The definitions of critical illness are changing.

If you are an existing policyholder or planning to get CI coverage, how would these changes affect you?

In this article, I’ll cover:

- Why do we have these definitions in the first place

- The specific changes

- What’s the impact

And then you’ll know whether these changes matter or not.

Read on!

In a Nutshell

The Life Insurance Association Singapore (LIA) is changing the critical illness definitions – known as the LIA Critical Illness (CI) Framework.

These definitions are first standardised across insurers back in 2003.

And it’s not the first time that they’re changing it.

In 2014, they made a few changes too.

One of which is that it used to consist a maximum of 30 critical illnesses, but changed it to include 37 conditions.

And so now in 2019, they will be making some changes again.

The actual change will take effect on 26 August 2020, and it applies to individual life policies (term insurance, whole life insurance, standalone critical illness plans), group insurance and general insurance.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

The Purpose of Having This Framework

Why did they come up with this framework in the first place?

The insurance companies used to have different definitions for critical illnesses. And because of that, one company may pay out and the other may reject.

This caused consumers to compare products based on their definitions – which may be tedious.

So LIA came up with this framework which will standardise all CI definitions.

In addition, this framework will allow CI coverage to stay relevant with time and make the scope of coverage clear.

Ultimately, this benefits consumers.

SIDE NOTE

These definitions are for the 37 critical illnesses only. Definitions of early and intermediate stages are not standardised and may differ from insurers.

So, Why Did the Framework Change Again?

With rapid medical and technological advances, the LIA conducts regular reviews on this framework once every 3 years so that it stays relevant.

For example, what was not possible (e.g. surgically), may now be a possibility (new medical procedures).

Furthermore, even with the standardised definitions, insurers may still interpret it differently when a claim comes – one pays out; the other rejects.

The reason: ambiguity.

So LIA is tightening the definitions to be more specific, thus reducing grey areas.

The 2019/2020 Changes in Critical Illness Definitions

The information below are summarised but you can view the full changes in the LIA Critical Illness (CI) Framework 2019.

Change in Headings

To start off, there are many illnesses and diseases around, so what constitutes to a critical illness or a dread disease?

To be categorised as a CI, it must fall under one of the 37 critical illnesses.

Generally, these are towards the advanced stages of an illness.

Here’s the list of changes in CI headings:

(Bolded words reflect the changes)

| Old 2014 Framework | New 2019 Framework | |

| 1. | Major Cancers | Major Cancer |

| 2. | Heart Attack of Specified Severity | Heart Attack of Specified Severity |

| 3. | Stroke | Stroke with Permanent Neurological Deficit |

| 4. | Coronary Artery By-pass Surgery | Coronary Artery By-pass Surgery |

| 5. | Kidney Failure | End Stage Kidney Failure |

| 6. | Aplastic Anaemia | Irreversible Aplastic Anaemia |

| 7. | End Stage Lung Disease | End Stage Lung Disease |

| 8. | End Stage Liver Failure | End Stage Liver Failure |

| 9. | Coma | Coma |

| 10. | Deafness (Loss of Hearing) | Deafness (Irreversible Loss of Hearing) |

| 11. | Heart Valve Surgery | Open Chest Heart Valve Surgery |

| 12. | Loss of Speech | Irreversible Loss of Speech |

| 13. | Major Burns | Major Burns |

| 14. | Major Organ / Bone Marrow Transplantation | Major Organ / Bone Marrow Transplantation |

| 15. | Multiple Sclerosis | Multiple Sclerosis |

| 16. | Muscular Dystrophy | Muscular Dystrophy |

| 17. | Parkinson’s Disease | Idiopathic Parkinson’s Disease |

| 18. | Surgery to Aorta | Open Chest Surgery to Aorta |

| 19. | Alzheimer’s Disease / Severe Dementia | Alzheimer’s Disease / Severe Dementia |

| 20. | Fulminant Hepatitis | Fulminant Hepatitis |

| 21. | Motor Neurone Disease | Motor Neurone Disease |

| 22. | Primary Pulmonary Hypertension | Primary Pulmonary Hypertension |

| 23. | HIV Due to Blood Transfusion and Occupationally Acquired HIV | HIV Due to Blood Transfusion and Occupationally Acquired HIV |

| 24. | Benign Brain Tumour | Benign Brain Tumour |

| 25. | Viral Encephalitis | Severe Encephalitis |

| 26. | Bacterial Meningitis | Severe Bacterial Meningitis |

| 27. | Angioplasty & Other Invasive Treatment For Coronary Artery | Angioplasty & Other Invasive Treatment for Coronary Artery |

| 28. | Blindness (Loss of Sight) | Blindness (Irreversible Loss of Sight) |

| 29. | Major Head Trauma | Major Head Trauma |

| 30. | Paralysis (Loss of Use of Limbs) | Paralysis (Irreversible Loss of Use of Limbs) |

| 31. | Terminal Illness | Terminal Illness |

| 32. | Progressive Scleroderma | Progressive Scleroderma |

| 33. | Apallic Syndrome | Persistent Vegetative State (Apallic Syndrome) |

| 34. | Systemic Lupus Erythematosus with Lupus Nephritis | Systemic Lupus Erythematosus with Lupus Nephritis |

| 35. | Other Serious Coronary Artery Disease | Other Serious Coronary Artery Disease |

| 36. | Poliomyelitis | Poliomyelitis |

| 37. | Loss of Independent Existence | Loss of Independent Existence |

As you can see, the list of 37 CIs still stay the same. Only their headings changed.

What’s more important are their individual definitions.

Change in Definitions

But even so, there are variations to each critical illness.

Say, if you contracted “Major Cancer”, you might not be able to claim under “Major Cancer” if your definition is not satisfied – claim pays out only if there’s a match.

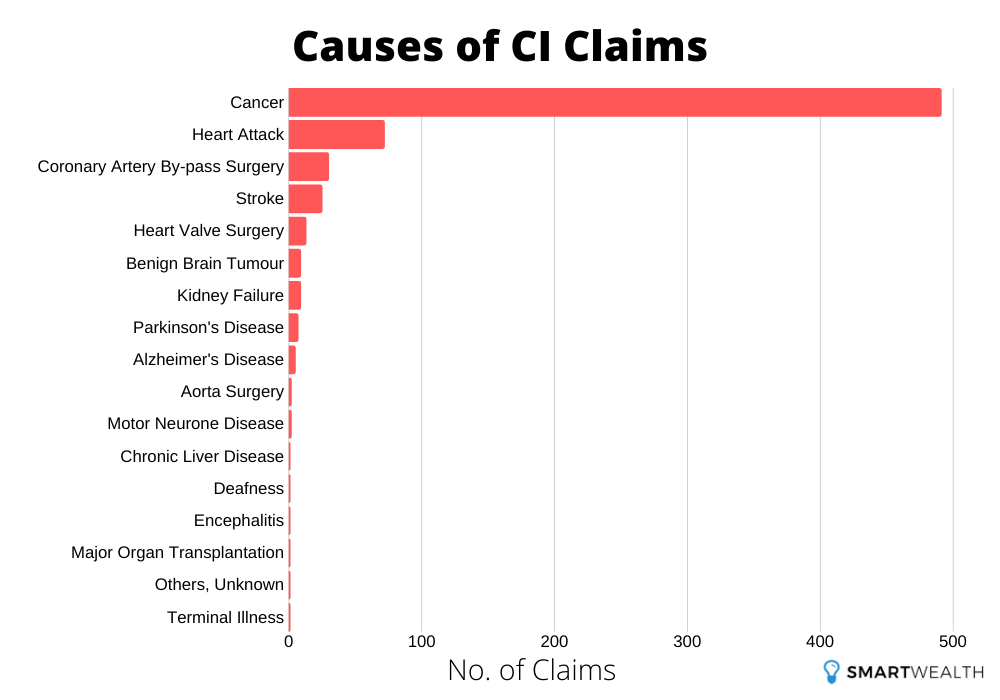

Before continuing, it’s good to know that more than 90% of all CI claims are from only these 5:

- Major Cancer (see more cancer statistics)

- Heart Attack of Specified Severity

- Stroke with Permanent Neurological Deficit

- Coronary Artery Bypass Surgery

- End-Stage Kidney Failure

But it’s even more skewed than that.

From an analysis of CI claims statistics, cancer accounts for a huge majority of CI claims.

But for now, I’ll just touch on these 5 only, and not the full 37 conditions.

Because I’m not a medical doctor and I don’t wish to be too technical, I’ll just quote LIA’s own words.

(Bolded words reflect the changes)

| Version 2014 | Version 2019 |

| Major Cancers A malignant tumour positively diagnosed with histological confirmation and characterized by the uncontrolled growth of malignant cells with invasion and destruction of normal tissue. The term malignant tumour includes leukemia, lymphoma and sarcoma. For the above definition, the following are excluded: • All tumours which are histologically classified as any of the following: Pre-malignant; Non-invasive; Carcinoma-in-situ; Having borderline malignancy; Having any degree of malignant potential; Having suspicious malignancy; Neoplasm of uncertain or unknown behavior; or Cervical Dysplasia CIN-1, CIN-2 and CIN-3; • Any non-melanoma skin carcinoma unless there is evidence of metastases to lymph nodes or beyond; • Malignant melanoma that has not caused invasion beyond the epidermis; • All Prostate cancers histologically described as T1N0M0 (TNM Classification) or below; or Prostate cancers of another equivalent or lesser classification; • All Thyroid cancers histologically classified as T1N0M0 (TNM Classification) or below; • All tumours of the Urinary Bladder histologically classified as T1N0M0 (TNM Classification) or below; • All Gastro-Intestinal Stromal tumours histologically classified as T1N0M0 (TNM Classification) or below and with mitotic count of less than or equal to 5/50 HPFs; • Chronic Lymphocytic Leukaemia less than RAI Stage 3; and • All tumours in the presence of HIV infection. | Major Cancer A malignant tumour positively diagnosed with histological confirmation and characterized by the uncontrolled growth of malignant cells with invasion and destruction of normal tissue. The term Major Cancer includes, but is not limited to, leukemia, lymphoma and sarcoma. Major Cancer diagnosed on the basis of finding tumour cells and/or tumour-associated molecules in blood, saliva, faeces, urine or any other bodily fluid in the absence of further definitive and clinically verifiable evidence does not meet the above definition. For the above definition, the following are excluded: • All tumours which are histologically classified as any of the following: Pre-malignant; Non-invasive; Carcinoma-in-situ (Tis) or Ta; Having borderline malignancy; Having any degree of malignant potential; Having suspicious malignancy; Neoplasm of uncertain or unknown behavior; or All grades of dysplasia, squamous intraepithelial lesions (HSIL and LSIL) and intra epithelial neoplasia; • Any non-melanoma skin carcinoma, skin confined primary cutaneous lymphoma and dermatofibrosarcoma protuberans unless there is evidence of metastases to lymph nodes or beyond; • Malignant melanoma that has not caused invasion beyond the epidermis; • All Prostate cancers histologically described as T1N0M0 (TNM Classification) or below; or Prostate cancers of another equivalent or lesser classification; • All Thyroid cancers histologically classified as T1N0M0 (TNM Classification) or below; • All Neuroendocrine tumours histologically classified as T1N0M0 (TNM Classification) or below; • All tumours of the Urinary Bladder histologically classified as T1N0M0 (TNM Classification) or below; • All Gastro-Intestinal Stromal tumours histologically classified as Stage I or IA according to the latest edition of the AJCC Cancer Staging Manual, or below; • Chronic Lymphocytic Leukaemia less than RAI Stage 3; • All bone marrow malignancies which do not require recurrent blood transfusions, chemotherapy, targeted cancer therapies, bone marrow transplant, haematopoietic stem cell transplant or other major interventionist treatment; and • All tumours in the presence of HIV infection. |

| Version 2014 | Version 2019 |

| Heart Attack of Specified Severity Death of heart muscle due to obstruction of blood flow, that is evident by at least three of the following criteria proving the occurrence of a new heart attack: • History of typical chest pain; • New characteristic electrocardiographic changes; with the development of any of the following: ST elevation or depression, T wave inversion, pathological Q waves or left bundle branch block; • Elevation of the cardiac biomarkers, inclusive of CKMB above the generally accepted normal laboratory levels or Cardiac Troponin T or I at 0.5ng/ml and above; • Imaging evidence of new loss of viable myocardium or new regional wall motion abnormality. The imaging must be done by Cardiologist specified by the Company. For the above definition, the following are excluded: • Angina; • Heart attack of indeterminate age; and • A rise in cardiac biomarkers or Troponin T or I following an intra-arterial cardiac procedure including, but not limited to, coronary angiography and coronary angioplasty. Explanatory note: 0.5ng/ml = 0.5ug/L = 500pg/ml | Heart Attack of Specified Severity Death of heart muscle due to ischaemia, that is evident by at least three of the following criteria proving the occurrence of a new heart attack: • History of typical chest pain; • New characteristic electrocardiographic changes; with the development of any of the following: ST elevation or depression, T wave inversion, pathological Q waves or left bundle branch block; • Elevation of the cardiac biomarkers, inclusive of CKMB above the generally accepted normal laboratory levels or Cardiac Troponin T or I at 0.5ng/ml and above; • Imaging evidence of new loss of viable myocardium or new regional wall motion abnormality. The imaging must be done by Cardiologist specified by the Company. For the above definition, the following are excluded: • Angina; • Heart attack of indeterminate age; and • A rise in cardiac biomarkers or Troponin T or I following an intra-arterial cardiac procedure including, but not limited to, coronary angiography and coronary angioplasty. Explanatory note: 0.5ng/ml = 0.5ug/L = 500pg/ml |

| Version 2014 | Version 2019 |

| Stroke A cerebrovascular incident including infarction of brain tissue, cerebral and subarachnoid haemorrhage, intracerebral embolism and cerebral thrombosis resulting in permanent neurological deficit with persisting clinical symptoms. This diagnosis must be supported by all of the following conditions: • Evidence of permanent clinical neurological deficit confirmed by a neurologist at least 6 weeks after the event; and • Findings on Magnetic Resonance Imaging, Computerised Tomography, or other reliable imaging techniques consistent with the diagnosis of a new stroke. The following are excluded: • Transient Ischaemic Attacks; • Brain damage due to an accident or injury, infection, vasculitis, and inflammatory disease; • Vascular disease affecting the eye or optic nerve; and • Ischaemic disorders of the vestibular system. Permanent means expected to last throughout the lifetime of the Life Assured. Permanent neurological deficit with persisting clinical symptoms means symptoms of dysfunction in the nervous system that are present on clinical examination and expected to last throughout the lifetime of the Life Assured. Symptoms that are covered include numbness, paralysis, localized weakness, dysarthria (difficulty with speech), aphasia (inability to speak), dysphagia (difficulty swallowing), visual impairment, difficulty in walking, lack of coordination, tremor, seizures, dementia, delirium and coma. | Stroke with Permanent Neurological Deficit A cerebrovascular incident including infarction of brain tissue, cerebral and subarachnoid haemorrhage, intracerebral embolism and cerebral thrombosis resulting in permanent neurological deficit. This diagnosis must be supported by all of the following conditions: • Evidence of permanent clinical neurological deficit confirmed by a neurologist at least 6 weeks after the event; and • Findings on Magnetic Resonance Imaging, Computerised Tomography, or other reliable imaging techniques consistent with the diagnosis of a new stroke. The following are excluded: • Transient Ischaemic Attacks; • Brain damage due to an accident or injury, infection, vasculitis, and inflammatory disease; • Vascular disease affecting the eye or optic nerve; • Ischaemic disorders of the vestibular system; and • Secondary haemorrhage within a pre-existing cerebral lesion. |

| Version 2014 | Version 2019 |

| Coronary Artery By-pass Surgery The actual undergoing of open-chest surgery or Minimally Invasive Direct Coronary Artery Bypass surgery to correct the narrowing or blockage of one or more coronary arteries with bypass grafts. This diagnosis must be supported by angiographic evidence of significant coronary artery obstruction and the procedure must be considered medically necessary by a consultant cardiologist. Angioplasty and all other intra arterial, catheter based techniques, ‘keyhole’ or laser procedures are excluded. | Coronary Artery By-pass Surgery No changes made. |

| Version 2014 | Version 2019 |

| Kidney Failure Chronic irreversible failure of both kidneys requiring either permanent renal dialysis or kidney transplantation. | End Stage Kidney Failure No changes made. |

For the rest of the conditions, you can check them out here.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

How Would These Impact You

What matters the most is how these changes will affect you as a consumer.

For existing policyholders

For those of you who have existing insurance plans with the “older” CI coverage, there will be no change (even after 26 August 2020).

The CI definitions will still stay the same as per the policy contract.

In my opinion, I see it as more lenient as it can still be open for interpretation (when there’s a claim).

So you don’t have to do anything.

The question you should be asking is whether you have sufficient coverage or not.

For future policyholders (or those who don’t have enough coverage)

Before 26 Aug 2020

You may be thinking whether now is a better time to buy…

Well, if you already have the need but have not done anything, the best time to buy was yesterday.

When dealing with insurance, timing is sensitive.

When you’re well-prepared, the doubts, worries and “what ifs” can be eliminated.

To me, the older definitions seem more lax.

If you get it before 26 Aug, you’ll still be covered on the 2014 framework.

If you’re healthy now, why should you wait?

Don’t wait till you’re a +1 into the statistics of critical illness.

After 26 Aug 2020

After this date, the policies you purchased with CI will be under the new framework.

You won’t be able get the older CI coverage.

The Real Question Is…

Should you be affected by this change?

To some, the changes may seem overwhelming.

It’s easy to get caught up in the whirlwind of information, and then lose sight of what’s important.

We will never ever know what exactly is going to happen to us.

Zooming out to the bigger picture, the question we should be asking is, “are we sufficiently covered?”

To start off, you can estimate how much life insurance or critical illness coverage you should have.

And if you want to learn more, check out our other articles on term insurance, whole life insurance and standalone early critical illness insurance.