll go more into details later.

A Brief History and Introduction to the MINDEF/MHA/SAF Group Term

The MINDEF/MHA/SAF term is an example of group insurance.

For the old birds, do you still remember that one day during BMT where we were all made to seat in the auditorium and listen to a Major share stories and pitch about insurance?

We were “strongly encouraged” to apply then.

At that time, we recognised the importance of providing something for our family if something happens to us although we didn’t really know what insurance really was or much about financial planning.

So, we just paid for it using our small allowance we had.

Times have changed since then.

Together with Singlife with Aviva, the Ministry of Defence (MINDEF) and the Ministry of Home Affairs (MHA) jointly introduced the MINDEF & MHA Group Insurance, which covers members from the SAF, SPF, SCDF, and affiliate members.

Now, there are two schemes: Core and Voluntary

1) Core Scheme

In summary, it covers national servicemen (NSFs or NSmen) during their full time service and operationally ready duties. Regulars and volunteers are also included.

As of 1 Jan 2023, here’s what the Core Scheme provides:

- $300,000 for Group Term Life

- $300,000 for Group Personal Injury

The premiums are paid by MINDEF and MHA.

2) Voluntary Scheme

In the voluntary scheme, members can choose to further enhance their own coverage and/or insure their dependants (spouse or children).

The maximum coverage amount for the voluntary scheme is up to $1,000,000 for Group Term Life and $1,000,000 for Group Personal Injury (previously known as Group Personal Accident).

Even after your service (e.g., ORD, MR, ROD, etc), you can still retain the coverage.

Furthermore, you’re able to add on different types of cover.

The 6 Types of Coverage and Their Premiums

There are currently six different types of cover that you can get with the Singlife with Aviva’s SAF Group Insurance:

- Group Term Life (main plan)

- Group Personal Injury (main plan)

- Living Care (rider)

- Living Care Plus (rider)

- Disability Income (rider)

- Outpatient Medicare (rider)

They cater to different needs.

To add on a rider, you need to have a main plain, either the Group Term Life or the Group Personal Injury. If you wish, you can have all six types of coverage, but the most common one would be the Group Term Life.

These coverage also applies to your spouse and/or children.

Let’s take a greater look at each type of cover.

1) Group Term Life

Overview

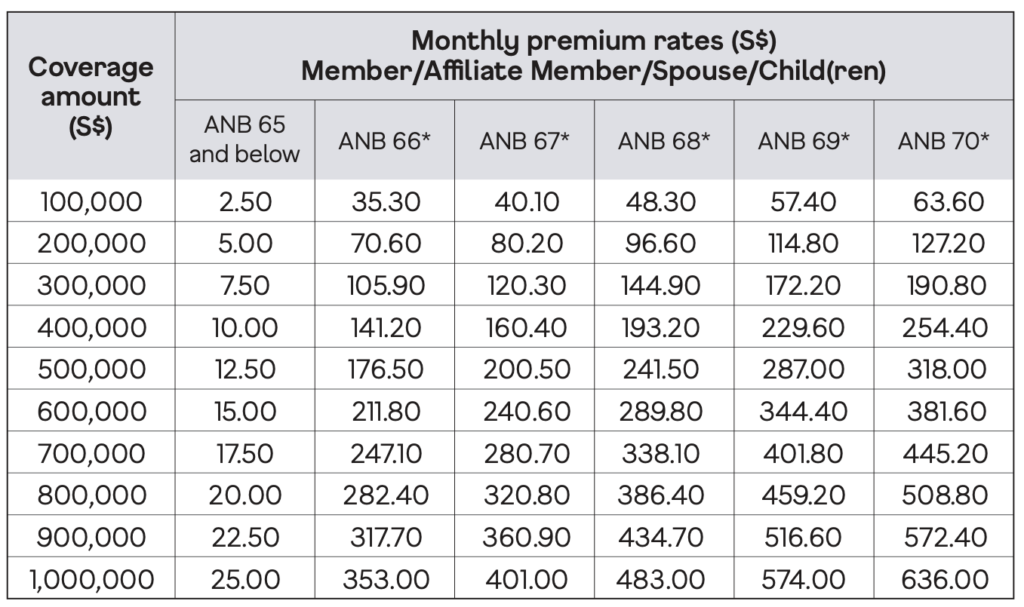

The Group Term Life (GTL) provides coverage for Death and Total and Permanent Disability (TPD) up to 70 years old (age next birthday).

Benefits

- Get a maximum cover of $1,000,000 for death and TPD

- Level premiums up to age 65; increasing premiums from age 66 to 70

- Very affordable

- Can provide $30/day of hospital cash benefit (only from the 11th to the 40th day of hospital stay)

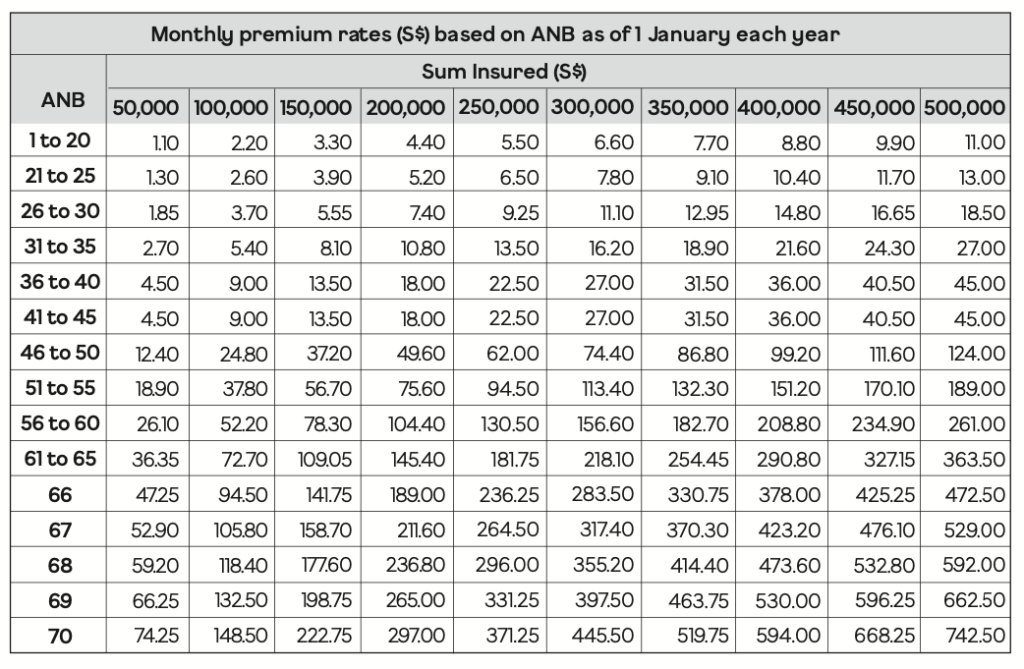

Premiums

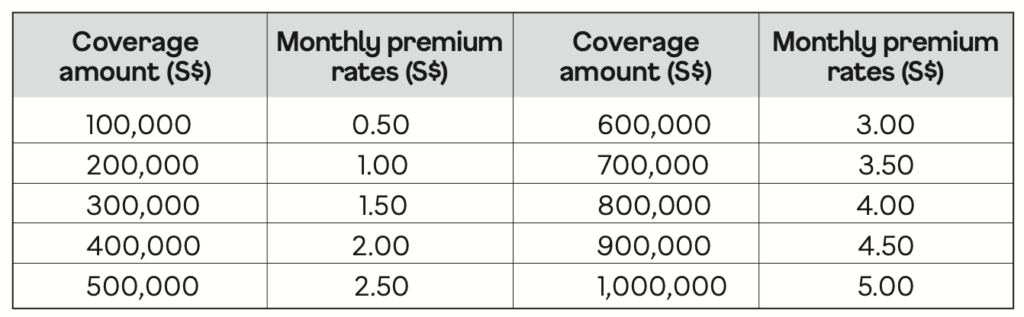

2) Group Personal Injury (previously known as Group Personal Accident)

Overview

The Group Personal Injury provides coverage in case of an accident, up to age 70 (age next birthday).

Benefits

- Get a maximum cover of $1,000,000

- Receive 150% of your insured amount if a TPD happens because of an accident

- Provides coverage of up to 100% of the insured amount if total and permanent dismemberment happens due to accidents (less serious than TPD)

- Level premiums up to age 70

- Additional cover for fractures due to accidents

Premiums

3) Living Care

Overview

The Living Care rider provides coverage if any of the 37 severe-stage critical illnesses happen.

Benefits

- Get up to $500,000 coverage

- Receive the claim in a lump sum

- Claim payout doesn’t reduce the insured amounts of other plans (GTL and/or other riders)

List of Critical Illnesses covered:

- Major Cancer

- Heart Attack of Specified Severity

- Stroke with Permanent Neurological Deficit

- Coronary Artery By-pass Surgery

- End Stage Kidney Failure

- Irreversible Aplastic Anaemia

- End Stage Lung Disease

- End Stage Liver Failure

- Coma

- Deafness (Irreversible Loss of Hearing)

- Open Chest Heart Valve Surgery

- Irreversible Loss of Speech

- Major Burns

- Major Organ / Bone Marrow Transplantation

- Multiple Sclerosis

- Muscular Dystrophy

- Idiopathic Parkinson’s Disease

- Open Chest Surgery to Aorta

- Alzheimer’s Disease / Severe Dementia

- Fulminant Hepatitis

- Motor Neurone Disease

- Primary Pulmonary Hypertension

- HIV Due to Blood Transfusion and Occupationally Acquired HIV

- Benign Brain Tumour

- Severe Encephalitis

- Severe Bacterial Meningitis

- Angioplasty & Other Invasive Treatment For Coronary Artery

- Blindness (Irreversible Loss of Sight)

- Major Head Trauma

- Paralysis (Irreversible Loss of Use of Limbs)

- Terminal Illness

- Progressive Scleroderma

- Persistent Vegetative State (Apallic Syndrome)

- Systemic Lupus Erythematosus with Lupus Nephritis

- Other Serious Coronary Artery Disease

- Poliomyelitis

- Loss of Independent Existence

These critical illnesses (CI) are standardised across insurance companies. Take a look at the definitions of these CIs here.

Premiums

4) Living Care Plus

Overview

The Living Care Plus rider provides coverage if any of the 10 early critical illnesses happen.

Benefits

- Get up to $500,000 coverage

- Receive the claim in a lump sum

- Claim payout doesn’t reduce the insured amounts of other plans (GTL and/or other riders)

List of Early Critical Illnesses covered:

- Early Cancer

- Large Asymptomatic Aortic Aneurysm Or Minimally Invasive Surgery to the

Aorta - Cardiac Pacemaker Insertion Or Pericardectomy Or Cardiac Defibrillator

Insertion Or Early Cardiomyopathy - Primary Pulmonary Hypertension

- Transmyocardial Laser Revascularisation Or Insertion of Vena-cava Filter

- Surgical Removal of One Kidney

- Heart Valve Repair Surgery

- Small Bowel Transplant Or Corneal Transplant

- Mild Coronary Artery Disease

- Brain Aneurysm Surgery Or Cerebral Shunt Insertion

Premiums

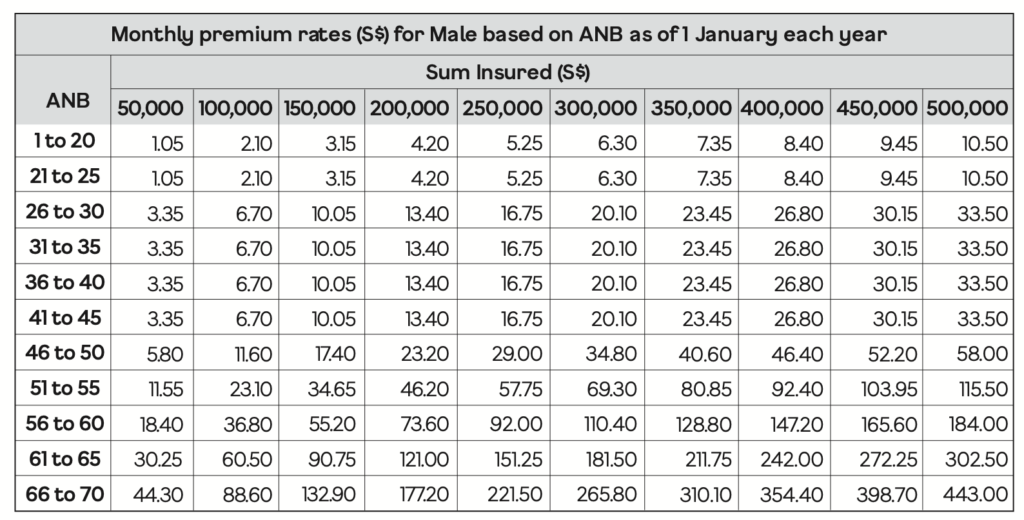

For Male:

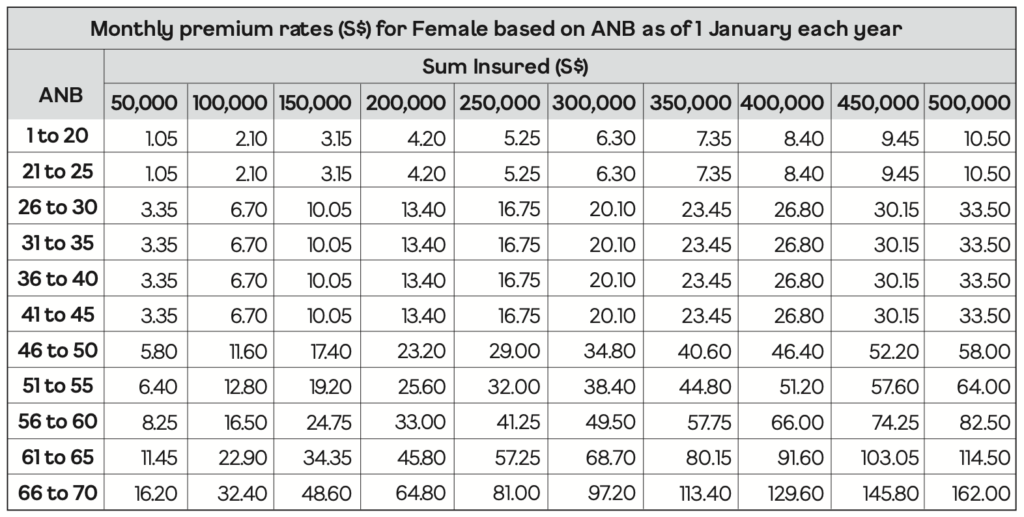

For Female:

5) Disability Income

Overview

The Disability Income rider pays out a monthly income in the event of a disability.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Benefits

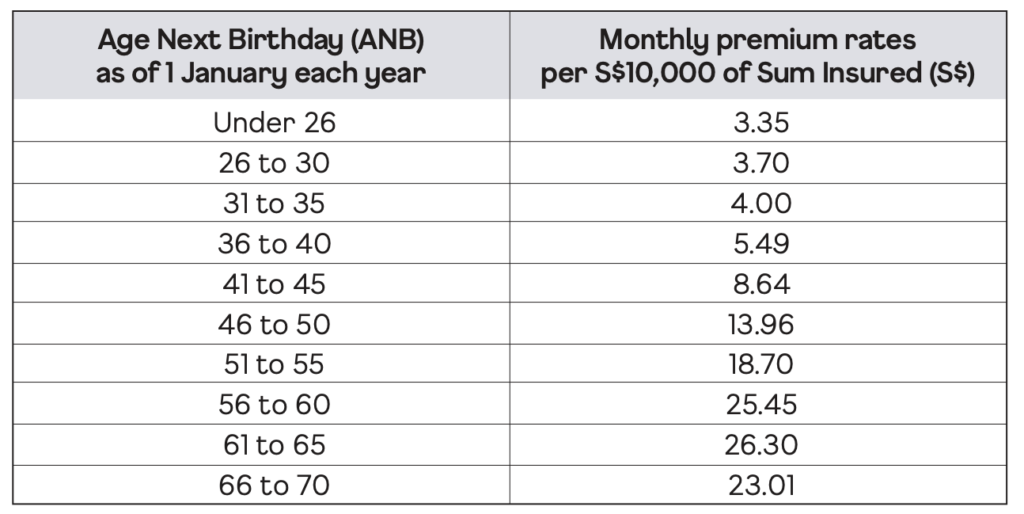

- Provides coverage of up to age 70

- The annual coverage is based on 50% of your monthly basic salary multiplied by 12 times; maximum of $120,000

- Annual inflation adjusted escalation benefit at the rate of 3%

Premium

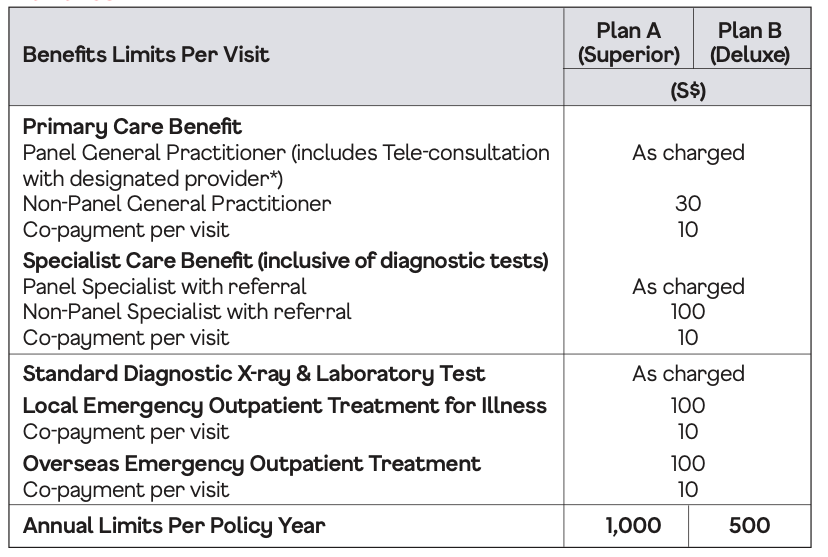

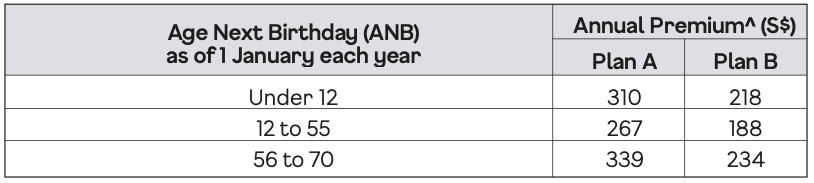

6) Outpatient Medicare

Overview

The Outpatient Medicare rider provides coverage for consultation and treatment expenses.

Coverage

Premium

How to Apply for the MINDEF/MHA Group Insurance

Eliminate the hassle of hard-copy application forms.

You don’t even need to meet anyone to apply. Simply apply online through Singlife with Aviva’s website.

Steps:

- Go to https://singlife.com/en/mindef-and-mha/mindef-group-insurance

- Click on “Get a quote” at the top of the page

- Follow the instructions

How to Claim

As there is no agent tagged to you, claims have to be made by yourself or your family members.

Claim forms can be downloaded, filled and submitted online via email along with the relevant documents.

You’re still able to email or call them if you have any questions.

Singlife with Aviva’s MINDEF/MHA Group Term Insurance vs Personal Term Insurance

We’ve come to the most important question: “should I go for the Singlife with Aviva’s MINDEF group term or a personal term insurance?”

Is the group insurance too good to be true?

Let’s be objective and look at the pros and cons.

Because the Group Term Life (death and TPD), Living Care (critical illness) and Living Care Plus (early critical illness) are what most people are considering, I’ll only talk about them, and they also happen to be the core elements in life insurance.

The Good

1) Premiums are cheap

At the top of the list, what makes the MINDEF group term so irresistible is the affordable premiums.

Scratch that.

The premiums are extremely cheap.

If you’re looking for the cheapest term plan, then you don’t have to read further because there’s nothing else that can beat it.

2) Able to get high coverage at level premiums

If you’ve just entered the workforce, a sum of $1,000,000 coverage can be a good amount to be insured with because of the concept of income protection.

And whether it’s $100,000 or $1,000,000, the premiums are proportionate – $2.50/mth vs $25/mth. There’s no discrimination with smaller sum assured amounts.

It also doesn’t matter at which age you enter since premiums are the same across ages (if you’re age 65 and below).

But $1,000,000 is the maximum you can get with the Group Term Life. If you want higher coverage, you have to look for personal term plans.

The Group Term Life also makes sense if you only wish to get coverage up to 65 years old. Beyond that, the increase in premiums can be too heavy.

For Living Care and Living Care Plus, the premiums do substantially increase with certain age bands.

3) Able to apply for your spouse and children

You’re able to take advantage of the affordable premiums and get the same coverage for your spouse and children.

It’s something that you can easily start for them. At least in the meantime, they are protected.

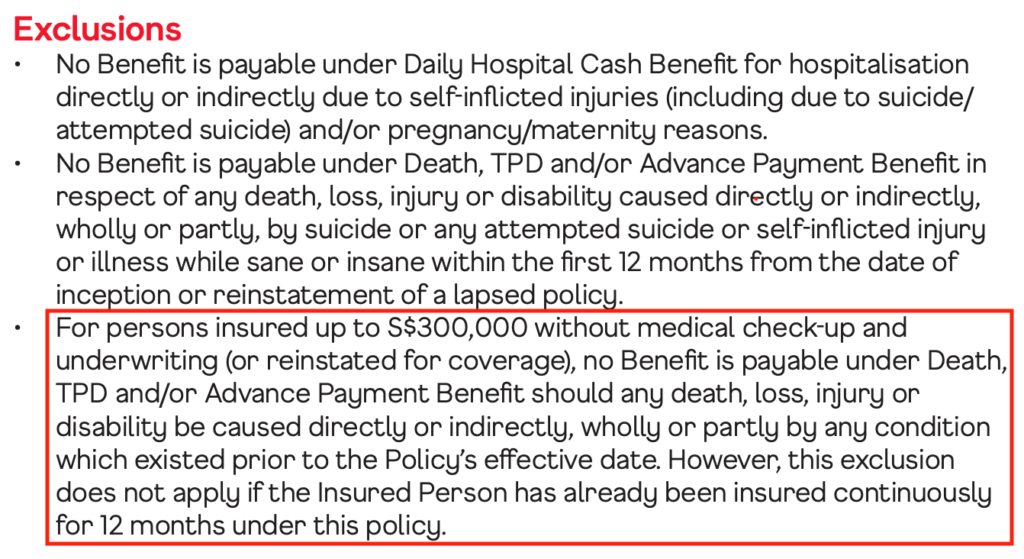

4) Get coverage even if you have pre-existing conditions

For those who have pre-existing conditions, it can be a challenge to get any form of life insurance coverage especially if they are severe.

MINDEF group term life (death and TPD) can still provide coverage of up to $300,000 for those who have pre-existing conditions without medical underwriting or checkups, subject to terms and conditions.

5) It should last for some time

Unlike typical group insurance from employers which will stop if you were to switch companies, the SAF term can still be active even if you’re out of service.

But make sure you apply for it when you’re eligible.

As there are many participants in this particular group insurance, it is also unlikely that Singlife with Aviva or MINDEF/MHA would discontinue it completely in the short term, but there’s still a possibility.

The Not-So-Good

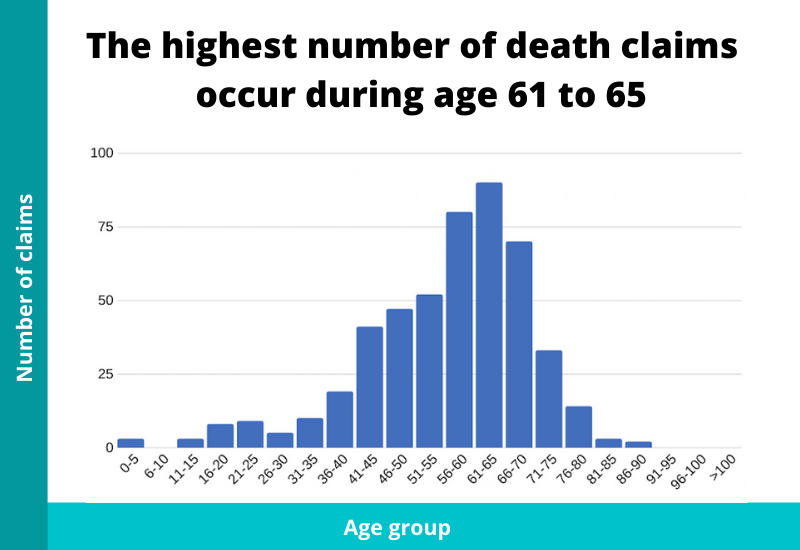

1) The Young may be “paying more” for the Old

If you realise, for GTL, the premiums are the same for Age Next Birthday (ANB) 65 and below.

This means that no matter whether you’re 23 years old or you’re 59 years old, you’re paying the same premium.

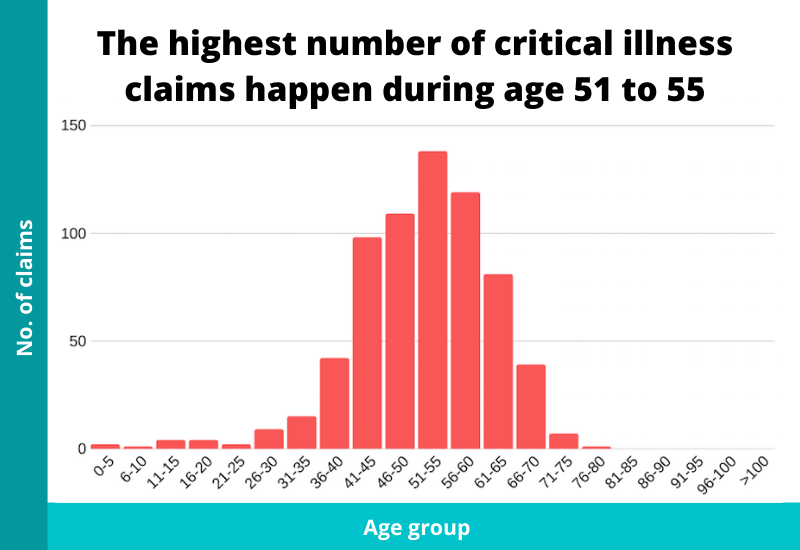

Based on statistics, most claims happen when you’re older.

So if you’re older and wiser, you can take advantage of this.

But if you’re younger, the pool of monies gathered favour the older folks more.

And just as a side note, if those older people were to buy private insurance, the premiums will never ever be the same and will be much higher.

2) Premiums are not guaranteed

The premiums you see in the MINDEF group term life insurance are not guaranteed. They are subject to revisions, upwards or downwards, as seen previously.

On the other hand, death and TPD premium rates in private term insurance are oftentimes level and guaranteed – they stay the same and cannot be revised during the duration specified in the term plan.

It is still important to note that premiums for critical illness coverage are usually not guaranteed, whether it be from a group insurance or private insurance. It is just a safeguard for the insurance company to make premiums sustainable for everyone in case something like an “epidemic” happens.

3) Critical illness coverage can be more expensive

The premiums for the standard critical illness (Living Care) and early critical illness (Living Care Plus) coverage increase with certain age bands.

While it’s true that at younger ages, the premiums are much more affordable, they go up substantially higher from 46 years old onwards, and they keep increasing at steeper rates.

Now, statistics have shown that most claims usually happen from 40 to 70 years old.

So that’s usually the “critical” period to be covered for.

If nothing happens and you add all the CI and ECI premiums for the SAF term together, the total premiums could be more expensive than a comprehensive multipay critical illness plan.

Also, in private term plans with attached CI and ECI, the premiums for CI and ECI are level.

In short, although premiums from a standalone multipay critical illness plan or CI/ECI riders attached to private term plans can be higher than the SAF group CI/ECI cover in the beginning, over time, the total premiums could be lower.

4) Fewer conditions covered for early critical illnesses

Broadly speaking, there are 37 severe-stage critical illnesses whose definitions are standardised across insurance companies.

The same applies to Living Care coverage.

However, if you’re looking to get early critical illness coverage, then those definitions and what they cover do differ between insurers.

In Living Care Plus, it only covers 10 conditions, which will be very limited.

5) There are claim limits

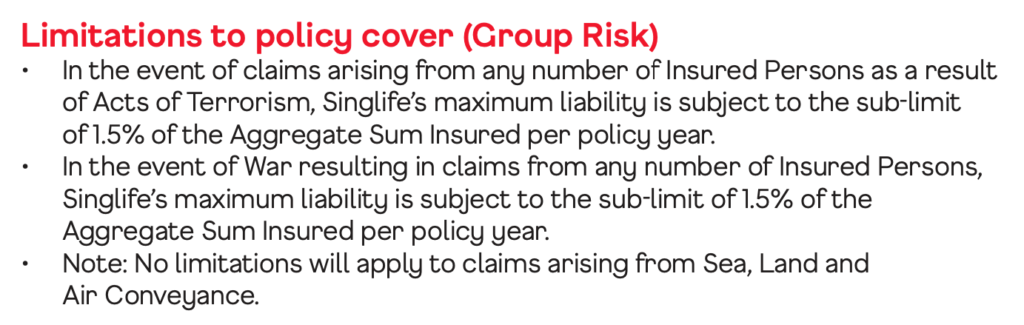

While still a minor point, the group term life has limits if certain scenarios happen.

For acts of terrorism or in the event of a war, the liability on Singlife with Aviva may be reduced.

Although Singapore is relatively safe, it’s something for you to take note of.

6) You’re not the policy owner

Contractually, MINDEF and MHA are the policy owners.

You’re just the insured person.

This means that there are restrictions in what you can and cannot do.

If in the future, they decide to change insurers, policy premiums, coverage and revise terms and conditions, they can do so.

This presents a problem to you if the policy is the only life insurance policy you have because you would be stuck with it. You may think that it isn’t an issue because you can apply for insurance elsewhere but health and older age might not be in your favour.

7) No agent is able to service you

What’s the purpose of buying insurance? It’s simple: just in case you need to make a claim.

The MINDEF group term can be applied online but there’s no agent tagged to you.

Any questions have to be directed to their email or hotline.

Another thing is that you need to ensure your premiums are paid on time if not the policy will lapse.

But more importantly, if claims arise, no one else can assist you other than yourself or your family members. When such crisis happens, it can be overwhelming for all parties.

In a personal term insurance, an agent is not there to just “sell” you the policy, but to ensure that everything else in your financial portfolio is sound, the policy is kept in-force throughout, and most importantly, to be there if an unfortunate event happens.

8) Lack of flexibility

Do you want other options?

Do you want to have higher coverage?

Do you want to be covered for a longer period?

The group term is structured to be rigid. It’s “take it or leave it”.

But for personal term plans, you can do longer terms till 75 , 85 or even till 99 years old. With an increasing life expectancy in Singapore, a coverage beyond 65 might be something to think about.

There is greater flexibility so that it suits your needs rather than the other way around.

Summary of the Pros and Cons

| Pros | Cons | |

| 1. | Premiums are cheap | The Young may be “paying more” for the Old |

| 2. | Able to get high coverage at level premiums | Premiums are not guaranteed |

| 3. | Able to apply for your spouse and children | Critical illness coverage can be more expensive |

| 4. | Get coverage even if you have pre-existing conditions | Fewer conditions covered for early critical illnesses |

| 5. | It should last for some time | There are claim limits |

| 6. | You’re not the policy owner | |

| 7. | No agent is able to service you | |

| 8. | Lack of flexibility |

Wrapping Up

If your decision is based solely on premiums, the SAF term is hard to beat, but insurance companies also know this.

That’s why it’s not a simple decision to just go for the cheapest. There are many features and benefits that come with getting your own personal term insurance.

The SAF term need not be an all or nothing either. You can complement it with other individual private plans to achieve a sound financial portfolio.

For example, a popular method is to combine the group term life (just the death/TPD coverage) with a standalone multipay early critical illness plan (which covers early, intermediate and late stages; able to claim multiple times; pays out a multiple of the sum assured if a late stage happens first).