A shiny new policy, CareShield Life, has suddenly dropped into your hands.

Whether you like it or not, there’s no escaping since it’s compulsory.

So what we can do now is to see how it can integrate and further improve on our current financial planning.

One major consideration is whether upgrading with CareShield Life supplements is worth it or not.

In this article, I’ll cover the pros and cons.

So, read on!

This page is part of the CareShield Life 3-Part Series:

- Part 0: ElderShield vs CareShield Life

- Part 1: What is CareShield Life?

- Part 2: CareShield Life Supplement (you’re here)

A Primer on CareShield Life

CareShield Life is a national healthcare scheme that provides protection against severe disability. It’s a type of insurance that provides a monthly payout to cater for long term care needs when the unfortunate happens.

Most of you would’ve already known the basics of this policy.

But for those who don’t or are still unsure, here’s a recap:

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Who Will Be Covered?

If you’re a Singapore Citizen or a Permanent Resident (PR), you’ll be automatically enrolled into CareShield Life once you turn 30 years old.

And because CareShield Life was meant to replace ElderShield, there was a transition period. This meant that those who are born between 1980 and 1990, will also be automatically enrolled in 2020.

For those who are born in 1980 or later, CareShield is compulsory.

For those who are born in 1979 or earlier, you have the option to enrol into the scheme from end-2021. But specifically for those born between 1970 to 1979, you’ll be automatically enrolled into CareShield Life when end-2021 comes, and have the option to opt out from it by 31 Dec 2023 with full refunds.

What Exactly Does It Cover?

To claim from CareShield, you’ll need to satisfy the definition of a severe disability.

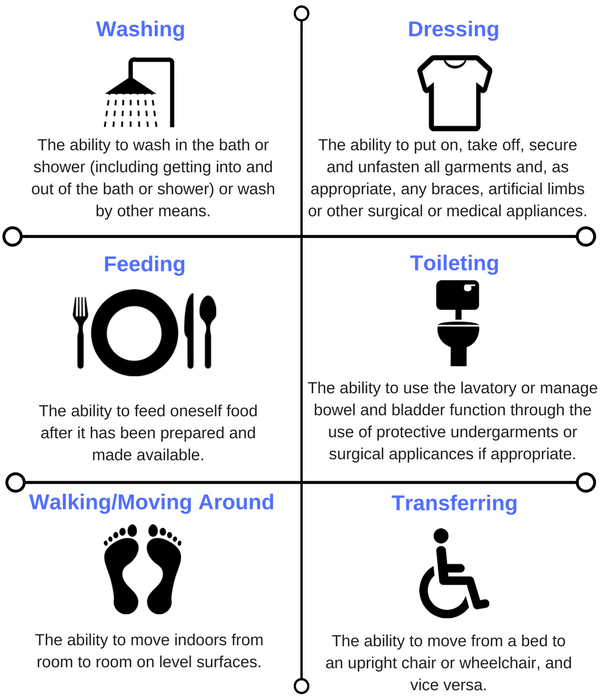

That definition is this: inability to perform at least 3 out of 6 Basic Activities of Living (ADLs).

The 6 Basic Activities of Living:

- Washing

- Dressing

- Feeding

- Toileting

- Walking or Moving Around

- Transferring

And you can find the definitions of each ADL below:

5 Main Benefits of the Basic CareShield Life

To cut the long story short, here are the core benefits:

1) A Lifetime of Coverage

Yes, you can continue to be covered for life, even after you’ve finished paying the premiums.

The coverage only ends upon death.

2) Receive a Lifetime of Payouts

As long as you meet the criteria of severe disability (at least 3 out of 6 ADLs), you’re eligible to receive the monthly cash payouts for life.

However, if you recover from the disability (e.g. it becomes 2 out of 6 ADLs instead), the payouts will stop.

3) Payouts Increase Over Time

The monthly payout starts from $600/month in 2020. It increases approximately at a rate of 2% per year (not guaranteed) until the age of 67, or when you’ve made an eligible claim, whichever is earlier.

This is great as it can account for the increasing cost of living which is a normal occurrence.

4) Pre-Existing Conditions Will Be Covered

If you’re born in 1980 or later, no matter what kind of health conditions you have – major or minor – you’re able to be covered under the basic CareShield Life.

In the scenario where you’re already severely disabled, you can still be entitled to the payouts.

However, for those who are born in 1979 or earlier, a different set of rules apply.

5) Premiums Are Fully Payable by CPF MediSave

It’ll be good to know that you need not fork out cash to pay the premiums.

They’re fully payable using your CPF MediSave.

The premiums need to be paid from age 30 and it’s targeted to stop at age 67, or when a claim is made.

Similar to the increasing payouts, the premiums would also increase at a rate of approximately 2% per year (not guaranteed).

Your starting premium will vary as it depends on various factors. To check the actual premiums payable, use the CareShield Life Premium Calculator by MOH.

The 1 Reason Why the Basic CareShield Life Is Not Enough

Amongst the various reasons, there’s really only one which highlights the limitations of what the basic CareShield can do.

It boils down to this: “Money No Enough“.

What I mean by this?

CareShield Life is meant to be basic

Quoting the Ministry of Health, “CareShield Life is intended to provide basic financial protection for long-term care needs…”

To further reinforce the point of it being basic, for the scheme to be made compulsory for all Singaporeans (including the lower income group), the coverage amount inevitably has to be made lower (or “basic”) for the premiums to be affordable for everyone.

But what we need may be more than the minimum.

You’d likely need a higher amount

So how much do we need?

From several studies done, the answer to that question may be $2300/month (see this and this).

But, of course, this will differ from person to person.

Now, in an event where you’re experiencing severe disability, would you want to burden your family members to take care of you? They still have their own lives to live.

You’d need some money for these expenses:

- Daily living expenses

- Hiring a maid or a caregiver to take care of you

- Staying in a nursing home

- Medical aids

- Miscellaneous expenses

- etc

Would the monthly payout (e.g $600/month in 2020) be sufficient for you?

There’s a cap to the monthly payout you can receive

If you’ve paid attention, you’ll know that if a severe disability happens in 2020, you’ll receive $600/month. If not, that monthly amount would increase until you’re 67 years old, or when a claim is made, whichever is earlier.

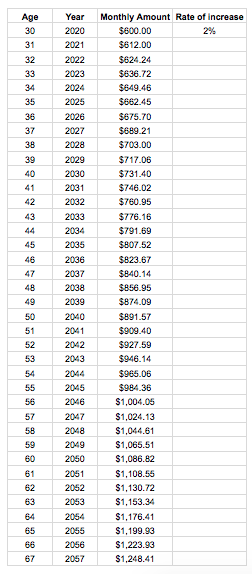

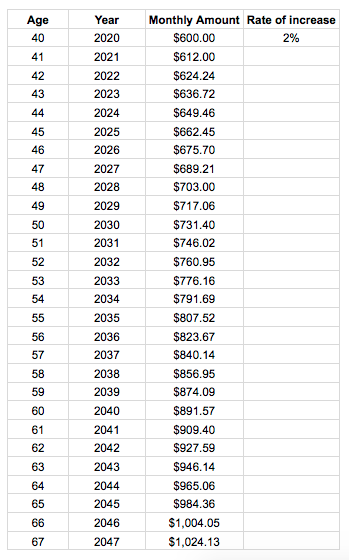

So I set out to find how high that monthly payout can go with some spreadsheet calculations.

Assumptions made:

- payouts grow at a fixed 2% per year

- payouts increase only until age 67

- no claim is made before age 67

Here are some findings:

For a 30 years old in 2020:

At 67 years old, the estimated monthly payout is $1248.41.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

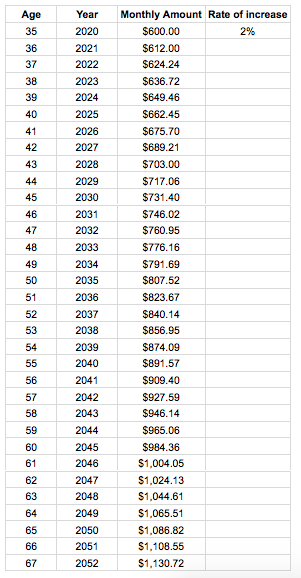

For a 35 years old in 2020:

At 67 years old, the estimated monthly payout is $1130.72.

For a 40 years old in 2020:

At 67 years old, the estimated monthly payout is $1024.13.

In summary, depending on your age now, you’re capped to receive a certain monthly payout.

Take note that this monthly payout will be lower if you make a claim at an earlier age.

This also highlights the point that it’s likely we have a shortfall, considering how much we should be covered and how much we’re covered.

What If You Have Your Own Private Insurance Already

Most of you would’ve done some sort of financial planning before and purchase insurance protection plans. If you haven’t, it’s never too late.

Examples of such insurance plans:

- Term Insurance

- Whole Life Insurance

- Disability Income Insurance

Such plans may include some form of disability coverage.

Depending on how you see it, it can be seen as a complement or an overlap with what CareShield offers.

But there’s one critical point: the disability coverage of such plans usually ends around 70 years old.

CareShield on the other hand provides lifetime coverage beyond that age. So with that, it should be seen more as a complement.

Good News: You Can Upgrade Your Basic CareShield

For those who wish to have a higher coverage amount, and even more benefits, you can upgrade now.

There are only 3 insurance companies who provide CareShield Life supplements, and they’ve been launched already.

Here are the companies and their plans:

- Singlife with Aviva

- Singlife CareShield Standard

- Singlife CareShield Plus

- NTUC Income

- Care Secure

- Great Eastern (GE)

- GREAT CareShield

- GREAT CareShield Advantage

You Need Not Use Cash to Upgrade With the Supplements

The main factor to upgrade your CareShield Life is that you don’t need to pay with cash to get a higher amount of coverage.

The premiums can be paid by either you or your immediate family members:

- Spouse

- Parents

- Children

- Siblings

- Grandchildren

The paying of premiums can come from your CPF MediSave, up to a limit of $600/calendar year/insured. If the premium is above that limit, then a cash top up is needed.

At the end of the day, if you think your corresponding monthly payout is still not enough, you can still upgrade to an even higher amount.

7 Benefits of Upgrading Your CareShield Life Early

1) Get higher monthly payouts

Probably the most obvious and important point.

Given that the CareShield Life only provides for the most basic needs, a higher monthly payout will allow you better care facilities and cater to more expenses if the need arises.

You can enhance up to monthly payout of $5,000 but cash premiums are usually needed at that point.

Assuming that you want to stick with a fixed premium of $600/year (the limit you can use from MediSave), you can get a higher monthly payout (or at a lower premium) if you upgrade now compared to if you upgrade later.

2) Option of an easier claim eligibility

The basic CareShield Life only pays out when at least 3 out of 6 Activities of Daily Living (ADLs) can’t be done.

That’s the only definition.

With CareShield supplements, there’ll be more options.

You can just to stick with the standard 3 out of 6 ADLs, or select a claim eligibility of 2 out of 6 ADLs, etc.

Compared to the 3 out of 6 ADLs option, the 2 out of 6 ADLs do come at heavier cost, which will lower your monthly payout if you wish to stick with the $600/year MediSave limit.

The next consideration is whether you think 2 out of 6 ADLs is likely to happen.

In my opinion, if someone can qualify for 2 out of 6 ADLs, it’s likely that they can qualify for 3 out of 6 ADLs too.

3) Choice of various premium paying terms

Choices for premium terms of supplements open up too.

You need not stick with the standard – pay till 67 years old.

Depending on the company, there are various options such as pay till age 67, 84, 97, etc.

Just take note that the shorter the premium paying term, the higher premiums, with all things equal.

4) Get enhanced benefits

The sole benefit of having the basic CareShield Life is that you get the monthly disability payout – that’s pretty much it.

With CareShield upgrades, there are more benefits that come with it.

These include:

- Waiver of premium even if 1 or 2 ADLs happen

- Level or increasing payouts

- Increased payouts if you have dependants

- Still get a reduced payout if you recover to 2 ADLs

- etc

But in my opinion, such benefits are secondary. The main one is still the higher monthly payout.

5) Making better use of your CPF MediSave

Just to iterate again, you may use your MediSave to pay for the premiums of the supplements. The cap is $600/year, and so if the premiums are higher, you’ll need to top up in cash.

Most Singaporeans would just fully utilise at least up to the limit of $600.

Why?

Your CPF MediSave balances give you 4% interest per year.

Assuming you have $40,000 in your MediSave right now, that 4% interest equates to $1,600. So even if you stop working now and no more CPF contribution comes in, that interest can cover the premiums (not considering other factors).

Moreover, there are limitations in using MediSave:

- Your MediSave monies don’t form part of the Retirement Account and thus can’t be withdrawn

- Although you may use MediSave for various medical expenses, there are limits in place. Outside of that, you can only use it to pay for selected national schemes such as MediShield Life, CareShield Life, and ElderShield

- Only if you pass away, the MediSave balance would then be given to your beneficiaries

But, of course, having an already capped MediSave balance offers other benefits such as an overflow to the Special Account.

6) Take advantage of your good health

Although the basic CareShield covers pre-existing conditions, the CareShield Life supplements offered by the insurance companies might not.

You may need a pay a higher premium, get excluded, or rejected, if you have existing health conditions.

Thus, if you’re currently enjoying good health now, you may want to take this chance to apply for better coverage.

7) You don’t need to be locked in

Similarly to the Integrated Shield Plan (the upgrade of MediShield Life), you “pay as you go”.

It’ll be unlike the endowment savings plans or whole life plans that require you to commit as the penalties of discontinuing will be heavy.

As the CareShield Life upgrades do not accumulate cash value, you may discontinue it without penalties (other than the premiums you’ve already paid).

So let’s say 5 years down the road and you’re really not able to continue paying the premiums, you may discontinue the upgrade. But the disadvantage is that you’ll lose that additional coverage that come with the supplement. So speak to your financial consultant before doing anything like that.

How to Upgrade Your CareShield Life

You don’t need to do anything to be included into the basic CareShield Life – it’s automatically enrolled.

However, as the supplements are only offered by the 3 insurance companies:

- Singlife with Aviva

- NTUC Income

- Great Eastern

All enquiries, applications, and claims for the CareShield Life supplements, should be directed to the respective insurance company or one of their representatives.

Finding the Best CareShield Life Supplement in Singapore (2021)

In summary, what the basic CareShield Life provides may be inadequate for your needs.

If you have an excess of CPF MediSave and want to have a higher monthly payout, why not do something about it with CareShield Life upgrades?

To find which is the best CareShield upgrade for you, a comparison of various plans is needed.

At the same time, if you have yet to go through a proper financial planning session or it has been a while, consider going through our FullCircle™ planning.