Retirement is bound to happen, whether you like it or not.

Even if you love what you’re doing and don’t intend to retire, there comes a point in time when old age or bad health catches up.

If you didn’t set aside a sum of money to live on, it can be a struggle.

Thankfully for Singaporeans, there’s the Central Provident Fund (CPF).

And whether you’re a working adult or soon-to-be retiree, you’d have thought about this: “is my CPF enough for retirement?”

Can you solely rely on what CPF provides for you in your golden years, or do you have to do more?

Let’s find out now.

How Much Retirement Income Is Enough?

Although the process of retirement planning contains many moving parts, the first step is to begin with the end in mind.

It’s about working backwards, mathematically.

There are questions to ask yourself:

- What type of retirement lifestyle do you want?

- Do you want to travel twice a year? Would you bring the whole family along?

- What kind of expenses would you incur?

- and many more..

Answering such questions will give you an idea of how much you’d need (e.g $3,000/month) to sustain your desired standard of living.

As this is likely to be in today’s value, you’d then need to future value it with an inflation rate. You can use a retirement planning calculator.

The final answer to that is what you require.

And there shouldn’t be any compromise. If you want to enjoy the sweeter fruits of labour in the future, you’d have to sacrifice more now.

If you want a more minimalistic lifestyle, then you may not need that much.

Therefore, deciding how much you need during your retirement years will no doubt determine whether your CPF is adequate to support it.

And depending on who you ask, you’ll get different answers because each individual’s situation and goals are different.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

CPF Is a Core Component of Our Finances

The primary role of CPF is to help Singapore Citizens and Permanent Residents set aside retirement funds to at least provide for the basic needs during old age.

Furthermore, CPF encourages you to supplement retirement income with the use of your own personal savings.

So unless you don’t contribute to CPF, it’s always critical to understand how CPF works.

Why?

Because up to 37% of your salary goes into the CPF accounts. And part of your retirement income is derived from the bulk of it.

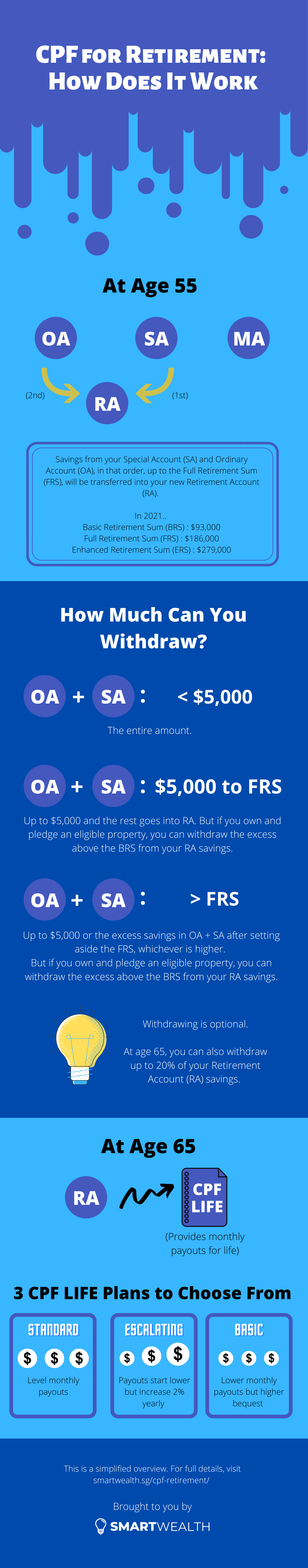

Here’s a simple overview:

In my opinion, it’s quite clear that CPF strives to provide for the basic needs of the masses (as with most nationwide policies), and if you wish to have more than that, more effort on your part is needed – saving or investing more.

But let’s look deeper into this.

What’s the Average CPF Payout?

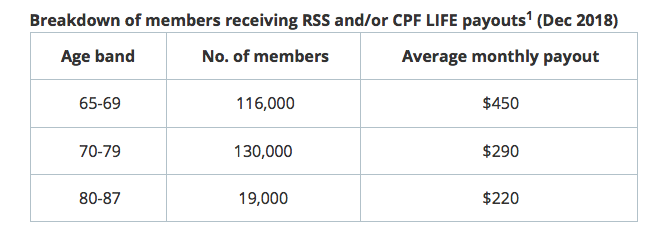

To answer this question, we should look at what Josephine Teo, Minister of Manpower, answered in response to parliamentary questions on CPF payouts:

At first glance, the figures may come as a shock.

To add, 74% of those who received payouts had monthly payouts of less than $500.

One thing that immediately came to my mind was whether these amounts were sufficient for the basic needs.

But more has been done.

CPF members may also receive additional support through various schemes like the Silver Support Scheme, Workfare Income Supplement, GST vouchers, ComCare, etc.

And because of the improvements made to the CPF system and an increase in the labour force, younger cohorts are expected to have higher CPF payouts.

For example, about 6 in 10 members who turn 55 in 2017 have at least the Basic Retirement Sum (BRS). A BRS of $83,000 at 55 years old in 2017 translates to a monthly payout of around $700 to $750 for life.

Next, we’ll have to look at the average monthly expenses..

What’s the Average Monthly Expenses of a Retiree?

Although this is a simple question, there’s no straightforward answer.

One of the reasons is because retirees can live in households which have active income earners (e.g children), and vice versa. This meant that bills and expenses can be shared between active income earners and retirees. Besides, retirees can live on their own as well.

But in a recent report, Household Expenditure Survey 2017/2018 shows some interesting statistics:

| Average Monthly Household Expenditure | |

| HDB (1 to 2 rooms) | $1,545 |

| HDB (3 rooms) | $2,709 |

| HDB (4 rooms) | $3,933 |

| HDB (5 rooms & executive) | $5,504 |

| Condo & Other Apartments | $7,963 |

| Landed Properties | $10,500 |

| Total | $4,906 |

| Average Monthly Household Expenditure (households comprising solely non-working persons aged 65 years and over) | |

| HDB (1 to 2 rooms) | $891 |

| HDB (3 rooms) | $1,206 |

| HDB (4 rooms) | $1,555 |

| HDB (5 rooms & executive) | $1,948 |

| Condo & Other Apartments | $4,571 |

| Landed Properties | $4,645 |

| Total | $1,966 |

| Average Monthly Household Expenditure Per Household Member (households comprising solely non-working persons aged 65 years and over) | |

| HDB (1 to 2 rooms) | $678 |

| HDB (3 rooms) | $786 |

| HDB (4 rooms) | $979 |

| HDB (5 rooms & executive) | $1,061 |

| Condo & Other Apartments | $2,679 |

| Landed Properties | $2,171 |

| Total | $1,154 |

Question: Does the average CPF payout or average monthly household expenses matter to you?

No.

What matters is how much CPF payout and expenses you can expect according to your unique situation and goals.

What’s Your Estimated CPF Payout?

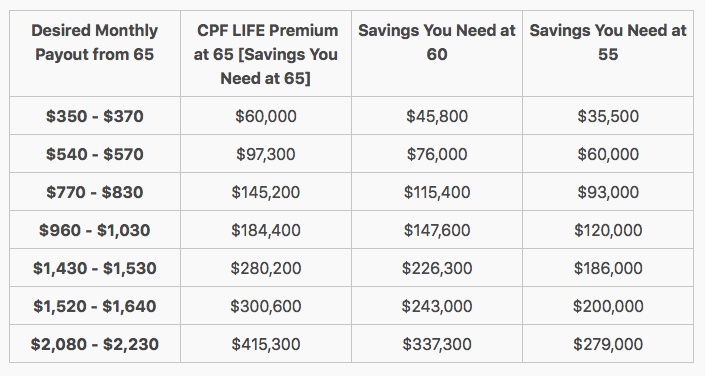

As a start, you can gauge how much is your CPF payout with this infographic:

If you want a more accurate picture, check out the CPF Life Estimator tool.

Once you have that number, compare it against the expected expenses during retirement years (if you’ve done the exercise at the beginning), and you’d roughly know whether your CPF is enough for your needs.

If there’s a shortfall (expected expenses > expected CPF payout), your CPF is most likely not enough.

One of the reasons for this is stated in the next section ..

Can CPF Set You Back?

CPF is a comprehensive social security system to help you save for retirement.

But some may say that the payouts are low.

Why?

The main reason, as you know, is that the CPF accounts can help in other areas such as:

- providing a roof over your head

- paying for education fees

- enhancing assets through CPF Investment Schemes

- paying for several types of insurance like Dependants’ Protection Scheme, MediShield Life, ElderShield, CareShield Life, Home Protection Scheme

- and more..

All these meant that it’s flexible.

But being flexible comes at a cost too.

For example, the homeownership rate is relatively high in Singapore, standing at 90.4%. The biggest reason is likely to be that property can be bought using CPF OA balances, and loans can be repaid with it as well.

And if we buy a bigger property that we can’t afford (although on paper, we can), it directly affects our retirement funds in the end, leading to lower payouts.

On the flip side, because of this flexibility, more couples are able to get their own homes and start family planning early.

Furthermore, when we’re young, we may not have the financial foresight to set aside money for a down payment of a property, but because of the forced CPF savings, we’re able to do so.

So it’s always good to know both sides of the story.

At the end of the day, you must strike a balance by making good financial decisions.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Correctly Using CPF Will Improve Your Finances

While negative comments about CPF exist, here’s the hard truth:

We can’t change the rules of CPF.

There are reasons why it’s structured that way.

And I see it as an advantage to us just because we’re humans and tend to derail from time to time. Therefore, some form of forced savings will provide us with a minimum safety net when the time comes.

So rather than focusing on the negatives, why not divert our attention to what’s within our control?

In the realm of government schemes, there are ways to capitalise such as:

- voluntarily contributing and topping up CPF balances

- max out CPF SA and MA as fast as possible

- CPF SA shielding

- contributing to Supplement Retirement Scheme (SRS) account

- and more

At the end of the day, there are still some limitations:

- CPF rules could change in the future

- if you want even more, you have to look outside of what CPF + SRS can offer

- specific ages to start withdrawals

- you don’t want to put everything into CPF

- you want potentially higher returns

- you want to have the ability to withdraw partially/fully if you wish

These push Singaporeans to look at alternative investments.

3 Things That Hinder Your Chances at Retirement

Whether it’s contributing more to CPF or other investments, these 3 things will affect your retirement savings:

1) Inflation Rate

The cost of living will increase; things will get more expensive in the future.

Thus, the CPF minimum sums increase every year to reflect this. But don’t forget that your CPF monies do earn interests as well and that can offset the inflation.

However, if you have personal assets that are earning low interest (i.e money in the bank) then be ready to lose massive value in the long run.

Outside of emergency funds and short term financial commitments, it’s generally not a good idea to leave the bulk of your money in low interest-earning assets unless you have too much of a surplus, and depending on your risk appetite.

2) Longer Life Expectancy

In case you haven’t noticed, we’re living longer now.

Mortality rates in insurance reflect that as well – life insurance premiums for death is much cheaper than before.

Currently, life expectancy in Singapore stands at 83.6 (both genders).

It’s expected to grow to 85.4 years in the year 2040.

What does it mean?

We need to accumulate more now because of an extended period of retirement.

To illustrate this:

- we assume our retirement age stays constant at 65

- life expectancy was 80 but now it’s 85

- so we need to accumulate more during our working years now to make up for an additional 5 more years of expenses

The good thing is that CPF Life’s payout is for life.

But if you’re not relying solely on CPF, you either need to earn more, save more or invest more.

3) Other Life Goals

As much as we want to narrow down our focus to just saving for retirement, most of the time, we can’t.

Along the way, other financial commitments come along.

It could be providing for your kid’s education, paying for unexpected medical expenses, buying a car, etc.

Or you may not feel like saving at all, and just want to be in the present and enjoy the luxuries of life.

These no doubt will reduce our chances of having a proper retirement.

It’s Only Going to Be an Uphill Battle

The above 3 things will either drain your retirement savings or require you to accumulate more.

But none will be as critical as this:

Time.

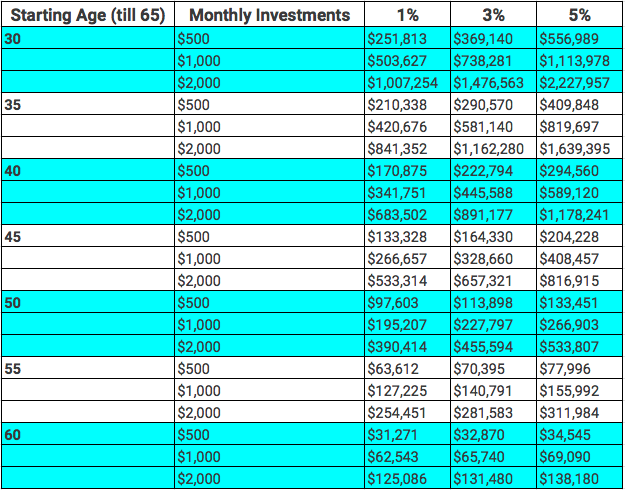

With time, saving gets much easier with the power of compounding.

Without time, you’ll never be able to hit your retirement goals (realistically), as saving for retirement is often a marathon and not a sprint.

Here’s an illustration of how time has a huge impact on retirement savings:

As always, the best time to start planning for your retirement is yesterday.

But time has to be coupled only with action. If you do nothing, time will just be wasted.

So what can we do?

The Goal Is to Create Alternate Assets

All in all, is CPF enough for retirement?

As you can see, as everyone’s needs are different, it entirely depends on what retirement lifestyle you want and your current financial situation.

It can be enough for one, but not the other.

In both cases, you can fatten it up by creating alternate assets for 2 reasons – to diversify and to supplement. An example of such is a private retirement annuity plan which can supplement on top of what CPF pays out.

Oh, don’t forget to check out our guide on retirement planning in Singapore too.