With the new introduction of CareShield Life, what should you expect?

What are the options available for you and what should you do?

If you’re born in 1980 or later, this article is not meant for you, go to my other article: “What is CareShield Life?” instead.

If you’re born in 1979 or earlier, you’re in the right place.

I’ll cover the general differences between ElderShield and CareShield Life, and then touch on specific scenarios.

Do read from the start for full understanding!

This page is part of the CareShield Life 2-Part Series:

- Part 0: ElderShield vs CareShield Life (you’re here)

- Part 1: What is CareShield Life?

- Part 2: CareShield Life Supplement

What’s the Purpose of ElderShield and CareShield Life?

Just to trigger your memory in case you’ve forgotten, the purpose for both ElderShield and CareShield Life is to protect against a severe long term disability.

They’re unlike MediShield Life and the Integrated Shield Plan, which are health insurance that allow you to claim for inpatient and selected outpatient treatments at the hospital.

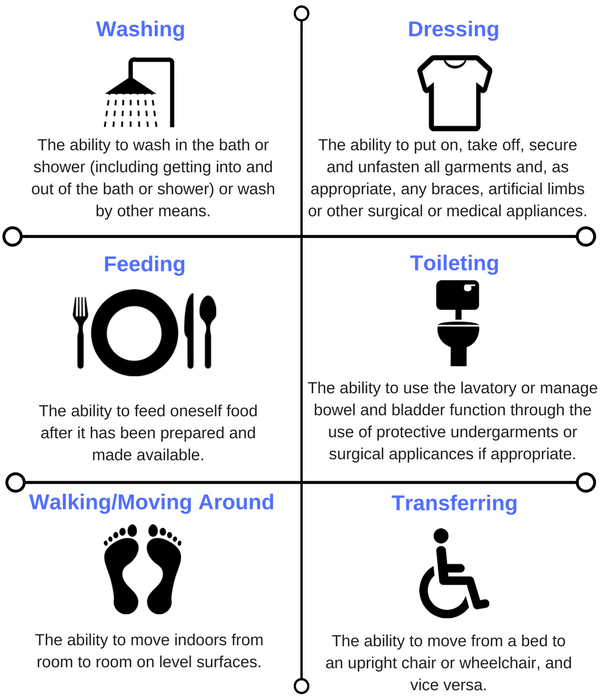

The definition for a severe disability is the inability to perform at least 3 out of 6 Activities of Daily Living (ADLs).

Here are the 6 ADLs:

Source: MOH

Once you’re deemed to be severely disabled (by a certified assessor), you’re able to receive a monthly cash payout for a period of time.

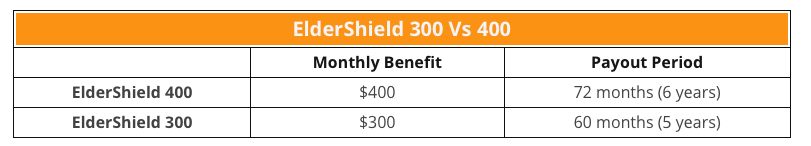

Here are the monthly cash benefits for ElderShield 300 and 400:

Both plans are fully MediSave payable.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Why is ElderShield Being Replaced by CareShield Life?

There must be very good reasons why the Government revamped the entire policy.

In the older scheme, the payout of $300 or $400 per month may not be sufficient to cover for long term care expenses.

The payout period of 5 or 6 years may be too short to accommodate the longer life expectancy in Singapore (83.2 years).

In addition, those who have existing disabilities may not be able to join ElderShield at all.

And that’s why CareShield is introduced.

As a primer, CareShield Life provides a higher monthly cash benefit starting at $600/month in 2020, lifetime duration of payouts, and covers pre-existing conditions.

ElderShield vs CareShield Life: General Differences

Here’s the comparison between ElderShield and CareShield Life:

| ElderShield | CareShield Life | |

| Monthly Cash Payouts | $300 or $400 | $600 (starting from 2020) |

| Payout Duration | 5 or 6 Years | Lifetime |

| Payout Increments | None | – Increases with time (not guaranteed) till age 67 or when a claim is made, whichever is earlier – Increase at 2% per year for the first 5 years |

| Annual Premiums | – $174.96/year (Male) – $217.76/year (Female) – Above assumes you have ElderShield 400 and you didn’t opt out | Depends on entry age (see MOH premium calculator) |

| Premium Increments | None (premium is fixed) | – Increases with time (not guaranteed) till age 67 – Increase at 2% per year for the first 5 years |

| Premium Duration | From age 40 to 65 | From age 30 to 67 |

| MediSave Payable | Yes | Yes |

| Administration | Private Insurers | Government |

| Compulsory? | Automatically enrolled (but you can opt out) | Optional for those born in 1979 or earlier (compulsory for those born in 1980 or later) |

| Cover Pre-existing Conditions? | Depends | Can cover except those who are already severely disabled (for those born in 1979 or earlier) |

| Subsidies and Incentives | No | Yes |

5 Important Points You Must Know About the Transition

1) Enrolment is in batches

As CareShield Life is a new addition, not all would be on-boarded at the same time.

The first batch of enrolment started on 1 Oct 2020 and it consists of those who are born in 1980 to 1990. Those born in 1991 and later will be automatically enrolled once they reach 30 years old.

For those who are born in 1979 or earlier, you’ll only have the option to enrol into CareShield Life towards the end of 2021.

Which means, you can’t do anything till then.

2) Auto-enrolment for a specific batch

Heads up for those who are born between between 1970 and 1979…

As long as you are covered under the ElderShield 400 and are not severely disabled, you’ll be automatically enrolled into the CareShield Life in end-2021.

If you choose not to be included in the new scheme, you’ll have till 31 Dec 2023 to opt out and get your premiums refunded.

3) ElderShield and ElderShield supplements will stay intact

As long as you’re already covered under the existing plans – ElderShield and/or its upgrade – they will continue to protect you.

You can continue to enjoy the same benefits and premiums as before.

4) The Government will take over ElderShield eventually

To make the transition more smoothly, the Government will take over the administration of ElderShield 300 and 400 from insurers in end-2021.

This wouldn’t affect you as a policy owner.

On the other hand, the ElderShield supplements would still stay with the insurers but wouldn’t be affected either.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

5) ElderShield will eventually be closed to new applications

Once CareShield Life is launched, those who are born in 1979 or earlier might not be able to apply into ElderShield and/or its supplements.

However, currently as at 2 Oct 2020, you can still apply.

5 Different Groups of Categories

This is where things get a little more complicated as not everybody will be in the same position.

You may have different benefits and premiums from one another.

I’ll touch on the 5 main groups:

- Basic ElderShield vs Basic CareShield Life

- ElderShield Supplement vs Basic CareShield Life

- No ElderShield

- Basic ElderShield vs CareShield Life Supplement

- ElderShield Supplement vs CareShield Life Supplement

1) Basic ElderShield vs Basic CareShield Life

At 40 years old, you were automatically enrolled into the basic ElderShield and you didn’t opt out.

You’re entitled to receive $300 or $400 per month for 5 or 6 years if a severe disability happens.

Assuming you didn’t opt out and you entered at the age of 40, the premiums for ElderShield 400 is fixed at $174.96/year (males) and $217.76/year (females) till 65 years old.

If you were to switch to CareShield Life…

The monthly benefit amount is $600 (starting from 2020) and it increases.

The premium term is till 67 years old and the premiums increase with time.

As for the premiums you would need to pay, please visit the CareShield premium calculator and see how much it’ll be like.

Options you can take:

- Switch to CareShield Life in End 2021

- Remain on the basic ElderShield

- Upgrade your basic ElderShield

2) ElderShield Supplement vs Basic CareShield Life

For those that have upgraded their ElderShield, you can receive a higher monthly benefit and for an extended period, if a severe disability happens.

For the actual amount and the length of payout, you’ll need to check your own policy for further details.

You’ll need to have the basic ElderShield in order to have its supplement.

Assuming you didn’t opt out and you entered at the age of 40, the premiums for ElderShield 400 is fixed at $174.96/year (males) and $217.76/year (females) till 65 years old.

As for the upgrade, you could use up to $600/year from your MediSave to pay for the premiums (and top up cash for those who want an even higher monthly benefit).

The premiums are levelled but the premium term depends on the supplement. For example, it could be up to 65, 85 years old, or for lifetime, etc.

One thing to note is that you may be covered for 2 out of 6 ADLs too.

If you were to switch to CareShield Life…

Your monthly benefit will only be at $600 (starting in 2020) and it increases.

The premium term is till 67 years old and the premiums increase with time.

The actual premiums of CareShield Life depends on your current age.

Do visit the premium calculator to see how much it would be in order to make a better decision.

If you do have a higher monthly benefit already and the payout is for lifetime, what the basic CareShield Life can provide (for now) may be insignificant, unless you also do an upgrade for the CareShield Life.

Options you can take:

- Remain on ElderShield and its supplement

- Switch to CareShield Life in End 2021

3) No ElderShield

If you’re in this section, there are 3 reasons:

- Having opted out previously

- Rejected before

- Older than 40 when ElderShield launched in 2002

Now, if you think that CareShield Life is a good scheme and wish to join in, you may be able to do so (if you’re not already severely disabled).

First, check how much premiums you’ll need to pay using the premium calculator.

Then decide for yourself.

4) Basic ElderShield vs CareShield Life Supplement

For those of you who are on the basic ElderShield only, and have not upgraded before, listen up.

You can still enhance your coverage with the current ElderShield supplements.

And as at 2 Oct 2020, there’s at least one company that allows you to upgrade with their new CareShield Life supplement, even though you’re on ElderShield.

If not, you can wait till end 2021 and enrol into CareShield Life and/or its supplements.

5) ElderShield Supplement vs CareShield Life Supplement

This would be more sensitive.

In my opinion, if you’ve upgraded your ElderShield before, it might not make sense for you to switch unless the benefits are significant.

This is because you’ll need to replace/switch your ElderShield supplement and it comes with possible disadvantages such as your pre-existing conditions (if any) might not be covered under the new CareShield Life supplement, lower benefits with the new supplement, etc.

What’s Next?

Both ElderShield and CareShield Life have their pros and cons.

The outcome of your decision really depends on your particular situation – whether you’ve upgraded before, your entitled monthly benefits and premiums, and what your goals are, etc.

As of now, that decision to make may still be far away (end-2021), so you might want to look into this only in the future.

You can also check back on CareShield Life supplements for new information.