If an economy is improving, inflation is inevitable. The cost of goods and services will be rising over time.

If nothing is done to your liquid cash in the bank, its value will gradually diminish. And when it’s time for you to use the funds for your children’s education or for your own retirement, you might not have enough.

One alternative to deal with inflation in Singapore is through an endowment savings plan.

In this article, you’ll learn about what it is, how it works, factors to consider, the pros and cons, and more.

So, read on!

This page is part of the Endowment Plan 2-Part Series:

- Part 1: Guide to Endowment Insurance Savings Plans

- Part 2: Finding the Best Endowment Insurance Savings Plans

What Is an Endowment Savings Plan?

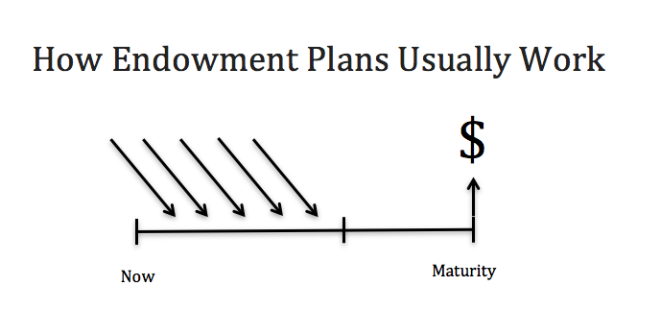

An endowment plan is an insurance policy that’s geared to provide higher potential returns instead of life insurance coverage (it still has some coverage for death).

Most plans require you to save on a regular basis.

The objective is to build a substantial nest egg over a longer period with bite-sized regular savings. This is so when the plan matures, you’re able to utilise the cash payout for its intended purpose.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

How Do Endowment Savings Plans Work?

In most cases, the premiums from policyholders are pooled together to form what is called a participating fund.

This fund is professionally managed and the proceeds are reinvested into various asset classes, which include bonds, equities, and properties. The aim is to generate higher returns.

In return, as a policyholder, you’re entitled to guaranteed payouts – most modern-day endowment plans are capital-guaranteed upon maturity. In addition, there are non-guaranteed bonuses which are declared throughout the policy term.

That way, the money you’ve put into the plan is secured, yet you’re still able to participate in the gains from higher-risk investments.

Get a comparison of the best endowment savings plans in Singapore.

Factors to Consider When Purchasing an Endowment Plan

Many insurance companies have restructured their endowment plans recently.

Although their offerings are now streamlined, the plans still differ from company to company. Here are some things to take note of.

1) Premium term

While a single premium option is available, the most common premium mode is saving on a regular basis, usually monthly or yearly. The yearly mode tends to yield better returns (or cost lesser) than the monthly option.

As for the premium term, it should be dependent on what you’re trying to save for. Consider lengethening the premium term if you have a large amount to save for. This ensures that you’re not overstretching yourself and makes the act of saving more comfortable.

But, this isn’t a rule and your financial situation should still be taken into account.

2) Accumulation period

The accumulation period refers to the period between the maturity date and the end of the premium term.

During the accumulation period, your money would still be generating returns.

Although there are variations to this, the most commonly seen structure is that of a “limited-pay”. For example, a plan having a policy term of 20 years but a premium term of 10 years.

3) Maturity date

The maturity date is simply the date when the plan ends.

In most cases, you would receive a lump sum payout. This date should coincide with what you’re trying to save up for, be it for your children’s education, retirement, or just general savings.

Typical options are 20 and 25 years.

4) Payouts

As mentioned earlier, payouts are made up of guaranteed and non-guaranteed amounts, which are specified in the policy documents.

Generally, the longer the policy term, the higher the potential returns and the eventual payouts. Also, short term plans carry some reinvestment risk – you’ll need to keep finding alternatives after the plan matures.

The payouts can be a lump sum payout or a series of income payments, which are also seen in private retirement/annuity plans.

Pros and Cons of Endowment Savings Plans

Here are some of the advantages and disadvantages of endowment plans.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Pros

1) A form of disciplined savings

If you have not developed proper money management, you might find it hard to save. Saving is always a deliberate process and it should come first before spending. That way, your assets will always be increasing.

Savings plans can help you achieve that in a structured way as money will be GIRO-ed out into the plan regularly. This is a passive and easy process so you don’t need to think so much, and have more time for yourself and your family.

2) Provides diversification

Depending on your situation, you might want to consider diversifying your assets.

Because of the nature of endowment plans, they can appeal to investors on the opposite ends of the spectrum.

To the conservative investor, such plans offer an alternative to counter inflation (rather than leaving money in the bank account or fixed deposits). To the savvy investor, endowments can offer capital guarantees away from highly volatile assets.

The predictability endowments offer and how they form a solid foundation is mentally (and emotionally) beneficial too.

3) Flexible enough to suit your different needs

Thankfully, endowment plans can be customisable to suit your unique situation.

Being able to tweak the amount to save, the savings period, and when you’ll receive the payouts ensure you’ll get a perfect fit.

If that’s not enough, there are even more specialised plans that cater to different needs such as retirement plans and education plans.

4) Guaranteed issuance without medical underwriting

Most modern savings plans have negligible insurance, and thus, don’t require medical questions to be asked.

This is great if you have pre-existing health conditions or want to have a no-frills application process.

However, you can add on riders to enhance the plan’s coverage. For example, if you add on a specific rider, the plan can be fully paid up if a critical illness were to happen. In such cases, medical underwriting may still be required.

In my opinion, the purpose of endowment plans is to solely save for the future. Separating savings and insurance coverage could be a good idea. For your insurance coverage needs, consider other plans such as term insurance, whole life insurance, and health insurance.

Cons

1) Projected bonuses are not guaranteed

The projected returns from endowment plans can potentially beat inflation (if inflation does not go crazily high), but take note that those bonuses aren’t guaranteed and you may find that the end figure you receive could be lower than the illustrated returns in the policy documents.

However, insurance companies practise something called “smoothing of bonuses” – they retain excess returns in good years and use those excess to pay out in bad years. This ensures that bonuses can be more stable over the long run.

Furthermore, reputation is important as well. If companies constantly cut bonuses, no one will take up such plans.

In any case, if you’re worried about potential losses, look for plans that offer capital guarantees.

2) Requires commitment from you

Once you’ve decided on the specifics of the plan and it becomes active, it’s imperative for you to follow through with the requirements of the plan.

One of the most important requirements is the fulfilment of premium payments for the specified duration. Failure to do so will lead to unfavourable situations, such as receiving a lower amount than what you’ve put in.

Therefore, it’s important that you don’t overcommit and have liquid emergency funds on hand.

For some, this could still be seen as a plus point as the act of saving is “enforced”.

What’s Next?

If you think that endowment plans suit your needs, the next step is to find the best one.

While not all insurance companies can cater to your specific needs, find those that can. And at the same time, numbers, such as returns and premiums, do matter in the end.

So, compare the best endowment savings plans in Singapore today!